On-chain knowledge exhibits the Bitcoin steadiness held by the short-term holders has jumped just lately. Right here’s what this might imply for BTC’s value.

Bitcoin Quick-Time period Holder Provide Has Registered An Uptick

In a brand new put up on X, the market intelligence platform IntoTheBlock has talked about how the totally different Bitcoin cohorts have seen their provide change just lately. The teams in query have been divided on the idea of holding time.

The analytics agency classifies the buyers into these teams: ‘merchants’ who bought their cash inside the previous month, ‘cruisers’ who did so between one and twelve months in the past, and ‘HODLers‘ who’ve been holding for greater than a 12 months.

Typically, the longer an investor holds onto their cash, the much less probably they’re to promote them sooner or later. Thus, the holder resolve will get stronger as one goes from the merchants to the HODLers.

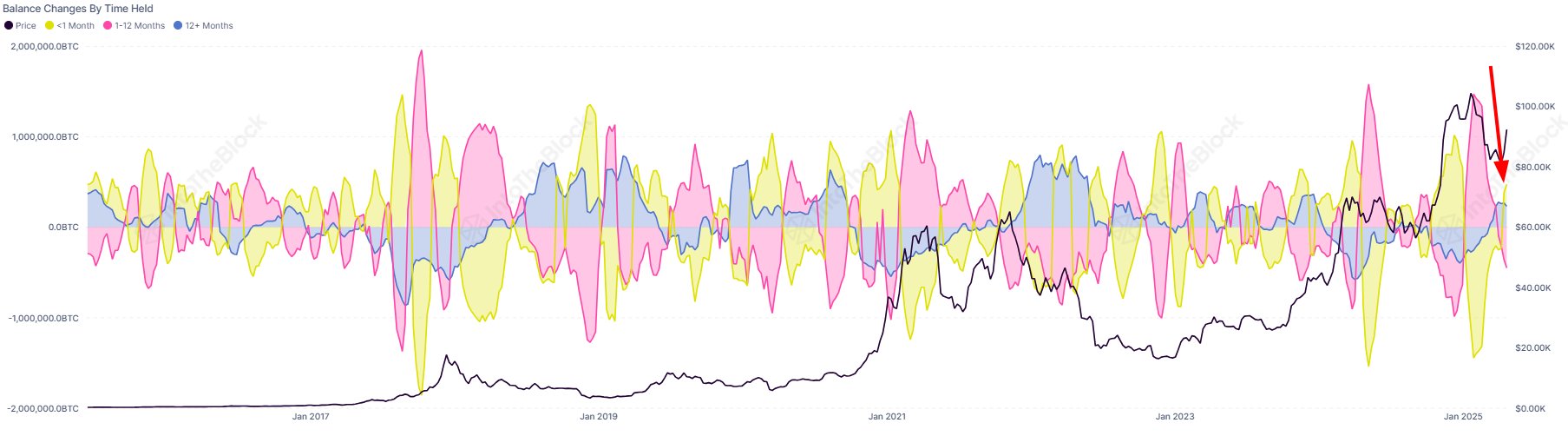

Now, right here is the chart shared by IntoTheBlock that exhibits the pattern within the web change of the steadiness held by every of those teams through the previous decade:

Seems just like the merchants have seen a constructive change in latest days | Supply: IntoTheBlock on X

As displayed within the above graph, the Bitcoin merchants have registered a constructive worth on this metric just lately, suggesting the steadiness held by the group has gone up. This improve for this cohort has come as BTC has been witnessing a value rally.

Every time the availability of the merchants observes an increase, it means members of 1 or each of the older cohorts are breaking their dormancy. On condition that the most recent surge has coincided with an uplift within the asset’s value, it’s doable that it’s a sign of profit-taking out there.

From the chart, it’s seen that the HODLers have additionally seen a constructive change just lately, implying these diamond fingers are persevering with to carry tight. This leaves the cruisers as the one group that may be chargeable for the promoting, and certainly, the damaging steadiness change would verify so.

The cruisers are extra resolute than the merchants, however even they are often susceptible to panic promoting as they haven’t fairly achieved the identical stalwartness because the HODLers, so the most recent distribution from them might not be too shocking.

Whereas the profit-taking might not be a constructive signal for Bitcoin, the rise within the dealer provide could possibly be checked out from a extra bullish perspective: it may suggest there may be contemporary demand flowing into the sector.

This was seemingly the case again through the rally that occurred within the final couple of months of 2024, the place the dealer provide change spiked excessive into the constructive territory.

“If this inflow persists, it helps the view that the present transfer is greater than a reduction rally and could possibly be the opening leg of a broader uptrend,” notes the analytics agency.

BTC Worth

Bitcoin noticed a pullback beneath $93,000 yesterday, however it seems the coin has regained bullish momentum as its value has now surged to $95,200.

The value of the coin appears to have shot up through the previous day | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, IntoTheBlock.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.