G0d4ather

My Thesis Replace

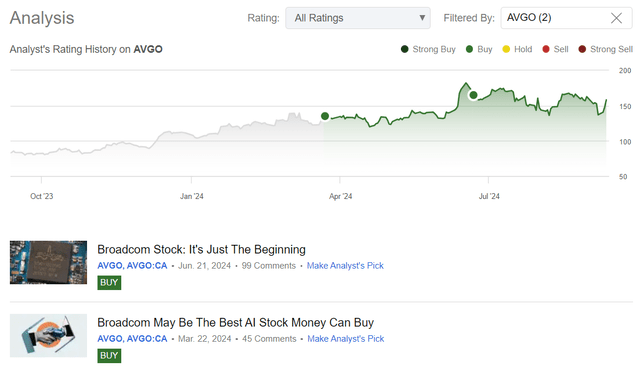

I first initiated protection of Broadcom Inc. (NASDAQ:AVGO) on March 22, 2024, stating that “the corporate’s robust financials, gross sales construction updates, and AI prospects pointed to additional outperformance sooner or later.” Since then, AVGO’s whole return has outperformed the S&P 500 (SPY) (SP500) by roughly 3 instances. However since I up to date my bullish thesis in June, AVGO inventory went right into a consolidation section amid rising volatility, so AVGO is definitely lagging behind the market since my final name:

Searching for Alpha, Oakoff’s protection of AVGO inventory

Regardless of the heightened volatility as I mentioned above, I nonetheless imagine Broadcom is among the greatest AI performs to this point because the latest company occasions clearly point out that development expectations for the corporate are doubtless well-founded, and we should always anticipate extra top-line development, increased margins, and continued dividend development supporting the excessive valuation multiples. So I made a decision to replace my protection at this time with a “Purchase” score as my predominant present thesis stays largely unchanged.

My Reasoning

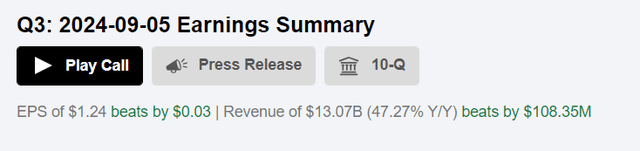

Broadcom reported for its fiscal Q3 FY2024 with income reaching $13.07 billion (+43% YoY, or +5% sequential rise), exceeding the consensus estimate of $12.96 billion – that wasn’t the heaviest beat of the previous few quarters (AVGO beat by <1%), however the actual fact appears to be like spectacular, provided that analysts have been elevating their estimates persistently since Q2. After all, the inorganic a part of the expansion, coming from the VMware acquisition was the primary driver with the natural half amounting to only 4% YoY, however nonetheless. Whole prices of income went up by virtually 74% YoY, so the gross revenue surged lower than the highest line did – by simply over 35% YoY in Q3. The working bills almost doubled, amounting to $4.5 billion for Q3 alone, so Broadcom’s EBIT determine of ~$3.8 billion was really a YoY decline of -1.7%. Regardless of the web loss on a GAAP foundation, the adjusted diluted EPS of $1.24 was up 18% from the earlier yr and surpassed the consensus forecast of $1.21:

Searching for Alpha, AVGO

Definitely, not all enterprise areas of AVGO had been robust in Q3. Storage server connectivity and broadband confronted challenges, with broadband income down 49% YoY. Regardless of these headwinds, Broadcom’s general efficiency was bolstered by its diversified portfolio and robust AI development, which greater than offset these weaknesses. One of many key drivers of Broadcom’s success this quarter was its AI-related income, which remained sturdy at round $3.1 to $3.2 billion. This phase is on monitor to generate $12 billion in income for the fiscal yr, up from earlier steerage of $11 billion.

Talking of the Semiconductor Options phase, AVGO’s income on that entrance was $7.27 billion, with AI-related merchandise accounting for >40% of this whole quantity. From what I see, Broadcom’s management in networking, significantly with Ethernet merchandise and customized AI accelerators, has been a significant development space. Networking income alone was $4.0 billion, up 43% year-over-year, pushed by “the demand for AI clusters and the transition to higher-speed networks.”

