Key Takeaways

- BlackRock information exhibits Bitcoin allocations in portfolios can considerably outperform conventional investments.

- Bitcoin’s position as a hedge towards fiat foreign money decline is emphasised by BlackRock.

Share this text

On the Digital Property Convention held at present, BlackRock unveiled its newest insights on Bitcoin’s volatility and future efficiency, stating that Bitcoin’s volatility has considerably decreased and can proceed to take action over time.

BREAKING: BITCOINS VOLATILITY HAS DECLINED AND WILL CONTINUE TO FALL – BLACKROCK pic.twitter.com/iCWafcyLyD

— marty (@thinkingvols) October 3, 2024

BlackRock, the world’s largest asset supervisor, emphasised Bitcoin’s evolving position within the world monetary ecosystem. In response to BlackRock, Bitcoin’s volatility has been declining steadily, a pattern that the agency expects to proceed as adoption grows and the asset matures.

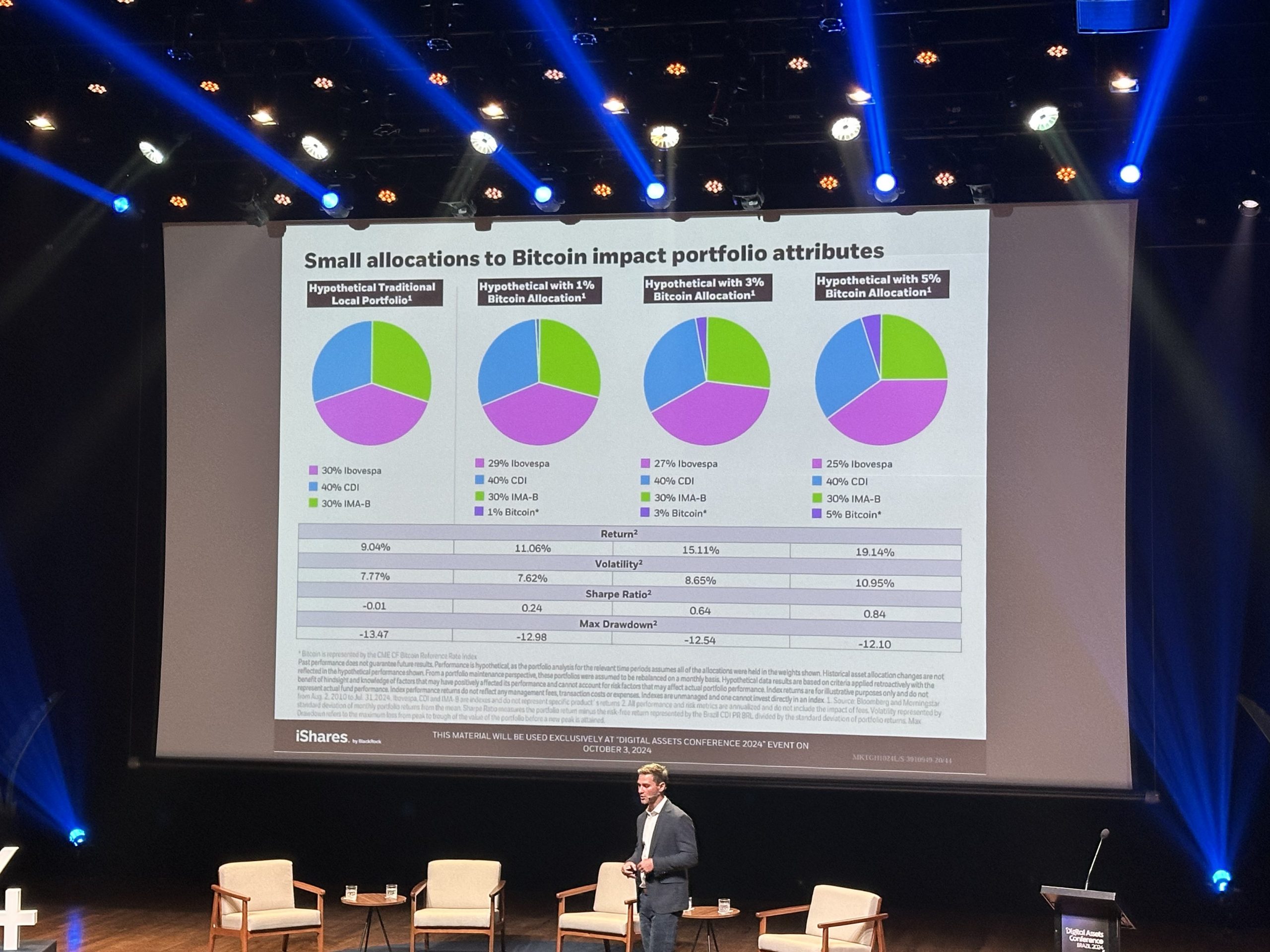

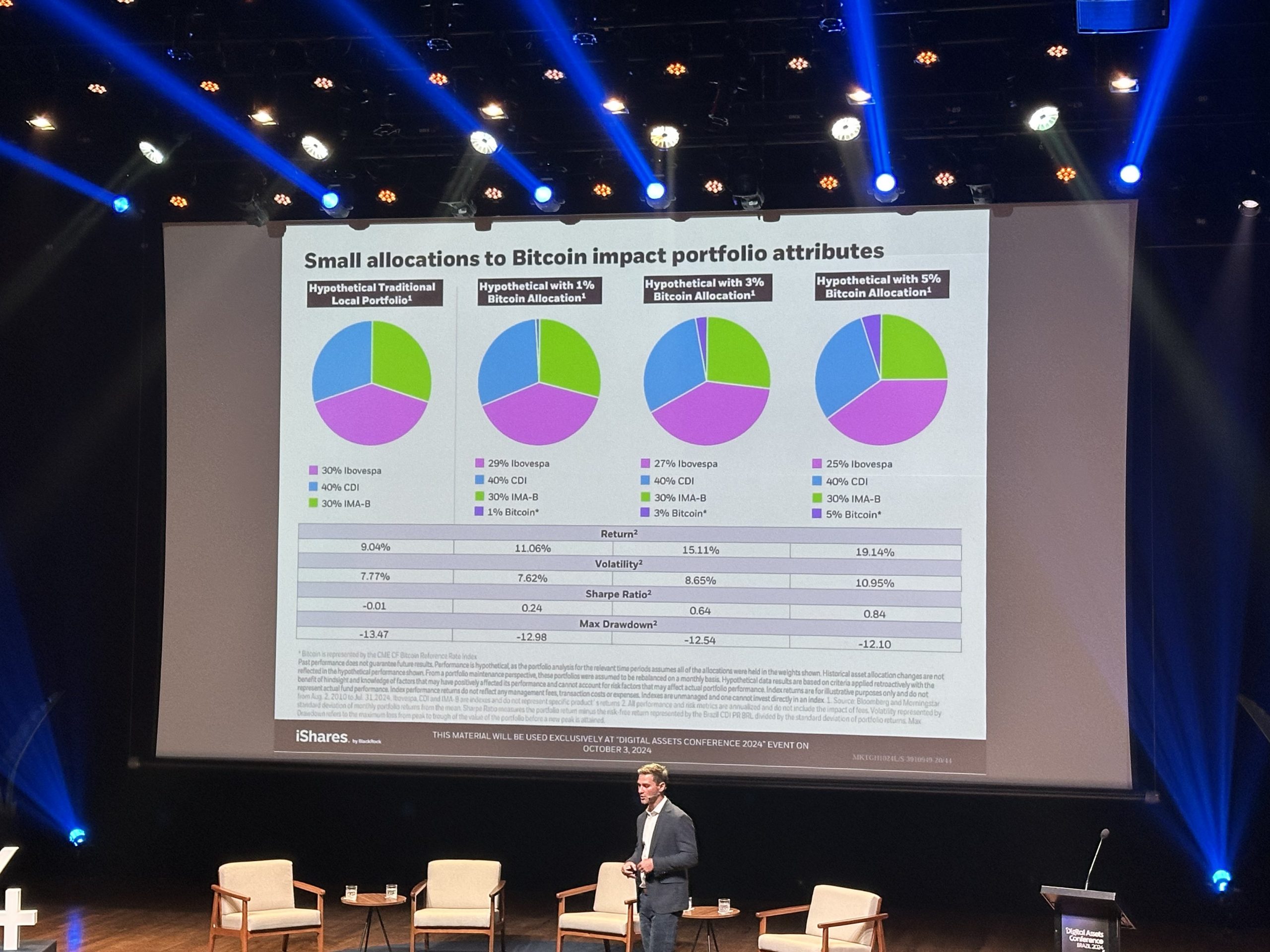

BlackRock’s information confirmed that including Bitcoin to portfolios improved risk-adjusted returns throughout a number of time horizons. Portfolios with a 1%, 3%, or 5% Bitcoin allocation noticed increased returns over one, two, 5, and ten-year intervals in comparison with conventional portfolios.

