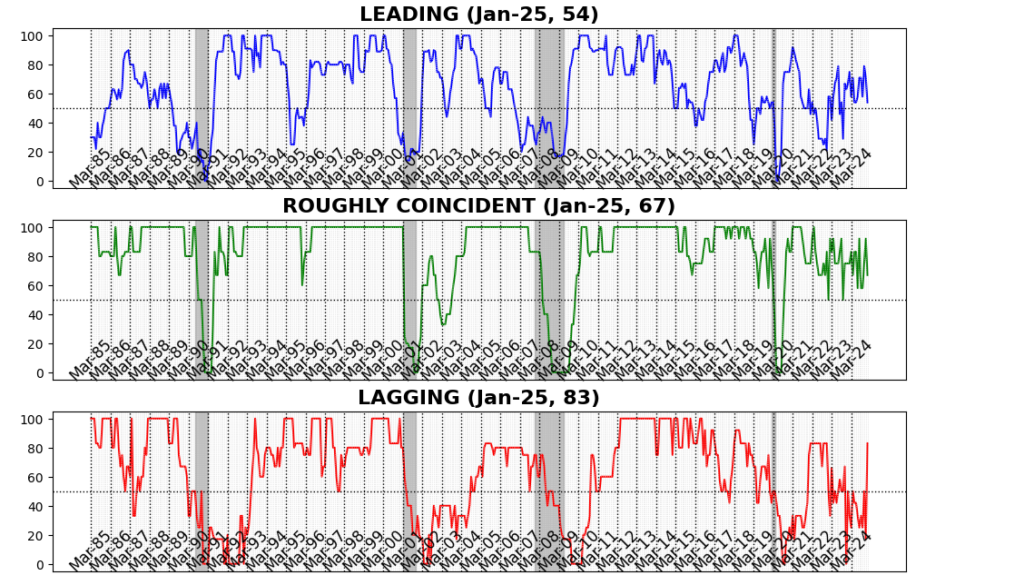

In January 2025, the AIER Enterprise Situations Month-to-month indicators confirmed reasonable financial momentum, with main indicators moderating, coincident measures remaining strong, and lagging indicators rebounding sharply. The Main Indicator declined to 54, down from 71 in December, reflecting softening forward-looking financial exercise. Nevertheless, the Roughly Coincident Indicator held agency at 67, indicating regular real-time financial situations, whereas the Lagging Indicator surged to 83, suggesting enhancing situations in longer-cycle financial traits. The divergence between main and lagging measures signifies short-term uncertainty, although the broader economic system reveals resilience for now.

Main Indicator (54)

Of the twelve Main Indicator parts, six rose, one was unchanged, and 5 declined in January.

