Revealed on July twenty eighth, 2022 by Josh Arnold

The patron staples class is plagued by nice dividend shares. In spite of everything, staples are merchandise that buyers want, and subsequently, don’t are inclined to see the ebbs and flows in demand that extra discretionary merchandise do. That’s nice from a dividend investor’s perspective, as a result of that stability results in extremely predictable earnings, money circulate, and talent to pay a rising dividend.

It’s little surprise, then, that lots of the 350+ shares within the checklist of Blue Chips are within the client staples class. Blue Chips are shares which have at the very least 10 consecutive years of dividend will increase.

The topic of this text, Tyson Meals (TSN), boasts an 11-year streak of consecutive dividend will increase. Whereas there are actually client staples shares with longer streaks, we discover Tyson’s dividend rankings to be fairly excessive, and it has an above-market present yield.

We’ve compiled an inventory of greater than 350 comparable shares, which you’ll be able to obtain by clicking under:

Along with the checklist of Blue Chips, we’re individually reviewing the highest 50 Blue Chip shares at the moment as ranked utilizing anticipated whole returns from the Certain Evaluation Analysis Database.

This installment of the 2022 Blue Chip Shares In Focus sequence will check out Tyson.

Enterprise Overview

Tyson is a meals supplier that operates worldwide. The corporate has 4 segments: Beef, Pork, Hen, and Ready Meals. Its main enterprise is processing dwell cattle, hogs, and rooster. By means of this course of it creates varied cuts of meat, totally cooked meat, frozen meat, value-added rooster merchandise, hides and extra. In additions, it prepares varied ready-to-eat merchandise comparable to sandwiches, hamburgers, pepperoni, bacon, sausage, and extra.

Tyson was based in 1935, produces about $53 billion in annual income, and trades with a market cap of $31 billion.

Tyson’s second quarter earnings have been launched on Could 9th, 2022, and simply beat expectations on each the highest and backside strains.

Whole income was $13.1 billion, a 16% achieve over the year-ago interval. Beef led the way in which with a 24% income improve, however all 4 segments produced double-digit good points. Larger gross sales volumes drove elevated income for beef and rooster, whereas pricing actions undertaken to fight price inflation helped drive additional income good points.

Supply: Investor presentation, web page 4

Adjusted working revenue was $1.16 billion, up greater than half year-over-year, whereas adjusted earnings-per-share was $2.29. That was up from $1.34 in the identical interval a yr in the past.

The corporate stated the USDA forecasts flat demand for protein manufacturing this yr, however Tyson is outperforming that and raised steering. It now expects ~$53 billion in gross sales, up from ~$50 billion beforehand. Primarily based upon this, we now count on to see $9.00 in adjusted earnings-per-share for the fiscal yr.

Now, let’s check out the corporate’s prospects for future development.

Development Prospects

Tyson has executed an incredible job of rising earnings previously decade. The corporate has averaged virtually 17% earnings-per-share enlargement yearly previously decade, with a lot of that development coming since COVID hit.

We don’t see something like that kind of fee of development as sustainable, so we as an alternative forecast 3% for the approaching years. Tyson has lapped the pandemic-driven growth in gross sales and margins, so development from this a lot increased base of earnings might be tougher.

Supply: Investor presentation, web page 17

Steerage was raised with Q2 earnings, together with a large improve to the gross sales forecast, and better margins. That interprets to revenue development, and we consider this file yr of earnings might be difficult to develop from.

The corporate is grappling with flat-to-down volumes in a lot of its universe, so pricing motion is creating the majority of income good points. As well as, the corporate has undertaken some productiveness initiatives that ought to assist drive margins within the coming years.

