Yves right here. A lot of you have got learn David Graeber’s Debt: The First 5000 Years. This text doesn’t try to present such a broad look, however as an alternative focuses on the interval simply earlier than trendy banking began getting its headway, as calls for for credit score elevated as a result of rise of the bourgeoisie and the rise in commerce. But these casual preparations served usually to finance borrowing for emergencies and common seasonal wants.

Maybe I’ve a biased pattern, however fairly just a few of the instances I do know of individuals lending to assist a relative or pal out have produced squabbles and even broken the connection. However the writer stresses the shift from earlier casual and adaptive remedies of borrowing to the inflexible phrases in credit score devices, and the disadvantages they produce.

Nonetheless, the writer oddly doesn’t acknowledge right here (maybe she does in her e-book) that this bespoke, extremely private lending doesn’t scale. This was confirmed within the wake of the monetary disaster, when default servicers, aka fight servicers, have been set as much as modify defaulted mortgage, which is a case-by-case exercise. It was nicely acknowledged that that these firms becaem unhealthy at their job after they obtained to be too massive, which IIRC was over 400 workers.

By Elise Dermineur, Affiliate Professor of Financial Historical past Stockholm College. Initially printed at VoxEU

The worldwide monetary disaster of 2008 has led economists, historians, and policymakers alike to re-examine the foundations of our monetary infrastructure. This column revisits the world of credit score earlier than the rise of contemporary banking to attract insights for up to date reform. Drawing on historic analysis from early trendy Europe, it reveals that communities lengthy relied on deeply embedded, interpersonal credit score methods grounded in belief, reciprocity, and adaptability. These casual networks, whereas imperfect, have been usually extra adaptive and inclusive than present fashions. This historic perspective invitations us to think about credit score methods which can be extra humane, responsive, and socially embedded.

The worldwide monetary disaster of 2008 raised profound questions concerning the resilience, equity, and sustainability of contemporary banking methods. As thousands and thousands misplaced their houses and livelihoods within the wake of economic collapse, the pitfalls of institutional finance turned strikingly clear (Tooze 2018). This second of rupture has led economists, historians, and policymakers alike to re-examine the foundations of our monetary infrastructure. Among the many extra intriguing paths of inquiry is the query: what existed earlier than banks? How did people and communities handle credit score within the absence of formal monetary establishments? And may these historic preparations supply beneficial classes for right now? In a brand new e-book, I try and reply these questions (Dermineur 2025).

The Ubiquity of Embedded Credit score

Lengthy earlier than the emergence of contemporary banking, credit score was a significant facet of financial life. In early trendy Europe, borrowing and lending occurred frequently, not only for funding or commerce but in addition for survival. Households relied on credit score to handle seasonal shortages, address emergencies, purchase land or livestock, and fulfil tax obligations. Importantly, a lot of the capital allotted was not supplied by establishments however by means of interpersonal networks inside native communities. These preparations have been characterised by sturdy social norms which allow monitoring and enforcement mechanisms.