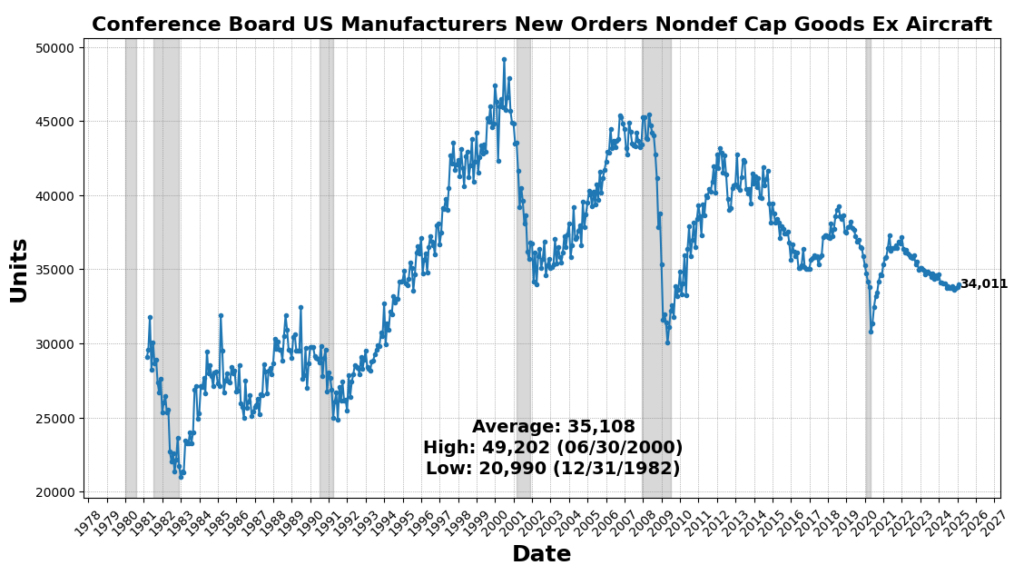

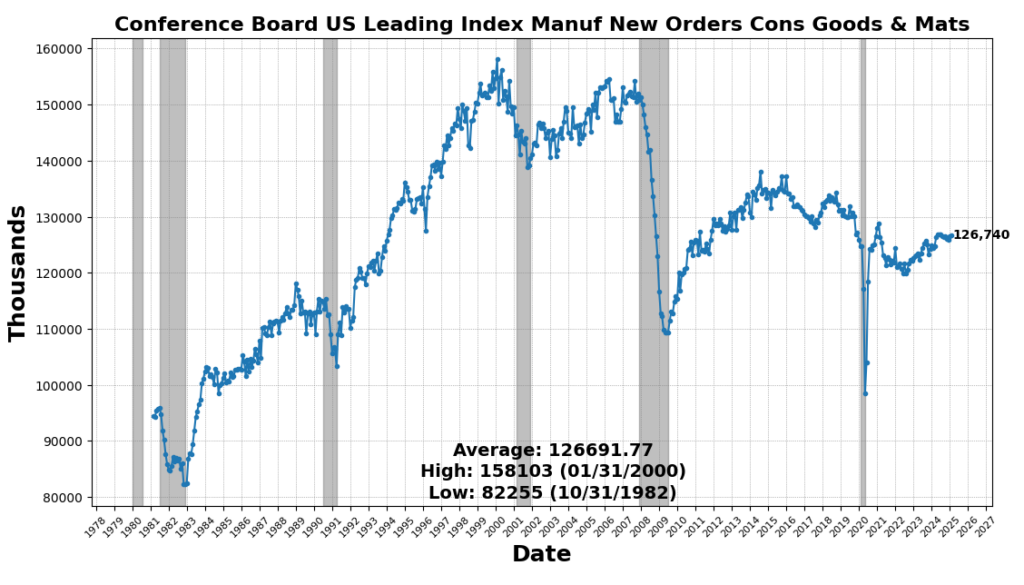

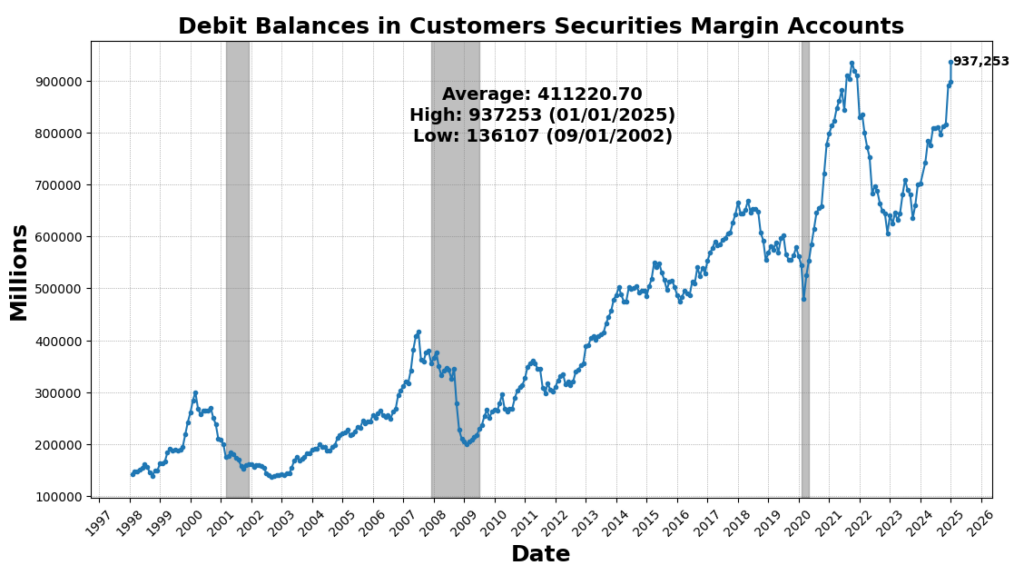

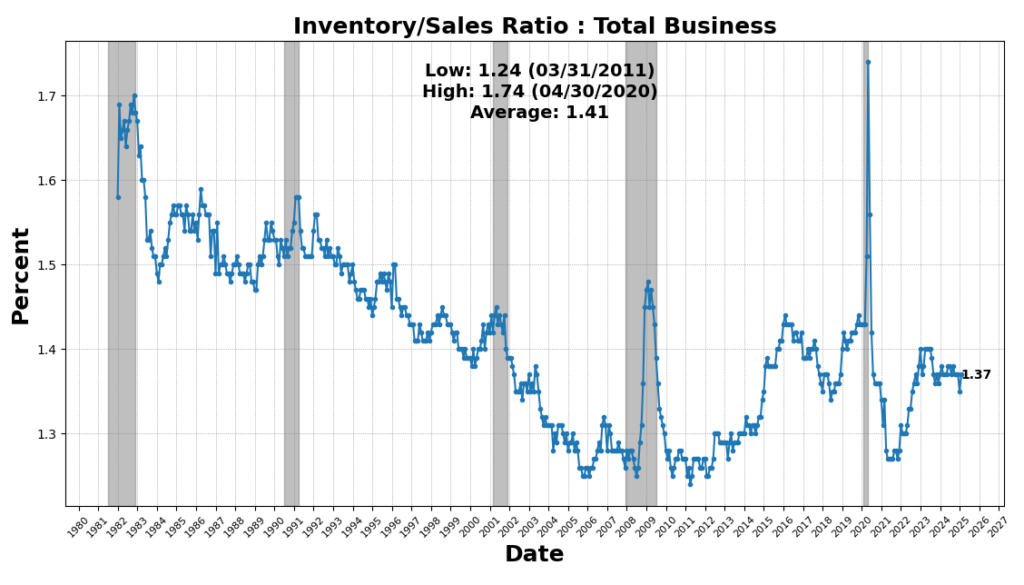

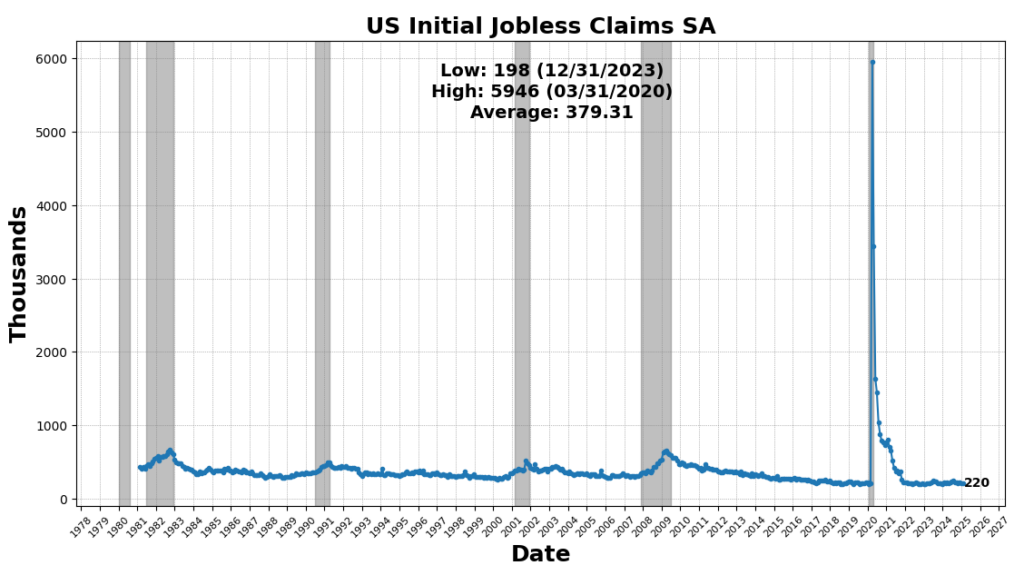

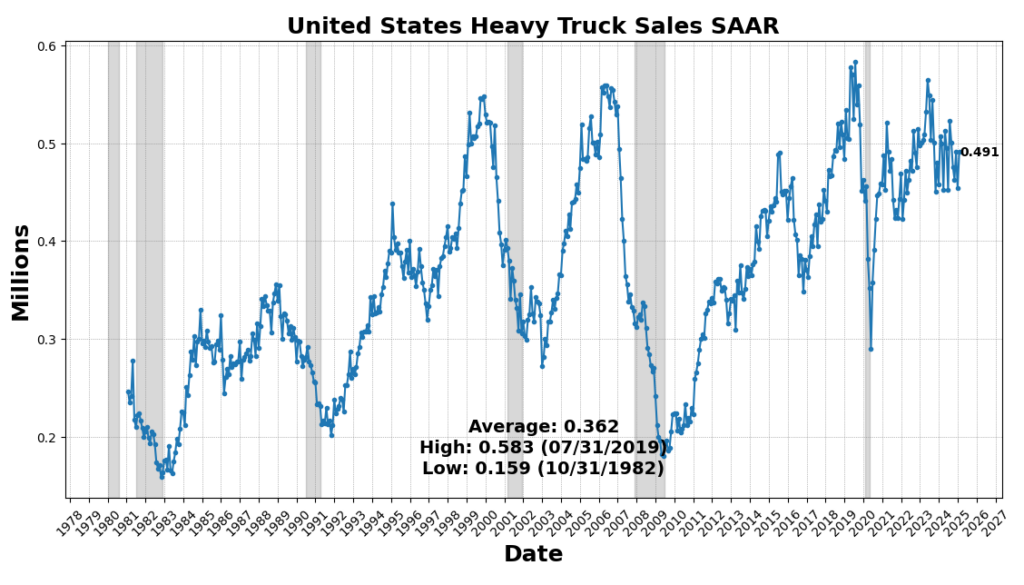

The biggest enhance got here from United States Heavy Vans Gross sales SAAR, which rose 8.2 p.c, reflecting continued demand for sturdy items and enterprise funding in transportation gear. Nevertheless, a few of this surge could also be attributed to ahead ordering as corporations search to preempt potential value will increase from upcoming tariffs. US Preliminary Jobless Claims SA (4.3 p.c) and FINRA Buyer Debit Balances in Margin Accounts (4.2 p.c) additionally elevated, indicating a still-resilient labor market and continued threat urge for food in fairness markets. Manufacturing new orders noticed modest beneficial properties, with the Convention Board’s Manufacturing New Orders for Nondefense Capital Items (ex-Plane) up 0.6 p.c and the Manufacturing New Orders Client Items & Supplies Index up 0.12 p.c, suggesting marginal energy in manufacturing demand. The Stock/Gross sales Ratio rose barely (0.01 p.c), pointing to flat stock administration traits.