“Weaker demand and stock reductions within the storage, broadband, and industrial chip finish markets have partially offset robust natural AI chip development”, as Morningstar analyst William Kerwin just lately famous (proprietary supply), however the administration positively guided for sequential development within the October quarter throughout the newest earnings name, and so we could anticipate multiyear rebounds to begin meaningfully in fiscal 2025.

We anticipate This fall semiconductor income of roughly $8 billion, up 9% year-on-year. For infrastructure software program, we anticipate income to be about $6 billion. So we’re guiding This fall consolidated income to be roughly $14 billion, which is up 51% year-on-year.

We additionally anticipate this may drive This fall consolidated adjusted EBITDA to approximate — to realize roughly 64% of income. This This fall steerage would suggest we’re elevating the outlook for our fiscal 2024 income to $51.5 billion and adjusted EBITDA for the yr to 61.5%.

I believe Broadcom is certainly on monitor with its integration of VMware and cost-cutting measures, with steerage calling for a 64% non-GAAP EBITDA margin within the October quarter that we noticed within the above quote. Additionally, the expectation that as much as 40% of income will come from software program suggests a good margin profile, which ought to assist continued profitability, for my part.

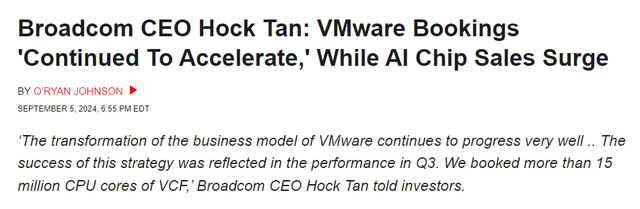

Whereas some fellow SA analysts anticipate that “Broadcom’s termination of VMware’s perpetual license mannequin and controversial pricing modifications could drive companions to rivals”, it is clearly not the case but – the just lately acquired VMware’s bookings “proceed to speed up”, in accordance with the CEO and President Hock Tan. It does not look like the corporate’s making ready for an enormous buyer exodus, actually having a differentiated and “moaty” enterprise mannequin.

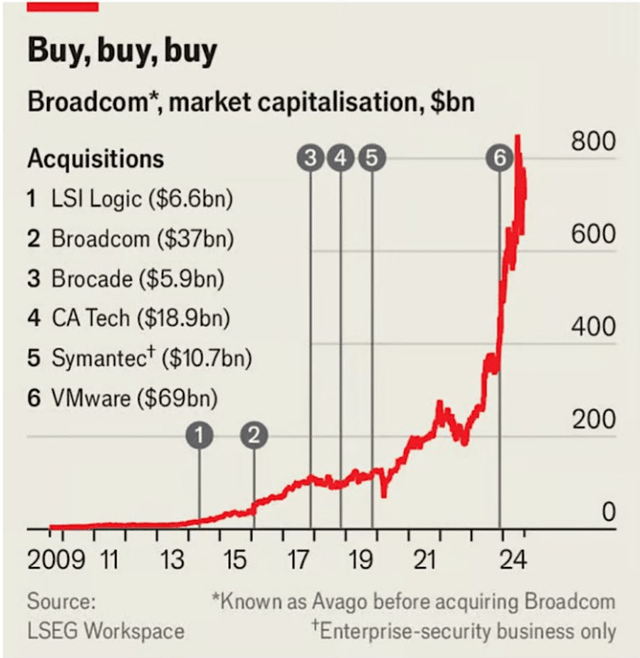

CRN

I imagine Broadcom’s strategic give attention to AI and infrastructure software program, mixed with its skill to adapt and combine acquisitions like VMware, positions it nicely for sustained development and additional market share positive aspects. This has been the case for the previous few years, even earlier than the AI hype started to dominate the market – Broadcom is a silent compounder, that has enormously expanded its portfolio by systematic M&A offers, in order that at this time, in view of the rising demand for chips, it occupies a dominant place in sure niches and is unlikely to go away the “breeding floor” it has been creating for years to anybody else.