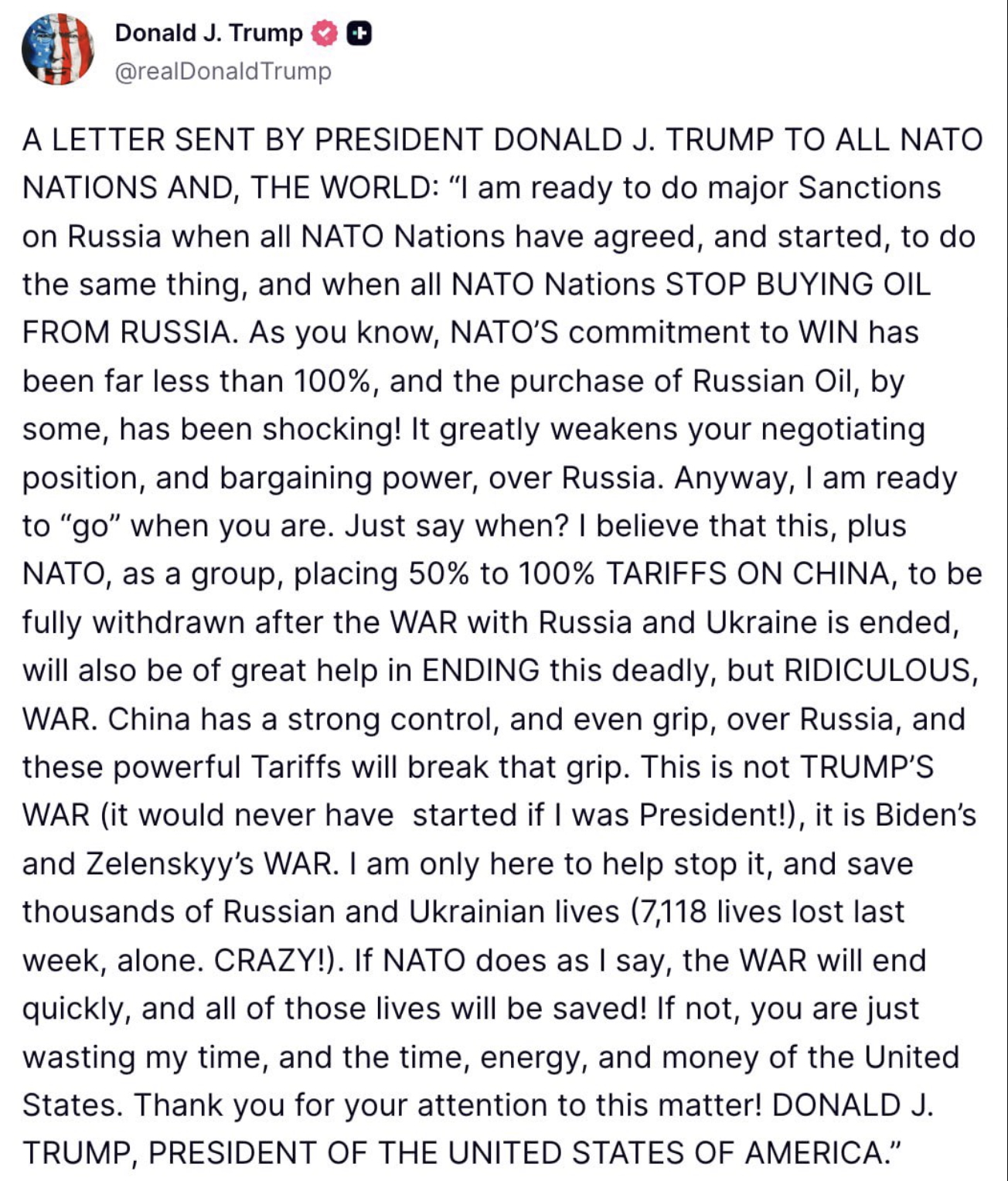

Determine 1 Non-intermediated credit score transactions within the seigneurie of Florimont, 1780-85

Notice: Based mostly on probate inventories of the seigneurie of Florimont, 1780-85. Nodes are coloured based on the place of residence and weighted based on the out-degree. Non-intermediated transactions have been credit score exchanges agreed upon between non-public people with out institutional intermediation.

Supply: Dermineur (2025)

One of the crucial putting options of those pre-banking credit score methods was thus their embeddedness in social relations. Monetary transactions weren’t remoted occasions however a part of ongoing relationships formed by mutual expectations, reciprocity, and group norms. The flexibility to entry credit score usually depended extra on one’s standing throughout the group than on formal monetary {qualifications}. A great fame, a historical past of reciprocity, and shared kinship or neighbourly ties mattered very a lot. Such embededness forces us to ask if such credit score markets have been in reality markets in any respect.

Flexibility and Different-Relating to Norms

Loans have been organized with or with out formal contracts. They have been usually, at first, verbal agreements or usually solely recorded informally, in family account books or on non-public notes. Phrases various broadly relying on the wants and circumstances of the events concerned. Curiosity was usually repaid in sort when money was not accessible. Crucially, reimbursement schedules might be adjusted in response to altering circumstances. If a borrower suffered a failed harvest or sickness, lenders may lengthen deadlines or cut back obligations. This flexibility helped preserve social cohesion and decreased the chance of financial exclusion.

