Eoneren/E+ by way of Getty Photographs

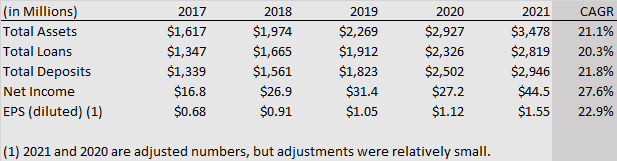

Generally you’re actually good, and typically you simply get fortunate. Bridgewater Bancshares (NASDAQ:BWB) has been each. It has loved over 20% natural common annual asset and mortgage progress and over 25% annual internet earnings progress over the previous 4 years. Most banks are lucky if they’ll develop over 5% organically a yr. The expansion has all been natural, there have been no current acquisitions.

This text will discover how are they getting this progress, how sustainable, and what the financial institution must be valued at.

Background

Bridgewater is predicated in St. Louis Park, Minnesota, a suburb of Minneapolis. It was shaped in 2005 by traders and native bankers together with the present CEO. Its IPO was in 2018. Bridgewater has an asset gentle mannequin. It solely had 8 branches as of June 30, 2021. It focuses on business actual property lending but additionally has a big portfolio of business loans. The financial institution is kind of plain vanilla. There are few actions outdoors of loans and deposits. There is no such thing as a wealth administration, insurance coverage, funding banking, belief or different actions many different banks get into. About 85% of loans are made inside its Twin Cities market.

Financials

Monetary outcomes for the final 5 years are summarized under.

Bridgewater 2021 Kind 10-Okay

The expansion historical past isn’t simply current. It has been constant going again a minimum of 9 years. In actual fact, mortgage progress was so quick, deposits couldn’t sustain. The financial institution addressed this by pursuing brokered deposits, and centered advertising extra on native deposits. It was capable of scale back the mortgage to deposit ratio to 96% on December 31, 2021, from 107% three years earlier. However the financial institution’s value of deposits remains to be above its peer median. That is greater than offset by a better than peer asset yield.

Typically, when a financial institution grows sooner than its friends, it does so by underpricing. That results in a under peer asset yield and fewer cushion to soak up losses. Bridgewater really has an above common asset yield, at over 4% in 2021. They declare this was not finished by taking extra threat however by higher service and a faster turnaround. That is corroborated by their low mortgage loss historical past.

The Native Financial institution Market

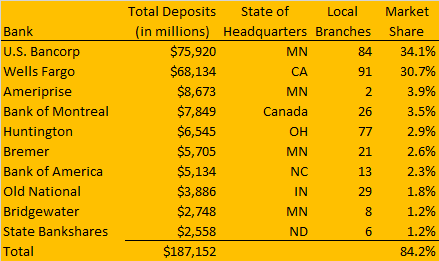

A giant a part of the funding case right here is the native financial institution market. There have been quite a few mergers lately, the place out of state banks have acquired native ones. The result’s there stays one massive native financial institution (U.S. Financial institution) a midsized native financial institution (Bremer) and Bridgewater amongst these of any dimension serving the Twin Cities market. I used to be a profession banker working for neighborhood banks like Bridgewater. I’ve persistently seen {that a} well-run neighborhood financial institution can simply and persistently take market share from the most important banks attributable to higher service. The issue is most aren’t that nicely run. The chart under exhibits financial institution market share within the Twin Cities MSA as of June 30, 2021 (the latest FDIC numbers obtainable).

Bridgewater Kind 10-Okay

As proven above, two large banks have about 2/3 of the market. Ameriprise is listed as headquartered within the space, however that could be a financial institution hooked up to a nationwide monetary planning agency and not likely a neighborhood competitor. In actual fact, they’ve few loans. Huntington entered the market in June, 2021, by buying TCF Financial institution. Bridgewater has not too long ago picked up staff from TCF, together with the Investor Relations individual I spoke to. Bremer is 92% owned by The Otto Bremer Belief, a charitable belief. The Belief has declared an intention to promote the financial institution. Pushback from the financial institution has led to the Minnesota Lawyer Basic suing the Belief to take away trustees. That exhibits a deep concern by the State over dropping native banks. Outdated Nationwide acquired its manner into the market in 2017 and 2018 by buying two native banks.

The results of all that is Bridgewater has develop into one in every of two preeminent local people banks, and if Bremer is offered, could be the just one.

Catalysts and Strengths

Bridgewater has quite a few strengths and catalysts that seem adequate to maintain the sturdy progress going.

1. Very Sturdy Effectivity Ratio – The effectivity ratio was 42.0% in 2021, down from 49.0% in 2020. This ratio is a measure of profitability and decrease is best. The peer median, per the FDIC in 2021 for banks over $1 billion in belongings, was 61%. That is partially attributable to Bridgewater having few actions apart from loans and deposits, leading to much less bills.

2. Sturdy internet curiosity margin– Bridgewater had a internet curiosity margin of three.54% in 2021, nicely above the peer median of two.52%.

3. Massive insider possession – As of February 28, 2022, officers and administrators owned 22% of the inventory. It is a very excessive stage for a financial institution. Jerry Baack, the CEO, helped discovered the financial institution in 2005 and owns 5%. He has been CEO since inception.

4. Market disruption – Latest in market mergers have led to the financial institution buying vital new enterprise and staff. It has additionally drastically diminished domestically based mostly choices for patrons. If Bremer sells, this might add gasoline to that fireside.

5. Sturdy market – The median family earnings within the Twin Cities MSA is $83,698 nicely above $67,521 for the U.S. The inhabitants can be rising above the U.S. common at 10.3% within the decade ending 2020.

