Marko Geber/DigitalVision through Getty Photographs

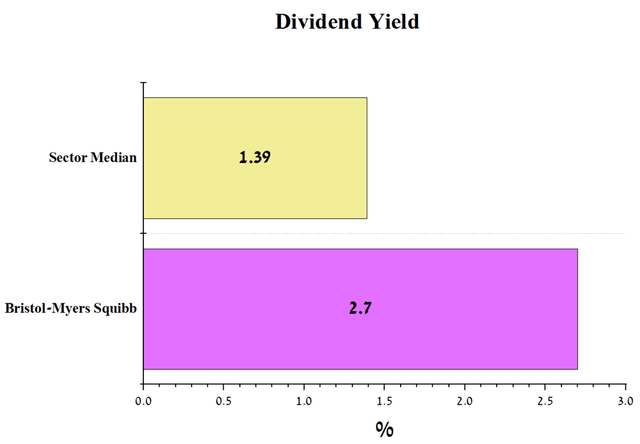

Bristol-Myers Squibb (NYSE:BMY) is among the largest pharmaceutical firms specializing within the improvement and commercialization of medicines for the remedy of most cancers and cardiovascular ailments. Because of an aggressive M&A coverage, the corporate’s portfolio has many medicines, and the top-selling of them are Revlimid, Opdivo, and Eliquis, that are geared toward combating numerous sorts of most cancers, stopping blood clots, and stroke, and thereby saving tens of millions of lives world wide. A 2.7% dividend yield, quarter-on-quarter progress in working revenue, and a wealthy pipeline make Bristol-Myers Squibb a candidate for buyers with a long-term funding technique after the corporate’s inventory correction.

Firm’s Monetary Place

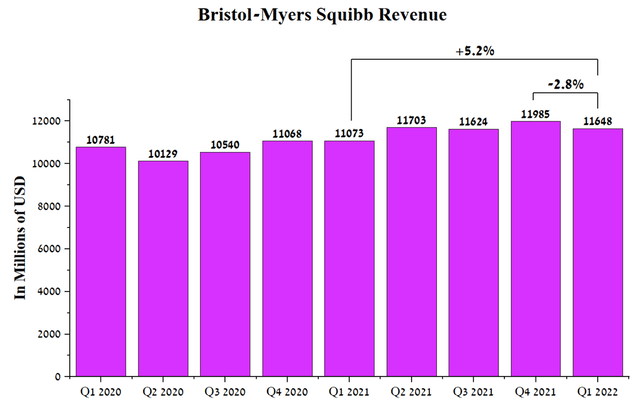

Underneath the management of Giovanni Caforio, the corporate earned $11,648 million in Q1 2022, up 5.2% from Q1 2021.

Supply: Writer’s elaboration, primarily based on Searching for Alpha

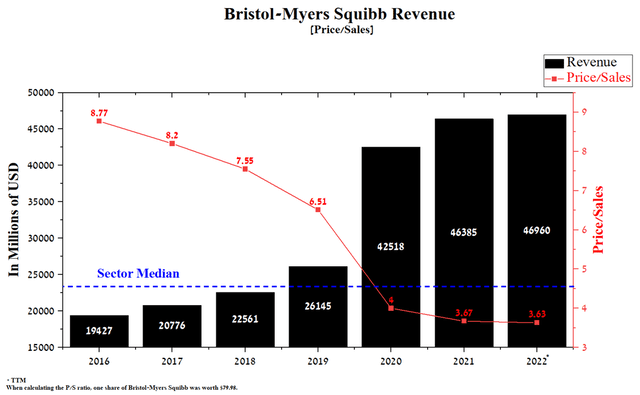

In keeping with Bristol-Myers Squibb administration, the corporate’s income can be about $47 billion in 2022, up 1.3% from a yr earlier. The modest enhance is principally because of the begin of the commercialization of the generic model of Revlimid, and this example can be analyzed in additional element later within the article. Regardless of increasing using the corporate’s key medication, the Value/Gross sales ratio continues to say no and stands at 3.63 on the finish of Q1 2022, which is considerably decrease than the typical for the pharmaceutical trade. Thus, this means that Bristol-Myers Squibb is an undervalued firm by Wall Road on this indicator.

