Dzmitry Dzemidovich

One of many extra fascinating diversified REITs in the marketplace right now is Brandywine Realty Belief (NYSE:BDN). Though the enterprise could also be seen as secure due to its various portfolio of property that features workplace properties, medical amenities, residential property, and mixed-use properties, it has confronted problems with stability lately. Most not too long ago, shares have taken a beating, however this has occurred at a time when the corporate is lastly displaying sturdy indicators of stabilizing. Between shares falling and operations stabilizing, the corporate now seems to be to be a reasonably engaging prospect for buyers who just like the workplace area class. Due to these modifications, I’ve determined to extend my score on the corporate from a ‘maintain’ to a ‘purchase’.

The state of affairs is bettering

the final time I wrote an article about Brandywine Realty Belief was again in early November of 2021. At the moment, I acknowledged that shares of the corporate have been buying and selling at fairly low-cost ranges. I even went as far as to say that it doubtless supplied engaging upside consequently. On the similar time, nevertheless, I mentioned that the corporate wanted stability from an working perspective to be able to justify that upside. And till that stability shaped, I couldn’t think about it something apart from a extremely speculative play and a ‘maintain’ prospect at greatest. Because the publication of that article, quite a bit has modified. Considerations over the near-term outlook for the economic system appear to have helped to push shares of the corporate down, leading to buyers who had bought the inventory on the time that my final article was printed being down by 34.7%. That compares to the 12.2% decline skilled by the S&P 500 over the identical timeframe.

Creator – SEC EDGAR Information

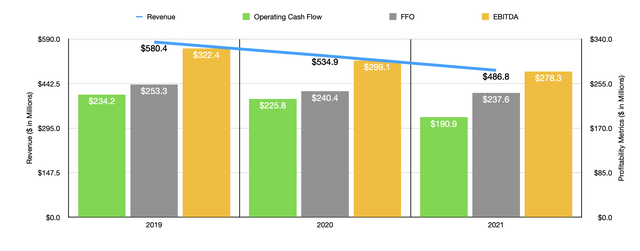

Based mostly on this disparity between the market’s return and the return seen by Brandywine Realty Belief, you may assume that the basic efficiency of the corporate was worsening. However that is not likely the case. Earlier than we get into the latest knowledge, nevertheless, we should always contact up on how the corporate completed its 2021 fiscal 12 months. This goes a good distance towards demonstrating the shortage of stability that led to my preliminary ‘maintain’ score. Gross sales for that 12 months got here in at $486.8 million. That is down from the $534.9 million reported for the 2020 fiscal 12 months and compares to the $580.4 million seen in 2019. Working money circulation dropped from $225.8 million in 2020 to $190.9 million final 12 months. FFO, or funds from operations, fell from $240.5 million to $237.6 million. And EBITDA dropped from $299.1 million to $278.3 million.

Creator – SEC EDGAR Information

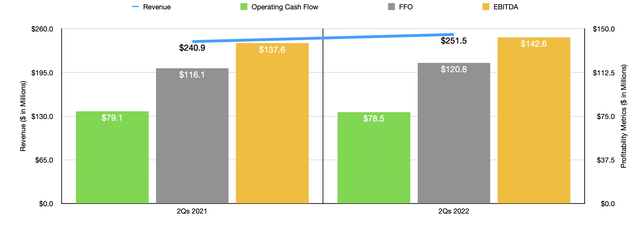

Happily for buyers, the image has proven indicators of enchancment. To see what I imply, we’d like solely take a look at monetary outcomes masking the 2022 fiscal 12 months up to now. For the primary half of the 12 months, income for the corporate got here in at $251.5 million. This represents a slight enchancment over the $240.9 million generated the identical time final 12 months. This enhance got here even because the sq. footage of the corporate remained nearly unchanged and because the occupancy price at its properties declined from 89.9% to 89.4%. This rise, as an alternative, was pushed by a number of components. For example, the corporate benefited to the tune of $2.3 million due to a growth property in Texas there’s positioned into service within the third quarter of 2021. The corporate benefited to the tune of $2.2 million on the highest line due to a not too long ago acquired or accomplished property. $2 million price of a rise associated to the residential and lodge elements on the FMC Tower that the corporate has due to greater occupancy as COVID-19 pandemic restrictions have been lifted. And the corporate benefited to the tune of $1.4 million due to the graduation of operations of a life science incubator lab in its Philadelphia CBD section.

