Jitalia17

By Bonds Go Massive & John R. Mousseau, CFA

“If one thing can not go on perpetually, it is going to cease.” – Herb Stein, former Chairman of the Council of Financial Advisers underneath Presidents Nixon and Ford

Dr. Stein uttered these phrases in 1986, they usually have been referenced in varied kinds since. They make an excellent segue to the about-face in each fairness and bond markets previously week.

Treasury yields moved markedly decrease final week on the again of two occasions: first, a dovish press convention by Chairman Jay Powell after a Fed assembly wherein they left the short-term fed funds fee at 5.25–5.5%. That was adopted by a softer than anticipated payrolls report on Friday, with employment rising by solely 114k jobs – far lower than the expectation of 175k jobs being created. This was the primary bigger miss on the draw back in fairly some time. As well as, the unemployment fee rose 0.2 share factors to 4.25%. The mixture despatched fairness markets sharply decrease and bond markets sharply greater in value and decrease in yield. In a outstanding shift, the consensus of Wall Road economists switched to a number of fee cuts and probably 50-basis level fee cuts in September and November, adopted by 25 bps cuts going ahead. Although there’s a Federal Reserve convention at Jackson Gap later this month, we doubt it is going to be the backdrop for an emergency Federal Reserve fee minimize between scheduled conferences.

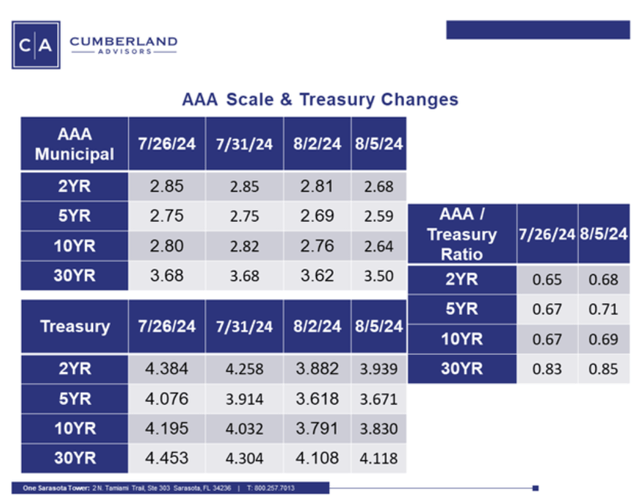

The desk under exhibits the outstanding drop in each US Treasury charges and AAA tax-free bond charges since Friday, July 26th, 11 days in the past.

It’s essential to keep in mind that when these vigorous bond market rallies happen, nothing retains tempo with US Treasuries. This consists of Munis, taxable or tax-free, corporates, or mortgages. If the economic system is slowing down, it’s not a far leap to assume that credit score spreads on company points can even start to widen.

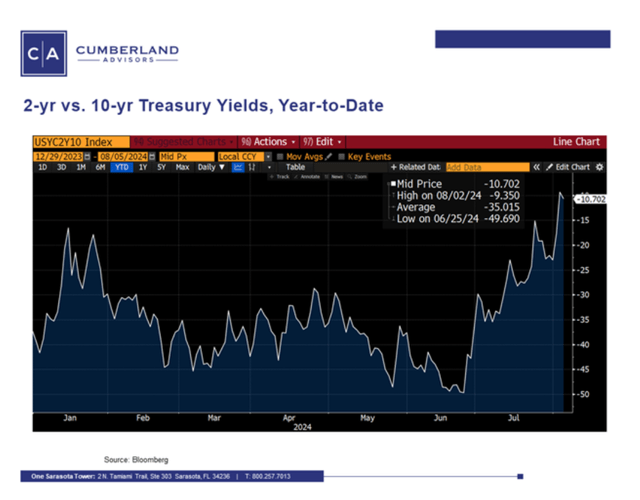

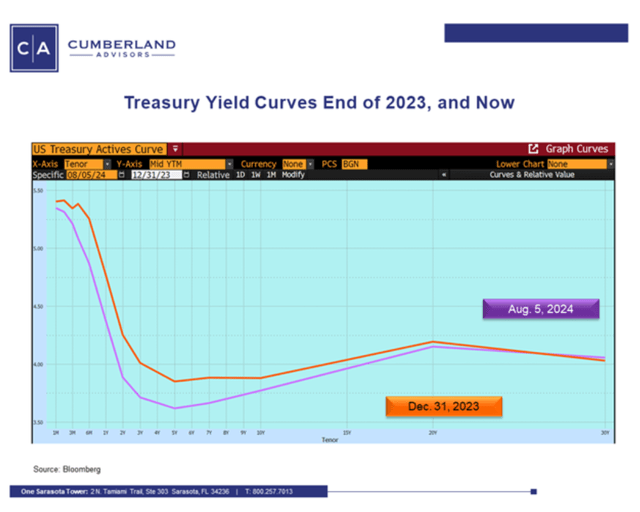

The about-face in each the fairness and bond markets has additionally been accompanied by the unwinding of the inverted yield curve. Beneath are two charts displaying the change in yields between the 2-year Treasury and the 10-year Treasury at year-end and now. We’ve additionally included a graph displaying the US Treasury yield curve at year-end and now. The yield curve had been inverted for the reason that fall of 2022. That’s a very long time by historic requirements, nevertheless it has been our rivalry that the inversion lasted longer due to the financial results of Covid – stimulus, spending, and so on.

The disinversion of yield curves often precedes a recession or slowdown and thus often happens in entrance of a Federal Reserve cycle of slicing short-term charges. You may see that the very entrance finish stays inverted due to the excessive stage of fed funds charges, however the curve is optimistic now from 5 years on out versus 10 years on out at the start of the yr.

It is also instructive that the 10-year bond yield, which started the yr at 3.88% and climbed to 4.70% by mid-April, is now under its stage at the start of the yr, at 3.76%. It’s come a great distance in a brief time period.

What’s driving this? Definitely, concern of a recession or a slowdown. This has been mirrored within the drop within the S&P 500 of over 5% since July 26th and a drop within the Nasdaq of over 7% in the identical interval. Concern has additionally been mirrored within the large swing into bonds. Is that this the return of the October 1987 inventory market crash? Clearly not, because the harm was a lot lower than that day. However it does most definitely characterize a interval of consolidation of latest good points and a transition to a slowing economic system. We are going to know extra within the subsequent few weeks, however the change within the yield curve displays the concern of slowing that’s on the market.

Unique Submit

Editor’s Be aware: The abstract bullets for this text had been chosen by Searching for Alpha editors.