Printed on July thirtieth, 2022 by Nikolaos Sismanis

If one thinks of their favourite blue chip shares, the primary names that come to thoughts are often big corporations that generate tens of billions of {dollars} in income per 12 months. Whereas it’s true that generally greater corporations take pleasure in a variety of aggressive benefits, together with a terrific moat and scaling economics, amongst others, the scale of an organization isn’t essentially a crucial issue to its high quality.

On this article, we’re taking a look at Neighborhood Belief Bancorp, whose annual revenues are hardly over $225 million. For a inventory to be labeled as a blue chip one, our situation is that it numbers at the very least 10 years of consecutive annual dividend will increase. We consider that such a observe document displays an organization’s capability to generate regular progress and lift its dividend, even in a recession.

With 41 years of consecutive annual dividend will increase, Neighborhood Belief Bancorp has definitely confirmed its capability to develop its dividend by means of numerous intervals of harsh financial circumstances. Thus, we take into account it a real blue chip inventory regardless of its admittedly small market cap of simply $775 million.

To browse tons of of high quality corporations, we created a listing of 350+ blue-chip shares which you’ll be able to obtain by clicking under:

Along with the Excel spreadsheet above, we’ll individually overview the highest 50 blue chip shares at present as ranked utilizing anticipated whole returns from the Positive Evaluation Analysis Database.

This installment of the 2022 Blue Chip Shares In Focus sequence will analyze Neighborhood Belief Bancorp, Inc. (CTBI).

Enterprise Overview

Neighborhood Belief Bancorp is a neighborhood financial institution, working 84 department places in 35 counties in Kentucky, Tennessee, and West Virginia. It’s the second-largest financial institution holding firm in Kentucky, with a market cap of simply $775 million presently.

The corporate engages in a broad vary of economic and private banking and belief and wealth administration actions. These embrace accepting time and demand deposits, originating loans to firms and people, offering money administration providers, issuing letters of credit score, renting secure deposit containers, and offering funds switch providers, amongst others.

Neighborhood Belief Bancorp operates with a $5.4 billion stability sheet. As of June thirtieth, whole shareholders’ fairness stood at $653.3 million, and belief property beneath administration had been $3.6 billion, together with CTB’s funding portfolio totaling $1.5 billion.

On account of its small market cap, Neighborhood Belief Bancorp doesn’t belong to the S&P 500 index, and therefore, it isn’t thought-about a Dividend Aristocrat although it has raised its dividend for 41 consecutive years.

Neighborhood Belief Bancorp’s newest outcomes demonstrated the financial institution’s potential to submit reslilent numbers even throughout a tricky buying and selling atmosphere. Its Q2-2022 internet curiosity earnings edged up 2.0%, due to mortgage progress. The financial institution’s non-interest earnings decreased -by 7% over the prior 12 months’s quarter, however the decline was principally as a consequence of adjustments within the valuation of mortgage servicing rights.

Furthermore, the financial institution elevated its provision for credit score losses by $0.1 million, whereas it had recovered provisions of $4.3 million within the prior 12 months’s quarter. General, identical to within the earlier quarter, the financial institution confronted a tricky comparability over its blowout outcomes final 12 months, and thus, its earnings-per-share dipped by 15%, from $1.34 to $1.14. Nonetheless, it exceeded the analysts’ consensus by $0.04. It’s essential to notice that many of the progress final 12 months resulted from the reversion of provisions for mortgage losses, and therefore buyers ought to anticipate decrease earnings in 2022. Accordingly, we anticipate EPS to land near $4.40 in fiscal 2022, implying a year-over-year decline of 10.9%.

This doesn’t translate to a deterioration within the firm’s efficiency, nonetheless.

Supply: SEC filings, Creator

Development Prospects

Excluding the document 12 months 2021, during which Neighborhood Belief Bancorp posted blowout earnings due to the reversal of mortgage loss provisions recorded in 2020, the financial institution has grown its earnings-per-share at a 4.3% common annual price over the previous decade and at a 4.7% common annual price over the past 5 years.

The economic system has recovered from the pandemic, and the Fed has began to boost rates of interest aggressively this 12 months. This must be confirmed a tailwind to Neighborhood Belief Bancorp. Nonetheless, the non-recurring declines within the tax price of the financial institution, which fueled a terrific portion of the underside line progress in 2018 and 2019, is not going to be significant progress drivers anymore.

Consequently, we don’t anticipate the corporate to speed up its progress sample within the upcoming years. By taking a prudent method, we anticipate Neighborhood Belief Bancorp to develop its earnings per share at a 2.0% common annual price over the following 5 years.