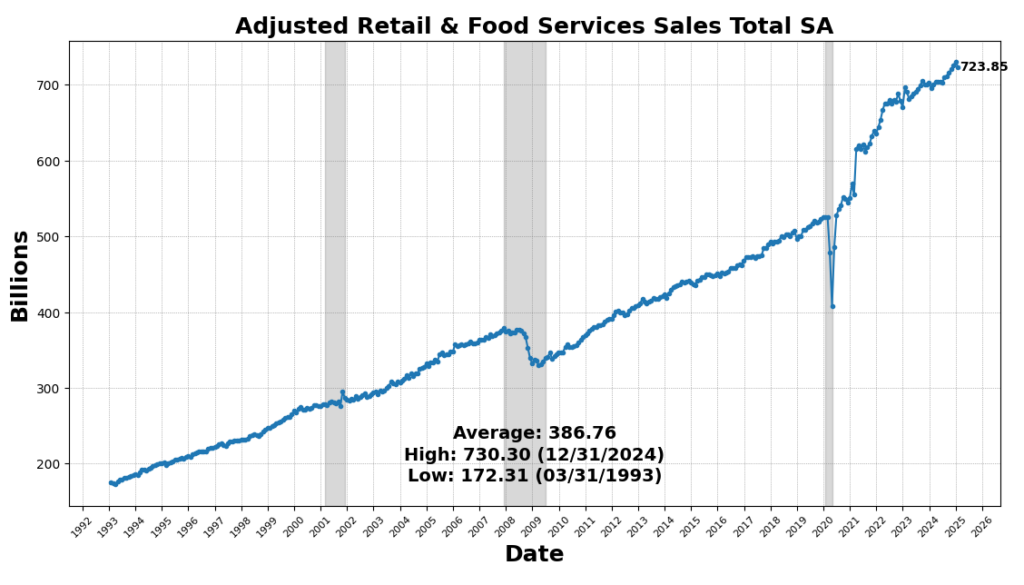

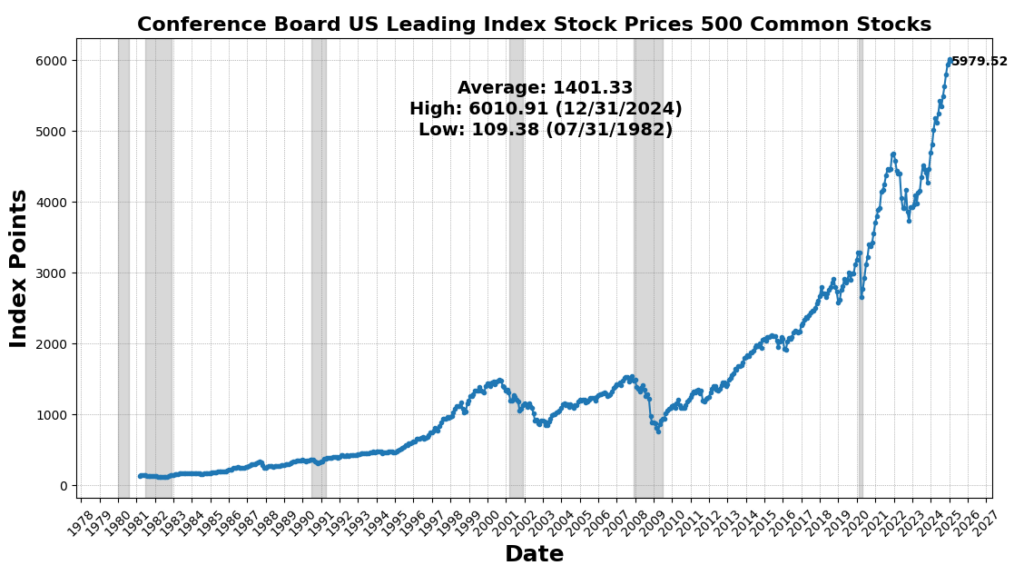

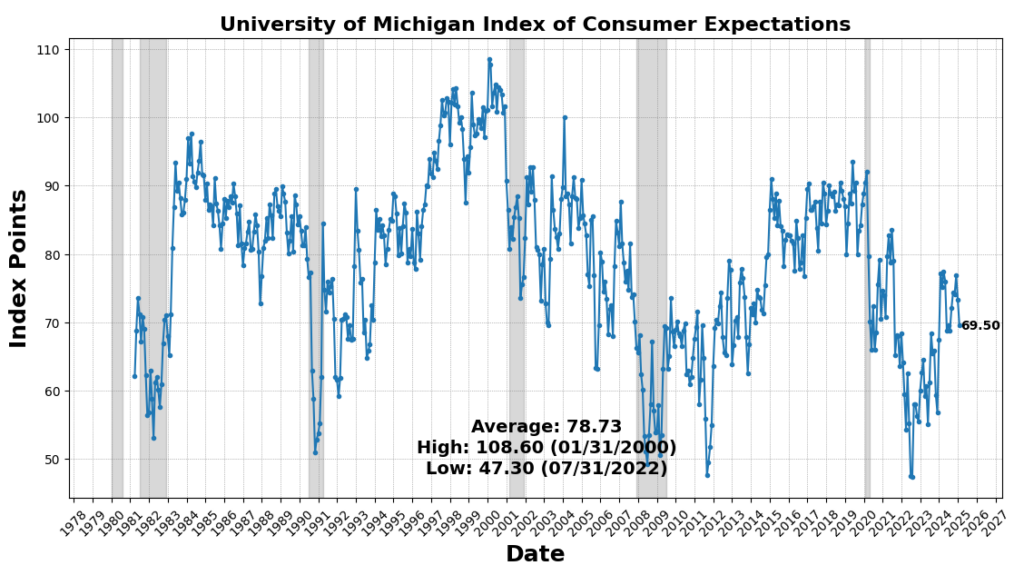

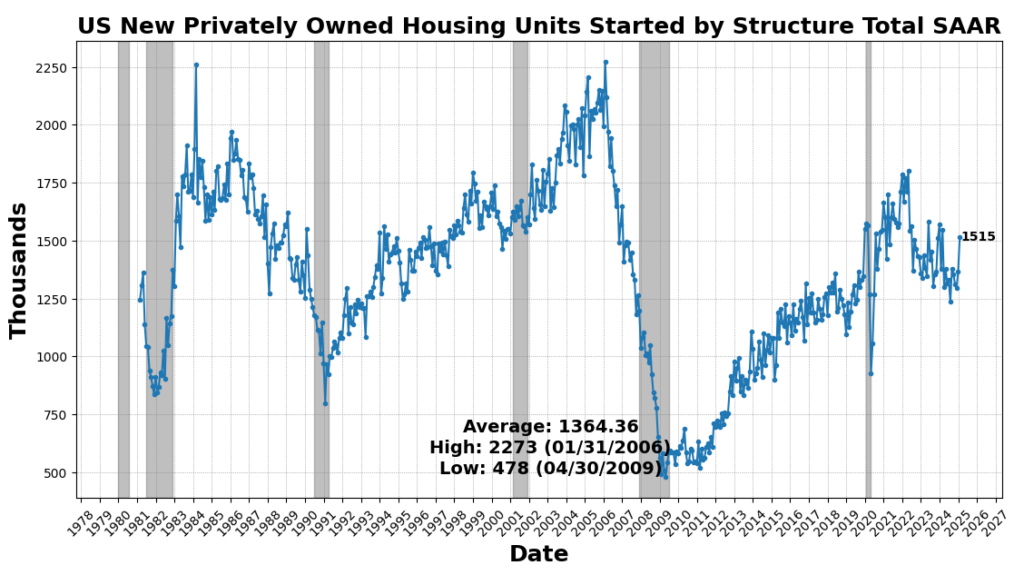

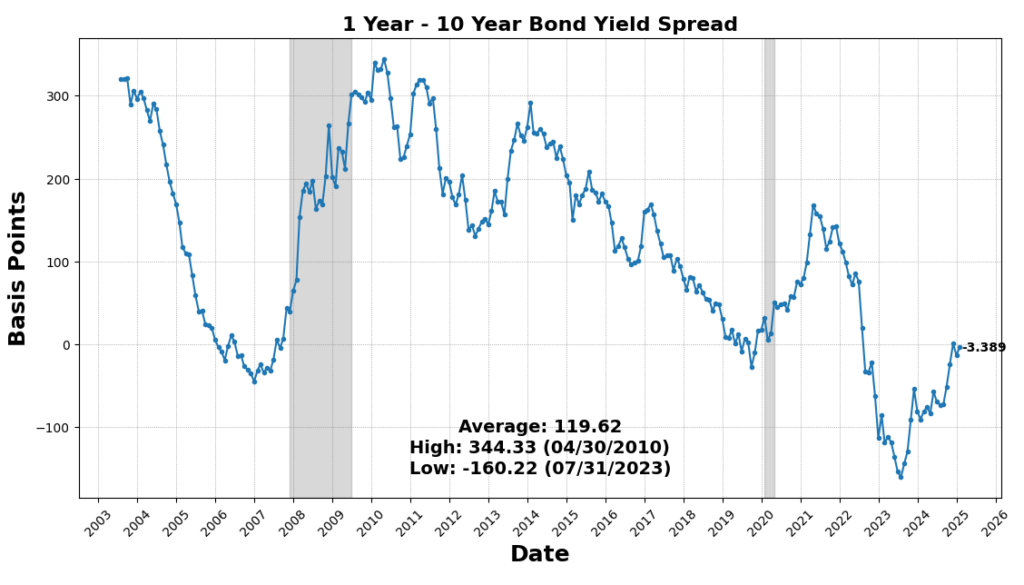

On the draw back, housing exercise remained weak, as US New Privately Owned Housing Items Began fell 9.9 p.c, marking a continued slowdown in residential building. The 1-to-10 12 months US Treasury unfold declined 8.3 p.c, sustaining its deep inversion, traditionally a powerful recession sign. Client sentiment weakened, with the College of Michigan Client Expectations Index down 5.3 p.c, and Adjusted Retail & Meals Providers Gross sales Whole SA down 0.9 p.c, signaling softening client demand. Lastly, the Convention Board’s Main Index of Inventory Costs fell 0.6 p.c, reflecting fairness market volatility and investor warning.

