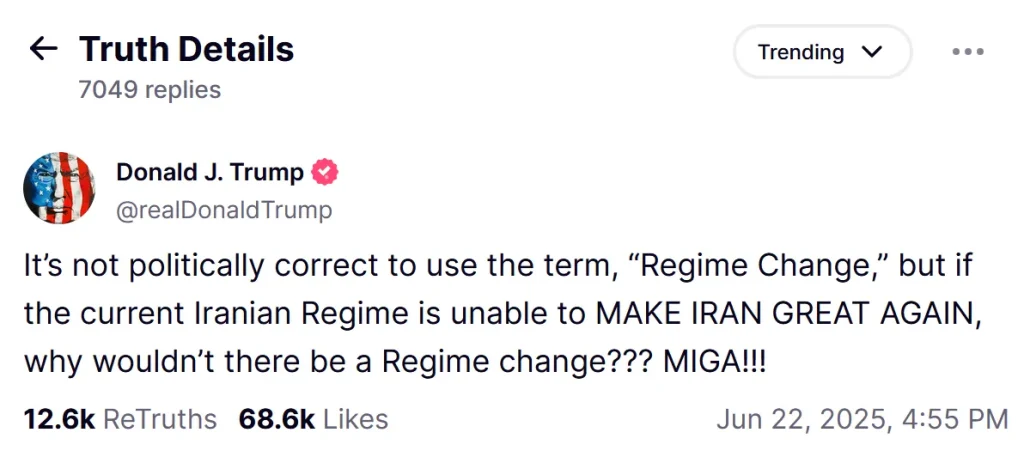

From navy strikes, to retaliations, to shaky ceasefires, there is no such thing as a scarcity of geopolitical headwinds coming from the Center East proper now. Brad Simpson, Chief Wealth Strategist with TD Wealth, speaks with MoneyTalk’s Greg Bonnell about how traders ought to be fascinated by the present setting.

Transcript

Greg Bonnell – From navy strikes to retaliations to an general escalation, there are not any scarcity of geopolitical headwinds coming from the Center East proper now. So how ought to traders be fascinated by this present setting? Properly, who higher to ask than Brad Simpson, Chief Wealth Strategist with TD Wealth? Brad, at all times nice to see you. Welcome again to this system.

Brad Simpson – Hey, it is nice to be right here.

Greg Bonnell – So we have talked about no scarcity of considerations. We have all been watching the Center East very fastidiously. How is the scenario really influencing general danger sentiment?

Brad Simpson – Properly, in the event you assume that– all this began, let’s name it, someplace between 12 to 14 days in the past. And in the event you take a look at the place markets are proper now, you’d assume that it is already come and gone. And so if something, I might assume that the market is in danger. Markets are dealing with this unbelievably effectively.

I introduced a chart alongside. Possibly– I feel, this can be a nice solution to set the tone for this a part of the dialogue. And I feel the title says all of it, is, regardless of tensions within the Center East, concern is out, and greed is again. So that is our greed and concern index. And whereas it isn’t within the full-on on the darkish inexperienced, it is a gentle inexperienced. And this can be a market that continues to carry out with unbelievable power.

And so I feel the underside line is, this can be a market that is hooked on headlines. And I’ve by no means

:max_bytes(150000):strip_icc()/health-broccoli-vs-brussel-sprouts-template-1_720-c310b4225b194326b0f2e80f1478c02b.jpg)