Darren415

This article was first released to Systematic Income subscribers and free trials on Jan. 14.

Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the second week of January.

Be sure to check out our other Weeklies – covering the Closed-End Fund (“CEF”) as well as the preferreds/baby bond markets for perspectives across the broader income space. Also, have a look at our primer of the BDC sector, with a focus on how it compares to credit CEFs.

Market Action

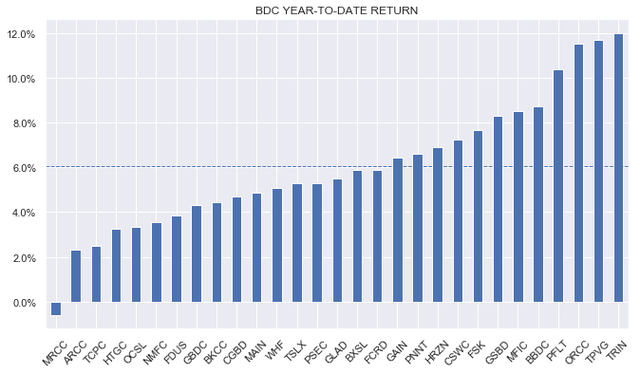

BDCs had another strong week with all but one name in our coverage finishing in the green. Year-to-date, the average total return is 6%, led by strong reversals in a pair of venture-debt focused names TPVG and TRIN, which bounced off depressed valuations at the end of the year.

Systematic Income

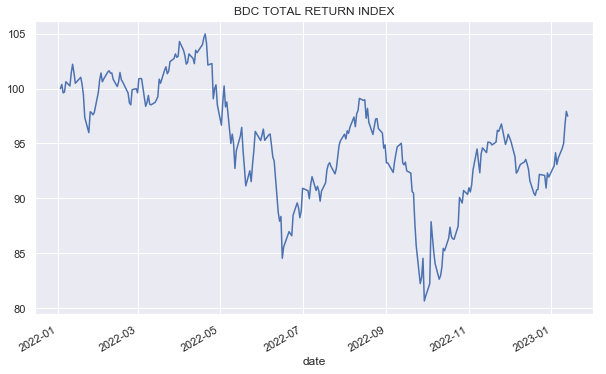

This most recent rally takes the BDC universe to within 2% of their starting point in early 2022 – a great result for the sector and BDC investors. NAV resilience, a low default rate environment and rising net incomes have supported BDCs over the past year.

Systematic Income

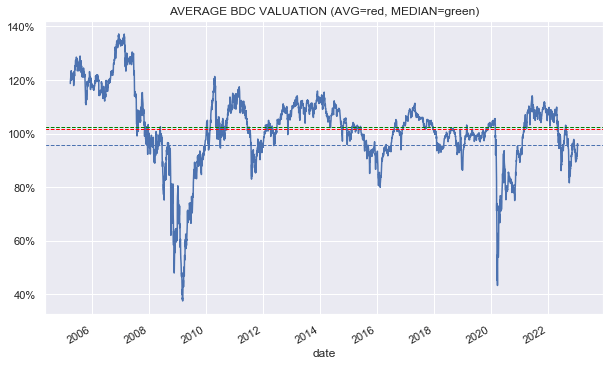

The average BDC valuation is approaching 100% (it’s at 96% at the moment). It’s quite likely that we will see another quarter of modest NAV falls which could raise the average valuation towards around 97% – a level that looks on the expensive side to us, being close to the longer-term historic average. This is in the context of a difficult macro environment which leaves little margin of safety in case of a further slowdown in corporate earnings.

Systematic Income

Market Themes

One of the ways that lenders manage the risk of their loans is to accept collateral in exchange for cash. However, as many investors realize, not all collateral is the same.

One issue that lenders try to minimize or avoid when looking at collateral is, what is called, wrong-way risk. Wrong-way risk exists if there is a high relationship between the value of the collateral and the creditworthiness of the borrower.

The best way to explain this is to use intuition. For instance, an example of wrong-way risk would be to lend to a particular CEO against the shares of the company they head up. This could be a problem because if something bad happens to the company (which is likely to reduce the value of the collateral), the CEO would also very likely be in a worse financial position otherwise (i.e. they could lose their job, their stock options / stock holding would be worth much less etc.)

Another example is to lend to, say, a Greek Bank against Greek government bonds. We could easily have a scenario where the Greek economy crumbles (i.e. the price of the Greek government bonds that serve as collateral goes down) which is also likely to cause the bank a lot of difficulties, making it less creditworthy.

