Key FactorsQuarterly-filed Kind 13Fs permit traders to trace the shopping for and promoting exercise of Wall Road’s main fund managers.

Fundsmith’s billionaire boss has been a decisive net-seller of shares, and he is sending a transparent message to Wall Road along with his actions.

Nevertheless, being a long-term optimist (like Terry Smith) has its statistical benefits.

- 10 shares we like higher than S&P 500 Index ›

Quarterly-filed Kind 13Fs permit traders to trace the shopping for and promoting exercise of Wall Road’s main fund managers.

Fundsmith’s billionaire boss has been a decisive net-seller of shares, and he is sending a transparent message to Wall Road along with his actions.

Nevertheless, being a long-term optimist (like Terry Smith) has its statistical benefits.

For greater than a century, Wall Road has served as a bona fide wealth creator. Although different asset courses have helped traders develop their nominal wealth, nothing has been in a position to match the common annual return of shares over prolonged intervals.

Nevertheless, this does not imply the broad-based S&P 500 (SNPINDEX: ^GSPC), ageless Dow Jones Industrial Common (DJINDICES: ^DJI), or innovation-fueled Nasdaq Composite (NASDAQINDEX: ^IXIC) transfer from Level A to B in an orderly vogue. Inventory market corrections, bear markets, and even crashes are regular, wholesome, and inevitable points of the inventory market cycle, and will be described as the worth of admission to this time-tested wealth creator.

The place to take a position $1,000 proper now? Our analyst workforce simply revealed what they imagine are the 10 greatest shares to purchase proper now. Proceed »

Berkshire Hathaway CEO Warren Buffett is arguably essentially the most well-known proponent of buy-and-hold investing. The appropriately named “Oracle of Omaha” has continuously cautioned traders to not wager in opposition to America.

However even the world’s savviest traders have their limits.

Picture supply: Getty Photographs.

Billionaire Terry Smith of Fundsmith, who’s generally known as “Britain’s Warren Buffett,” has been sending a transparent and unmistakable warning to Wall Road that traders can be good to not ignore.

Britain’s Warren Buffett has been a persistent internet vendor of shares

The rationale Smith, who’s overseeing $23 billion in property below administration, is known as “Britain’s Warren Buffett” is as a result of he and Berkshire’s billionaire boss share comparable funding beliefs. They’re each long-term traders at coronary heart, with a deeply rooted want to purchase stakes in high-quality/undervalued companies.

Although Buffett and Smith are good cookies who acknowledge the nonlinearity of inventory market cycles (i.e., that shares rise over lengthy intervals), their line-in-the-sand approaches relating to worth investing imply their short-term actions do not all the time align with their long-term resolve.

Due to required quarterly Kind 13F filings with the Securities and Alternate Fee, traders have the flexibility to trace the shopping for and promoting exercise of Wall Road’s smartest cash managers — and Terry Smith is close to the highest of the listing.

Fundsmith’s 13Fs have despatched an unmistakable warning to traders over the past yr. Though seven new shares have been launched and 5 current holdings added to, Fundsmith’s billionaire boss lowered his place in 23 current holdings and jettisoned eight others from July 1, 2024, by way of June 30, 2025.

This promoting exercise has been particularly pronounced in Fundsmith’s two largest holdings, Meta Platforms and Microsoft, which have been lowered by 27% and 31%, respectively, over the trailing yr (ended June 30).

This promoting exercise sends a transparent message: worth is troublesome to come back by amid a traditionally expensive inventory market.

That is the third priciest inventory market spanning 150 years

Fact be advised, “worth” is within the eye of the beholder. A inventory that you simply really feel is dear is perhaps considered as a cut price by one other investor. This lack of a one-size-fits-all blueprint relating to recognizing worth is what makes Wall Road so unpredictable.

Nevertheless, historical past paints a special image that leaves nearly no margin for error.

