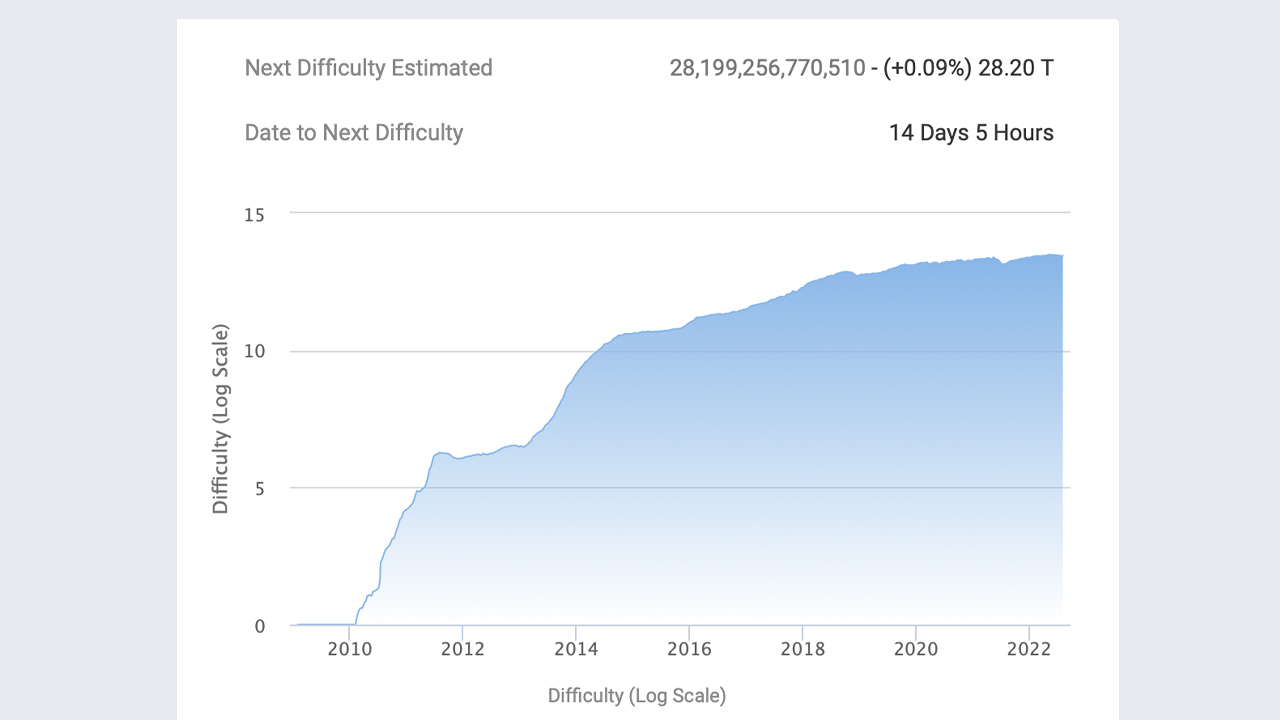

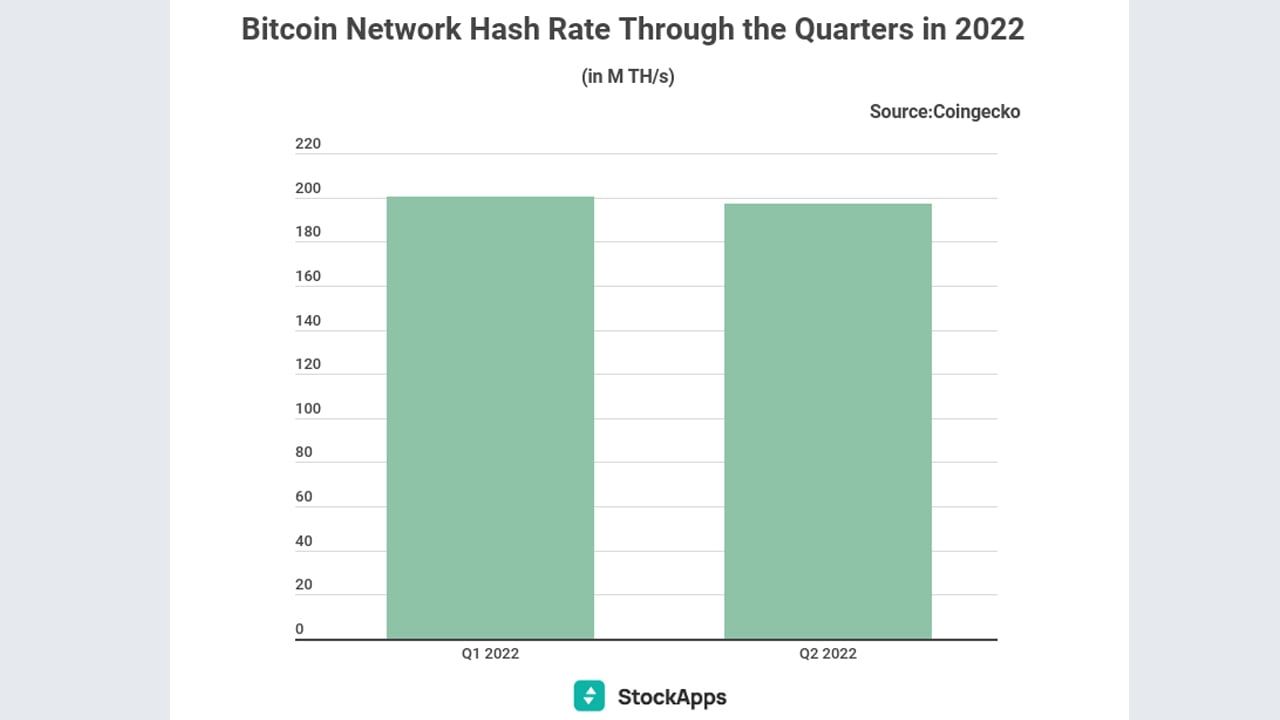

The mining problem tied to the Bitcoin community elevated for the primary time in 57 days, rising 1.74% larger than the final two weeks. In the meantime, Bitcoin’s hashrate has been beneath common because the community’s computational energy is down 1.7% decrease within the second quarter than in Q1 2022. After reaching 292 exahash per second (EH/s) on June 8, Bitcoin’s hashrate as we speak is coasting alongside beneath the 200 EH/s mark at 182 EH/s.

Bitcoin’s Problem Will increase, Making It Extra Troublesome to Uncover Block Rewards for the Subsequent 2 Weeks

Following the three consecutive problem adjustment algorithm (DAA) reductions during the last six weeks, the DAA has shifted upwards for the primary time since June 8. On August 4, at block peak 747,936, the problem elevated by 1.74%, bringing the metric up from 27.69 trillion to the present 28.20 trillion.

The DAA, or problem epoch, modifications each 2,016 blocks or roughly each two weeks. The DAA will increase when the two,016 blocks are found too quick and the metric decreases when the invention time is simply too gradual. Satoshi Nakamoto’s design makes it so roughly each ten minutes, a brand new BTC block is discovered because the DAA system is modeled by a Poisson distribution scheme.

Because the 1.74% improve on Thursday, it’s now more durable to discover a bitcoin block than it was over the past two weeks. Previous to the rise, the DAA shifted downwards 3 times in a row after June 8. At the moment, the community’s 28.20 trillion problem metric is 9.76% decrease than the all-time excessive in mid-Could when it tapped 31.25 million.