One example of recent wrong-way risk in the BDC space was to lend to Bitcoin miners against their mining equipment. In theory, Bitcoin mining equipment is a hunk of computer hardware that should be able to retain its value whatever happens to Bitcoin. In practice, its value is tightly linked to the value of Bitcoin itself and, ultimately, to the mining companies themselves. The higher the value of Bitcoin, the more Bitcoin mining equipment is in demand and the better the outlook for Bitcoin mining companies. And vice-versa, the lower the price of Bitcoin, the worse the outlook for Bitcoin mining companies and the less value there is in the very specialized Bitcoin mining equipment. In short, the creditworthiness of the companies and the value of the collateral is very tightly linked, making the mining equipment collateral much less useful.

In 2022 Bitcoin more than halved in value while electricity prices surged. This combination made Bitcoin mining unprofitable and flooded the market with cheap equipment from miners who no longer needed it. Many machines lost 80% of their value, according to the WSJ.

This development made many loans secured by Bitcoin mining equipment, in effect, nearly unsecured while also bankrupting some Bitcoin mining companies. For example, one of the largest US-listed miners Core Scientific filed for bankruptcy recently. Other miners trade at deeply depressed prices, indicating a struggling business model.

The BDC Trinity Capital (TRIN) was caught out by this development, having around 15% of its NAV in loans to miners, including Core Scientific, collateralized by Bitcoin mining equipment.

Some measure of wrong-way risk is always present (a long-lasting global recession would not only wipe out many businesses but also depress the value of nearly all kinds of collateral). What’s important is to avoid a situation where there is very tight coupling between the business of the borrower and the nature of the collateral. In this case, TRIN clearly misjudged the level of this coupling as well as a reasonable worst-case scenario for the value of the mining equipment. Hopefully, a lesson learned.

Market Commentary

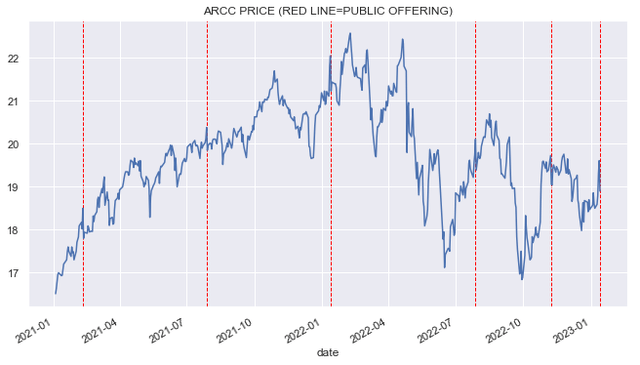

Ares Capital (ARCC) has announced another public offering for 9m (+1.4m greenshoe) shares at a price 4% below the previous close. The offering price is above the expected Q4 NAV so it will be accretive. ARCC is a frequent issuer of additional equity which makes sense as it tends to trade at a premium to NAV. The price drops due to the offering discount are usually retraced in short order and this is what we expect this time around as well.

Systematic Income

Trinity Capital (TRIN) issued a press release highlighting a large amount of commitments originated over Q4 at $240m. Commitment numbers can often be ignored because they are not the same as investments. Actual funded investments were about half at $121m. Net of repayments, portfolio growth was a more modest $66m.

Earlier, TRIN announced a JV with another small credit manager comprising $171m of capital ($21m from TRIN). Many BDCs use JVs – they can be a way to further leverage the BDC’s portfolio.

Stance and Takeaways

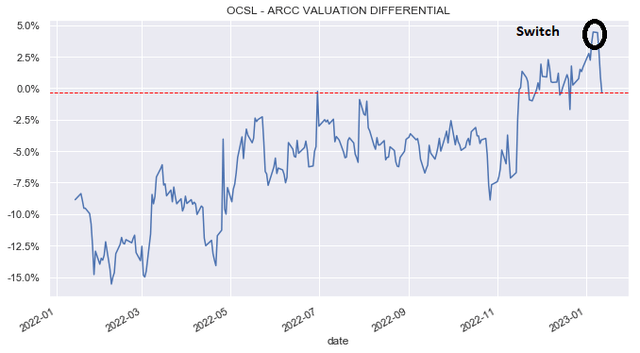

This week we made a switch from (OCSL) to (ARCC) in our Core Income and High Income Portfolios. At the time of the rotation OCSL was trading at a historically high valuation vs. ARCC – a nearly 5% higher premium (105% for OCSL vs 100% for ARCC).

Systematic Income

This elevated premium for OCSL looked expensive on a couple of fronts relative to ARCC. First, ARCC has significantly higher historic total NAV returns than OCSL. Second, ARCC has a much higher net income beta to rising short-term rates, owing to its higher proportion of fixed-rate debt. ARCC also boasts a more diversified portfolio than OCSL and a longer-term track record which can give investors more confidence in its forward performance. A potential risk is that ARCC has a lower first-lien allocation, though it has to be said that this hasn’t prevented the company from maintaining a low level of non-accruals and running with net realized gains over time.