Revealed on August 4th, 2022 by Yiannis Zourmpanos

T. Rowe Worth Group (TROW) the worldwide funding administration agency with $1.31 trillion of belongings beneath administration, is a sound funding for buyers in search of long-term excessive returns and secure returns within the present bear market.

The corporate has elevated its dividend for over 30 consecutive years, making it a Blue Chip shares inventory, which is a gaggle of greater than 350 corporations with at the very least 10 consecutive years of dividend will increase.

We see these shares as among the many higher dividend inventory buys available in the market at the moment, merely due to their willingness and talent to return increasingly more capital to shareholders annually.

We’ve created a full listing of the 350+ Blue Chips accessible at the moment, which you’ll obtain under:

Along with the spreadsheet above, we’re individually reviewing the highest 50 Blue Chip shares at the moment as ranked utilizing anticipated complete returns from the Certain Evaluation Analysis Database.

This text within the 2022 Blue Chip Shares In Focus collection will analyze T.Rowe Worth, together with latest earnings, development prospects, and complete returns.

Though the inventory has taken a considerable hit as a result of weak fairness market following the quick tightening of the financial system by the FED, the inventory has traditionally fought again drawdowns. Furthermore, the corporate is positioned in each doable technique to be a winner in the long term.

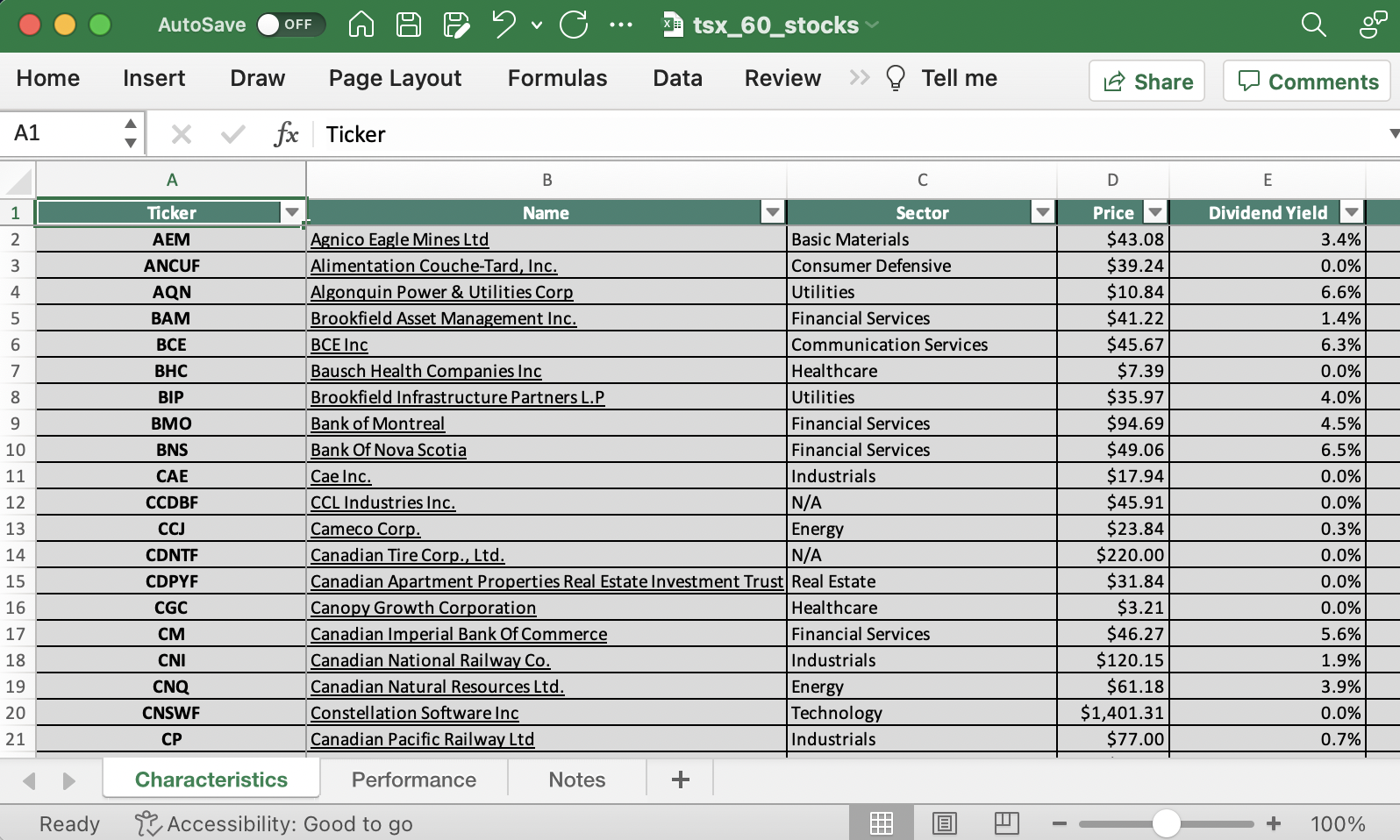

Enterprise Overview

T. Rowe Worth Group offers funding administration providers by its subsidiaries in North America, EMEA, and APAC. The supplied merchandise embody U.S. mutual funds, sub-advised funds, individually managed accounts, collective funding trusts, and different T. Rowe Worth merchandise akin to open-ended funding merchandise.

The corporate has an extended monitor file of producing sturdy development.

Supply: Investor Presentation

Funding advisory providers additionally present associated administrative providers, together with distribution, mutual fund switch agent, accounting, and shareholder providers; participant record-keeping and switch agent providers for outlined contribution retirement plans; brokerage; belief providers; and non-discretionary advisory providers by mannequin supply.