Roughly Coincident Indicator (67)

4 constituents of the Roughly Coincident Indicator rose and two declined.

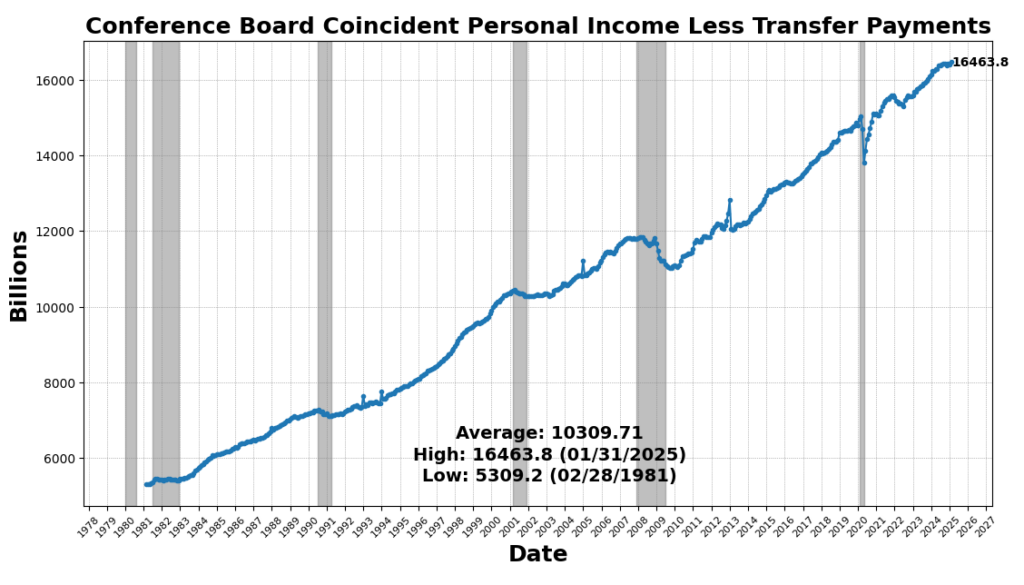

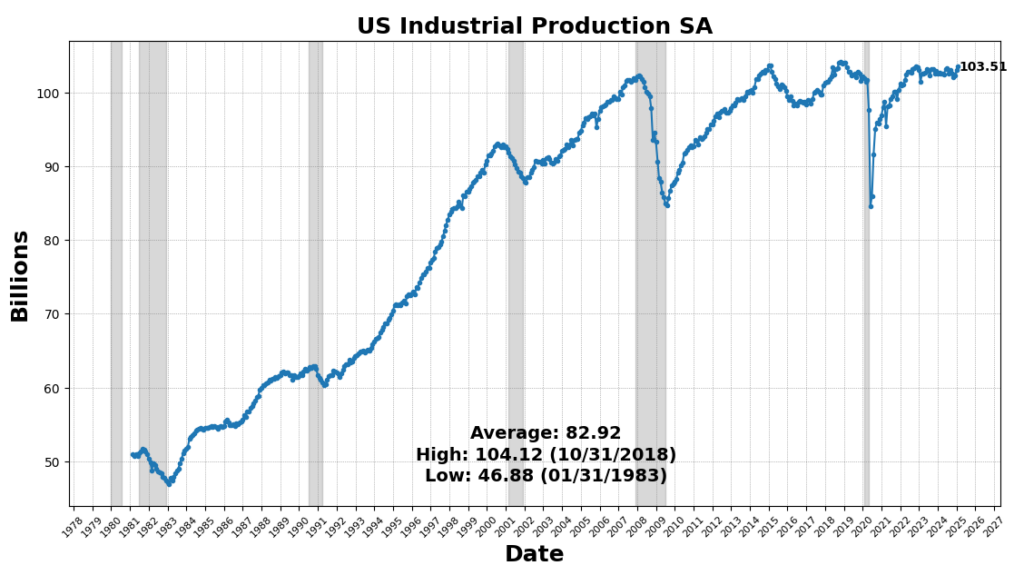

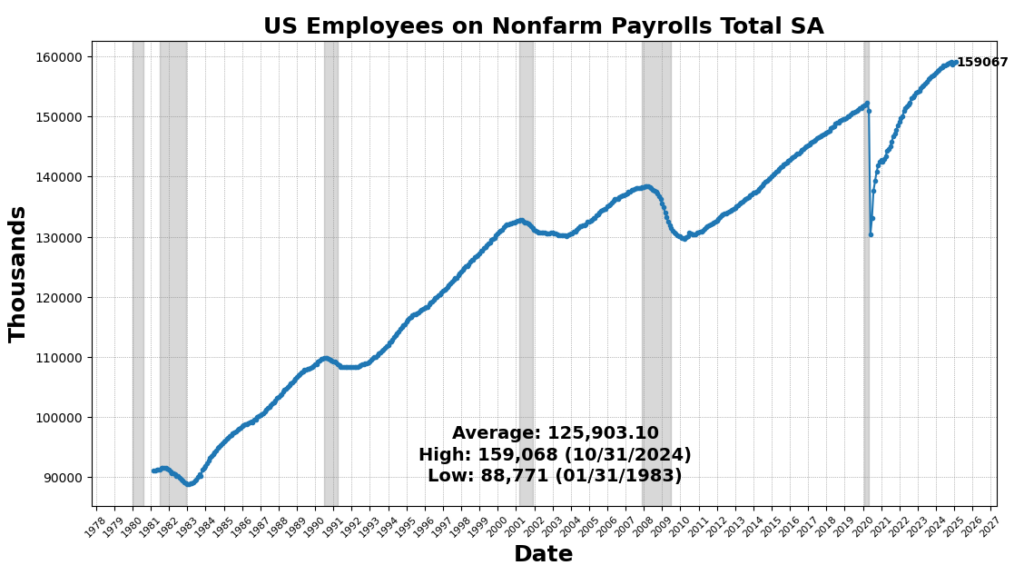

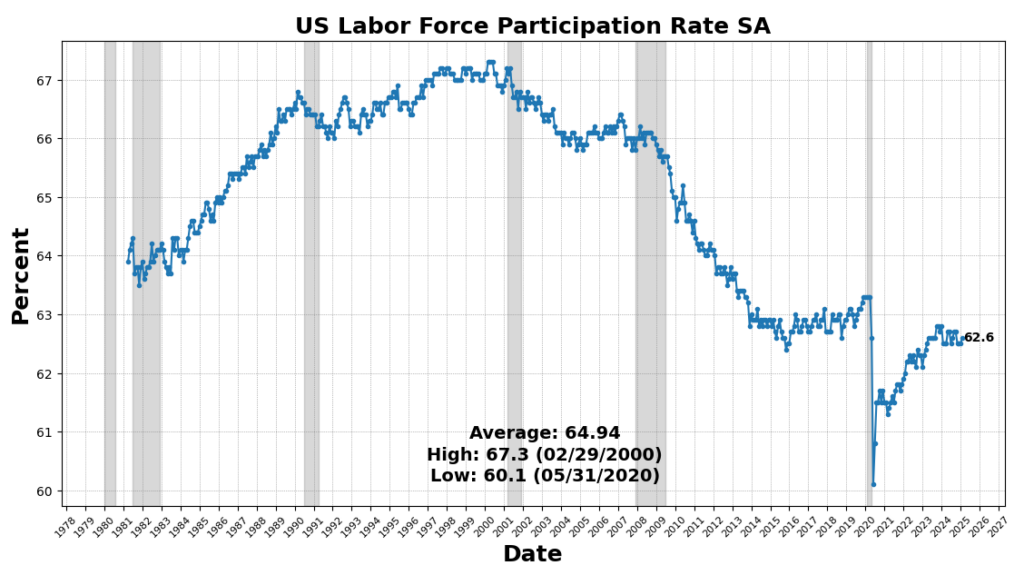

The strongest enhance got here from US Industrial Manufacturing SA (0.5 p.c). Convention Board Coincident Private Earnings Much less Switch Funds rose 0.4 p.c, indicating reasonable revenue development exterior of presidency assist. Labor market participation improved, with the US Labor Pressure Participation Price up 0.2 p.c and Nonfarm Payrolls rising barely (0.1 p.c). These replicate ongoing, however slowing, job development in January 2025.

