Nastco/iStock Editorial via Getty Images

Bitcoin (BTC-USD) is on track to end the week marginally higher, treading water ahead of the Federal Reserve’s meeting next week. This follows a brief rally last week after Fed chair Jerome Powell signaled a slower pace of rate hikes soon.

The Fed will meet on Wednesday, where it is widely expected to raise interest rates by 50 bps.

“Bitcoin seems stuck around $17K and that could continue until next week’s FOMC decision. If the Fed signals more work may need to be done and if legislation looks crippling for bitcoin, sellers could quickly emerge and make a push to retest November lows,” said Edward Moya, senior market analyst, OANDA.

The top cryptocurrency rose to $17.38K on Monday, its highest level in a month following the collapse of crypto exchange FTX (FTT-USD) that sent prices spiraling. Bank of America believes there are still silver linings as the fallout will result in increased regulatory scrutiny, which may enable more institutional engagement.

The global cryptocurrency market cap stands at $852.08B, down 0.68% over Thursday, according to CoinMarketCap.

FTX updates

- Sam Bankman-Fried, founder of failed crypto exchange FTX (FTT-USD), is reportedly being investigated by U.S. federal prosecutors on whether he manipulated the prices of terraUSD (UST-USD) and its sister token luna (LUNC-USD) in May that led to their collapse.

- SBF said he’s “willing to testify” next week in front of the House Financial Services Committee.

- Alameda Research, the trading firm affiliated with FTX, was said to have been secretly funding crypto news site The Block for more than a year.

- As the FTX continues to send ripples in the industry, Canada’s largest pension fund CPP Investments reportedly stopped mulling over investment opportunities within the crypto space. CPPI told Reuters it has not made any direct investments in crypto.

- Goldman Sachs is reportedly looking to deploy tens of millions of dollars to buy or invest in crypto firms with bargain valuations after the downfall of FTX.

- Cryptocurrency exchanges Bybit and Swyftx announced layoffs, citing the fallout from the FTX collapse and the current bear market.

Regulatory news

- The SEC advised publicly-traded companies to disclose to investors any potential impacts from the crypto market as well as their risk exposure to bankruptcies in the space.

- Shares of Silvergate Capital (SI) continued to take a beating after U.S. state senators sent a letter to CEO Alan Lane, requesting clarity about its relationship with SBF’s crypto empire. Earlier this week, Lane said his company has an adequate liquidity position and a resilient balance sheet despite the crypto market turmoil.

Bitcoin price

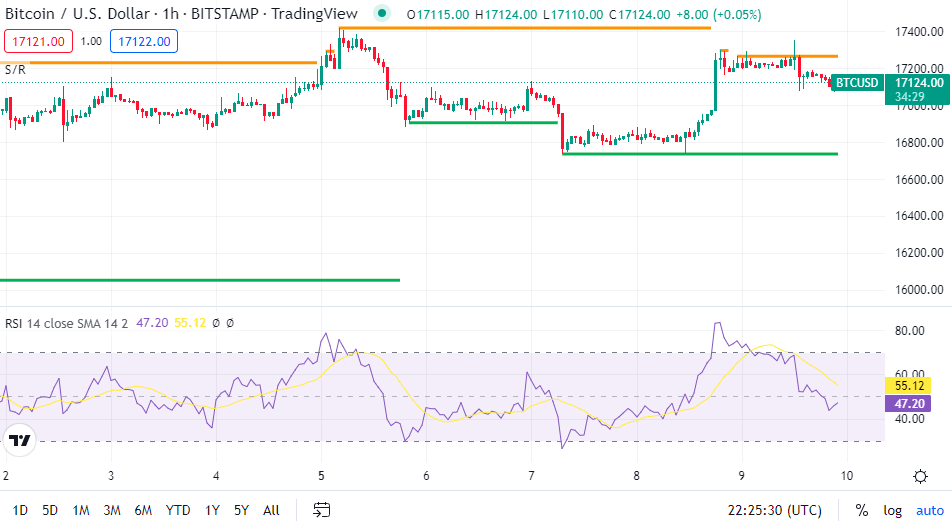

Bitcoin (BTC-USD) slipped 0.48% to $17.12K at 5.27 pm ET, while ether (ETH-USD) fell 1.48% to $1.26K.

Bitcoin (BTC-USD) has been trading in a tight range of $16.9K-$17.38K this week. “If Wall Street is confident that the Fed will be done hiking after the February rate rise and nothing new breaks in crypto, you could see bitcoin make a run for the $18K level,” said OANDA’s Moya.

Standard Chartered said bitcoin (BTC-USD) could tank another ~70% to $5K in 2023 as it factored in interest rates plunging and potentially more crypto-related bankruptcies.

SA contributor Practical Crypto Capital expects additional macro pressure on bitcoin, while Ariel Santos-Alborna believes the worst is priced in and now is the time to consider opening or adding to a position.

Crypto-related stocks that ended in the red on Friday include: Marathon Digital (MARA) -7.2%, Coinbase (COIN) -6%, Riot Blockchain (RIOT) -4.1%, Bitfarms (BITF) -3.9%, Robinhood Markets (HOOD) -2.2%.