Round 90% of the revenues encompass funding advisory charges. The fee-based income mannequin makes T Rowe depending on its AUM.

Supply: Investor Presentation

Development Prospects

The asset supervisor has a whole lot of room for natural development. Though there have been web outflows within the final two quarters, and the corporate expects additional outflows within the coming months, this doesn’t imply the agency can’t appeal to new investments. When the time is true, T Rowe has a whole lot of methods by which it might get money inflows.

For instance, funds which might be closed to new buyers may be opened. Final 12 months, T. Rowe introduced reopening the $38.9 billion fund T. Rowe Worth Mid-Cap Development after closing it in 2010. This is only one instance of how the asset supervisor can enhance its AUM, which is able to enhance revenues.

Nevertheless, the time to draw extra AUM would come in the direction of the year-end when there could be extra readability over the looming recession. Thus, the short-term headwinds will not be an enormous concern for this inventory.

Moreover, the corporate’s makes an attempt to reinforce its funding capability, develop its attain, spend money on state-of-the-art expertise, and strengthen its distribution channels within the US, EMEA, and APAC areas will enable it to keep up sustained development for the instances to come back.

T Rowe’s capital administration is one thing one can’t assist however admire. The corporate sits on $2.1 billion money in Q2 2022, with insignificant long-term debt. This liquidity and money move era have allowed it to return money to its shareholders by way of dividends and buyback shares whereas benefiting from low costs throughout a unstable surroundings.

As well as, the corporate repurchased $510.5 million value of widespread inventory in the latest quarter. With a powerful steadiness sheet, the corporate has additionally began to search for enlargement alternatives by main acquisitions.

T Rowe has been striving for natural development with solely small steps in the direction of inorganic development by restricted and small offers. The acquisition of OHA, accomplished in December 2021, is a shift in deploying capital in the direction of shopping for development. At a time when natural development in conventional enterprise appears to be slowing down, and competitors is changing into intense, the OHA acquisition permits T Rowe to diversify and develop its choices in various investments.