With decrease BTC costs and the newest problem improve, the modifications may have an effect on miners negatively in the course of the subsequent two weeks. At press time, the community’s computational energy is beneath the 200 EH/s zone, because it’s coasting alongside at 182 EH/s as we speak.

The general Bitcoin hashrate slipped 1.7% decrease in Q2 2022 in comparison with the primary quarter, in line with statistics compiled by stockapps.com’s fintech knowledgeable Edith Muthoni. “Within the second half of the second quarter, Bitcoin’s general hash charge grew extra irregular and variable,” Muthoni notes in her analysis. “This habits signifies miners are struggling to adapt to the altering market situations.”

At 182 EH/s, Bitcoin’s hashrate is 37% decrease than the 292 EH/s all-time excessive posted on June 8. Second quarter information signifies that Foundry USA was the highest mining pool, capturing 22.27% of Q2’s general hashrate. Foundry found 2,843 BTC blocks out of the 12,766 blocks present in Q2.

Antpool adopted Foundry with 14.77% of the worldwide hashrate because the pool found 1,885 blocks in the course of the three-month interval. The third largest mining pool in Q2 2022 was F2pool, with 14.31% of the worldwide hashrate, because it mined 1,827 out of the 12,766 blocks found within the second quarter.

What do you consider Bitcoin’s problem rising 1.74% larger? Tell us your ideas about this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any injury or loss brought about or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.