Whereas Bitcoin barely elevated volatility in these hypothetical portfolios, the potential for increased returns typically outweighed the added danger. For instance, portfolios with a 5% Bitcoin allocation achieved a 19.1% return over the long run, considerably outperforming the 11% return from conventional portfolios with out Bitcoin publicity.

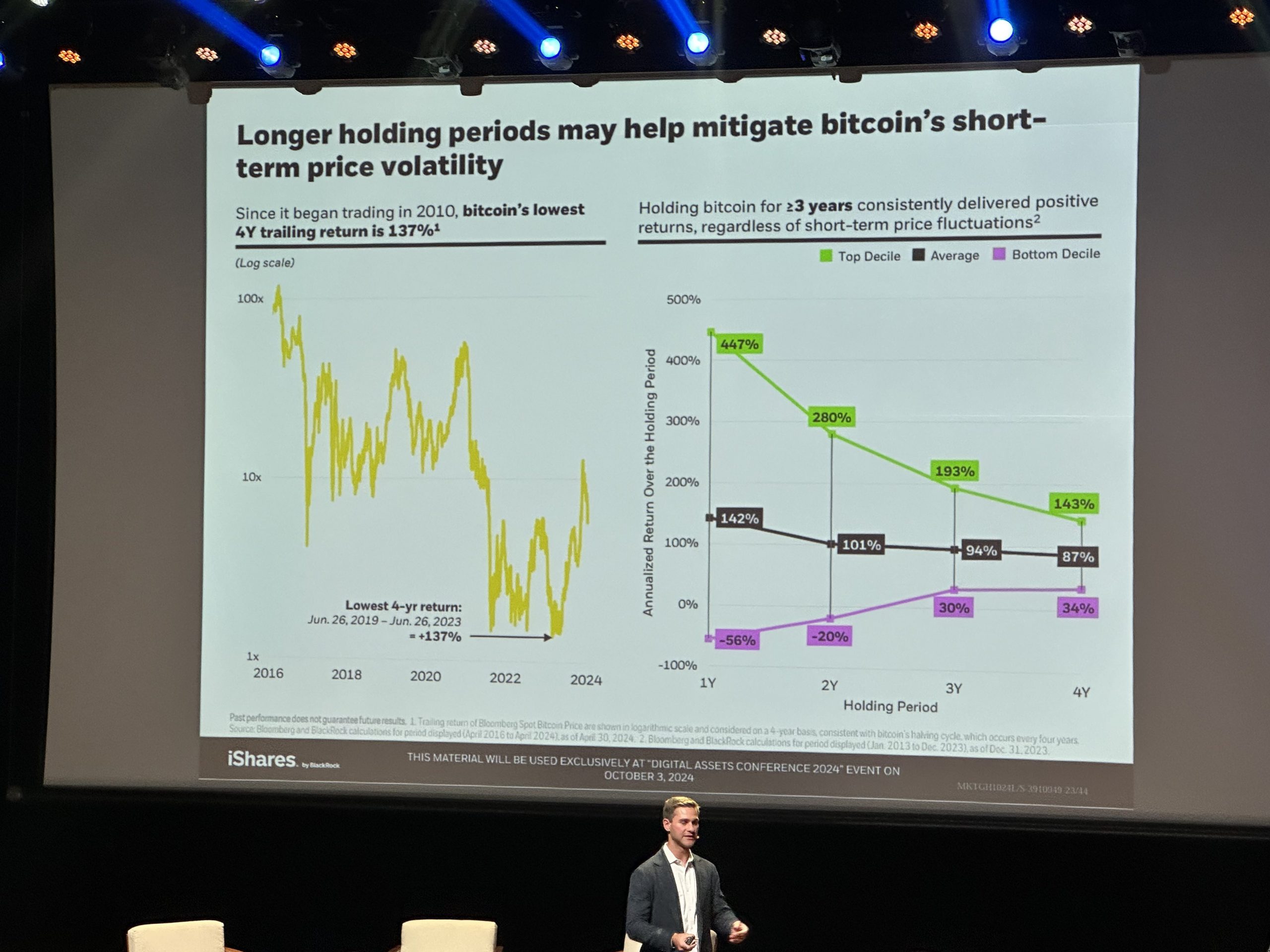

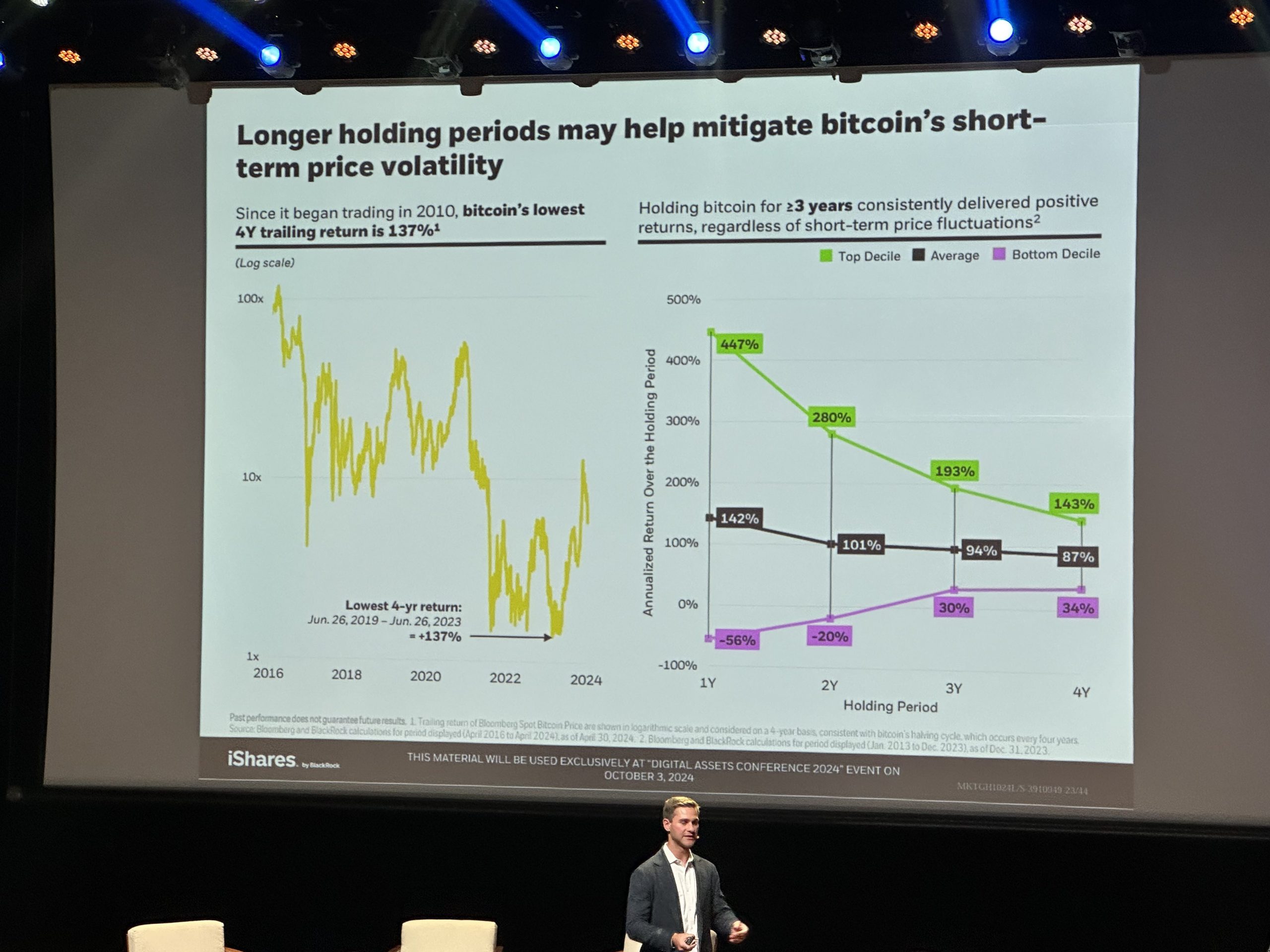

BlackRock’s evaluation additionally emphasised the significance of long-term holding with regards to Bitcoin’s volatility. In response to the agency, Bitcoin’s lowest four-year trailing return remains to be a powerful 137%, and holding the asset for 3 or extra years has constantly delivered optimistic returns.

Moreover, BlackRock in contrast Bitcoin to gold and US Treasuries, emphasizing its mounted provide, decentralized governance, and low correlation with conventional belongings, positioning it as a hedge towards declining belief in governments and fiat currencies.

Furthermore, BlackRock famous that whereas Bitcoin’s volatility stays elevated, it has declined because the asset matured. The evaluation confirmed Bitcoin’s low correlation with gold (0.1) and the S&P 500 (0.2), highlighting its position as an unbiased asset class.

Lastly, BlackRock emphasised Bitcoin as a hedge towards the declining worth of fiat currencies, particularly the US greenback. Highlighting the greenback’s drop since 1913, they positioned Bitcoin as a safeguard towards inflation. By providing Bitcoin ETFs, BlackRock alerts its belief in Bitcoin’s long-term worth and rising position in monetary markets.

Share this text