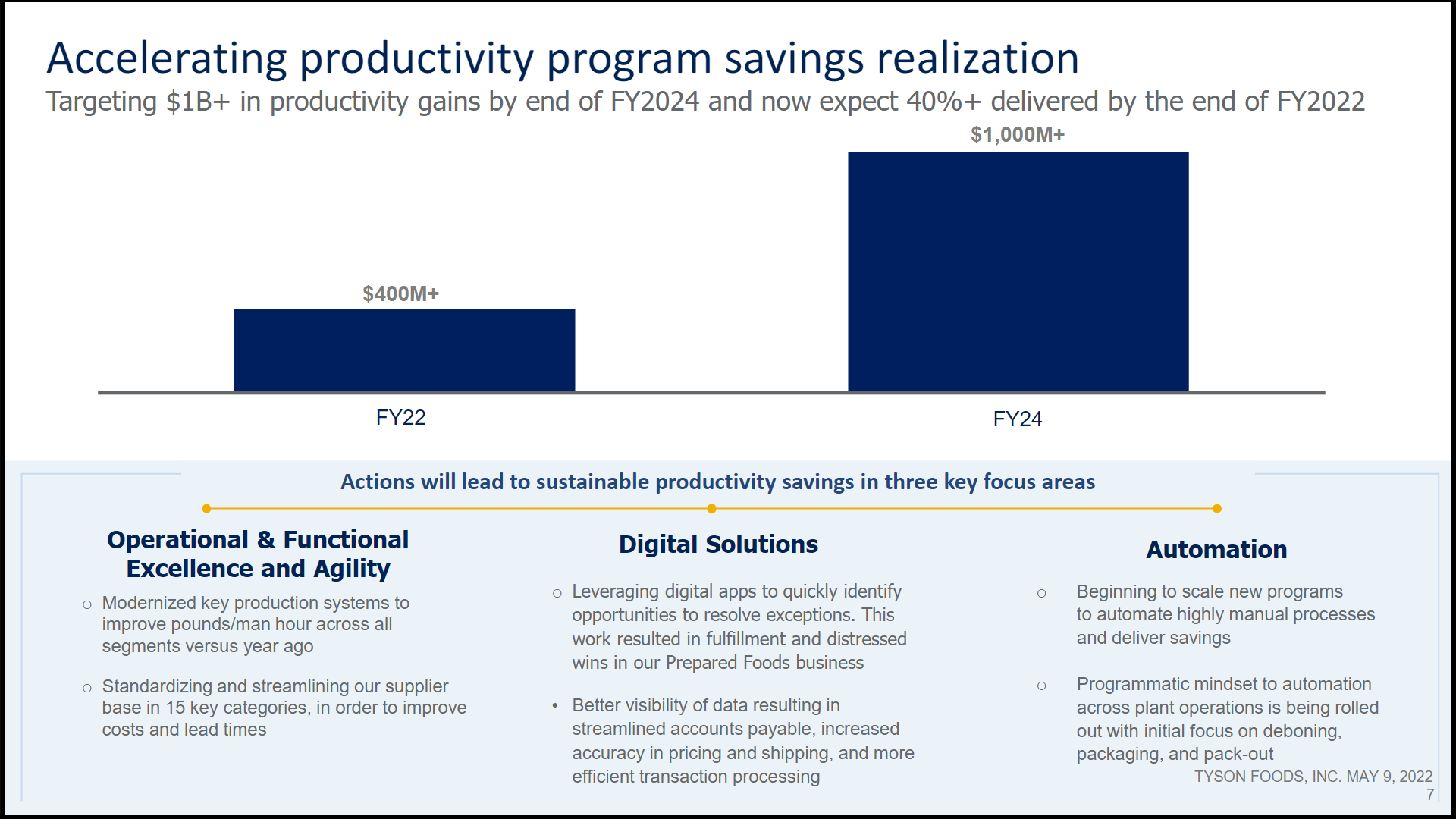

Supply: Investor presentation, web page 7

Tyson is concentrating on at the very least a billion {dollars} of productiveness good points by the top of fiscal 2024, greater than double the present degree. Ought to this be achieved, it’ll assist in profitability, and subsequently, EPS development.

The corporate additionally buys again a modest quantity of its personal shares, with the second quarter seeing 6.2 million shares repurchased for $523 million. We see repurchases as incremental when it comes to EPS development.

Tyson’s dividend development previously decade has averaged greater than 26% yearly, so it’s been a terrific dividend development story as nicely. We see 6% development going ahead, which places the inventory firmly into the dividend development class.

Aggressive Benefits & Recession Efficiency

Tyson’s aggressive benefit stems primarily from its scale and model recognition. As one of many oldest and largest gamers in what’s a closely commoditized trade, scale and model recognition assist it stand out from the group. We word that regardless of this, it’s nonetheless a commodities producer, basically, so benefits are tough to come back by.

Tyson struggled with earnings in the course of the Nice Recession, practically posting a loss in a kind of years. The corporate wants quantity and income to leverage down fastened prices, so it’s potential Tyson will see decrease earnings throughout a protracted recession.

Even when that happens, nonetheless, the dividend must be fairly secure. The payout ratio for this yr is projected to be simply one-fifth of earnings, so there’s substantial room for future will increase, in addition to absorbing momentary declines in earnings.

Valuation & Anticipated Returns

The inventory has usually traded round 11 to 12 occasions earnings previously decade, with decrease valuations throughout occasions of recession. Given the corporate is combating price inflation, in addition to flat or decrease volumes, we assess truthful worth at 10 occasions earnings at the moment.

Shares commerce for slightly below that worth, that means we might count on a fractional tailwind to whole returns from a rising valuation within the years to come back.

The present dividend yield is 2.1%, so combining the valuation tailwind and three% earnings development, we see ~6% whole annual returns for Tyson shareholders over the following 5 years.

Last Ideas

Whereas Tyson does face some cyclicality in its earnings, it additionally has a double-digit streak of spectacular dividend will increase, very robust dividend security, and respectable whole returns. It additionally possesses scale and model recognition in its area, and the mixture of those components makes it a Blue Chip inventory to observe.

The checklist of Blue Chips is only one solution to display screen for high-quality dividend shares.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].