Supply: Writer’s elaboration, primarily based on Searching for Alpha

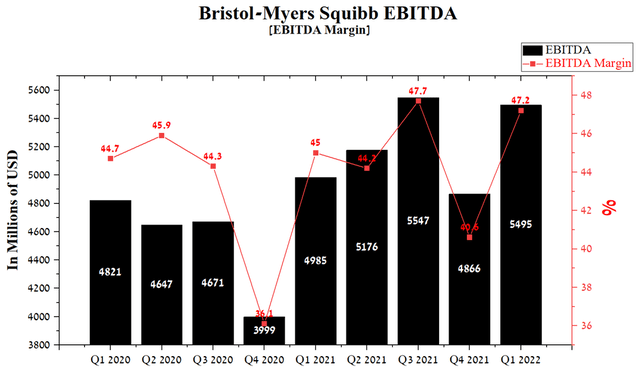

EBITDA was $5,495 million in 1Q 2022, up 10.2% year-on-year. This indicator continues to enhance from quarter to quarter, primarily because of the enhance in indications for using Opdivo and Yervoy in recent times. As well as, because the starting of the COVID-19 pandemic, the EBITDA margin has remained excessive and on the finish of Q1 2022, this determine was 47.2%, which is among the largest values within the pharmaceutical trade.

Supply: Writer’s elaboration, primarily based on Searching for Alpha

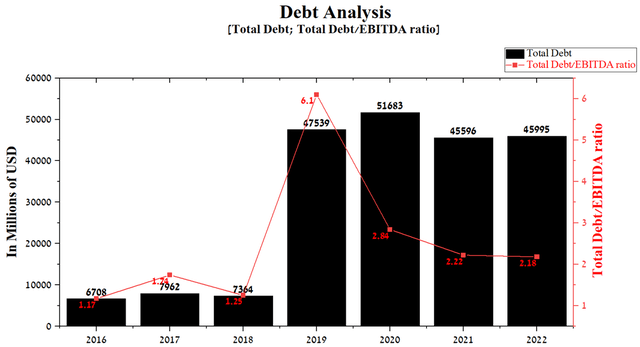

Bristol-Myers Squibb Debt

The corporate has considerably elevated its debt within the final 5 years, and this was as a consequence of two main acquisitions. In 2019, Bristol-Myers Squibb acquired Celgene for $74 billion, which led to the necessity to fund the cope with a $19 billion senior bond challenge and a mortgage settlement with Morgan Stanley and MUFG Financial institution. The corporate continued its aggressive M&A coverage with the acquisition of MyoKardia for $13.1 billion, which was funded by the corporate’s money and a $7 billion senior bond challenge. Whole debt was $45,995 million in Q1 2022, barely lower than the earlier quarter. Nonetheless, because the closing of those two main offers, the Whole Debt/EBITDA ratio has continued to say no to 2.18 in 2022, indicating that there aren’t any vital dangers related to Bristol-Myers Squibb’s debt.

Supply: Writer’s elaboration, primarily based on Searching for Alpha

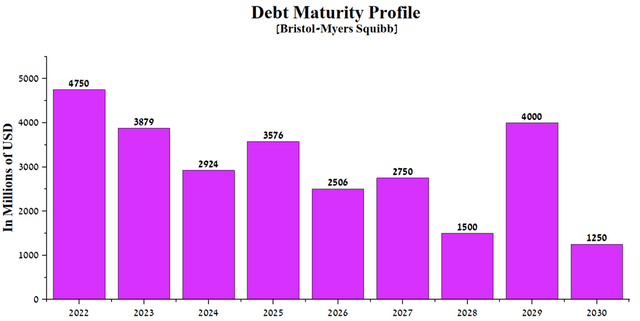

Bristol-Myers Squibb has generated greater than $10 billion in working revenue over the previous 12 months, effectively above the repayments of senior bonds and loans maturing by means of 2030.

