Bitcoin is at a crossroads as market individuals develop more and more divided on its subsequent transfer. Bulls stay eager for a breakout above the all-time excessive (ATH) close to $112,000, whereas bears argue {that a} deeper correction is imminent. The present indecision is mirrored within the value motion, with BTC struggling to achieve traction after its latest pullback, and volatility climbing amid rising macroeconomic and geopolitical tensions.

Analysts agree {that a} decisive transfer is coming, and all eyes are on on-chain knowledge for clues. Based on CryptoQuant, since November 2024, centralized trade (CEX) reserves have dropped by 668,000 BTC—a powerful long-term bullish sign suggesting continued accumulation and lowered promoting strain. Nonetheless, whereas the decline in reserves is notable, it’s removed from signaling exhaustion.

This divergence between bullish and bearish narratives units the stage for a vital second in Bitcoin’s cycle. Whether or not a provide squeeze triggers the subsequent leg up or rising world uncertainty results in additional retracement, the approaching days will doubtless outline BTC’s short-term trajectory.

Bitcoin Holds Essential Assist As Uncertainty Rattles Sentiment

Bitcoin is at present buying and selling at a key juncture, holding above vital demand ranges however failing to substantiate a decisive breakout above the $112,000 all-time excessive. The asset has proven resilience after a 7% pullback, however a scarcity of sturdy momentum has left the market in a state of uncertainty. Analysts stay divided, with some anticipating a renewed bullish impulse whereas others warn of a bigger correction amid rising volatility.

The macroeconomic backdrop provides to the unease. The aggressive and unpredictable bond market continues to form world threat dynamics, with surging US Treasury yields signaling systemic stress that would ripple via crypto markets. Merchants have gotten extra cautious, and sentiment has shifted right into a extra defensive posture.

Nonetheless, on-chain knowledge gives a glimmer of long-term optimism. Based on prime analyst Axel Adler, centralized trade (CEX) reserves have fallen by 668,000 BTC since November 2024. This notable decline alerts lowered promoting strain and elevated confidence amongst long-term holders. Nonetheless, it’s untimely to declare reserves depleted. As of now, there are nonetheless 2,432,989 BTC obtainable throughout exchanges.

At present market costs, it will take over a quarter-trillion {dollars}—roughly $253.4 billion—to soak up that liquidity fully. This huge capital requirement means that whereas bullish alerts are rising, the market stays removed from a real provide squeeze. Till BTC reclaims $112,000 with conviction, traders ought to put together for additional consolidation and even deeper retests.

BTC Value Evaluation: Resistance Nonetheless Looms

Bitcoin is holding above a key help zone round $103,600 after bouncing off this degree earlier within the day. The 4-hour chart reveals BTC making an attempt a restoration, with short-term resistance now forming close to the 34-EMA ($105,720), which aligns carefully with the 50 and 100 SMA cluster. A break above this confluence may open the door to retest the $109,300 resistance—a degree that capped the earlier rally and triggered the present correction.

Quantity stays modest, suggesting a scarcity of sturdy conviction from bulls or bears. Nonetheless, the 200 SMA remains to be sloping upward and sits under present value motion, offering structural help close to $103,200.

If BTC fails to reclaim the $106K vary, additional consolidation is probably going, and a clear break under $103,600 may expose the market to deeper retracement towards $100K psychological ranges.

Bulls should clear $106K to regain short-term momentum, whereas bears can be eyeing a breakdown under $103.6K to achieve management. With macro volatility rising and on-chain knowledge displaying sturdy accumulation from giant holders, the subsequent few periods may provide extra readability on BTC’s short-term route.

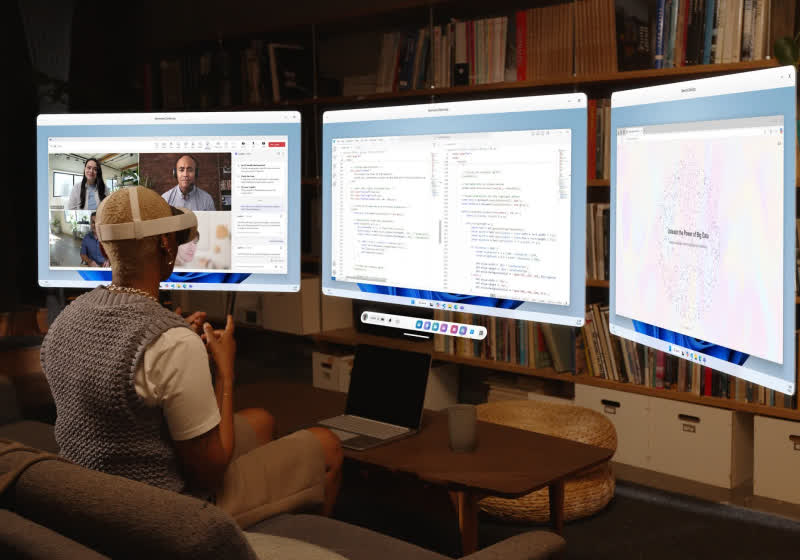

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.