6. Sturdy historical past of progress – Bridgewater has persistently grown organically over 20% a yr for a minimum of 4 years. In actual fact, when you take a look at the 5 prior years (2012-2017), annual mortgage progress averaged 28.9% and earnings progress averaged 28.0%. Most banks are lucky to develop solely 5% a yr. It has a confirmed monitor report of worthwhile progress. With two behemoths controlling two thirds of the market, there’s a massive runway for progress as bigger banks usually present much less service, except you might be sufficiently big to get their consideration. Bridgewater has reached the dimensions and recognition that it’s now getting a take a look at a lot of the native offers which are obtainable.

7. Low drawback loans – On December 31, 2021, non-performing loans have been negligible at solely 0.03% of complete loans. It was the identical one yr earlier. The historical past is sweet too. Bridgewater remained worthwhile in the course of the late 2000s recession in contrast to many different banks.

8. Sturdy capital stage – Normally excessive progress banks should faucet the fairness window once in a while to fund the expansion, diluting shareholders. With tangible internet price at 10.9% of belongings, no dilution is required for the foreseeable future. The shortage of a dividend helps, as all income go towards rising fairness.

Considerations

There are some points with Bridgewater which can partially clarify the low valuation although none that are overly regarding.

1. Low liquidity – The inventory trades about 38,000 share per day. Not illiquid, however tough for a bigger establishment to take a place.

2. No dividend – Administration has elected to place all of its capital towards progress. I agree with the choice, as a result of most banks aren’t capable of get their stage of natural progress. Nevertheless it does exclude a complete class of traders who’re searching for a dividend. These traders are extra quite a few with financial institution shares. In case you are a progress investor, a scarcity of a dividend is a constructive as it is going to take longer for any dilution to happen to fund the expansion.

3. Rising rates of interest – Bridgewater has quite a lot of fastened price actual property secured loans. As such it’s barely asset delicate. Which means their fashions present earnings declines barely in a rising rate of interest setting. We’re in a rising rate of interest setting. That is partially mitigated by their progress. All newer loans are approaching on the new increased charges. One other mitigating issue is a excessive stage and speedy progress of non-interest paying deposits. These are gold in a rising rate of interest setting. Not like different liabilities their value doesn’t improve as mortgage yields go up. The result’s prone to be EPS progress will path mortgage progress considerably this yr.

4. Focus of multifamily secured loans – Multifamily actual property loans have been $910 million or 32.3% of the mortgage portfolio as of December 31, 2021. One of these property is at present extremely in demand and there have been nearly no historic losses.

5. Brokered deposits – Brokered deposits often come from depositors outdoors a financial institution’s market space. They’re often increased value and thought of scorching cash. Sizzling cash means, the depositor has no loyalty to the financial institution and can usually transfer it elsewhere if one other financial institution has a better price. Bridgewater’s brokered deposits have been 14.3% of complete deposits on December 31, 2021, just like 13.9% two years earlier. This isn’t an extreme stage however comparatively excessive.

6. Recession – Banks shares have a tendency to say no in a recession even when they don’t battle. Banking could be cyclical. Nevertheless, the vast majority of U.S. banks carried out nicely in two of the final three recessions.

Valuation

In relation to valuation for banks, issues like EBITDA and capex are principally irrelevant. Depreciation, amortization and capex are typically fairly small relative to internet earnings. The PE ratio is a very powerful. Worth to e-book is subsequent in significance, however extra for banks which are struggling. Not the case right here. One other issue is liquidity of the inventory. Worth to gross sales is just not related as rates of interest can impression revenues as a lot as progress.

Many banks that loved speedy progress not too long ago did it with PPP loans which isn’t sustainable and is at present reversing. Few banks get sustainable double-digit natural progress, although that quantity has elevated lately. SVB Monetary (SIVB) is probably the most notable. Most banks lately have had natural mortgage and asset progress of 5% or much less. Bridgewater is uncommon in that their progress has been 4X that and has been sustained.

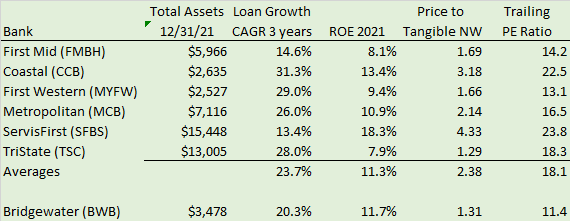

To search out comparables, I seemed for different neighborhood banks with sustained double digit mortgage progress. These are proven under.

Varieties 10-Okay and Yahoo Finance

The six comparable banks have an ROE just like Bridgewater on common and a mortgage compound common annual progress price (CAGR) barely above Bridgewater. First Western trades at a low PE ratio. This seems a minimum of partially attributable to illiquidity in its inventory nicely past the others together with Bridgewater. I consider that Bridgewater has a barely increased threat profile with its focus in multi-family secured loans and average sensitivity to rising rates of interest.

Primarily based on the comparables, I consider Bridgewater must be buying and selling at a PE ratio of 16 to trailing earnings. That places my present valuation at $24.64. The inventory closed at $17.56 on March 16, 2021. Assuming 15% earnings progress over the following yr, my one yr worth goal is $28.00. I used 15% progress as an alternative of the 20% historic common to account for rising rates of interest.

Takeaway

I consider Bridgewater can maintain a minimum of a 15%+ progress price for the foreseeable future. Nevertheless it’s not being priced like the expansion inventory it’s. In actual fact, the present PE ratio of 11.4 locations it squarely amongst most banks organically rising 5% or much less a yr. It is a disconnect for traders to make the most of. I like to recommend a protracted place in Bridgewater Bancshares.