Supply: Writer’s elaboration, primarily based on 10-Okay

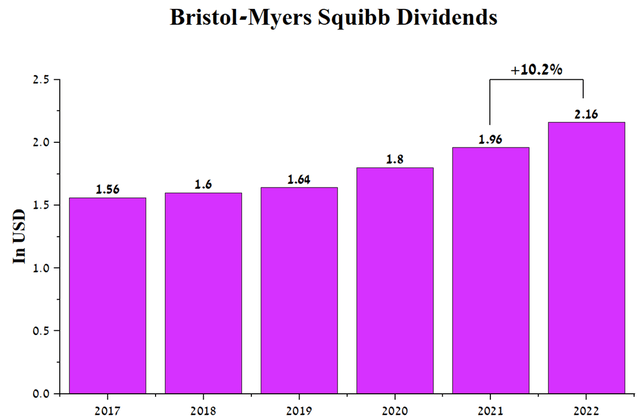

Sustaining a steady monetary place for the corporate allowed Bristol-Myers Squibb administration to extend dividend funds during the last 13 years. In 2022, buyers ought to obtain $2.16 per share, up 10.2% from a yr earlier.

Supply: Writer’s elaboration, primarily based on Searching for Alpha

The corporate’s dividend yield of two.7% is increased than the pharmaceutical trade common, making Bristol-Myers Squibb enticing to massive institutional buyers.

Supply: Writer’s elaboration, primarily based on Searching for Alpha

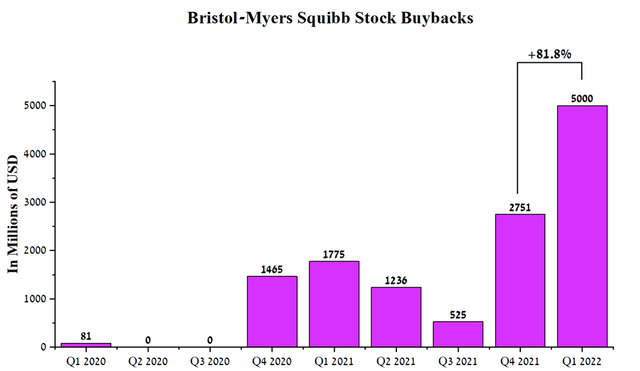

To take care of funding curiosity in Bristol-Myers Squibb, the corporate continues the coverage of repurchasing its shares. In Q1 2022, Bristol-Myers Squibb repurchased $5 billion of shares, up 81.8% from the earlier quarter. As well as, the remaining share repurchase capability was about $10.2 billion, leaving Bristol-Myers Squibb’s administration leverage to prop up the corporate’s share value throughout a difficult interval of excessive inflation and Fed price hikes.

Supply: Writer’s elaboration, primarily based on quarterly securities experiences

Product Pipeline Bristol-Myers Squibb

Via in-house improvement and acquisitions of main pharmaceutical firms, Bristol-Myers Squibb has dozens of patented medication geared toward treating cardiovascular, oncological, hematological, and different ailments. On this article, I need to look carefully at one of many firm’s key blockbusters and a drug that may trigger Bristol-Myers Squibb’s revenues to point out weak progress within the coming quarters.

Opdivo is among the main PD-1 inhibitors

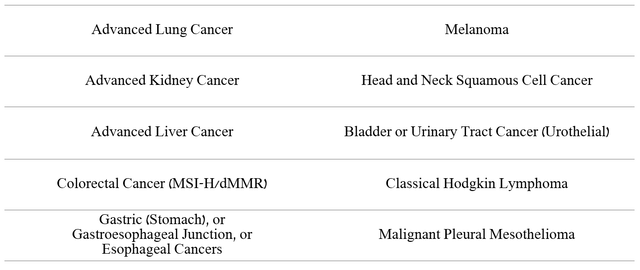

Opdivo (nivolumab) is a drugs that binds to the PD-1 protein to assist an individual’s immune cells struggle most cancers cells extra successfully. This drug is presently accredited for the remedy of many sorts of most cancers.

