Carl Court

Thesis

Bilibili Inc. (NASDAQ:BILI) has surged by approximately 57% since the company reported stronger-than-expected Q3 results, together with an upbeat guidance. But despite the recent valuation expansion, Bilibili stock is still down close to 90% from its all-time highs. And in my opinion, BILI stock is trading cheap versus the company’s business potential.

On the backdrop of Bilibili’s strong September quarter, and management commentary hinting on an increased focus on profitability, I raise my EPS expectations for Bilibili through 2025. I now calculate a base case price-target of $38.12/share.

For reference, Bilibili’s YTD performance gap versus the S&P 500 (SPY) remains considerable: BILI being down 55% as compared to a loss of “only” 15% for the SPY.

Seeking Alpha

Bilibili’s Q3 Results

Strong Business Expansion & Engagement

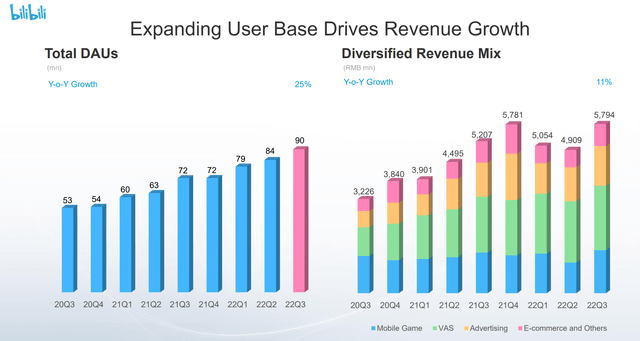

During the period from July to end of September, Bilibili generated total revenues of $814.5 million, which compares to about $734 million for the same period one year earlier (11% year-over-year increase) and to approximately $790 million as estimated by analyst consensus ($25 million beat).

Notably, as compared to Q3 2021, all of Bilibili’s monetization pillars recorded an expansion (emphasis added):

- Revenues from mobile games were RMB1.5 billion (US$206.8 million), representing an increase of 6% from the same period of 2021.

- Revenues from VAS were RMB2.2 billion (US$310.6 million), representing an increase of 16% from the same period of 2021.

- Revenues from advertising were RMB1.4 billion (US$190.5 million), representing an increase of 16% from the same period of 2021.

- Revenues from e-commerce and others were RMB757.8 million (US$106.5 million), representing an increase of 3% from the same period of 2021.

In general, I think it is fair to claim that Bilibili’s increase in revenue was more supported by a strong growth in user base than by a push for higher user monetization. By end of September 2022, Bilibili’s monthly active users (“MAU”) increased to 332.6 million, a 25% jump as compared to the same period in 2021. DAU reached 90.3 million, a 25% increase respectively. The paying MAU was recorded at 28.5 million (19% year-over-year growth).

Bilibili Q3 2022 Results

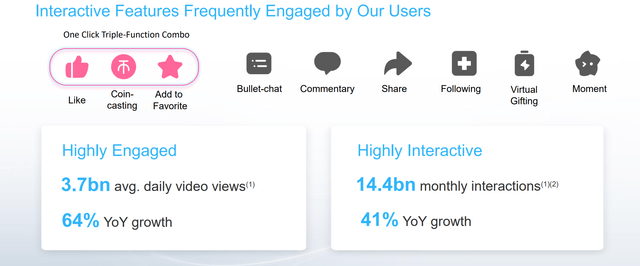

Bilibili’s user engagement continues to be very strong: in Q3 2022, the average daily time spent per user on the platform was 83 minutes. In addition, average daily video views increased 64% year-over-year, to 3.7 billion.

Bilibili Q3 2022 Results

Profitability Remains In The Red

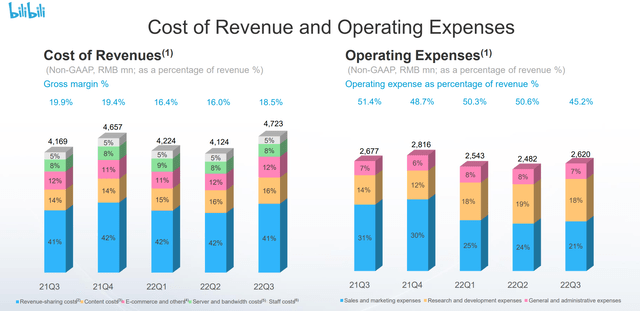

During Q3 2022, Bilibili recorded gross profit of $148.2 million, which represents a year-over-year increase of only 4% versus the same period in 2021. And although Bilibili’s operating expenses contracted to 45.2% (versus 51.4% in Q3 2021), the platform business remains loss making – net loss for the period was $241.2 million (narrowed 36% versus Q3 2021).