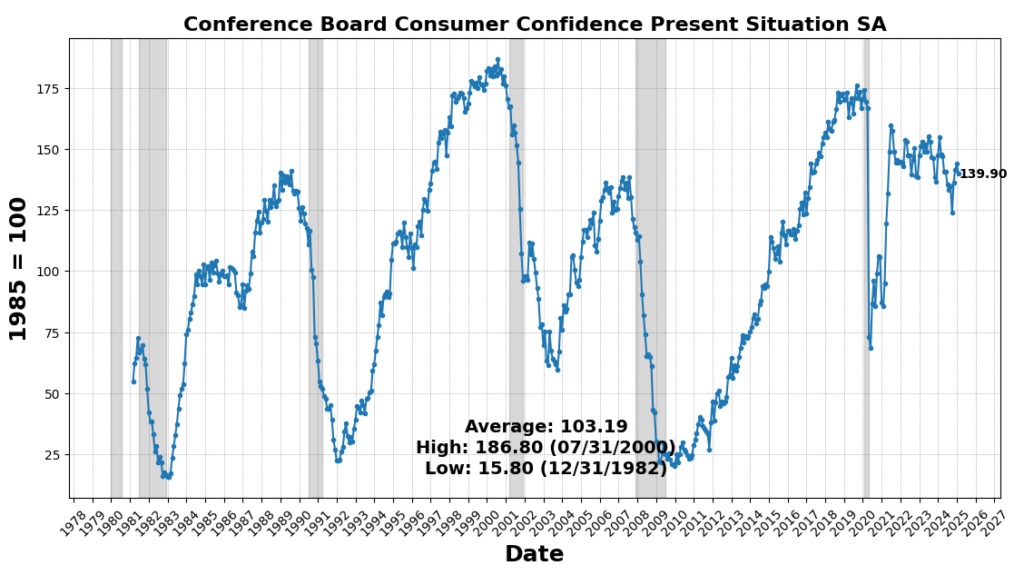

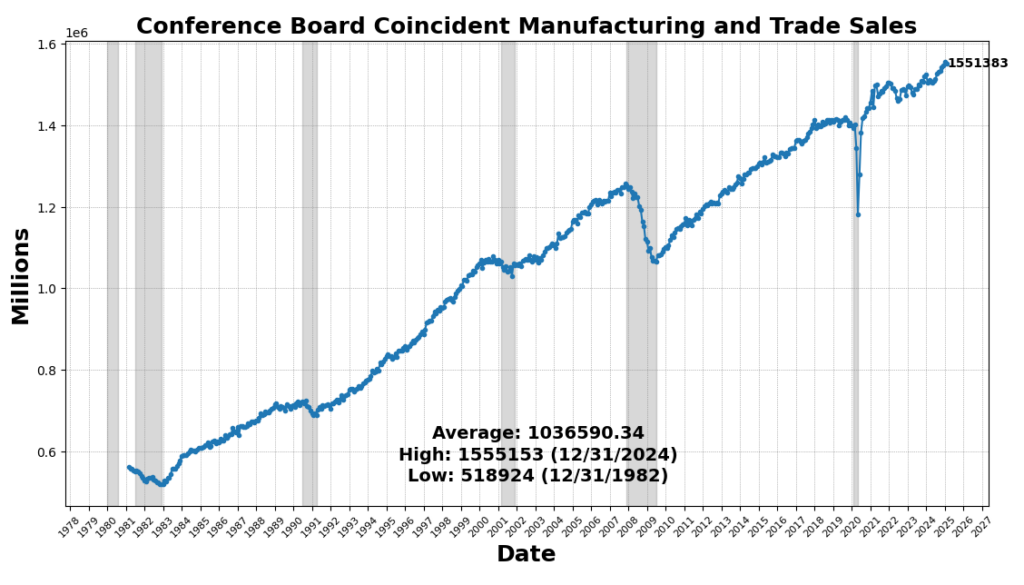

Nevertheless, client sentiment weakened, with the Convention Board’s Client Confidence Current State of affairs Index declining 2.9 p.c, reflecting rising uncertainty about near-term financial situations. Convention Board Coincident Manufacturing and Commerce Gross sales declined barely (0.2 p.c), suggesting a modest pullback in real-time enterprise exercise.

Lagging Indicator (83)

Of the six parts, 5 rose and one was unchanged. At 83, the Lagging Indicator is at its highest stage in 25 months (December 2022).