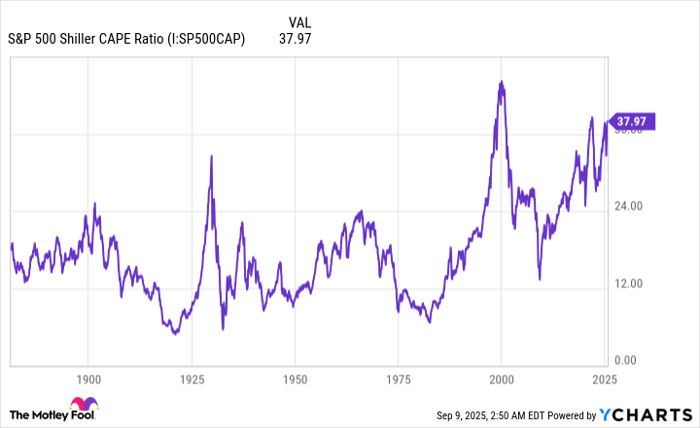

S&P 500 Shiller CAPE Ratio information by YCharts. CAPE Ratio = cyclically adjusted price-to-earnings Ratio.

The valuation measure that is elevating eyebrows and making historical past is the S&P 500’s Shiller price-to-earnings (P/E) Ratio, which can be generally known as the cyclically adjusted P/E Ratio, or CAPE Ratio. It is a valuation instrument primarily based on common inflation-adjusted earnings over the earlier 10 years, which suggests short-term shock occasions will not skew its studying.

When back-tested to January 1871, the Shiller P/E has averaged a a number of of 17.28. As of the closing bell on Sept. 8, the S&P 500’s Shiller P/E a number of had topped 39, which marks its third-priciest studying throughout a steady bull market in 154 years.

The concern is that historical past reveals premium valuations aren’t sustainable over prolonged intervals. Since 1871, the Shiller P/E has surpassed a a number of of 30 and held this degree for a minimum of two months on six events, together with the current. Following the 5 prior occurrences, the S&P 500, Dow Jones Industrial Common, and/or Nasdaq Composite misplaced a minimum of 20% of their worth, if not significantly extra.

Billionaire Terry Smith is probably going additionally conscious of the historic context of next-big-thing improvements pushing the broader market right into a bubble. Although synthetic intelligence (AI) is the most well liked factor since sliced bread, and AI shares like Meta and Microsoft have performed a giant position in lifting the tide for Wall Road’s main inventory indexes, each game-changing technological innovation for 3 a long time has endured an eventual bubble-bursting occasion.

Whereas the Shiller P/E Ratio is not a timing instrument and might’t concretely assure what’s to come back, historic precedent — and Terry Smith’s buying and selling exercise — clarify that vital eventual draw back is anticipated for shares.

Picture supply: Getty Photographs.

There’s one other facet to this story

Though historical past does not mince phrases of what is to be anticipated, this solely tells a part of the story.

Regardless of Britain’s Warren Buffett being a net-seller of equities over the past yr, he is continued to carry onto Fundsmith’s core positions. The rationale? The aforementioned nonlinearity of inventory market cycles.

On one hand, inventory market corrections are an inevitability of investing on Wall Road. However the pendulum swings disproportionately towards intervals of progress, and billionaire cash managers like Terry Smith understand it.

In June 2023, the researchers at Bespoke Funding Group printed an information set on X (previously Twitter) that calculated the calendar-day size of each S&P 500 bull and bear market courting again to the beginning of the Nice Despair in September 1929. Bespoke confirmed that the common S&P 500 bear market endured solely 286 calendar days, or roughly 9.5 months.

Compared, the everyday S&P 500 bull market caught round for 1,011 calendar days, or roughly 3.5 instances longer than the common downturn over a virtually 94-year stretch. Statistically, it is sensible to wager on Wall Road’s most influential companies to extend in worth over time, which is exactly what Terry Smith has been doing since Fundsmith’s founding in 2010.

Whereas Terry Smith’s warning to Wall Road over the quick run is plain, the inventory market’s basis, and its potential to ship superior long-term returns when in comparison with different asset courses, stays rock stable.

Do you have to make investments $1,000 in S&P 500 Index proper now?

Before you purchase inventory in S&P 500 Index, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and S&P 500 Index wasn’t one among them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Netflix made this listing on December 17, 2004… for those who invested $1,000 on the time of our suggestion, you’d have $681,260!* Or when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $1,046,676!*

Now, it’s value noting Inventory Advisor’s complete common return is 1,066% — a market-crushing outperformance in comparison with 186% for the S&P 500. Don’t miss out on the newest high 10 listing, out there whenever you be a part of Inventory Advisor.

See the ten shares »

*Inventory Advisor returns as of September 8, 2025

Sean Williams has positions in Meta Platforms. The Motley Idiot has positions in and recommends Berkshire Hathaway, Meta Platforms, and Microsoft. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.