Supply: Writer’s elaboration, primarily based on quarterly securities experiences

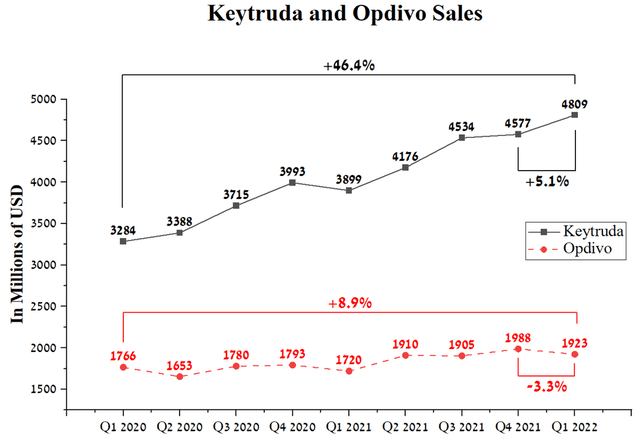

Opdivo is the second-ever accredited PD-1 inhibitor, which, just like the drug Merck (NYSE:MRK), obtained FDA approval in 2014. Nonetheless, as a consequence of extra indications and first-mover advantages, Keytruda gross sales are displaying extra vital gross sales progress relative to Opdivo. World gross sales of Opdivo had been $1,923 million in Q1 2022, up 8.9% year-over-year.

Supply: Writer’s elaboration, primarily based on quarterly securities experiences

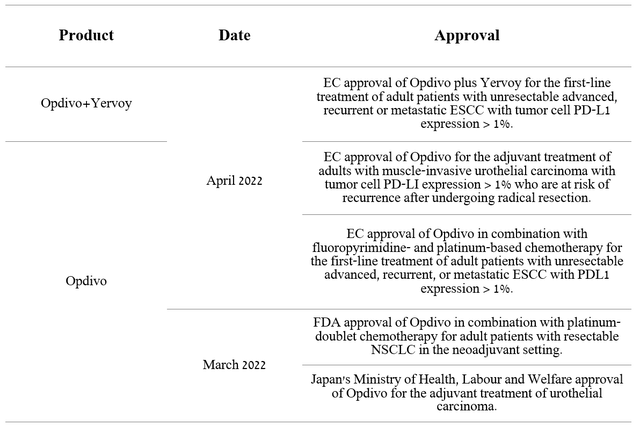

A major funding by Bristol-Myers Squibb permits Opdivo to take care of a comparatively excessive price of enlargement. So, this drugs has already obtained 5 regulatory approvals in 2022.

Supply: Writer’s elaboration, primarily based on 10-Q

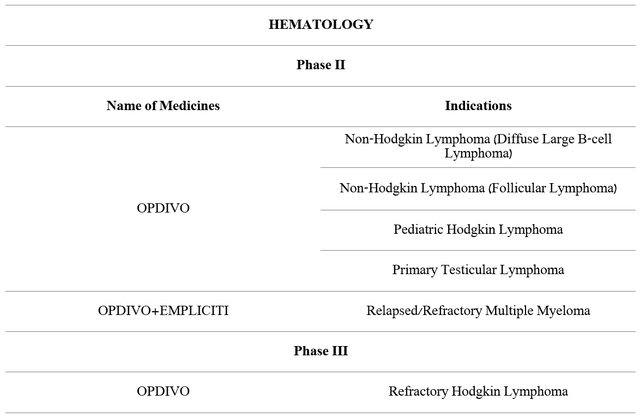

Nonetheless, Bristol-Myers Squibb administration doesn’t intend to relaxation on the progress that has been remodeled the previous seven years and continues to develop therapies utilizing Opdivo for the remedy of hematological ailments.

