Natalya Bosyak/iStock via Getty Images

Co-produced with PendragonY

When you have a diversified portfolio, not every position will experience good times at the same time. That also means that not every position will be experiencing bad times at the same time. A well-diversified portfolio means that your portfolio will always have relative outperformers and underperformers at any given time.

Last year was a very tough year for fixed income, and so far, this year hasn’t been much better. Many fixed-income funds experienced distribution cuts, including one we hold, Flaherty & Crumrine’s Dynamic Preferred & Income Fund (NYSE:DFP). With dozens of dividend hikes last year, why are we still holding a CEF that has seen its distributions cut?

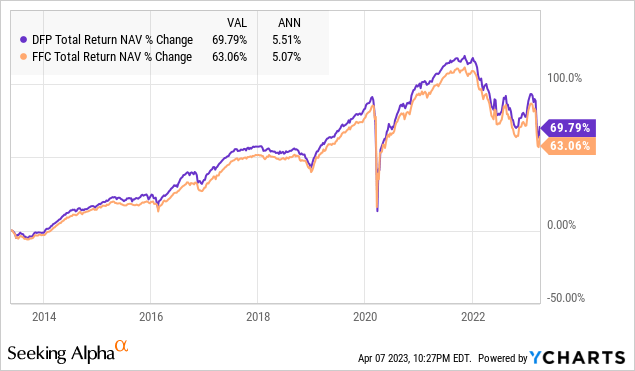

On a total return basis, DFP has done well even with its distribution cut and a tight year in 2022. One piece of advice that is often given in investing, is to buy low and sell high. What many often forget is that means that prices have to go low for them to be a good buy. Right now, DFP has certainly hit a low price. It is often in the midst of the worst that an investment is the best buy. The question is if the future looks better than the last year.

2022 was a horrible year for fixed income. It was the worst year on record. Preferred prices crashed, as we saw throughout much of our preferred and bond portfolio. As a CEF, DFP is required to pay out a distribution equaling their taxable income and all capital gains. They were faced with the option of cannibalizing their portfolio to overpay the distributions or reducing the dividend so that they can fully participate in recovery, DFP chose to take the latter route.

Why did we hold fixed income investments, even though many were (correctly) predicting that interest rates would rise?

Because the unexpected happens. It actually happens quite often. Remember COVID? Nobody expected that interest rates would be slashed to 0% in March 2020. Not a soul even entertained that as a possibility until shortly before it happened. You can’t predict the future. Sometimes, you can guess correctly. But don’t fool yourself into thinking you know what will happen.

This is why the HDO Model Portfolio was designed to be “agnostic” towards interest rates. We have some holdings that are benefitting greatly from rising interest rates. Most notably, we have seen many dividend hikes and supplemental dividends from our BDCs (business development companies). Other holdings, like DFP have struggled.

Looking Forward

Our outlook on fixed income continues to be very bullish, and the lower coupon preferred shares will likely recover more quickly when the Fed stops hiking. We can’t predict when interest rates will peak. Some believe they have already peaked, others believe the Fed will keep hiking a few more times. So we want to remain agnostic towards interest rates.

However, the probability of interest rates being at or close to peak is increasing. When DFP starts seeing a price increase in their holdings and a reduction of their borrowing costs, the fund will be in a position to start raising the distributions again.

It is never a good time to panic. Often investors will panic, will react quickly with poorly thought-out decisions, or will succumb to fear-mongers at the worst possible time. With interest rates continuing to rise, this bear market has resulted in a sell-off of several quality preferred securities and high-yield equities.

DFP allows an investor to easily gain exposure to a diversified set of income-oriented securities. The recent share price drop is just one of many examples of fear causing investors to miss the bigger picture. While the FOMC did hike rates at its latest meeting, the latest increase was only 25 basis points, a smaller increase than the prior increase, and the smallest increase in nearly a year. And while “safe” rates remain high, as soon as the Fed begins to cut rates (and maybe even before then) the high rates offered in money market accounts and CDs will disappear. Today’s buyers of discounted and quality yields will have a large and sustainable income stream and significant capital upside just from patience and persistence.

A Look At DFP’s Portfolio

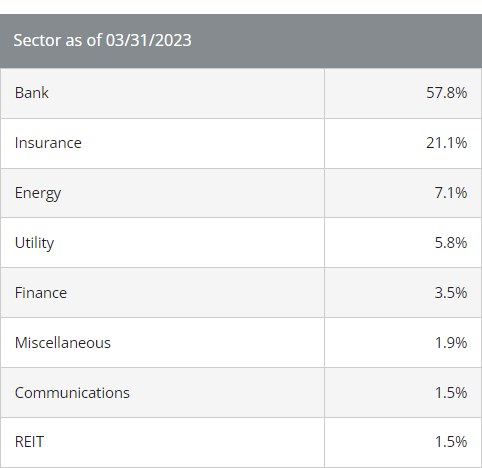

Flaherty & Crumrine specializes in managing preferred, contingent capital, and related income securities. As a CEF (Closed-End Fund), DFP invests in a portfolio of preferred and other income-producing securities. Around 71% of the issuers in its portfolio are U.S. companies, while the remainder are based outside of the U.S. As with any fund that invests a large portion of its portfolio in preferred securities, banks, and insurance companies, known for issuing safe and reliable preferred, constitute almost 79% of the fund. Source

Based on the 2022 annual report, 46.7% of the securities in the portfolio are rated as investment grade by Moody’s, while just 29.9% are rated below investment grade by all 3 rating agencies. Only 5.3% of managed assets are in securities where the security rating and issuer’s senior unsecured debt or issuer rating are below investment grade by all of the 3 rating agencies.