Such adaptability stands in stark distinction to the rigidity of many trendy monetary devices. Modern credit score methods are closely formalised, with standardised contracts, solely marginally negotiable rates of interest, and strict enforcement mechanisms. Whereas these options present readability and predictability, they’ll additionally produce inflexibility, particularly in periods of financial misery. The foreclosures disaster of 2008 is a working example, when thousands and thousands of households have been unable to renegotiate phrases and have been compelled into default.

Historic analysis reveals that the transition from casual, socially embedded credit score to formal, institutional finance was gradual. By the late 18th and early nineteenth centuries, the growth of economic and industrial actions, urbanisation, and state fiscal capability contributed to the expansion of banking establishments. This shift introduced new efficiencies and scale to monetary markets, but in addition marked a departure from the private and relational facets of earlier methods. As finance turned extra nameless and standardised, it additionally turned extra extractive and fewer attentive to particular person circumstances.

That doesn’t imply premodern methods have been perfect or free from inequality. Entry to credit score was nonetheless formed by hierarchies of gender, class, and standing. Wealthier people and households had better capability to lend and have been extra prone to have their money owed honoured. Nonetheless, the presence of community-based lending practices created alternatives for monetary inclusion that have been usually extra accessible than institutional credit score within the early phases of contemporary banking.

The World We Have Misplaced

The evolution of economic methods thus concerned a trade-off: the effectivity and scale of formal establishments got here at the price of social embeddedness and adaptability. Revisiting premodern credit score practices permits us to replicate on what was misplaced in that transition and what may be reclaimed. Particularly, the ideas of belief, reciprocity, and negotiated obligation counsel an alternate strategy to credit score that’s extra adaptive and probably extra equitable. As a working example, premodern practices proceed to persist in creating economies (Svetiev et al. 2022, Dermineur 2023).

Lately, there was a resurgence of curiosity in peer-to-peer lending and group finance. These initiatives, usually facilitated by digital platforms, try and reintroduce parts of interpersonal belief and native accountability into monetary transactions (Rodima-Taylor 2022). Whereas they differ in some ways from historic practices, their try and mimic these practices usually failed as a result of exactly of the dearth of embededness.

Furthermore, the continued challenges of economic exclusion, family debt, and credit score insecurity level to the restrictions of ‘one measurement matches all’ options (Wherry et al. 2019). Low-income households, gig economic system employees, and people with non-traditional revenue sources usually wrestle to entry credit score beneath present fashions. Historic precedents remind us that credit score methods might be designed to accommodate variability and reply to lived realities.

Wanting Forward

Coverage discussions round monetary reform continuously concentrate on regulation, transparency, and market stability. These are, after all, important. However equally essential is the normative query: what ought to monetary methods purpose to realize? If the aim is to assist financial resilience, social inclusion, and long-term well-being, then we could have to broaden our framework past institutional effectivity. Seeking to the previous, we see that monetary preparations might be embedded in ethics of care and group duty – not simply contracts and danger administration.

The premodern instance additionally invitations reflection on the ethical dimensions of debt. In the present day, debt is commonly framed in transactional phrases: a proper obligation that have to be fulfilled no matter context. In earlier societies, debt was understood extra dynamically (Goodhart and Hudson 2018). It was an obligation, sure, however one located inside an online of social relations. Forgiveness, delay, and renegotiation weren’t indicators of ethical failure however of mutual recognition (Hudson and Goodhart 2018). This attitude can inform present debates on scholar debt, medical debt, and chapter reform, the place inflexible enforcement usually clashes with social realities.

In the end, the aim of finding out historic credit score methods is to not romanticize the previous or to suggest a chimeric return to pre-banking fashions. Slightly, it’s to develop our creativeness about what monetary methods might be. By analyzing how societies managed credit score with out banks, we are able to think about different ideas and practices that may complement trendy finance.

In sum, the historical past of credit score earlier than banks reveals a world the place finance was deeply embedded into the material of on a regular basis life. It functioned not simply as an financial instrument however as a social follow. As we confront ongoing challenges in up to date finance – from inequality to instability – this historic perspective provides a beneficial useful resource. It encourages us to ask not solely how finance works, however for whom and to what finish. A extra inclusive, resilient, and humane monetary system could nicely require us to study from the previous as we glance to the longer term.

See authentic publish for references