Supply: Writer’s elaboration, primarily based on 10-Okay

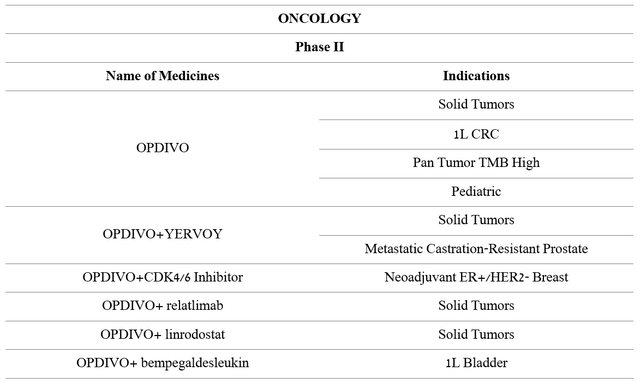

Extra spectacular R&D exercise is being noticed within the improvement of Opdivo together with different medication geared toward evaluating the efficacy and security of the remedy of breast, blood, esophageal, prostate, and different sorts of most cancers. This permits Bristol-Myers Squibb to have a diversified pipeline that helps enhance gross sales of this drug yr after yr.

Supply: Writer’s elaboration, primarily based on 10-Okay

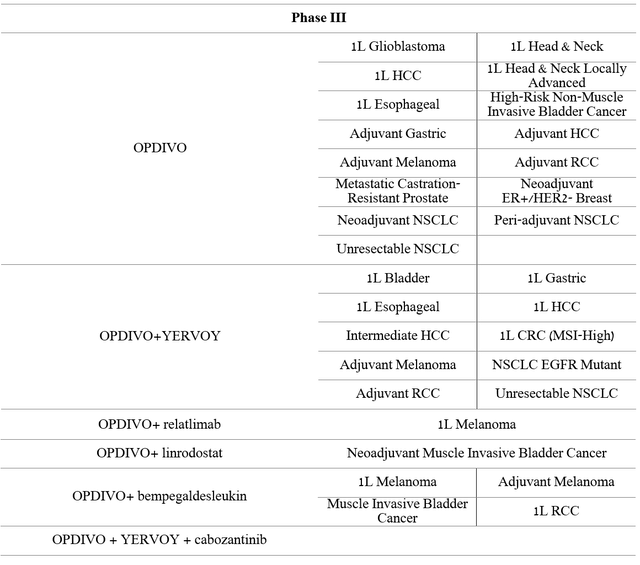

Greater than twenty section III medical trials, that are the ultimate stage earlier than making use of for regulatory approval, are presently underway. Furthermore, a big proportion of them evaluates Opdivo as a first-line drug, that’s, a remedy that’s the usual remedy for sufferers who’re first recognized with a specific sort of most cancers.

Supply: Writer’s elaboration, primarily based on 10-Okay

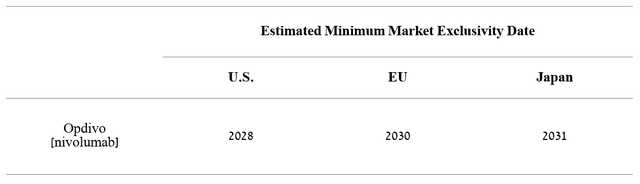

In my estimation, the corporate is doing the utmost quantity of medical trials the place the reward/danger is on Opdivo’s facet of the management group. That is achieved to attain the best variety of indications and thereby enhance gross sales of this drugs earlier than the patents expire.

Supply: Writer’s elaboration, primarily based on 10-Okay

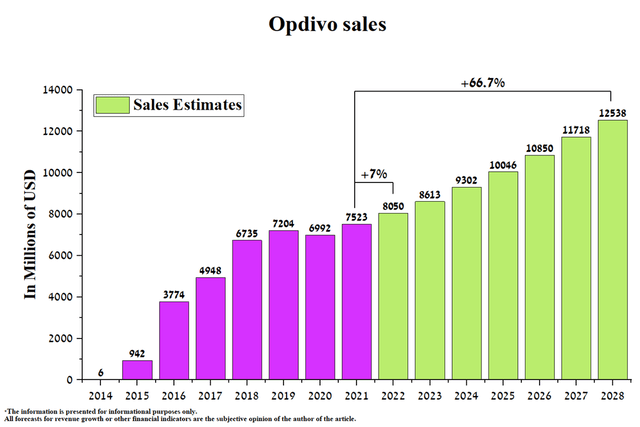

Given the historic traits in Opdivo gross sales and the enlargement of Bristol-Myers Squibb and Merck’s PD-1 inhibitors, I count on the following Opdivo gross sales earlier than 2028.