DFP

DFP is diversified across 213 holdings carrying 42% leverage to boost returns to shareholders. Remember, leverage amplifies returns both on the upside and on the downside. So when the markets were under pressure in 2022, DFP had to reduce its regular distribution but continued to accumulate capital gains from its active management. Since CEFs must distribute nearly all realized gains and earned income, DFP paid a massive special distribution. This resulted in the total 2022 payout exceeding 2021 even though the regular distribution saw a reduction. DFP pays $0.1145/month, an 8% annualized yield. Income investing requires patience, and DFP is an example of an investment that pays big over the long term through noisy market conditions. Source

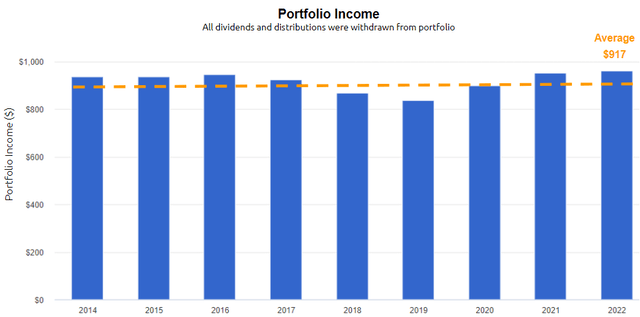

Portfolio Visualizer

Note:

With a $10K initial investment DFP has paid on average $917 each full year since 2014.

No ROC is used in the fund’s distribution strategy. DFP’s distribution has historically been covered by NII. The fund paid a special distribution last year because of large, realized capital gains.

DFP trades at an 6.5% discount to NAV, presenting an attractive entry point for income seekers. DFP is one of the best-in-class CEFs. Collect an 7.6% yield for your patience and persistence through the shaky markets.

Notes on Bank Risks

It is no secret that several banks have now run into significant trouble. First, there was Silicon Valley Bank and Signature Bank were closed by the FDIC. Then Credit Suisse ran into trouble and was taken over by UBS. That takeover resulted in a complete write-off of Credit Suisse AF1 bonds.

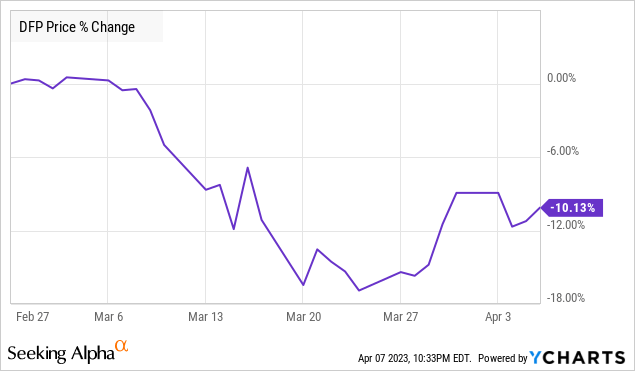

Most recently, concerns have been voiced over Deutsche Bank. And the FOMC increased interest rates by 25 basis points. All of these events have pushed down the price of DFP as well as other fixed-income CEFs. Investors see turmoil in the banking sector, and they sell first, then ask questions later.

Is a 6.5% discount to NAV warranted for DFP?

Looking at the annual report for DFP, we can see how much the fund has invested in each of these troubled banks. Between SIVB and Signature, DFP had $4.35 million. The fund’s Credit Suisse assets total $6.21 million. And in Deutsche Bank just $385K. That amounts to $10.943 million or 1.15% of the fund’s $704.75 million portfolio. The nearly 17% price decline is clearly overblown, given the maximum losses. Moreover, the negative impact of SIVB, Signature, and Credit Suisse are already reflected in NAV, since NAV is updated daily.

So yes, DFP likely realized some losses on certain holdings in its portfolio. Yet its portfolio is well diversified and far more bank preferred are down in price but are not at significant risk. This is common in the market when well-publicized trouble hits a particular sector. Everything in the sector is sold off, and CEF prices tend to be more volatile and sell off even further than NAV declines. This tendency creates a very attractive buying opportunity.

Conclusion

Over the last year, fixed-income securities and the funds that invest in them have been hit hard on price, even though they hold a higher margin of safety for both high income and price volatility than common stocks. This offers smart and conservative income investors a great unique opportunity. DFP has a solid track record and a quality portfolio producing solid income. The lower prices caused by various issues with banks have had a bigger impact on DFP than is warranted by the size of its holdings that are at risk. This overreaction by the market makes for a unique entry price. I am buying the dip for this 7.6% yield, while there is blood in the street!