The Economist, shared on X

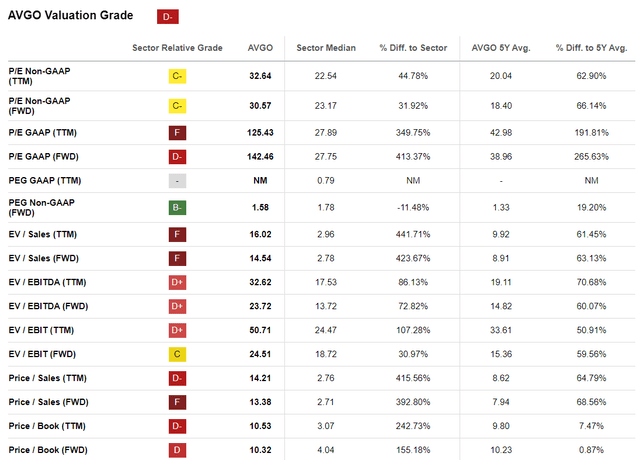

One other group of skeptics I learn says that AVGO is an overvalued behemoth whose lofty valuation and restricted FCF yield could restrict future traders’ returns. I respectfully disagree with that.

Certainly, Searching for Alpha Quant Ranking says that AVGO is a “D-” inventory when it comes to its Valuation grade, buying and selling at heavy 30.6x and 23.7x non-GAAP P/E and EV/EBITDA ahead multiples, respectively.

Searching for Alpha, AVGO

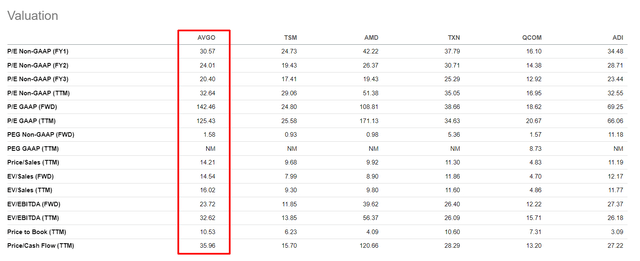

Nevertheless, as Argus Analysis analysts famous of their latest replace, peer group evaluation exhibits AVGO buying and selling under friends on EV/EBITDA and in line on P/E and value/gross sales. AVGO does have fairly average multiples after we evaluate the inventory to its closest friends:

Searching for Alpha, AVGO, notes added

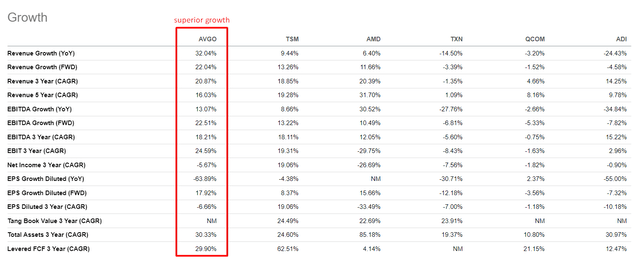

It needs to be famous right here that Broadcom is now rising a lot quicker and is higher-margined than up to now and has a fast-growing AI alternative that did not exist 2-3 years in the past. Due to this fact, its future development charges are prone to expertise a big tailwind, which might theoretically simply justify a good increased valuation premium than AVGO has at this time. On the identical time, when in comparison with the identical group of friends that I cited above, Broadcom seems to completely justify its valuation based mostly not solely on the longer term but in addition on the current (i.e. TTM enterprise development charges):

