BTCS Inc has elevated its Ethereum (ETH) holdings to 13,500 cash. This follows the latest acquisition of 1,000 ETH for roughly $2.63 million. The acquisition was made by means of the Crypto.com Change, utilizing its institutional buying and selling companies. As of June 2, this transfer marks a virtually 50% rise in ETH holdings because the finish of Q1 2025.

The corporate is specializing in ETH as a part of its broader blockchain infrastructure technique. In consequence, its acquisition helps each its treasury mannequin and infrastructure operations. BTCS goals to construct scalable blockchain techniques and sees ETH as central to those efforts.

BTCS Acquires 1,000 Ethereum, Complete Hits 13,500

The agency BTCS continues to broaden its blockchain operations and Ethereum reserves. With the addition of 1,000 ETH, the corporate now holds round 13,500 ETH. This enhance displays BTCS’s dedication to Ethereum-based applied sciences, together with its NodeOps and Builder+ actions.

Charles Allen, CEO of BTCS, acknowledged, “Ethereum stays on the core of our blockchain infrastructure technique.” He added that ETH acquisition is a byproduct of their infrastructure improvement, not only a digital asset reserve. The corporate is working to scale revenue-generating blockchain companies that function on Ethereum’s community.

BTCS isn’t exploring Ethereum simply because it might rise in worth. As an alternative, the main focus is on long-term improvement of assets and making companies sustainable and now making use of ETH to many areas of its enterprise.

Crypto.com Position within the ETH Acquisition

The ETH was acquired by means of the Crypto.com Change, an institutional-grade buying and selling platform. This trade is designed for superior and institutional customers and supplies deep liquidity and low latency. Crypto.com started providing U.S. companies in 2024 and has develop into a significant platform for institutional crypto buying and selling.

In response to BTCS, utilizing Crypto.com helped optimize commerce execution. The trade diminished slippage and ensured cost-effective capital deployment.

“We now have utilized Crypto.com’s institutional providing… lowering slippage and optimizing capital deployment,” stated Allen.

Eric Anziani, President and COO of Crypto.com, commented on the partnership: “We’re proud to associate with BTCS in its cryptocurrency acquisition technique.” He stated the platform is designed to supply establishments with superior instruments and liquidity for large-scale trades.

ETH Reserves Rising Amongst Public Corporations

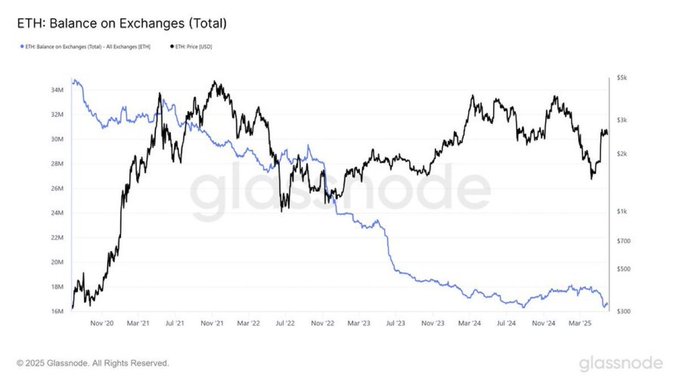

Subsequently, Ethereum trade balances are actually at their lowest level in seven years, in response to on-chain information. Extra public corporations are growing their ETH holdings, and provide on exchanges continues to drop.

BTCS is amongst a number of corporations growing ETH reserves. Grayscale Investments holds about 1.85 million ETH, BlackRock holds about 1.05 million ETH, and Constancy Investments holds round 460,900 ETH. As well as, Abraxas Capital and others have additionally made massive ETH acquisitions.

Concurrently, SharpLink Gaming additionally not too long ago closed a non-public placement deal to construct its Ethereum treasury. The corporate revealed that it goals to lift between $750 million and $1 billion. It’s aiming to surpass all others by holding the largest reserves of ETH available on the market.

Since company shopping for of ETH is growing, it might quickly develop into a key focus for a lot of corporations’ treasury and infrastructure plans, main others to do the identical.

Disclaimer: The introduced content material could embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.