Bitcoin has formally entered uncharted territory, breaking above its all-time excessive and reaching a formidable $111,888 earlier at present. This marks the start of a brand new value discovery part, igniting pleasure throughout the market. Whereas bulls stay firmly in management, sentiment is much from euphoric. Many analysts are urging warning, anticipating a doable retrace because the market digests this breakout.

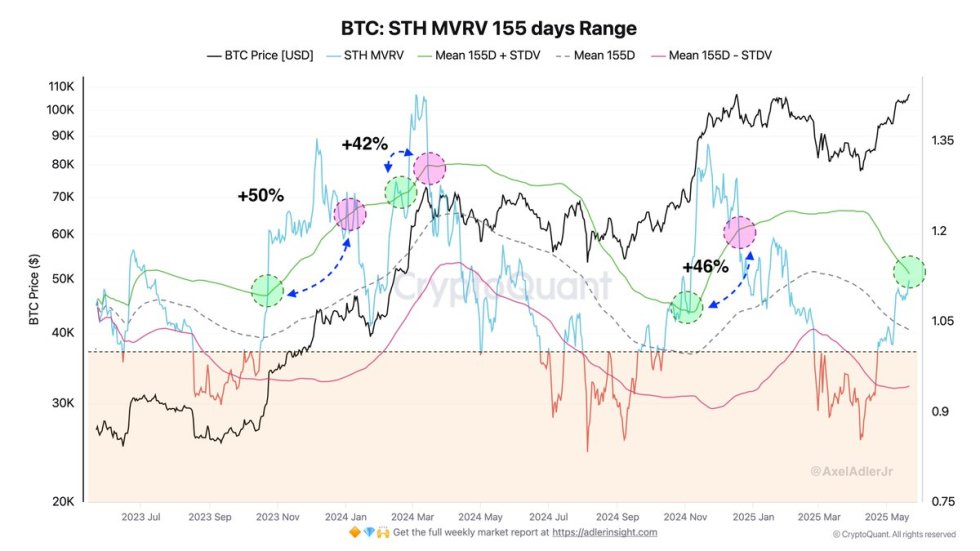

Prime analyst Axel Adler shared well timed insights, emphasizing that the sustainability of this rally hinges on the habits of short-term holders (STH) and ETF speculators. In line with Adler, the present STH MVRV (Market Worth to Realized Worth) ratio has not but crossed the “inexperienced” threshold of 1 normal deviation (+1 STDV), a stage traditionally related to “tremendous rallies.”

As of now, the information suggests that there’s nonetheless room for additional upside. Nevertheless, the danger urge for food of STH and ETF members will possible decide whether or not Bitcoin continues climbing or pauses for a correction. With market sentiment cautious however optimistic, all eyes are on whether or not this breakout can remodel right into a sustained, high-momentum bull part.

Bitcoin STH Threat Urge for food And ETF Flows Could Dictate Subsequent Transfer

Bitcoin is displaying outstanding energy because it pushes increased regardless of rising macroeconomic uncertainty. U.S. shares fell sharply yesterday, rattled by surging Treasury yields that signaled tighter monetary circumstances forward. But, in distinction, BTC has continued its climb, reaffirming its rising position as a hedge in opposition to conventional market volatility. Nonetheless, breaking above the $115,000 stage stays important. With out that breakout, Bitcoin dangers dropping momentum and dealing with a major correction.

Adler highlights that this rally hinges on the danger urge for food of short-term holders (STH) and ETF-driven speculators. In line with Adler, the present STH MVRV (Market Worth to Realized Worth) metric has not but crossed the “inexperienced” threshold of 1 normal deviation (+1 STDV). Traditionally, this stage has marked the start of a “tremendous rally,” a part through which costs speed up quickly till STH holders start profit-taking.

In earlier rallies of this cycle, Bitcoin surged a median of 46% above the +1 STDV line. Based mostly on at present’s information, this may venture a possible excessive close to $154,000. Nevertheless, Adler warns that the present late-stage atmosphere might curb positive factors. He anticipates promoting to start round $126,000, significantly from ETF consumers who entered across the $84,000 mark.

Whereas STH holders could also be prepared to experience out increased costs, ETF speculators might develop into the strain level. Their exits could set off the following correction, reinforcing the necessity for sturdy shopping for quantity to maintain the breakout. As Bitcoin navigates new highs, market habits will possible hinge on how each teams react to mounting positive factors.

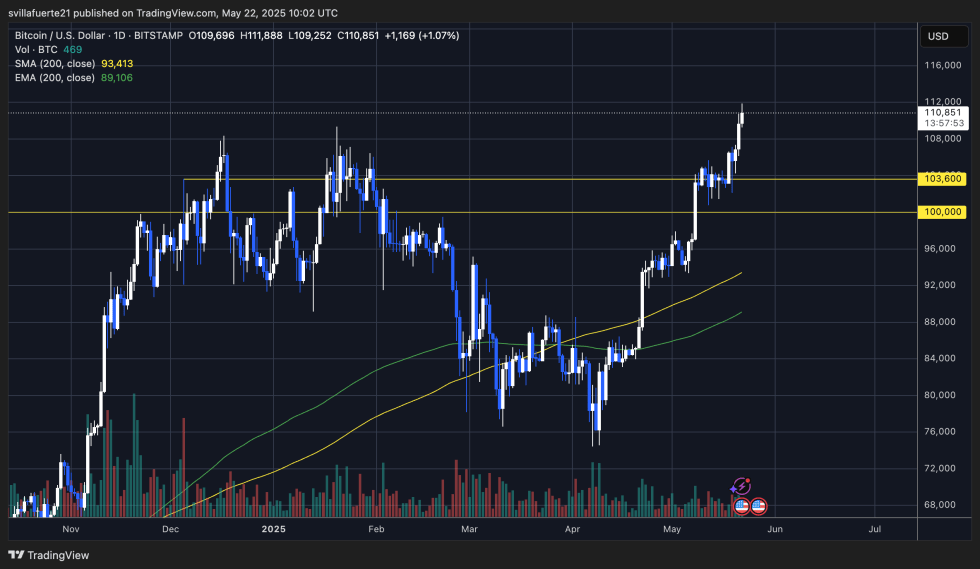

Technical Particulars: BTC Enters Value Discovery

Bitcoin has formally entered value discovery after breaking above its earlier all-time excessive, reaching $111,888 earlier at present. The chart exhibits a robust bullish construction supported by rising quantity and better lows because the breakout above $100,000 in early Could. The momentum has been constant, with BTC holding effectively above its 200-day easy shifting common (SMA) at $93,413 and the 200-day exponential shifting common (EMA) at $89,106, which now act as sturdy macro helps.

After clearing the $103,600 resistance zone cleanly, Bitcoin continued to climb with minimal retracement, signaling sturdy shopping for curiosity and low overhead provide. The absence of main resistance on this new vary will increase the probability of additional upside. Nevertheless, RSI-based overheating or funding charge spikes might quickly act as short-term obstacles.

Regardless of the bullish momentum, it’s necessary to look at for any bearish divergences or indicators of exhaustion close to the psychological $115,000 stage. An in depth above that mark with sturdy quantity would possible lengthen the rally into the $120,000–$130,000 vary. On the draw back, the $103,600 and $100,000 ranges now function essential help zones. If bulls can keep this construction and quantity stays favorable, the breakout might result in a sustained leg up on this cycle.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.