With $57 billion capital beneath administration and 300 staff in international places of work, OHA has expanded the worldwide footprint of T Rowe, and we see quite a few synergies from these acquisitions in investments in addition to distribution channels. We will count on additional acquisitions sooner or later, as hinted within the annual report 2021:

“As a way to keep and improve our aggressive place, we could evaluate acquisition and enterprise alternatives and, if acceptable, interact in discussions and negotiations that would result in the acquisition of a brand new fairness or different monetary relationships.”

Aggressive Benefits & Recession Efficiency

The aggressive surroundings in asset administration would require T Rowe to decrease its charges. Nevertheless, the spectacular working margins of 45-47% are above the trade common, so T Rowe nonetheless has the capability to turn into extra aggressive and profit from elevated development whereas decreasing charges.

T Rowe Worth grew to become public in 1986. Since then, the corporate has fought by numerous recessions, such because the early Nineties recession, the dot-com bubble of 2001, the nice recession as a result of monetary disaster of 2007-2009, and, extra just lately, the short-lived COVID-19 recession. We will see within the value chart that the inventory took a success following each recession however adopted a protracted interval of sustained development.

The financial disaster made the inventory tumble for a brief interval; the inventory tends to develop throughout a secure macroeconomic surroundings. It’s because the efficiency of asset managers is instantly associated to the financial surroundings, but additionally as a result of T Rowe’s administration, enterprise mannequin, technique, and development prospects are succesful sufficient of getting by these headwinds and carrying on its journey in the direction of development.

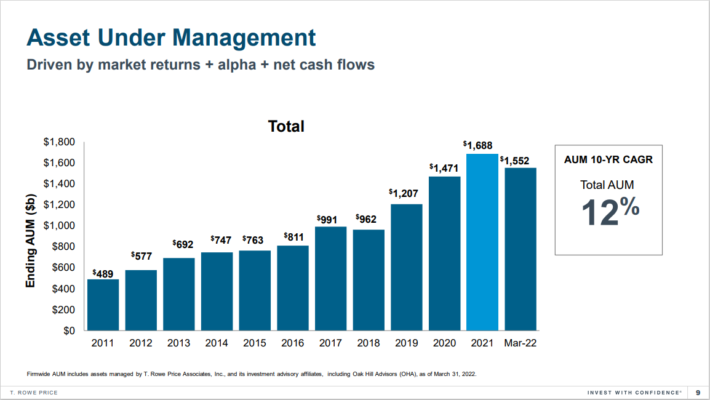

The corporate employs energetic funding methods to generate alpha for its shoppers. For this objective, it employs basic in addition to quantitative evaluation, utilizing high-quality knowledge and machine studying methods to plot its methods. As well as, it has maintained a file of introducing new methods and funding automobiles every so often to develop its choices and meet the aggressive problem within the trade. Because of this, AUM’s 10 YR CAGR, ending 2020, has been 12%.

