Natali_Mis

There are some who try to swing for the fences every time by investing in speculative growth stocks. While this may be a good strategy when everything is flying high, it can also be like a game of musical chairs. That is, you don’t want to be the last one standing when the music stops, and it eventually will.

Such as been the case with a number of high-risk companies like Stitch Fix (SFIX), which has lost 70% of its value over the past year. Even supposedly “safe” mega-cap tech names like Meta Platforms (META) and Google (GOOG) (GOOGL) haven’t been immune from the tech downturn.

That’s why I’ve always advocated for having meaningful exposure to dividend-paying stocks that won’t make you rich overnight, but rather hit singles and doubles that accumulate to long-term wins.

This brings me to Black Hills Corporation (NYSE:BKH), which remains an attractively priced utility with over 50 years of consecutive dividend increases. This article highlights why BKH is currently a sound buy for income investors, so let’s get started.

Why BKH?

Black Hills Corp. is an electric and gas utility company based in Rapid City, South Dakota. At present, it serves 1.3 million customers across eight states across Arkansas and the North Central region of the U.S., from Iowa to Wyoming. One of BKH’s key advantages is the company’s geographic diversity. With operations in several states, the company is able to spread its risk across multiple markets, reducing the impact of any one market downturn.

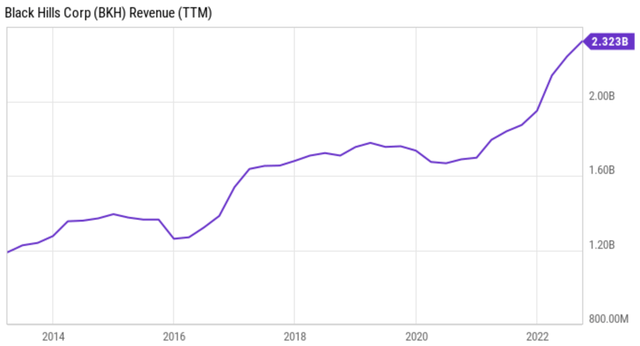

Growth in BKH’s key markets combined with the strategic acquisition of SourceGas back in 2016, which gave it access to markets in Rocky Mountain and Midcontinent states, have contributed to robust growth over the past decade. As shown below, BKH has nearly doubled its revenue over the past 10 years, to $2.3 billion over the trailing 12 months.

BKH Revenue (YCharts)

Importantly, BKH’s strong growth has also translated into meaningful shareholder returns. As shown below, BKH has produced a 50% total return over the past 5 years, just shy of the 53% total return of the S&P 500 (SPY) over the same timeframe.

One may wonder, then, why one would invest in BKH over the S&P 500 when the latter produced a better return. The answer to that is the dividend. The S&P 500 pays a notoriously low dividend yield of 1.6% due to its high exposure to non- or low-dividend paying names like Google, Apple (AAPL), and Tesla (TSLA) all of which have seen growth stall over the past year.

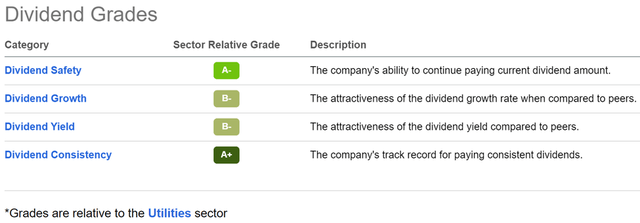

In the meantime, BKH’s 3.5% dividend yield is more than double that of the S&P 500 and is well protected by a 60% payout ratio with a 5-year CAGR of 6% and 52 years of consecutive dividend increases, making it a Dividend King. As shown below, BKH holds A and B grades for dividend safety, growth, yield, and consistency.

BKH Dividend Grades (Seeking Alpha)

Meanwhile, BKH continues to see strong operating fundamentals, with EPS growing by 9% YoY to $2.86 during the first nine months of 2022. This was driven by higher electric and gas margins due to new rates, rider recovery, and benefits from hot and dry weather in much of BKH’s service territories. Importantly, management reaffirmed guidance for $4.05 EPS at the midpoint for the full year and remains confident in long-term EPS growth of 5% to 7% annually.

Looking forward, BKH has attractive investment opportunities in renewable energy sources, including wind and solar power. This not only positions the company well for an increasingly climate-conscious future, but also provides a hedge against the volatility of fossil fuel prices.

That’s because renewable energy does not have commodity input costs after the upfront investment, and therefore, could result in higher margins for BKH. Management updated investors on the progress with its planned Colorado project during the last conference call:

In Colorado, we continue to work through the procedural schedule for approval of our Clean Energy Plan, which sets out our path to a potential 90% reduction in greenhouse gas emissions intensity in Colorado by 2030, again off of 2005 baseline.

Our plan proposes to add 400 megawatts of wind and solar resources and 50 megawatts of battery storage between 2025 and 2030. We expect to initiate the competitive bidding process by 2023 for these new resources and Colorado legislation provides up to 50% company ownership of these additions. These new clean energy additions would result in almost 80% of our Colorado customers’ electricity coming from renewable resources.

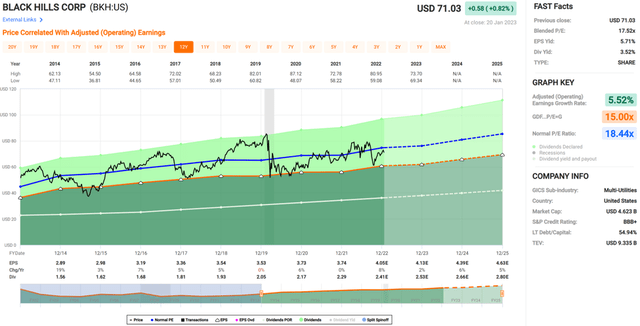

Notably, BKH maintains a strong BBB+ rated balance sheet to execute on its plan, and has $250 million in cash and accounts receivable. I also see value in BKH at the current price of $71 with a forward PE of 17.5, sitting below its normal PE of 18.4 over the past decade.

With a 3.5% dividend yield and expected 5% to 7% annual EPS growth, BKH could deliver ~10% total annual returns to shareholders over the long run. Lastly, analysts have a consensus Buy rating with an average price target of $76.

BKH Valuation (FAST Graphs)

Investor Takeaway

Black Hills Corp. is an attractively valued Dividend King with strong underlying fundamentals. It remains well-positioned for growth through its clean energy initiatives and maintains a strong balance sheet to support its growth. With potential for 10% annual long-term total returns, BKH could be a steady and reliable holding for an income portfolio.