Profitability for the corporate additionally appears to be displaying indicators of stabilization. Working money circulation within the second quarter got here in at $78.5 million. That is down barely from the $79.1 million reported one 12 months earlier. FFO elevated from $116.1 million to $120.8 million. Along with that, we additionally noticed an enchancment in EBITDA, with that metric rising from $137.6 million to $142.6 million. In terms of the 2022 fiscal 12 months as a complete, administration has not offered a lot in the best way of steerage. However one factor they did say is that FFO per share must be between $1.36 and $1.40. On the midpoint, that ought to translate to FFO of $236.6 million. That roughly matches the $237.6 million reported for the 2021 fiscal 12 months. Given how shut these two numbers are collectively, and since we do not have steerage masking the opposite profitability metrics, I’ll assume that each working money circulation and EBITDA roughly match what they have been in 2021.

Creator – SEC EDGAR Information

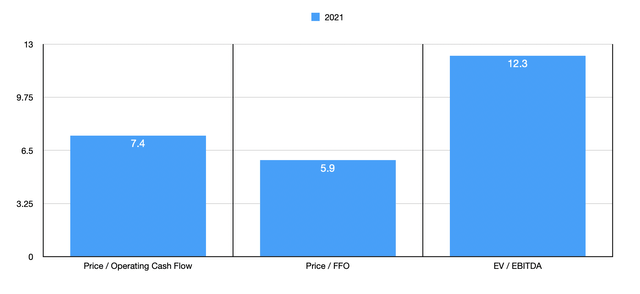

As long as this type of efficiency stays the case, the corporate has happy my customary that the enterprise stabilized. However now the query is what sort of upside, if any, the corporate may supply. If we have been to cost the corporate based mostly on outcomes from 2021, the agency could be buying and selling at a value to working money circulation a number of of seven.4. The worth to FFO a number of could be 5.9, whereas the EV to EBITDA a number of would are available at 12.3. As a part of my evaluation, I did examine the corporate to 5 comparable companies. On a value to working money circulation foundation, these firms vary from a low of 4.1 to a excessive of 17.2. On this case, three of the 5 firms have been cheaper than Brandywine Realty Belief. Utilizing the worth to FFO method, the vary is between 3.6 and 24. And relating to the EV to EBITDA method, the vary is between 9.4 and 25.9. In each of those situations, solely one of many firms is cheaper than our prospect.

| Firm | Value / Working Money Move | Value / FFO | EV / EBITDA |

| Brandywine Realty Belief | 7.4 | 5.9 | 12.3 |

| Veris Residential (VRE) | 17.2 | 24.0 | 25.9 |

| Piedmont Workplace Realty Belief (PDM) | 6.5 | 6.1 | 14.8 |

| Paramount Group (PGRE) | 6.7 | 7.5 | 14.5 |

| Easterly Authorities Properties (DEA) | 13.0 | 13.7 | 18.9 |

| Workplace Properties Earnings Belief (OPI) | 4.1 | 3.6 | 9.4 |

Takeaway

To date, the basic image for Brandywine Realty Belief is trying up. The enterprise has stabilized and shares have fallen sufficient to make the inventory look undervalued each on an absolute foundation and relative to comparable gamers. As a consequence of these components and as long as pricing stays interesting and fundamentals stay not less than secure, I’ve no cause to price the corporate as something apart from a ‘purchase’, reflecting my perception that it’s going to doubtless outperform the broader marketplace for the foreseeable future.