Supply: Investor Presentation

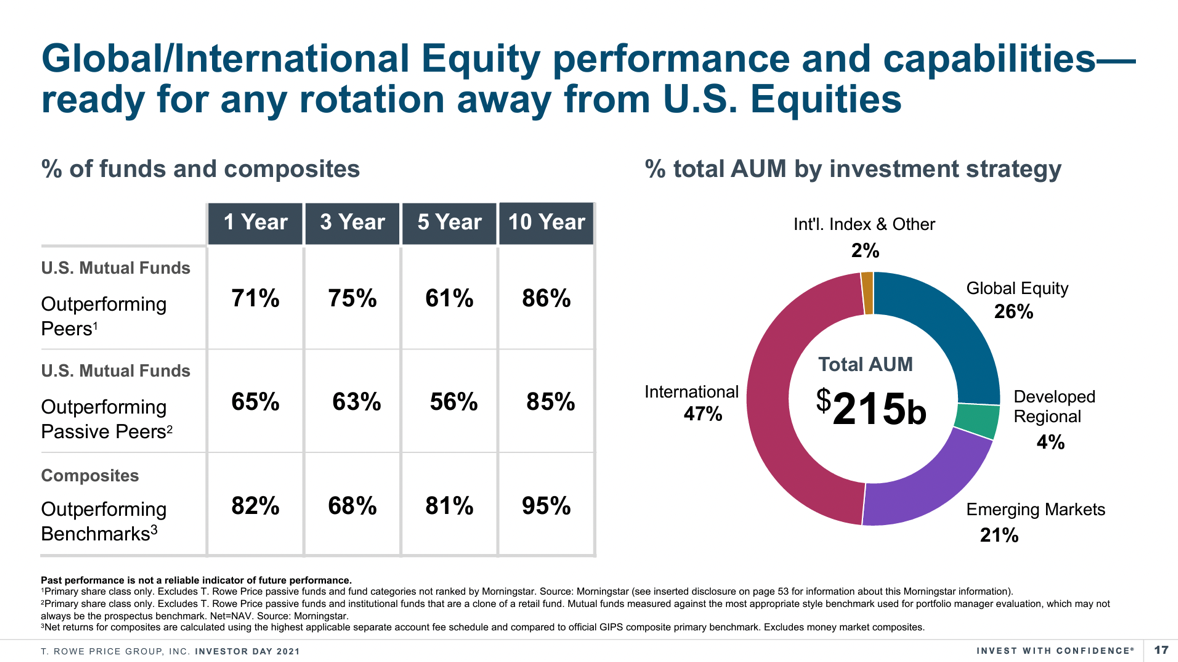

The asset supervisor has outperformed its friends and benchmarks by way of its Mutual funds’ efficiency and has additionally been investing a big proportion of its AUM in worldwide equities to scale back its dependence on the US equities market.

As a way to improve its capability, the agency has established a further funding advising subsidiary T. Rowe Worth Funding Administration, Inc. (TRPIM), with SEC and has introduced to switch sic U.S. Fairness and Fastened Revenue Methods to TRPIM. Different corporations, akin to Capital Group, aka American Funds, have adopted this technique of splitting into extra entities to handle capacities. If executed efficiently, this can enable the group to handle extra investments and implement extra methods with two separate analysis groups working for every entity.

Though there was a shift in the direction of passive investing in latest instances, the enterprise mannequin and variety in product choices make T. Rowe a really sturdy agency. As well as, the corporate has been successfully advertising its energetic methods and flaunting its outcomes in comparison with passive opponents. One exhibit of such advertising is that this report on how 11 of T. Rowe’s retirement funds have crushed passive opponents over numerous rolling intervals from inception by December 31, 2021, web of charges.

Valuation & Anticipated Returns

Though headwinds are anticipated within the quick run, a ahead PE ratio of 15.63x implies that at the moment, the inventory is buying and selling at very engaging multiples. For comparability, BlackRock and Blackstone are at the moment buying and selling at a ahead PE of 20.21x and 19.37x, respectively.

By this 12 months, T Rowe had paid out a daily quarterly dividend of $1.20 per share, a thirty sixth consecutive 12 months of dividend will increase for the reason that agency’s IPO in 1986. Final 12 months, the common quarterly dividend was $1.08 per share, with a particular dividend of $3 paid out within the third quarter of 2021.

Shares seem overvalued proper now, with a 2022 P/E of 14.9 in opposition to our truthful worth estimate of 14. Whereas we don’t count on one other particular dividend anytime quickly, a ahead annual dividend yield of three.6% and a payout ratio of 43.97% make the inventory a really engaging funding in instances of the bear market.

Closing Ideas

T.Rowe Worth inventory has had a troublesome begin to 2022, as a result of broader inventory market declines. Whereas the inventory seems to be overvalued proper now, we count on the corporate to develop its earnings over the subsequent a number of years. Lastly, the inventory has a 3.6% dividend yield, whereas the corporate ought to be capable of enhance its dividend annually. Complete returns are anticipated at 5.3% on the present share value, making T.Rowe Worth inventory a maintain.

There are numerous different methods to display screen for nice dividend shares apart from the Blue Chips.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].