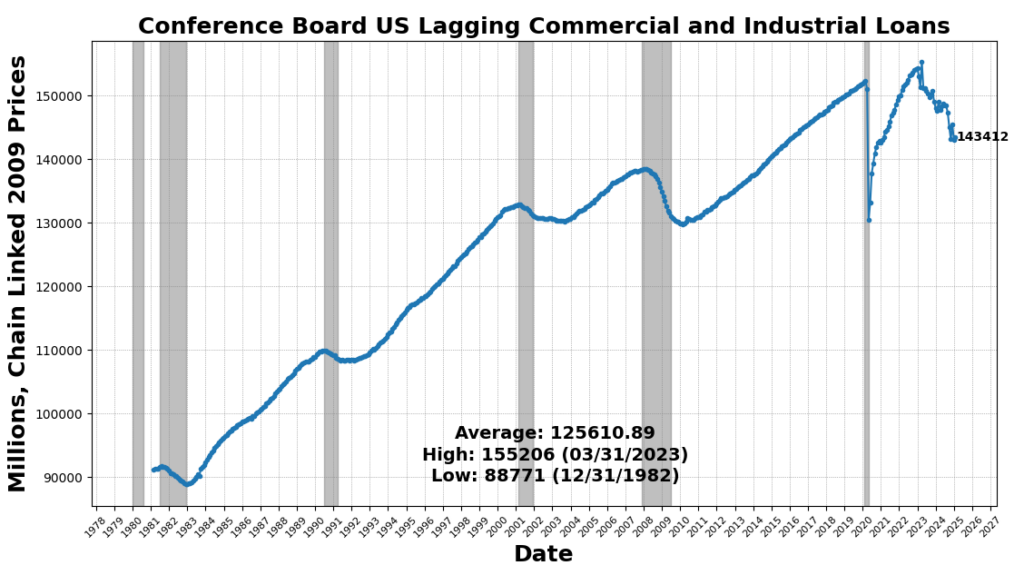

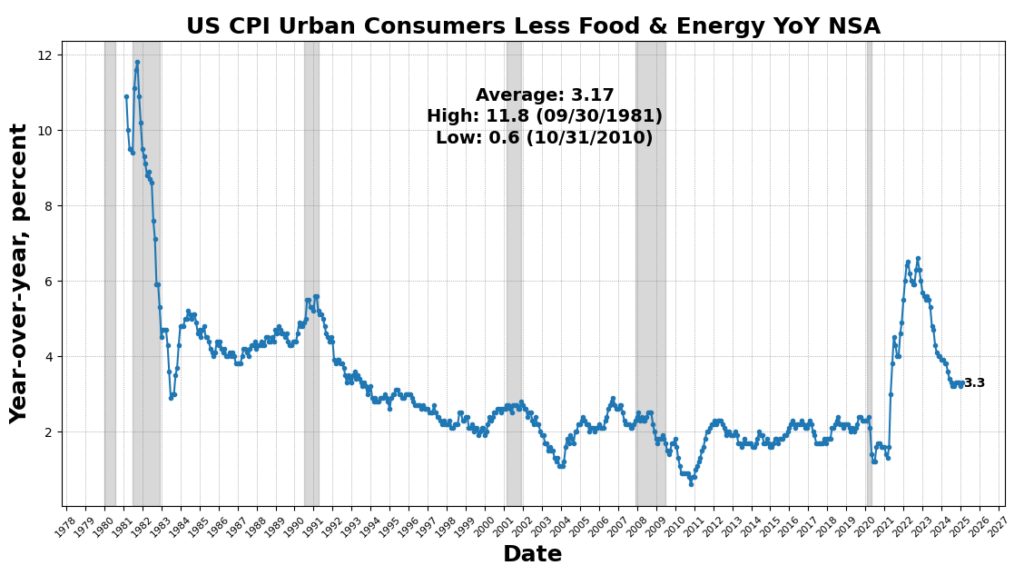

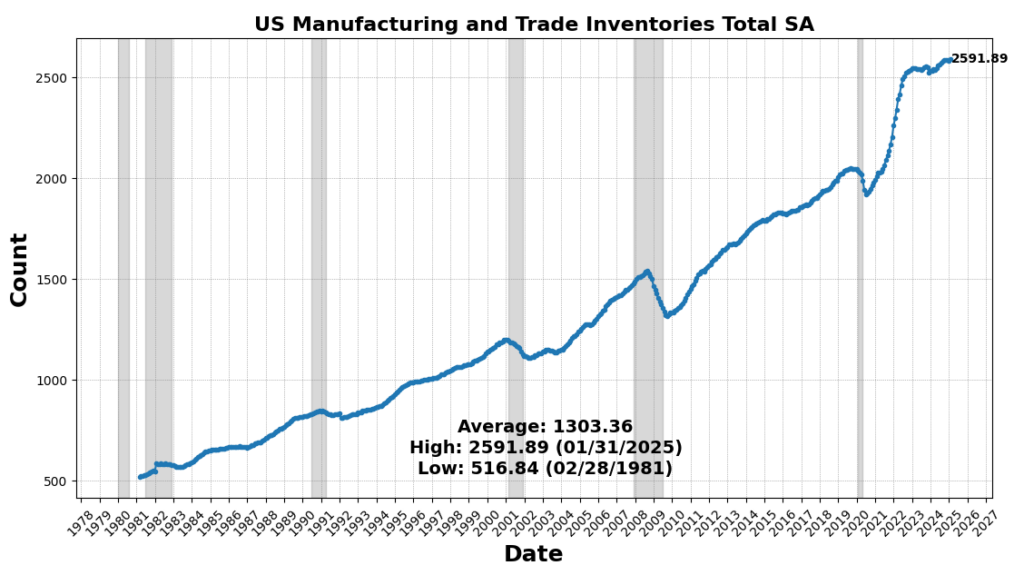

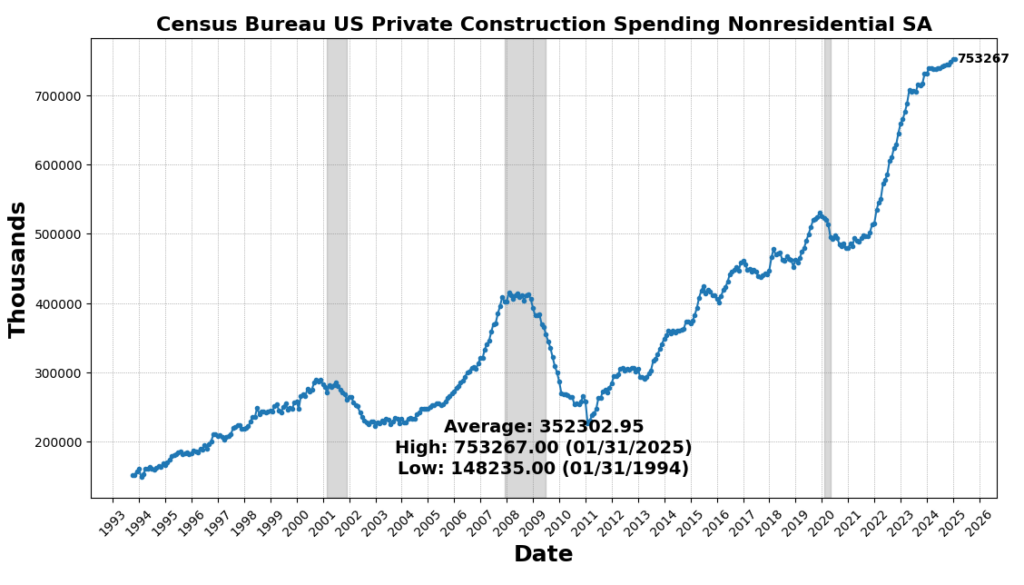

The strongest achieve got here from US CPI City Customers Much less Meals & Vitality YoY (3.1 p.c), reflecting a slowing of the disinflationary development in core items and providers. Business and Industrial Mortgage exercise improved (0.3 p.c), and Non-public Building Spending noticed a marginal achieve (0.01 p.c), revealing tepidity in long-cycle enterprise funding. US Manufacturing & Commerce Inventories ticked up very barely (0.003 p.c), signaling cautious, or maybe hesitant, changes to stock.

