Bitcoin is holding sturdy above the $110,000 stage after breaking its earlier all-time excessive on Wednesday, signaling the potential begin of a large bullish section. The breakout marks a major psychological and technical milestone, reigniting optimism throughout the crypto market. With bulls firmly in management, analysts are carefully watching value motion as BTC enters uncharted territory.

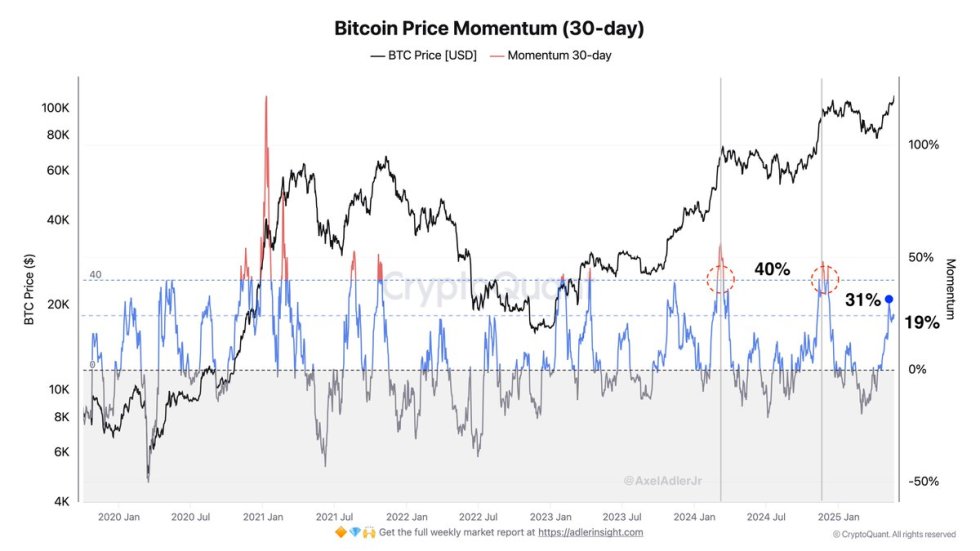

Nonetheless, regardless of the joy, the rally is displaying early indicators of cooling. Based on on-chain information from CryptoQuant, present momentum has slowed by 38% following the breakout, an anticipated technical cooldown after reaching new highs. Traditionally, Bitcoin usually consolidates or retraces shortly after breaching all-time excessive ranges, permitting the market to reset earlier than persevering with its upward pattern.

Nonetheless, the slowdown isn’t essentially a bearish sign. It could replicate wholesome market habits, giving contributors time to reposition and reinforcing the muse for a sustained transfer increased. So long as BTC holds above key assist ranges close to $105K, analysts stay assured within the broader bullish construction. Whether or not this consolidation results in an impulsive rally towards $120K or a short-term retrace stays to be seen, however one factor is obvious: Bitcoin is again in value discovery mode, and the subsequent transfer could possibly be decisive.

Bitcoin Faces Essential Check Amid Recession Fears

Bitcoin is coming into a pivotal section because it trades above the $110K stage, going through each macroeconomic headwinds and rising investor optimism. Whereas fears of an impending recession and tighter monetary circumstances proceed to dominate headlines, Bitcoin’s value motion tells a unique story—certainly one of power and resilience. In truth, BTC has steadily climbed increased regardless of rising bond yields, weakening fairness markets, and widespread uncertainty, highlighting its evolving position as a hedge towards conventional market instability.

Nonetheless, for this bullish narrative to carry, Bitcoin should decisively break above the $115,000 stage. Doing so would verify the beginning of a brand new impulsive leg upward and probably appeal to extra institutional capital because the asset enters full value discovery mode. Till then, BTC stays in a vital zone that might outline its pattern for the approaching weeks.

Based on high analyst Axel Adler, the present rally has naturally decelerated, with momentum slowing by 38% following the all-time excessive breakout. Adler explains this as a “technical cooldown,” a standard sample the place the market consolidates or pauses after reaching main milestones. This “breather” permits leveraged positions to unwind, liquidity to reset, and investor sentiment to stabilize earlier than a possible subsequent leg increased.

Regardless of macro issues, the value construction stays firmly bullish, and short-term consolidation could in the end strengthen the muse for an additional surge. If BTC can preserve present ranges and soak up overhead resistance, the trail towards $120K might come prior to anticipated. Till then, all eyes stay on Bitcoin’s habits on the $115K barrier—a vital mark that might outline whether or not this rally has extra gas or if a correction is due.

BTC Holds Above $111K: Momentum Slows After Breakout

The 4-hour chart for Bitcoin (BTC/USDT) reveals a powerful uptrend, with value at the moment consolidating round $111,000 after reaching a brand new all-time excessive at $111,356. Worth motion stays bullish, holding above the 34 EMA (inexperienced), 50 SMA (blue), and key assist ranges at $103,600 and $100,000. This construction signifies a wholesome continuation sample, the place BTC is taking a breather after an explosive rally from beneath $100K.

Quantity has tapered barely, supporting CryptoQuant’s perception that momentum has cooled by 38%—a standard pause after reaching new highs. Shifting averages are sharply upward-sloping, with the 200 SMA (pink) far beneath present value, reflecting sturdy bullish momentum and huge separation from longer-term traits.

The present consolidation zone resembles a flag or pennant formation, which generally precedes one other leg up if consumers step in with quantity. Nonetheless, merchants ought to monitor any sharp drop beneath $107K, which might sign fading momentum and enhance the danger of a correction towards the $103,600 assist.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.