Supply: Created by writer

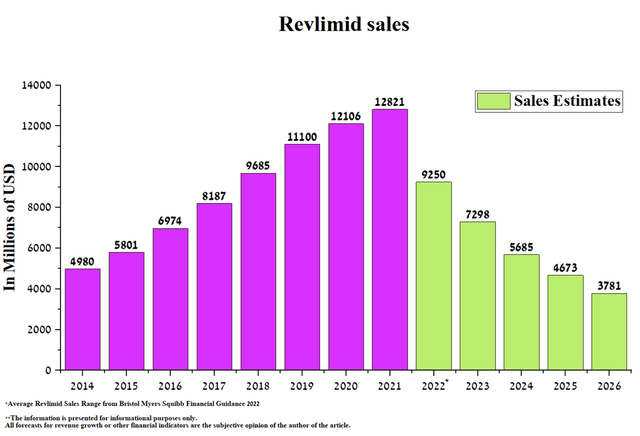

Revlimid is a blockbuster that has misplaced its exclusivity

Revlimid (lenalidomide) is an immunomodulatory drugs that’s used to deal with sufferers with a number of myeloma, anemia in sufferers with myelodysplastic syndrome, and hematological malignancies. Because of a lot of indications, excessive efficacy, and oral route of administration, Revlimid has grow to be a blockbuster in a comparatively brief time, bringing in billions of {dollars} a yr. Nonetheless, the scenario started to vary quickly because of the expiration of patents and the beginning of gross sales of a generic model of this drug in 2022.

Supply: Writer’s elaboration, primarily based on 10-Okay

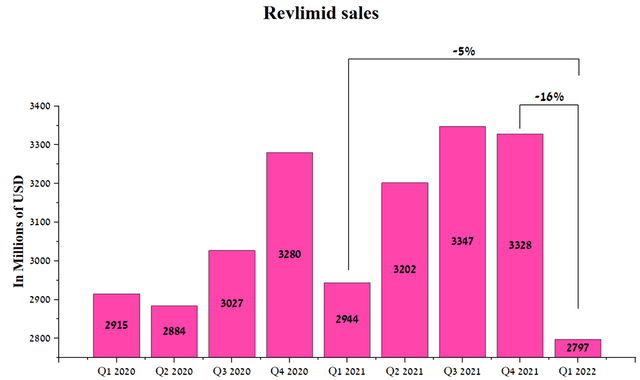

In consequence, Revlimid’s gross sales had been $2,797 million in Q1 2022, down 16% QoQ.

Supply: Writer’s elaboration, primarily based on quarterly securities experiences

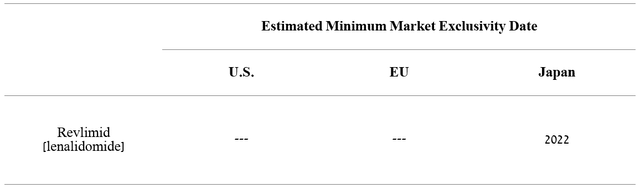

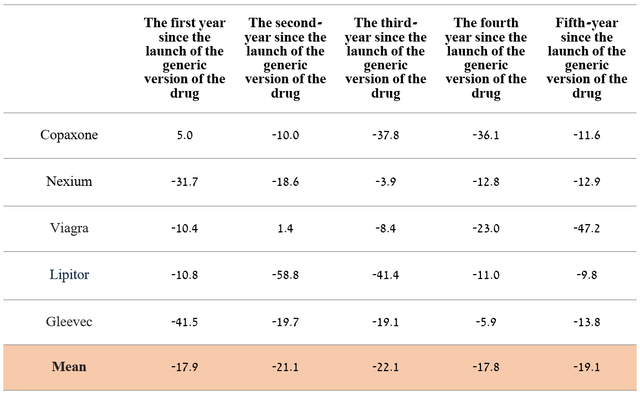

I count on gross sales of this drug to proceed to say no as new generics enter the market and grow to be commercialized in Japan. With the intention to extra precisely predict the speed of decline in Revlimid’s income over the following 5 years, gross sales of medicines which have misplaced exclusivity up to now had been analyzed.