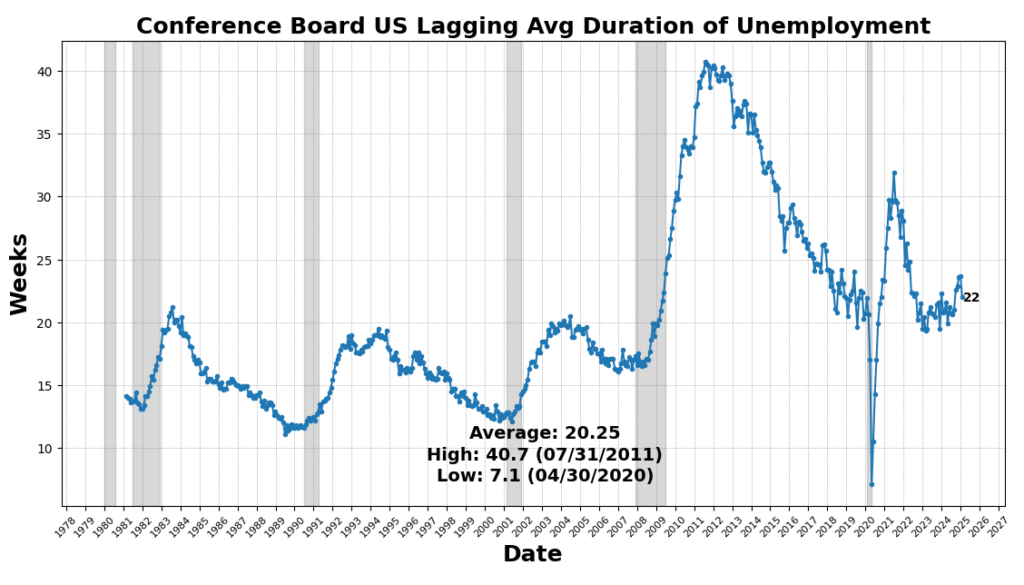

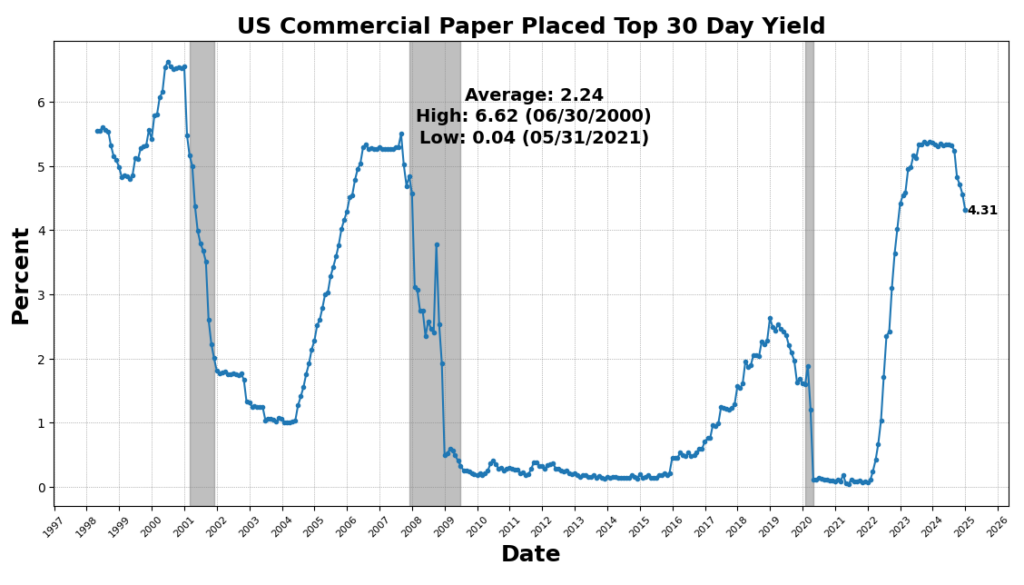

The one unchanged measure was US Business Paper Positioned High 30 Day Yield, indicating secure short-term credit score situations. The Convention Board’s Lagging Common Period of Unemployment fell 7.2 p.c, suggesting that unemployed people are discovering jobs sooner, a optimistic signal for the labor market.

The January 2025 AIER Enterprise Situations Month-to-month indicators replicate an economic system nonetheless increasing however extra slowly and with combined indicators. The decline within the Main Indicator from 71 to 54 was pushed by weakening client sentiment, slowing retail and meals providers gross sales, stagnation in manufacturing exercise, and strain from each a deteriorating housing market and tightening monetary situations.However that the Roughly Coincident Indicator (67) remained strong, and the Lagging Indicator (83) improved notably, indicating energy in slower-moving financial parts like inflation, credit score, and labor market restoration.

The divergence between main and lagging indicators makes the quickly escalating uncertainty in forward-looking financial situations clear, although real-time and lagging measures counsel areas of ongoing resilience. The twin menace of untamed, last-minute coverage fluctuations forward of April 2nd and the long-term penalties of what might be the most important tariff enhance for the reason that Smoot-Hawley Act of 1930 at the moment are the first forces shaping financial exercise and monetary market conduct.

DISCUSSION

February’s CPI report highlighted the results of weakening client demand for discretionary items, reinforcing broader indicators of softening consumption. Whereas providers disinflation continued, items worth declines stalled, significantly in classes delicate to tariffs together with automobiles, residence furnishings, and attire. The general impression of President Trump’s commerce insurance policies on inflation will rely upon whether or not weaker providers spending offsets rising items costs. For now, the February information means that providers disinflation outweighed the modest uptick in items inflation, delaying any vital reacceleration in worth development.

US wholesale inflation stagnated in February, as a 1 p.c decline in commerce margins offset rising prices in key sectors, tempering the general producer worth index (PPI), which remained unchanged from January’s revised 0.6 p.c achieve. Excluding meals and power, PPI declined for the primary time since July, although underlying worth pressures continued, significantly in classes tied to the Federal Reserve’s most well-liked inflation gauge, the non-public consumption expenditures (PCE) worth index. Hospital inpatient care prices rose 1 p.c, portfolio administration charges elevated 0.5 p.c, and core items costs (excluding meals and power) climbed 0.4 p.c—the most important month-to-month achieve in over two years. Whereas declining wholesale margins could briefly defend customers from greater import and manufacturing prices, sustained weak client confidence and pulled-forward sturdy items purchases might weaken demand later this 12 months, probably forcing retailers to just accept thinner revenue margins. Tariffs imposed by the Trump administration are additionally set to exert upward worth pressures, with a further 10 p.c levy on Chinese language imports launched in February contributing to notable worth beneficial properties in iron and metal scrap, equipment, and family items like furnishings and home equipment. In the meantime, meals costs surged 1.7 p.c, pushed by rising egg prices, whereas power costs fell 1.2 p.c. Regardless of these combined inflation indicators, a separate report confirmed jobless claims remained secure, reinforcing the resilience of the labor market.

February worth information confirmed broad-based will increase in each manufacturing and providers, with a number of regional and nationwide surveys reflecting stronger pricing energy throughout industries. The ISM Manufacturing Costs Index surged to 62.4, its highest stage since June 2022, up from 54.9 in January, whereas ISM Providers Costs remained elevated at 62.6. S&P World’s US Manufacturing sector recorded its quickest output worth development in two years, whereas US Providers corporations raised costs modestly, constrained by aggressive pressures and weak demand. Regional Federal Reserve surveys additional confirmed rising worth pressures, with the Kansas Metropolis Fed reporting a 3rd consecutive month of worth beneficial properties in manufacturing, and its non-manufacturing sector additionally seeing greater promoting costs. The New York Fed’s manufacturing costs acquired index jumped to 19.6 from 9.3, almost doubling its six-month common, whereas its providers counterpart climbed to 27.4 from 19.4. Equally, the Philadelphia Fed’s manufacturing index elevated to 32.9 from 29.7, whereas the Dallas Fed’s manufacturing costs acquired measure rose to 7.8 from 6.2. The Chicago PMI indicated an acceleration in worth growth, and the Richmond Fed’s manufacturing index confirmed a modest uptick, with costs acquired rising to 1.62 from 1.21.

Whereas worth pressures have been broadly greater, choose areas noticed moderation. The Dallas Fed’s providers sector reported a decline in promoting costs, falling to 7.9 from 13.7, and the Philadelphia Fed’s non-manufacturing costs acquired index turned unfavorable, dropping to -1.1 from -0.3. Richmond Fed providers costs edged decrease to three.31 from 3.55. General, the information suggests persistent inflationary pressures, significantly in goods-producing sectors, with some indicators of worth reduction in providers. This helps a combined inflation outlook, with worth development accelerating in manufacturing and remaining agency in providers, regardless of remoted situations of easing.

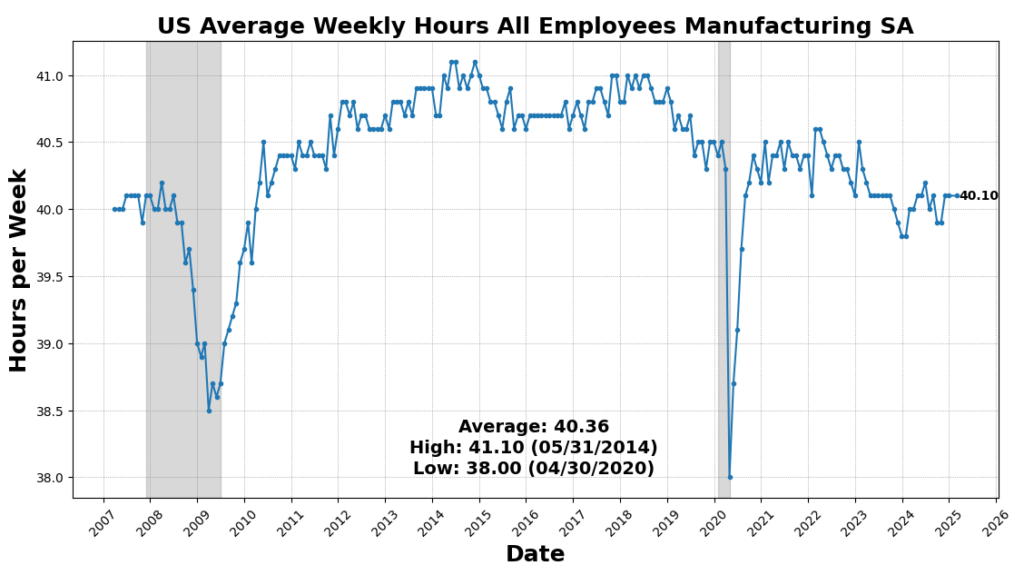

Job development in February 2025 exceeded expectations, with nonfarm payrolls rising by 151,000, led by beneficial properties in building, manufacturing, well being care, monetary actions, transportation, and social help, whereas declines occurred in leisure and hospitality, retail, and authorities employment, significantly on the federal stage as a result of a hiring freeze. The typical workweek remained regular at 34.1 hours, contributing to a 0.3 p.c enhance in weekly earnings. Nevertheless, labor market slack widened, with the unemployment fee (U-3) rising to 4.14 p.c, reflecting a rise of 203,000 unemployed people. The U-2 fee, which tracks job losses, additionally climbed, whereas the broader U-6 measure of underemployment surged to eight.0 p.c, indicating an increase in discouraged and involuntarily part-time staff. The labor power participation fee dipped to 62.4 p.c as employment declined by 588,000, and transitions out of unemployment slowed, signaling weaker hiring momentum. Combination labor revenue rose 0.4 p.c, largely on wage development, however indicators of labor market softening—significantly greater unemployment, an increasing pool of job seekers, and slower re-employment—reinforce expectations for a 75 foundation level fee lower by the Federal Reserve in 2025 as financial situations deteriorate.

