Bitcoin is as soon as once more beneath strain as macroeconomic fears and political unpredictability proceed to impression international markets. United States President Donald Trump’s erratic coverage selections—notably round commerce—have heightened investor anxiousness, triggering volatility throughout each equities and crypto. Inside this local weather, Bitcoin has struggled to reclaim momentum, at the moment buying and selling under vital resistance close to the $90K mark.

Regardless of latest makes an attempt to recuperate, demand stays weak round present ranges, and bulls have but to mount a convincing rally. Merchants are watching carefully, as Bitcoin must reclaim $90K to reestablish a bullish narrative. Till then, uncertainty reigns.

Including to the cautious sentiment, CryptoQuant knowledge exhibits that the common dealer is sitting at an unrealized lack of -13.86%—a degree that traditionally indicators mounting promoting strain. Whereas such loss ranges have beforehand marked backside zones, in addition they replicate a market gripped by concern, hesitation, and lack of conviction.

With Bitcoin down greater than 29% from its January all-time excessive, the following transfer can be vital. Will merchants capitulate beneath strain, or may this be the muse for a restoration? All eyes are on key help and resistance ranges because the market braces for its subsequent main transfer.

Sentiment Turns Bearish As Bitcoin Faces Essential Check

Bitcoin is battling intense skepticism from analysts and traders because it struggles to show that the present market cycle stays bullish. The macroeconomic atmosphere isn’t serving to both — recession fears, persistent inflation, and chaotic international insurance policies, together with unpredictable strikes from President Trump, have solid a shadow over all danger belongings, together with crypto.

As promoting strain intensifies, many market members have begun to anticipate the early phases of a bear market. Investor sentiment has develop into more and more cautious, and momentum indicators counsel a insecurity in a near-term rally.

Nevertheless, high analyst Ali Martinez gives a extra optimistic view. In a latest publish on X, he shared that Bitcoin merchants are at the moment sitting at a median unrealized lack of -13.86%. Traditionally, when merchants attain this degree of loss, it has usually marked the exhaustion level of promoting strain. These situations have beforehand signaled native bottoms and preceded robust recoveries.

If bulls wish to regain management, now’s the time to behave. A decisive transfer above resistance zones may invalidate the bearish outlook and reestablish upward momentum.

Value Vary Narrows As Bulls Put together For Key Breakout Check

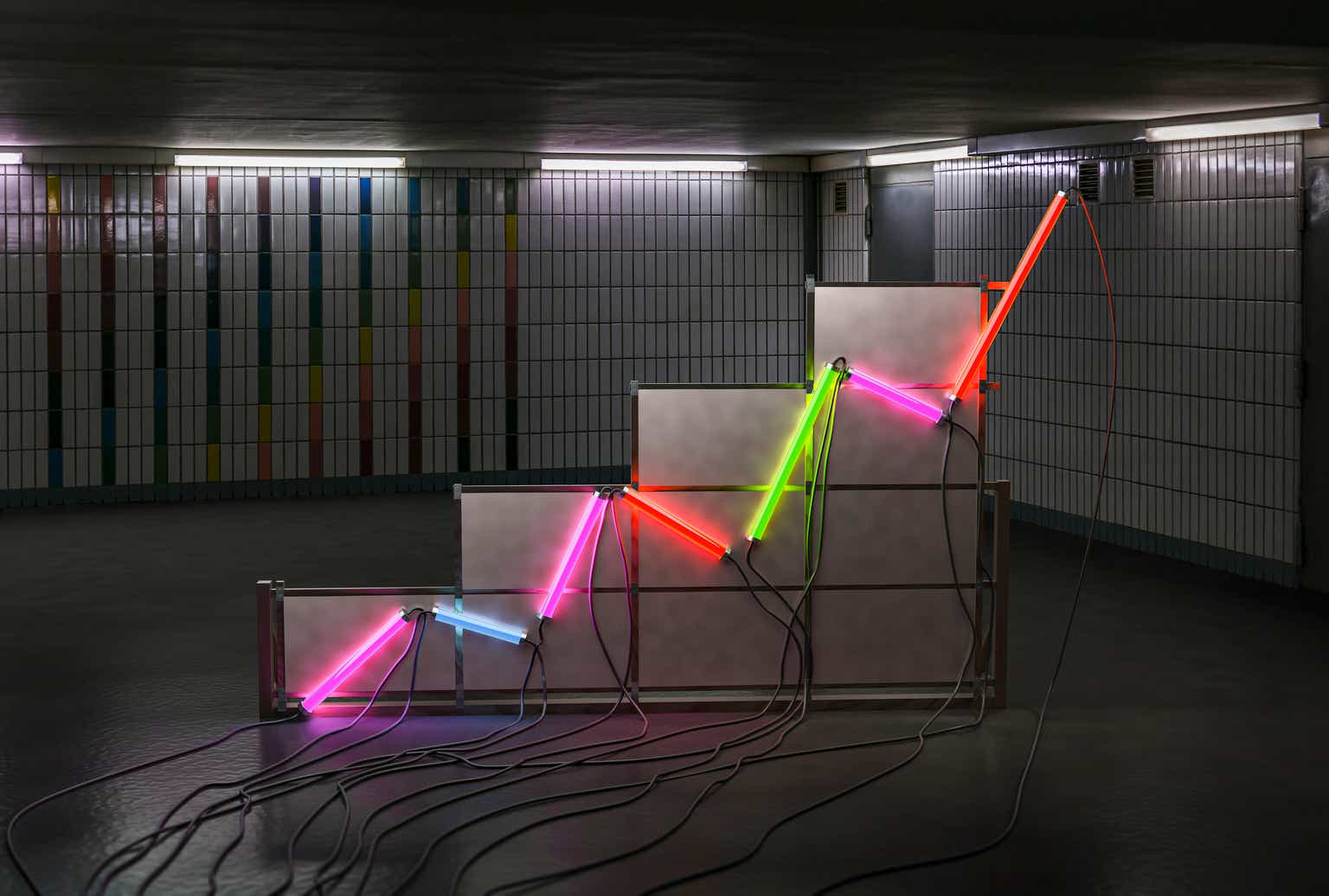

Bitcoin is at the moment buying and selling in a decent consolidation zone between $87,000 and $81,000, signaling {that a} decisive transfer could possibly be on the horizon. After weeks of volatility and promoting strain, worth motion has flattened out, creating stress out there as each bulls and bears await a breakout.

For bullish momentum to return, BTC should break above the $88,000 degree — a transfer that may additionally reclaim the 4-hour 200-day transferring common (MA) and exponential transferring common (EMA). A breakout above these ranges could be a short-term energy sign, doubtlessly opening the door for a rally towards the $90,000 mark and past.

Nevertheless, the longer BTC stays caught under resistance, the extra possible the market is to see renewed promoting. Failure to reclaim $88,000 within the coming classes may invite a wave of bearish momentum, pushing Bitcoin under $81,000 and presumably towards deeper help zones.

With Bitcoin trapped on this narrowing vary, all eyes are on quantity and volatility indicators to anticipate the following breakout route. The approaching days could show pivotal in figuring out whether or not BTC reclaims management or continues its drift into additional correction territory.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.