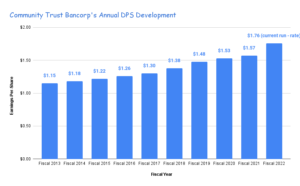

Relating to its dividend, Neighborhood Belief Bancorp has grown its dividend-per-share for 41 consecutive years on account of prudent capital administration and of constant concentrate on shareholder returns. The ten-year dividend-per-share compound annual progress price stands at 2.61%. This isn’t a passable progress price, and admittedly, it barely counterbalances the long-term inflation common. Nonetheless, buyers can discover consolation within the rising payouts and anticipate that the dividend can continue to grow for many years to return if the financial institution retains its present prudent administration.

Supply: SEC filings, Creator

It’s additionally price noting that the shortage of extra aggressive dividend progress doesn’t imply that shareholder worth creation isn’t maximized. With the corporate retaining a considerable portion of earnings, it has been capable of develop shareholders’ fairness (ebook worth) at a momentous price through the years.

Supply: Investor Presentation

Aggressive Benefits & Recession Efficiency

Neighborhood Belief Bancorp proved that it was effectively managed within the Nice Recession. Within the worst monetary disaster of the final 80 years, when most banks lower their dividends, this financial institution remained worthwhile and continued elevating its dividend. The COVID-19 pandemic in 2020 brought about an -8% lower within the earnings-per-share of Neighborhood Belief Bancorp. Nonetheless, this enterprise efficiency is superior to that of most different banks, due to the conservative mortgage portfolio. To supply a perspective, the financial institution has reported common internet mortgage charge-offs of solely 0.02% within the final 4 quarters, additional demonstrating its general qualities.

You may see a rundown of Neighborhood Belief Bancorp’s earnings-per-share from 2007 to 2011 under:

- 2007 earnings-per-share of $2.20

- 2008 earnings-per-share of $1.40

- 2009 earnings-per-share of $1.51

- 2010 earnings-per-share of $1.97

- 2011 earnings-per-share of $2.31

Whereas earnings-per-share fell by 36.4% in 2008, the corporate rapidly recovered. By 2011, earnings-per-share had been effectively above the 2007 degree.

General, we consider that Neighborhood Belief Bancorp’s dividend ought to stay secure even throughout a chronic recession. Throughout the previous 5 years, the corporate’s dividend payout ratio has averaged near 40%.

Based mostly on our anticipated earnings-per-share for fiscal 2022 and the present dividend-per-share run-rate, the payout ratio stands at exactly 40% as effectively. Regardless of the ample room to develop the dividend at a a lot sooner tempo, we consider that the financial institution will preserve the payout ratio near the present ranges as a part of its prudent technique, nonetheless.

Valuation & Anticipated Returns

Neighborhood Belief Bancorp is presently buying and selling at a price-to-earnings ratio of 9.5, which is decrease than its 10-year common price-to-earnings ratio of 12.6. Regardless of its constant profitability and general qualities, the market probably expects minimal progress within the coming years, which explains the low cost. Nonetheless, we consider that income-oriented buyers are prone to respect the corporate’s 4.0%, particularly in the course of the present shaky macroeconomic atmosphere. Together with the truth that rising charges ought to profit the corporate, we consider that the inventory might expertise valuation tailwinds to a P/E of 12.

If the price-to-earnings a number of expands from 9.5 to 12, future returns could be boosted by4.7% per 12 months over the following 5 years. Mixed with our EPS & DPS progress charges, in addition to the present dividend yield, we venture annualized returns might quantity to 9.8% by means of 2027.

Accordingly, we price Neighborhood Belief Bancorp a purchase.

Ultimate Ideas

Neighborhood Belief Bancorp is a well-managed financial institution. It accelerated its progress sample in 2018 and 2019 due to larger rates of interest and its decreased tax price. It additionally posted document earnings final 12 months due to the reversion of provisions for mortgage losses because the economic system recovered from the pandemic. Whereas internet earnings will decelerate this 12 months as a result of absence of final 12 months’s progress driver, fiscal 2022 ought to mark one other 12 months of wonderful backside line numbers.

The corporate additionally contains a wholesome payout ratio, which ought to maintain dividend funds and presumably dividend progress even when earnings had been to be materially affected. Neighborhood Belief Bancorp thus qualifies as a blue chip inventory to depend on for income-oriented buyers, notably given its distinctive dividend progress document.

The Blue Chips record isn’t the one solution to rapidly display screen for shares that usually pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].