Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

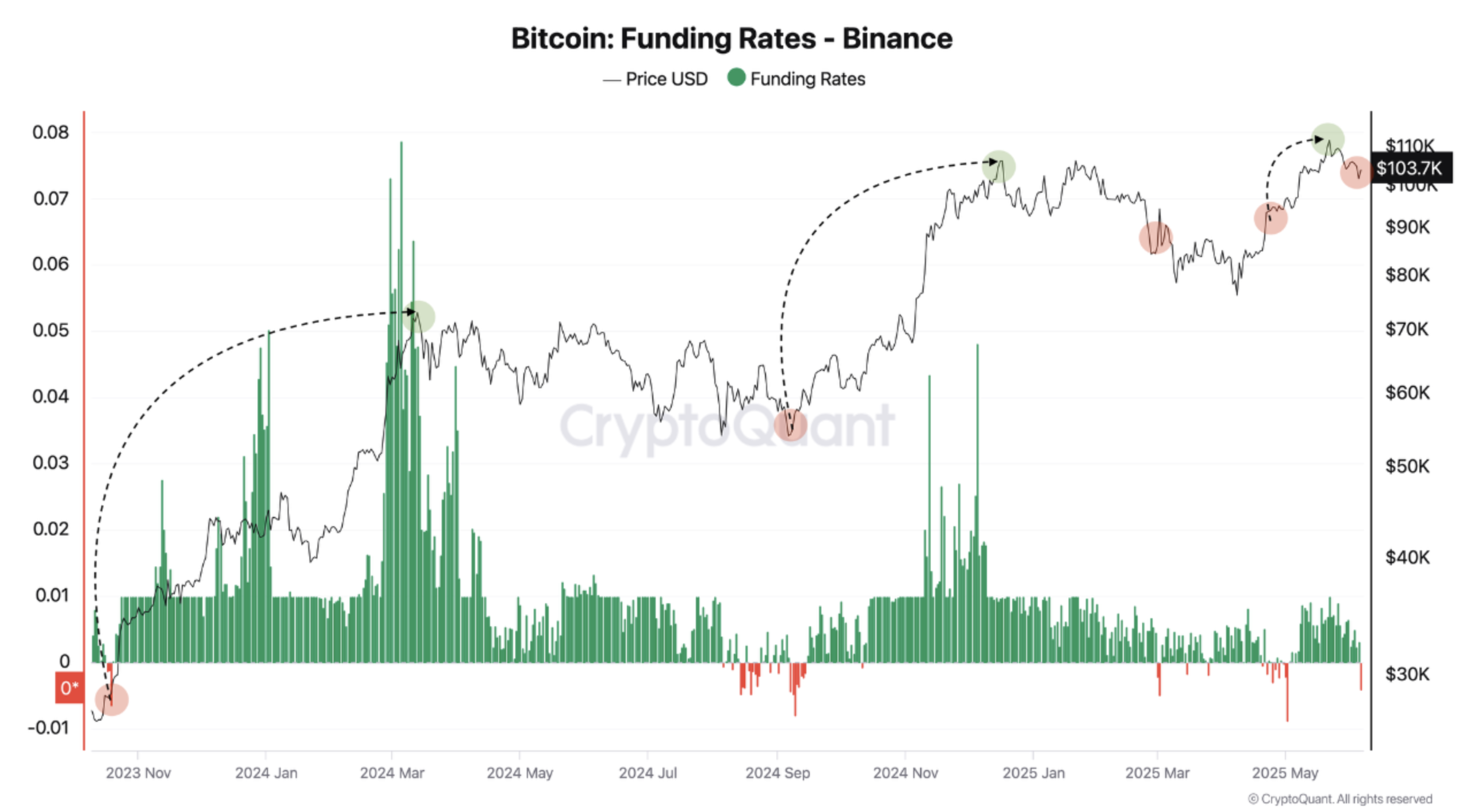

As political tensions between US President Donald Trump and Elon Musk escalated yesterday, the Bitcoin (BTC) market skilled a pointy shift in sentiment, with the funding fee on Binance flipping from constructive to destructive inside hours.

Bitcoin Funding Charges Flip Destructive On Binance

In keeping with a CryptoQuant Quicktake publish by contributor Darkfost, BTC funding charges on Binance have as soon as once more turned destructive, at the same time as the highest cryptocurrency continues to commerce above the $100,000 mark on the time of writing.

Associated Studying

The analyst attributed the sudden reversal in funding – from +0.003 to -0.004 – to the general public spat between Trump and Musk on social media. This fast shift displays rising worry amongst market contributors amid heightened uncertainty.

Following the sentiment shift, BTC fell from the mid-$100,000 vary to a low of $100,984, based on CoinGecko. Over the previous two weeks, the asset has declined by 4.1%.

That mentioned, the present dip could provide a major shopping for alternative to buyers. If Bitcoin rebounds strongly, it might lead to a powerful resurgence in shopping for strain, resulting in a brief squeeze that will propel BTC’s value additional up.

Darkfost highlighted that there have been three situations in the course of the present market cycle when BTC witnessed such deep destructive funding. Notably, every of those situations have been adopted by a powerful upward transfer within the cryptocurrency.

For instance, on October 16, 2023, BTC dipped into destructive funding territory earlier than rallying from $28,000 to $73,000. An analogous sample performed out on September 9, 2024, when the asset surged from $57,000 to $108,000.

The latest case was on Could 2, 2025, when BTC jumped from $97,000 to a brand new all-time excessive (ATH) of $111,000. If historical past repeats, then the market might even see a brand new ATH for BTC within the coming weeks. Darkfost famous:

Such excessive readings usually mark moments of most pessimism, exactly the type of sentiment that may precede a powerful bullish reversal when the quick time period negativity is gone.

Massive Traders Enhance BTC Publicity

In the meantime, Bitcoin whales – wallets holding massive quantities of BTC – proceed to build up at a fast tempo. Notably, new whales have acquired BTC value $63 billion, reflecting robust confidence within the asset’s near-term prospects.

Associated Studying

Supporting this bullish outlook, current evaluation by QCR Capital signifies that enormous buyers count on BTC to surge to as excessive as $130,000 by the top of Q3 2025. Moreover, the realized cap held by long-term holders has surpassed $20 billion, reinforcing constructive sentiment.

That mentioned, some analysts urge warning, anticipating BTC to crash beneath $100,000 earlier than resuming its bullish momentum. At press time, BTC trades at $104,069, down 0.5% previously 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com