US client sentiment fell sharply in early March, reaching its lowest stage since November 2022, as considerations over tariffs and financial uncertainty weighed on confidence. The College of Michigan’s preliminary sentiment index declined to 57.9 from 64.7 in February, marking a steeper drop than any economist forecasted. Lengthy-term inflation expectations surged by 0.4 proportion level to three.9 p.c, the most important month-to-month enhance since 1993, whereas one-year inflation expectations rose to 4.9 p.c, the best since 2022. As President Trump’s tariffs develop, customers throughout the political spectrum more and more concern rising prices, with 48 p.c of survey respondents mentioning tariffs unprompted, anticipating them to drive future inflation greater. Households’ monetary expectations hit a document low, and respondents assigned only a 48.7 p.c likelihood to inventory market beneficial properties over the following 12 months, the weakest studying since Might 2023.

Deteriorating confidence presents a rising threat to client spending, significantly in big-ticket purchases like properties, autos, and discretionary items. The present situations gauge fell to 63.5, a six-month low, whereas the expectations index dropped to its lowest stage since July 2022. Political divisions have been evident, with confidence amongst Democrats falling almost 10 factors, independents down 5.4 factors, and Republicans slipping almost 3 factors. Economists warn that elevated uncertainty over coverage shifts and financial situations is making it troublesome for customers to plan for the long run, reinforcing fears that slowing confidence might curb family spending and contribute to financial draw back dangers within the months forward.

Small-business optimism declined in February as inflation, coverage uncertainty, and considerations over tariffs weighed on sentiment. The NFIB Small Enterprise Optimism Index fell 2.1 factors to 100.7, barely beneath expectations, with the sharpest declines in financial outlook (-10 factors), anticipated gross sales (-6 factors), and growth plans (-5 factors). Whereas job openings (+3 factors), earnings traits (+1 level), and anticipated credit score situations (+1 level) improved, general optimism stays effectively beneath December’s peak of 105.1, although nonetheless greater than the pre-election stage of 93.7 in October. Hiring plans softened, with solely 15 p.c of householders planning so as to add jobs within the subsequent three months, down 3 factors from January, as retail, building, and manufacturing confronted the best labor shortages. Simply 19 p.c of companies plan to develop within the subsequent six months, reflecting decrease anticipated gross sales (14 p.c, down 6 factors) and weak profitability traits (-24 p.c). Inflation pressures intensified, with 32 p.c of corporations elevating costs, a 10-point bounce and the most important enhance since April 2021, although companies held off on preemptive pricing changes forward of tariffs. Regardless of tax cuts and deregulation boosting the long-term outlook, excessive uncertainty is protecting small companies in a wait-and-see mode, limiting hiring and growth.

February retail gross sales fell in need of expectations, reinforcing considerations a few slowdown in client spending, whereas weaker manufacturing and homebuilder sentiment additional signaled softening financial momentum. Retail gross sales rose marginally, however seven of the 13 classes declined, together with motor autos, electronics, attire, and gasoline, with restaurant and bar gross sales posting their sharpest drop in a 12 months. January’s figures have been revised downward, marking the most important decline since July 2021. Whereas e-commerce exercise and healthcare spending lifted control-group gross sales by 1 p.c, economists famous that seasonal changes performed a big function, limiting optimism for first-quarter GDP. Weaker revenue development and rising job insecurity are possible curbing discretionary spending, significantly amongst lower-income customers, whereas wealthier households may additionally in the reduction of on main purchases following current inventory market volatility. Enterprise warning is rising as New York state manufacturing exercise dropped to its lowest stage since early 2024 and homebuilder confidence fell to its weakest studying since August. Mounting uncertainty over tariffs, slowing wage development, and deteriorating client sentiment enhance the chance of weaker financial growth, with some analysts warning that first-quarter GDP development might contract.

US manufacturing exercise in February edged nearer to stagnation, with orders and employment contracting at the same time as enter prices surged. The ISM Manufacturing Index slipped 0.6 factors to 50.3, whereas costs paid for supplies jumped 7.5 factors to 62.4, the best since June 2022, signaling renewed inflationary pressures. New orders fell 6.5 factors to 48.6, the primary contraction since October 2024, and manufacturing unit employment dropped 2.7 factors to 47.6, marking contraction in eight of the previous 9 months. Rising prices, largely pushed by tariff-related provide disruptions, are creating backlogs and stock imbalances, with companies struggling to go on worth will increase amid softening demand. Imports climbed to 52.6, the best since March 2024, as corporations ramped up orders forward of Trump administration tariffs on Mexico and Canada set to take impact Tuesday. In the meantime, headline industrial manufacturing surged 0.7 p.c, largely as a result of a 4.3 p.c bounce in client sturdy items output, led by a pointy rise in automotive manufacturing. Manufacturing manufacturing expanded 0.9 p.c, whereas enterprise gear output rose 1.6 p.c, persevering with its robust development since November. Capability utilization elevated to 78.2 p.c from 77.7 p.c, as factories ramped up exercise. The surge in manufacturing could replicate corporations front-loading output earlier than tariffs disrupt provide chains, suggesting a possible slowdown forward. Nevertheless, with Trump administration insurance policies targeted on onshoring and boosting home manufacturing, industrial exercise could proceed to obtain reasonable tailwinds regardless of near-term volatility.

In February and early March of 2025 the US economic system confirmed combined situations. Reasonable client spending development, secure automobile gross sales, and resilience in monetary providers have been evident however clear indicators of pressure in manufacturing, building, and agriculture have gotten clear. Vacation retail gross sales exceeded expectations, and nonfinancial providers, together with leisure, hospitality, and transportation, expanded modestly, significantly in air journey. Business actual property noticed slight beneficial properties, and lending exercise remained regular with little deterioration in asset high quality. Nevertheless, building exercise declined as excessive materials and financing prices dampened development, and residential actual property remained stagnant as a result of elevated mortgage charges. Manufacturing slipped barely, with corporations stockpiling inventories in anticipation of upper tariffs and truck freight volumes fell, signaling weaker items demand. Rising delinquencies amongst small companies and lower-income households raised considerations about monetary stability and the general disposition of customers. Agricultural situations remained weak, with low farm incomes and climate disruptions including strain.

The massive surge in client and enterprise optimism seen in November 2024, pushed by disinflationary progress and powerful company expectations of pro-business insurance policies has steadily eroded within the face of skyrocketing uncertainty. By February and early this month cussed inflation, weakening employment traits, and clear indicators of client misery have fueled a pointy reversal in sentiment. File ranges of coverage instability—marked by an unprecedented tempo of government orders, shifting tariff threats, and mounting regulatory uncertainty—has additional compounded financial unease, disrupting enterprise planning and funding. With the Trump administration’s full slate of tariffs set to take impact on April 2nd, commerce flows, enter prices, and company methods face the potential for vital upheaval.

With companies and households more and more transferring to the sidelines amid mounting financial uncertainty, considerations over the chance of a recession have risen sharply. Public discourse on the topic has intensified, and whereas the final word consequence stays unsure, these considerations will not be untimely. Given the present coverage and financial panorama, robust warning is warranted.

LEADING INDICATORS

ROUGHLY COINCIDENT INDICATORS

LAGGING INDICATORS

CAPITAL MARKET PERFORMANCE