Searching for Alpha, AVGO, notes added

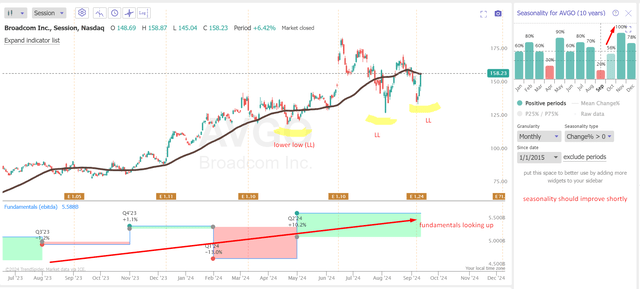

Talking of technical evaluation, I see on the each day chart that AVGO inventory is consolidating round its long-term 200-day easy shifting common. The value didn’t fall under the earlier low over the last correction, which is an effective signal for consumers. There may be additionally a elementary foundation for future development right here – I wrote about it within the monetary evaluation a part of at this time’s article above, and additionally it is proven on a separate small chart when it comes to EBITDA development. September is traditionally the weakest month of the yr for AVGO: in accordance with statistics from the final 10 years, AVGO has solely grown 20% of the time on this month. From October till the tip of the yr, nevertheless, the seasonality for AVGO ought to change drastically:

TrendSpider Software program, AVGO inventory, Oakoff’s notes added

Primarily based on each elementary and technical evaluation, in addition to the present state of the trade, I imagine Broadcom stays one of many prime AI firms within the US at this time. Regardless of some challenges, the corporate’s robust place in the long run markets helps my resolution to price the inventory as “Purchase” for the medium time period.

Dangers To My Thesis

As I famous in my earlier articles, regardless of my constructive view in the marketplace for personalized AI silicon chips and Broadcom’s market positioning from different friends, there are some key dangers that any potential purchaser of Broadcom inventory ought to take into account.

One main concern is potential competitors from Nvidia (NVDA), which might affect Broadcom’s market share. As Morgan Stanley identified final quarter (proprietary supply), there are press stories suggesting that Google (GOOG) might develop its personal ASIC, presumably in collaboration with MediaTek, which might jeopardize Broadcom’s Google TPU enterprise. There may be additionally the chance of a continued downturn in semiconductors and challenges in integrating VMware into its portfolio that we should not ignore.

Though the corporate has been conservative in its buyer assessments – we will see that from the earnings name – any EPS shortfalls might result in large a number of contractions.

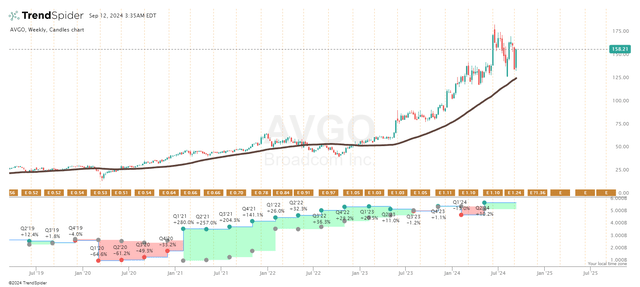

I am additionally confused by the truth that AVGO shares look fairly stretched on a weekly timeframe, technically talking: The inventory could undergo an extended consolidation section, and for brand new consumers, now will not be the perfect time to purchase. However once more, the basics look good and should greater than justify such type of a transfer.

TrendSpider Software program, AVGO inventory, Oakoff’s notes added

Your Takeaway

I imagine Broadcom’s important benefit lies in its proactive administration, which has ensured ample diversification and enlargement of its portfolio. Notably, the corporate ventured into synthetic intelligence choices nicely earlier than the hype surrounding AI started. Latest enterprise enlargement offers ought to have a robust constructive affect on the agency, as evidenced by the newest monetary statements exhibiting present enterprise development. Based on administration steerage, this development is projected to proceed into FY2025 and presumably past.

Regardless of the inventory buying and selling at over 30 instances subsequent yr’s earnings, I do not imagine it’s overvalued proper now. In actual fact, in comparison with its friends, AVGO seems to be in a extra favorable place. For my part, this is among the main AI firms at present, deserving of traders’ consideration. Due to this fact, I reaffirm my “Purchase” score and eagerly anticipate updates from Broadcom.

Good luck together with your investments!