“Startups were able to raise uncharacteristically sized rounds for their stage, commonly acquiring multiple years of runway pre-product, while over the course of the last six months, investors pivoted to underwriting fewer deals targeting higher conviction, more concentrated bets,” George told CoinDesk in a note. “During this period of time, investors began to re-evaluate their focus on what constitutes product market fit, realizing that large token incentive programs rewarding user participation creates distorted traction metrics and overlooks user stickiness.”

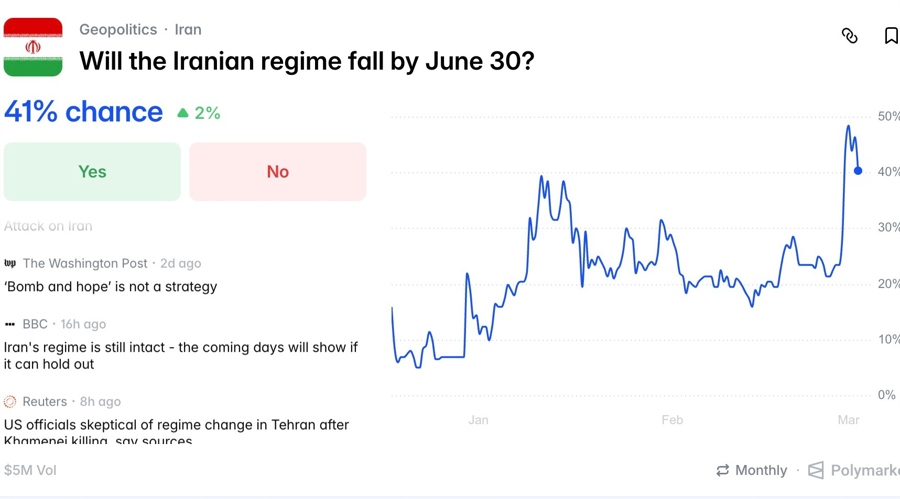

US Military Action Against Iran Exposes Split Between Polymarket and Kalshi Models

US and Israeli strikes on Iran over the weekend despatched shockwaves by prediction markets, exposing sharp operational contrasts as a...