Bilibili Q3 2022 Results

Expect Profitability Upside

However, there are two arguments that might add to investors comfort:

First, Bilibili’s balance sheet remains strong, resilient enough to absorb some losses. As of late September 2022, the company had $3,365 million of cash and cash equivalents and a net cash position of $659 million.

Second, in the upcoming few quarters Bilibili might realize considerable upside to profitability, as higher user monetization and cost optimization start to become a priority. Mr. Rui Chen, Bilibili’s CEO and chairman, commented (emphasis added):

In the third quarter, we took steps to shore-up our business foundation and narrow our losses, while continuing to provide users with the products and services they love

… Users remained highly engaged and the average daily time spent on Bilibili reached a 96-minute record high. While our community remains key to our long-term success, we believe it is essential to stay adaptive to the increasingly challenging macro environment.

… Putting profitability first, we will take additional initiatives to accelerate our monetization and implement cost containment measures including rationalizing headcount planning and cutting sales and marketing expenses, with our goal set to improve our margins and narrow our losses.

Valuation: Update Target Price

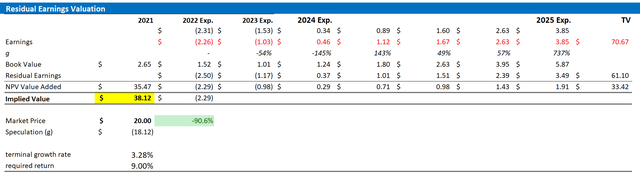

Following a strong Q3 report, I update my residual earnings model for BILI to account for EPS upgrades through 2025.

In line with my previous base-case assessment, I continue to anchor on an 9% cost of equity and a 3.28% terminal growth rate (approximately one percentage point higher than estimated nominal global GDP growth).

Given the EPS upgrades as highlighted below, I now calculate a fair implied share price of $38.12 versus $33.07 prior.

Author’s EPS Estimates, Author’s Calculations

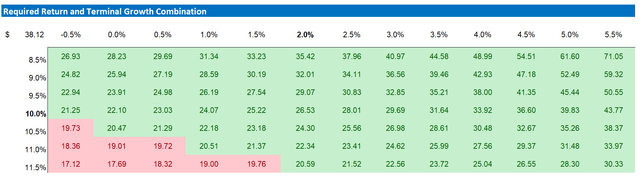

Here is the updated sensitivity table.

Author’s EPS Estimates, Author’s Calculations

Risks

Given that there has been no major risk-increase since I have last covered BILI stock (In fact, some risk factors appear to have softened), I would like to highlight what I have written before.

First, the video streaming industry in China is highly competitive (Douyin, Kuaishou, iQiyi, etc.) and, in theory, the streaming industry exhibits the features of an industry that is governed by the winner-takes-it-all principle. Although Bilibili records the highest user-engagement amongst the platforms, and the highest growth rates, I am not confident in my ability to pick a winner at this point.

Second, as we all know, China has pushed a stricter regulatory environment for tech / internet companies in 2021. Bilibili was no exception: The bad news began when state media publicly criticizing Bili for allowing vulgar content on the site. Then Bili suffered from restrictions and regulations around the gaming industry. Needless to say, the market is still spooked by these developments and investors should expect considerable volatility in Bili’s stock price until uncertainties are resolved – if ever.

A third risk is given by continued pressure coming from a potential ADR delisting. While investors have appreciated some positive headlines as China and US regulators seem to move towards an agreement, the risk of a potential delisting adds to the overall uncertainty surrounding an investment in Bili. For reference, Bilibili shares are also listed on the Hong Kong Stock Exchange under the ticker symbol HKG: 9626.

Conclusion

Bilibili stock is up sharply since the company reported stronger-than-expected Q3 results. But in my opinion, the rally has further to go: I am confident in believing that as Bilibili is slowly closing in on impressive scale (CEO’s milestone of 400 million MAU likely to be reached in 2023/ early 2024), content library expansion, and user engagement, a focus on profitability could sustain further price appreciation.

On the backdrop of Bilibili’s strong September quarter, and management commentary hinting on an increased focus on profitability, I raise my EPS expectations for Bilibili through 2025 – and I now calculate a base case price-target of $38.12/share. Reiterate “Buy” rating for Bilibili Inc.