ipopba

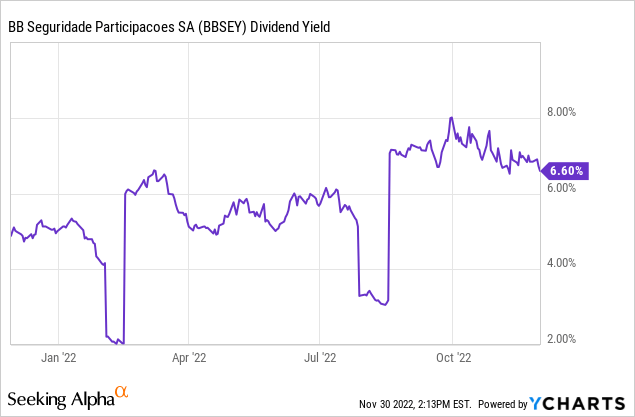

Having delivered another strong print this quarter, the setup looks good heading into Brazil-based insurer BB Seguridade’s (OTCPK:BBSEY) FY23 results. With management even providing some early FY23 guidance, citing that the Q3 earnings could be extrapolated into next year, the company appears to be on track for an annualized bottom line of >R$6.5bn (implying low-teens % YoY growth). Given the premium insurance product suite and industry-leading distribution network remain intact, BB Seguridade should be able to deliver high ROEs and dividend yields through the cycles as well. In the meantime, the La Niña impact is the key near-term risk to further normalization of rural losses, although lower COVID-related claims and a higher Selic rate present offsetting tailwinds to the insurance results. In addition to its defensive characteristics, the stock trades at an undemanding fwd P/E and pays an attractive high-single-digit % dividend yield.

Positive Q3 Results Across the Board

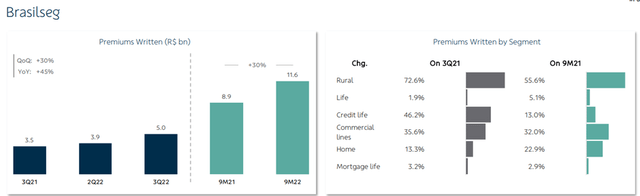

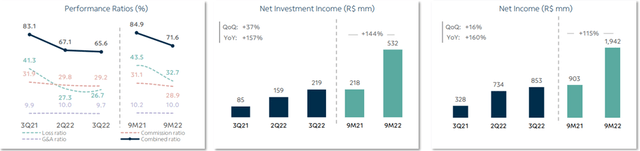

BB Seguridade ended Q3 strongly, even relative to what the September data had indicated (per filings with the insurance regulator SUSEP). BrasilSeg, the insurance arm, was the key highlight, with strong written premiums growth of +45% YoY, driving a +160% YoY increase in earnings. The outperformance was led by rural at +73%, followed by credit life at +46% and life at +2%. In particular, the size of the rebound in credit life premiums was a surprise, highlighting the traction of BB Seguridade’s new products, which target the INSS payroll (i.e., social security) and Pronampe portfolios (i.e., an SME support program in Brazil).

BB Seguridade

Despite the outsized growth, the company also kept its loss ratio in check – at ~27% for its latest quarter, the ratio was well below the ~41% in the prior year. It is also in line with the >20% target outlined post-COVID, supported by broad-based improvement across segments. Elsewhere, the increased rural contribution was an interesting development, now reaching >50% of underwriting income. Also helping earnings was the decline in financial expenses, with ‘pending claims’ significantly down to R$5m (vs. R$42m in Q2 2022).