Supply: Created by writer

Nonetheless, the corporate’s administration expects Revlimid’s gross sales to be $9-9.5 billion in 2022, about $3.5 billion or 27.9% decrease than in 2021.

Supply: Created by writer

Thus, I consider that the loss from gross sales of Revlimid will put strain on the monetary place of Bristol-Myers Squibb and, because of this, on the value of the corporate’s shares within the coming quarters.

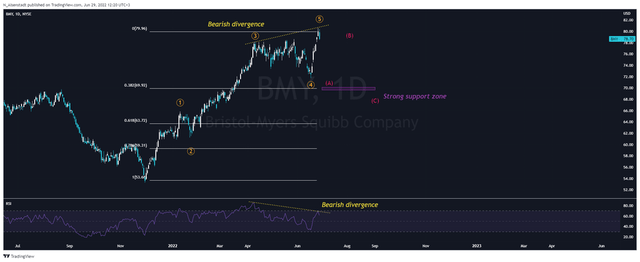

Technical Evaluation

On the every day chart, we see the tip of the impulse wave that started on December 1, 2021, and propelled the corporate’s refill by greater than 50%. In keeping with the Elliott Wave Idea, the Bristol-Myers Squibb inventory begins to type a corrective motion in wave A. It must be famous that the start of the correction from June 27 was foreshadowed by the formation of a bearish divergence, which is among the highly effective patterns in technical evaluation. Based mostly on basic and technical evaluation, I count on Bristol-Myers Squibb’s share value correction to proceed to a robust help zone round $68-69 per share.

N_Aisenstadt — TradingView

Dangers

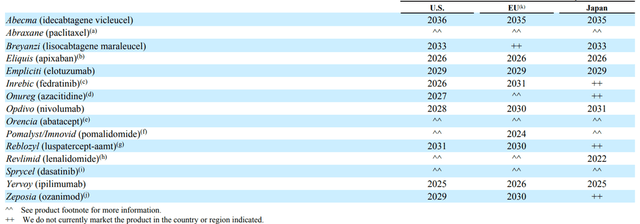

For my part, there’s a main danger related to the expiration of patents, which might negatively have an effect on the monetary place of Bristol-Myers Squibb within the subsequent 5 years.

Patent expiration

Patent safety for medicines is vital to sustaining an organization’s income and working revenue. The patents for one of many firm’s best-selling medicines, Yervoy, expire in 2025 within the US and the European Union in 2026. Yervoy’s gross sales had been $2,026 million for 2021, accounting for 4.4% of Bristol-Myers Squibb’s whole income. As soon as different pharmaceutical firms begin commercializing the generic model of Yervoy, it will negatively impression the corporate’s money stream past 2025. Basically, patents for different medication expire within the following years.

Supply: Writer’s elaboration, primarily based on 10-Okay

Conclusion

Bristol-Myers Squibb is among the largest pharmaceutical firms with an intensive portfolio of accredited medicines that generated about $10 billion in working revenue in 2021, up 26.7% from a yr earlier. Because of steady money stream, the corporate has an lively M&A and R&D coverage geared toward growing the variety of product candidates that may enhance the standard of lifetime of hundreds of sufferers world wide. However, the lack of Revlimid’s exclusivity will negatively have an effect on the corporate’s income progress within the coming quarters, and taking into consideration technical evaluation, I count on Bristol-Myers Squibb’s share value to appropriate within the vary of $68-69. Nonetheless, with year-on-year progress in dividend yields, rising EBITDA margins and web revenue, Bristol-Myers Squibb is a wonderful candidate for long-term buyers. Based mostly on the catalysts and dangers described within the article, I set a goal value for the corporate at $101 per share by 2025.