Bitcoin has soared previous the $98,000 on Thursday, fueling intense debate amongst merchants over whether or not the $100K milestone is once more inside attain or if the present rally is susceptible to a swift correction. Behind the scenes, market observers level to surging open curiosity (OI) and elevated leverage, spotlighting the opportunity of a leverage-driven push.

Bitcoin Rally Or Lure?

CryptoQuant group analyst Maartunn (@JA_Maartun) warned of a “leverage pushed pump,” noting a $2.4B soar in Bitcoin’s OI inside 24 hours. By way of X, he wrote: “Leverage Pushed Pump: $2.4B (7.2%) enhance in Open Curiosity in Bitcoin over the previous 24 hours.”

Confirming these observations, well-known crypto commentator Byzantine Normal (@ByzGeneral) highlighted the numerous function of contemporary lengthy positions in propelling costs greater: “A lot of contemporary longs coming in right here on BTC which is shoving worth greater. Kinda humorous that the whole market is getting lifted proper now off the again of those degen longs right here.”

Analysts from alpha dojo (@alphadojo_net) echoed sentiments of warning, underscoring a notable hole between futures-based open curiosity and spot-driven purchases: “BTC continues to grind upwards, whereas the OI rises steadily, however there’s little spot shopping for. BTC is now approaching the higher finish of the vary once more. Evidently some market contributors have tried to frontrun Saylor‘s deliberate $2 billion bid.”

Although the prospect of a big purchase might propel the market, they warn that with out contemporary catalysts like a “short-term narrative or constructive information, it at present seems like BTC will wrestle to sustainably pump above the $100k mark.”

Famend crypto analyst Bob Loukas offered a cyclical framework for deciphering Bitcoin’s worth actions, noting that the market could also be approaching the top of 1 multi-week cycle and the beginning of one other: “We’re on verge of finishing a Bitcoin Weekly Cycle, as I’ve been sharing final 6 weeks. For context, there have been simply 5 weekly Cycles for the reason that 2022 bear market lows. (Avg 6month occasions). 4 of those cycles had 90-105% strikes. One did not do a lot (June-Sept 23).”

When requested if this indicators an imminent market high, Loukas clarified:“I’m saying we’re about to start a brand new one. Cycles all the time start from the lows.” His feedback counsel that whereas a cycle transition is imminent, it doesn’t essentially equate to a market peak—slightly, it might mark the beginning of a brand new uptrend.

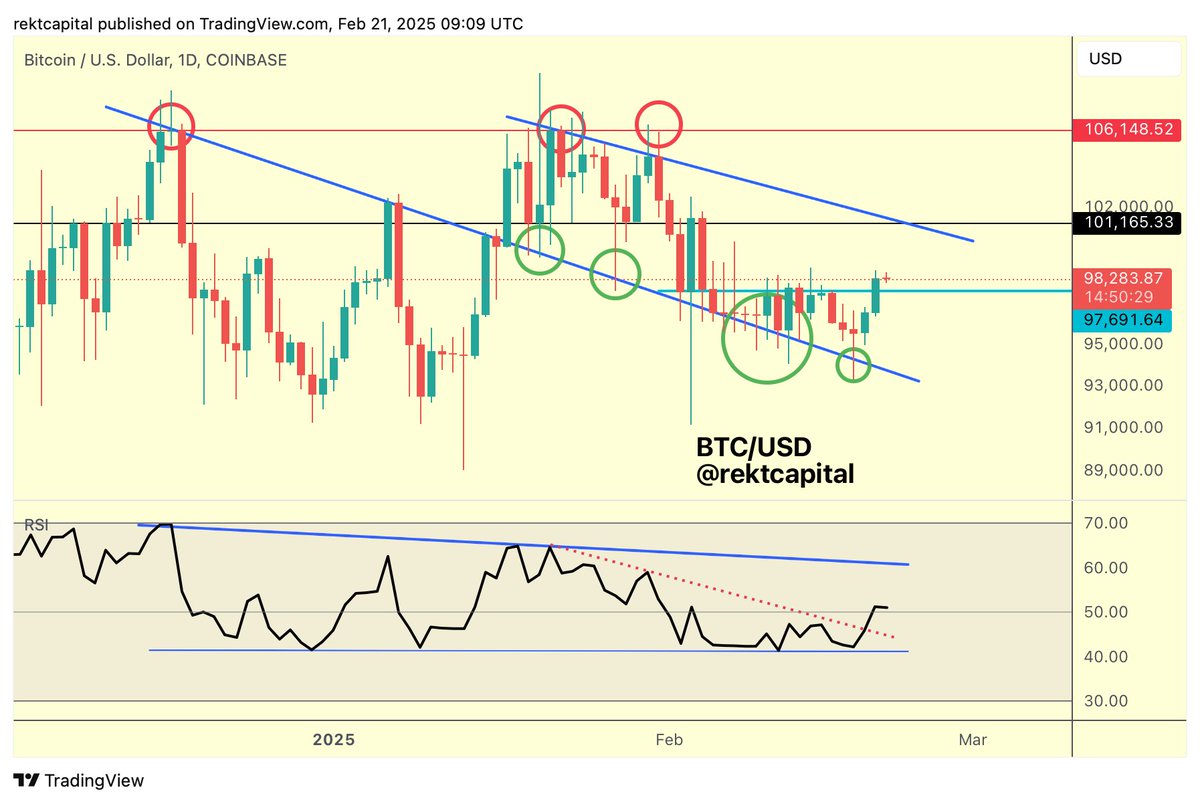

Technical analyst Rekt Capital (@rektcapital) emphasised the importance of Bitcoin’s every day shut above the $97,700 threshold, suggesting {that a} profitable retest of this zone might pave the best way for a transfer past $100,000: “The early-stage momentum generated by the Bullish Divergence has translated itself into this latest breakout transfer. And with the latest Day by day Shut above ~$97700, Bitcoin will now attempt to retest stated stage as assist to allow pattern continuation.”

He additional elaborated on Bitcoin’s relative energy index (RSI) channel, implying that the break above a sequence of decrease highs could sign the subsequent leg up: “Over time, Bitcoin’s worth continued to retest the blue trendline as assist. And the RSI continued to carry its Channel Backside. Recently, the RSI broke its sequence of Decrease Highs, indicating that the RSI could also be able to uptrend to the Channel Prime.”

Trying forward, a transparent retest of $97,700 as assist might verify Rekt Capital’s bullish outlook: “Day by day Shut above $97700 has been profitable (gentle blue). Any dips into $97700 would represent a retest try. A post-breakout retest of $97700 into new assist would totally verify the breakout to place BTC for a rally to $101k resistance.”

At press time, BTC traded at $98,645.