BB Seguridade

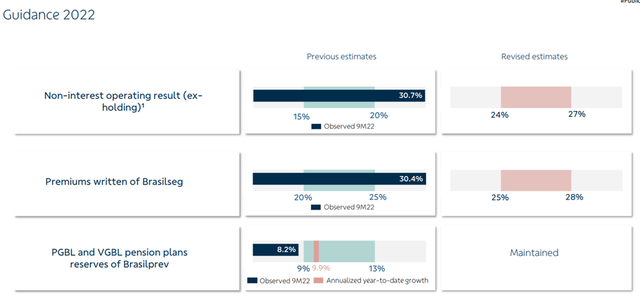

Near-Term Guidance Numbers Revised Upward

In line with the strong quarter, the company has revised its guidance ranges higher – non-interest operating results are now slated to grow at 24-27% (up from 15-20% previously), while written premiums growth has been pegged at 25-28% (up from 20-25% previously). Digging deeper, it seems the upward revision in the operating numbers was mostly down to lower realized claims in the rural segment. This implies management sees limited risks from potential climate events, including the upcoming La Niña. At first glance, this seems optimistic, particularly given the last spike in rural claims in H1 2022. That said, the rural portfolio has become more diversified, both from a counterparty standpoint and with regard to geographical exposure. Also helping is BB Seguridade’s established presence and strong track record of navigating climate events in Brazil which differentiates it from other competitors.

BB Seguridade

Heading into 2023, good premiums growth is expected to continue, although management has indicated some deceleration due to the elevated FY22 base at +20-25% written premiums growth. My main concern is rural premiums, which could see a fundamental slowdown should commodity prices continue to normalize lower without support from government subsidies. Depending on where prices go next year, the Brazilian government’s planned ~R$1.1bn allocation from next year’s spending budget to rural insurance premium grants ((or PSR)) may or may not be sufficient to keep up.

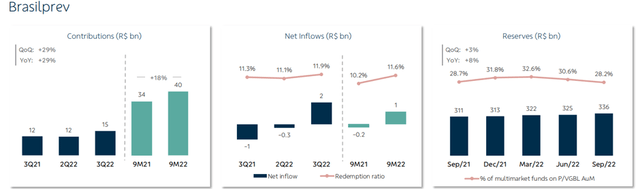

Still Room for Growth at the Pension Unit

While all eyes are on BB Seguridade’s insurance performance, the acceleration in its pension business deserves mention as well. Contributions rose to R$15.1bn in Q3 (up from R$11.7bn in Q2 2022), more than offsetting the elevated ~12% redemption rate (up from ~11% in Q2 2022). Net, this resulted in net inflows of +R$1.8bn – the first quarter of inflows in over a year. While management fees were down ~3bps QoQ, reaching 0.98% this time around, this was down to a ~4%pts shift in allocation away from hedge funds and should normalize over time. Meanwhile, the higher benchmark Selic rate continues to be a net benefit, although perhaps not as much as expected amid the yield curve volatility and the IPCA/IGP-M inflation index mismatch (note the IPCA index deflation impacted profitability on the asset side but was offset by the IGP-M impact on the liability side).

BB Seguridade

Despite already hitting record pension contributions this quarter, management still sees room for penetration to ramp up from here. The ability to target clients in the middle of the pyramid (most of BB Seguridade’s client base comprises this segment) is key – pension penetration rates are low here, so the potential to further grow their product relative to the more saturated affluent segment is much higher. The other tailwind is the redemption ratio, which has been on a downward trend throughout Q3 and looks set to continue into Q4 as well. Overall, the updated guidance for <R$50bn in contributions by year-end (up from >R$40bn YTD) bodes well for the bottom line.

Cheap Defensive Play with an Attractive Dividend

Overall, Q3 was another strong print from BB Seguridade, in line with the monthly data. The strong earnings result also translated into an upward guidance revision and potentially higher FY23 numbers as well, signaling the underlying momentum. More broadly, BB Seguridade offers investors valuable defensiveness against a worsening macro backdrop, backed by its best-in-class insurance product suite and distribution network. Further, it bears no NPL risk and stands to benefit from higher Selic rates, ensuring high ROEs and dividend yields through the cycles. At ~9x fwd earnings (~11x trailing P/E) and a high-single-digit % yield, the stock offers compelling value here.