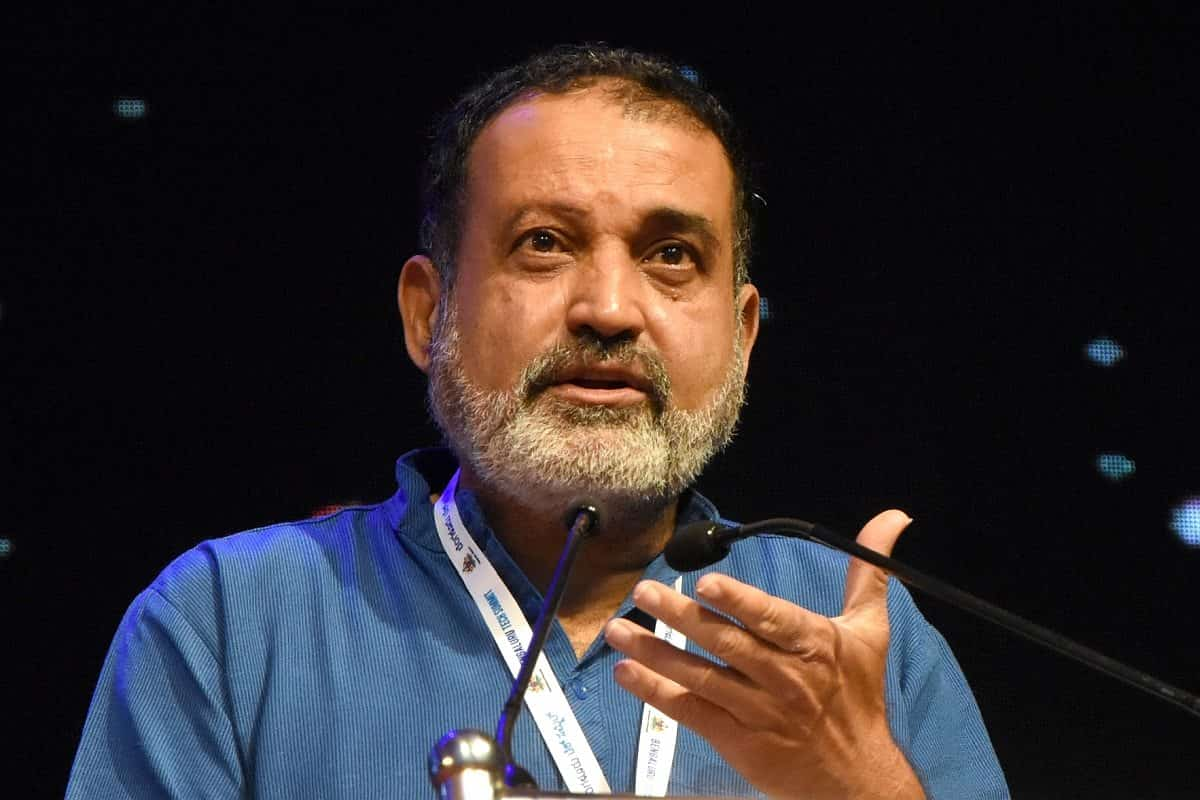

S Ravi, former chairman of the Bombay Inventory Alternate (BSE), expressed deep concern over the current allegations surrounding BluSmart, including that such incidents will harm investor belief and tarnish the broader notion of the startups.

S Ravi (Sethurathnam Ravi), the previous BSE chairman and founding father of Ravi Rajan & Co, warned that such actions might shake the boldness of traders within the new ventures and tarnish the credibility of even the well-established startups.

Just lately, market regulator Securities and Alternate Board of India (SEBI) flagged points associated to alleged fund diversion and doc falsification towards Gensol Engineering Ltd, which impacted BluSmart, resulting in the closure of companies of the corporate.

Anmol Singh Jaggi alongside together with his brother Puneet Singh Jaggi are the co-founders of BluSmart and administrators at Gensol Engineering, an Ahmedabad-based photo voltaic engineering and companies agency. Each have stepped down from the put up of administrators after the SEBI discover.

“It isn’t good for 2 causes. As soon as the brand new traders, new corporations will come there, these folks (Traders) wont begin funding them in any respect, (They are going to) cease funding. They will really feel that the startups are solely private good points and valuations, so it isn’t an excellent, factor in any respect,” former BSE chairman mentioned.

“The second from an excellent model as a result of BluSmart shouldn’t be a really small model as a result of it’s extremely effectively constructed. They demolished it…they demolished it for private good points. They’d have made their cash, however you realize this shortcut shouldn’t be proper,” the previous BSE chairman added.

Former BSE chairman highlighted that there have been allegations of insider buying and selling in addition to mismanagement and fund diversion.

By definition, insider buying and selling is shopping for or promoting an organization’s shares utilizing confidential, private data.

“There have been two set off factors. Initially, the pricing which occurred of the share. There have been a variety of complaints about insider buying and selling. Second, there was a imaginative and prescient blower, and there have been complaints towards this firm. SEBI went into an investigation and gave an interim order. Within the interim order, they discovered sure deficiencies. The deficiencies got here out in that order, which was diversion of funds. Second level that got here out was a misstatement,” he added.

Going ahead, Ravi recommended that startups and the promotors ought to talk extra and make extra sincere disclosures to cease such incidents.

“The startup neighborhood should begin speaking now with all of the lenders and stakeholders and present confidence that they’re all working collectively in an excellent governance construction,” he added.

Speaking in regards to the roles of impartial administrators and auditors, he asserted that promotors ought to present correct data for higher disclosures.

%20061020.jpeg?rect=0%2C0%2C1280%2C672&w=1200&auto=format%2Ccompress&ogImage=true)