Banco Bilbao Vizcaya Argentaria, S.A. (NYSE:BBVA) is a monetary establishment with extreme publicity to prices, a profile that was pretty good by means of the rising price of curiosity environment between 2023-24, nonetheless as monetary protection modified pretty shortly, every in Europe and in Mexico, which might be its two largest markets, I modified my view on BBVA to bearish some months up to now.

Moreover, the monetary establishment has launched a hostile takeover provide to buy its competitor Banco de Sabadell (OTCPK:BNDSY) in an all-share deal, which may dilute current shareholders and has been a headwind for BBVA’s share worth in present months.

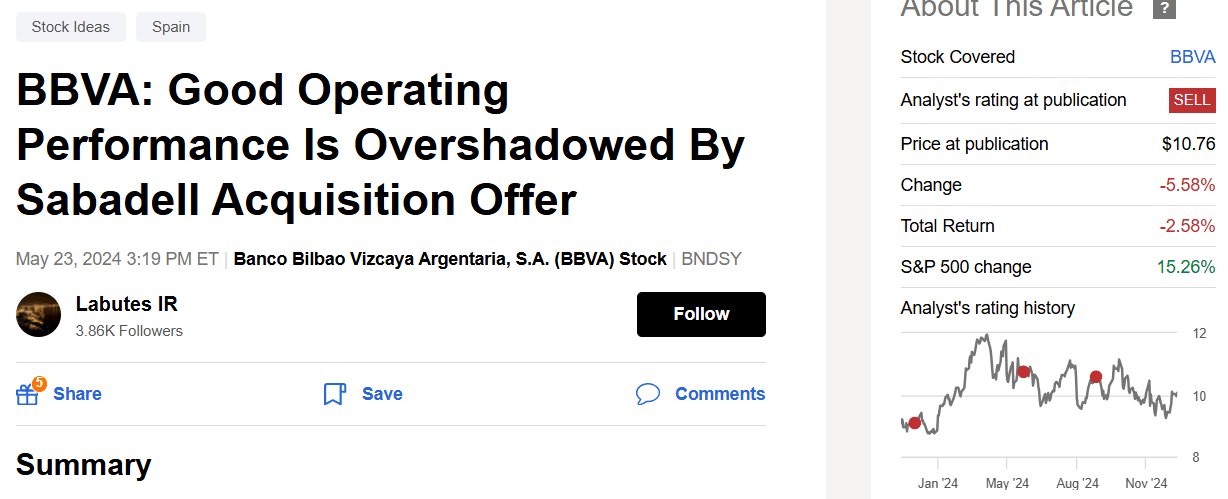

Actually, given that launch of its provide, BBVA’s share worth has traded type of sideways and has underperformed the market by a giant margin, as confirmed throughout the subsequent graph.

Further currently, the Spanish rivals authority has moved the analysis of this potential deal into an prolonged consider, which suggests it desires further investigation regarding the have an effect on of lower rivals throughout the Spanish banking market, and has moreover raised some points about market focus in some specific areas. Banco Sabadell is a monetary establishment with a sturdy presence in Catalunya and Valencia areas, particularly throughout the SME section, elevating some points about BBVA turning into too large and leading to lower choices for banking prospects.

This means it’s unsure BBVA shall be succesful to get regulatory approval for this acquisition, as a result of the rivals authority is anticipated to take some months to guage further in depth this potential combination, being a headwind for BBVA’s share worth for some further time. Furthermore, even when BBVA will get regulatory approval, it desires on the very least higher than half of Sabadell’s shareholders to approve the deal, which will also be unsure it ought to happen. This moreover raises the hazard that BBVA would possibly in the end elevate its provide and overpay to amass Sabadell, which could most definitely not be successfully acquired

Supply hyperlink