jetcityimage/iStock Editorial by way of Getty Pictures

Financial institution of America (NYSE:BAC) benefited from a pointy restoration in client spending following the Covid-19 pandemic, however report inflation, which is anticipated to worsen this yr, will lead to larger borrowing prices for the financial institution within the future.

Whereas will increase in client spending will proceed to be constructive for Financial institution of America, altering financial coverage with a view to comprise runaway inflation charges poses a big threat to the inventory in 2022.

Sturdy Restoration Good points

Financial institution of America has benefited from the financial system’s sturdy restoration during the last yr, with client spending and demand for brand new credit score merchandise growing considerably. The U.S. authorities’s beneficiant paychecks to Individuals throughout Covid-19 aided the market restoration, not solely within the financial system but in addition in Financial institution of America’s massively vital client banking phase.

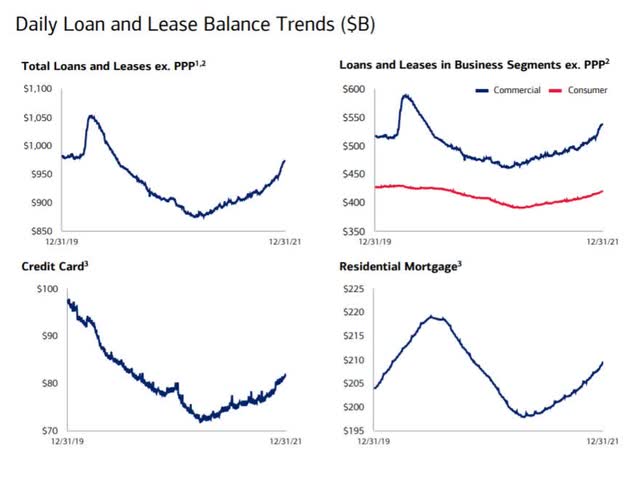

Loans, bank cards, and residential mortgages are among the many key sectors of the monetary trade which have seen a pointy turnaround in 2021. Whereas many of those indicators stay under their pre-Covid highs, the credit score market’s restoration has considerably aided Financial institution of America’s earnings rebound in 2021.

Every day Mortgage And Lease Stability Developments (Financial institution of America)

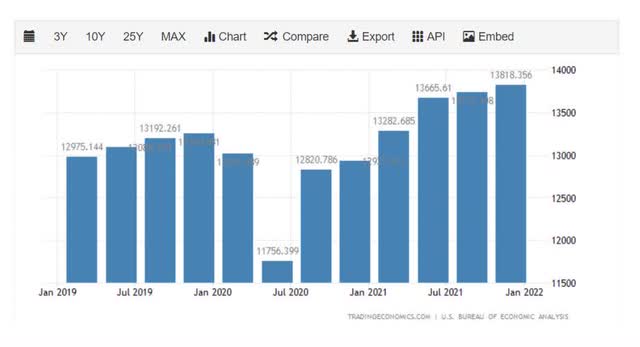

This restoration has been largely pushed by elements which have benefited the monetary well being of the American client. Shopper spending elevated dramatically within the second half of 2021, and Financial institution of America’s enterprise benefited in consequence.

Shopper Spending (Tradingeconomics.com)

Dangers Are Rising For BAC

Having stated that, the 20% drop within the valuation of Financial institution of America’s inventory may very well be the beginning of a bigger and longer correction, inflicting the inventory worth to fall a lot additional than it has already. Inflation charges and financial coverage adjustments, I imagine, can have a big impression on Financial institution of America’s funding worth in 2022.

Proper now, the most important threat for shoppers and monetary establishments like Financial institution of America is runaway inflation, which, let’s face it, is worse than anybody might have predicted. Inflation rose to 7.9% in February, and the March inflation report is anticipated to indicate a brand new 40-year excessive because of rising vitality prices related to the Ukraine battle, which can now be totally factored into inflation figures.

Inflation within the U.S. climbed to eight.5% in March which solely provides extra strain on the central financial institution to enact measures to counteract rising client costs. The central financial institution raised rates of interest by 25 foundation factors in March for the primary time since 2018, and it was solely shortly after that, within the second half of March, that Financial institution of America’s inventory worth started to consolidate once more.

Rates of interest at the moment are set at a spread of 0.00% to 0.25%, which is woefully insufficient provided that inflation charges are approaching (and sure exceeding) 8% (SOON).

Inflation is a threat not solely as a result of it’s anticipated to boost Financial institution of America’s borrowing prices, decreasing financial institution profitability, however it’s also a threat as a result of it considerably will increase recession dangers.

How Many Curiosity Fee Hikes Will There Be In 2022?

That relies on which funding financial institution you communicate with. The vast majority of funding banks count on 4 rate of interest hikes in 2022, however some see as much as six 25-basis level hikes, like Morgan Stanley. The central financial institution, alternatively, could act rather more shortly to rein in runaway inflation, particularly if inflation charges proceed to rise this yr.

Rising Bills Are A Danger To Financial institution Profitability

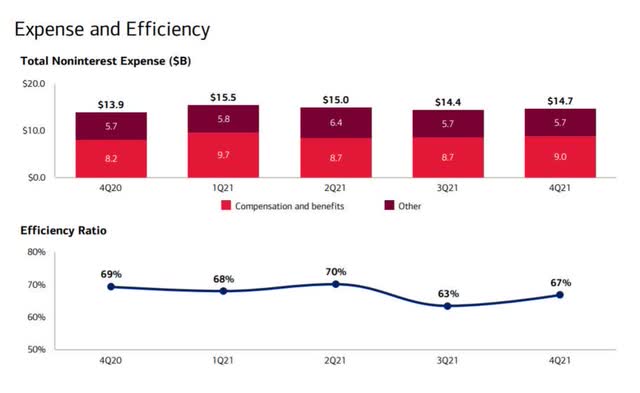

Financial institution of America’s prices elevated in 4Q-21, regardless of a restoration in client spending. Financial institution of America’s effectivity ratio, which measures working bills in relation to revenues, elevated from 63% in 3Q-21 to 67% in 4Q-21. The effectivity ratio is certainly a quantity to look at transferring ahead, and better working and curiosity prices would significantly undermine any remaining attraction of an funding in Financial institution of America.

Expense And Effectivity (Financial institution of America)

What May Drive Financial institution of America Decrease

Accelerating core inflation, larger borrowing prices, and weakening client spending are all severe dangers for Financial institution of America that I imagine traders are at present underestimating. The central financial institution may additionally elevate rates of interest a lot quicker than the market anticipates, forcing traders to shift funds into property which might be thought of higher inflation hedges, similar to banks and REITs.

BAC Inventory Is Nonetheless Costly

Although an funding in Financial institution of America prices 20% much less at this time than it did in February, I think about the financial institution to be something however a discount. Financial institution of America has an 83% premium to tangible e-book worth, which implies traders pay practically twice the e-book worth for the privilege of investing within the firm. With the growing headwinds, I’m not satisfied that that is an acceptable a number of to pay.

Financial institution of America’s Mortgage Enterprise Might Profit From Larger Curiosity Charges

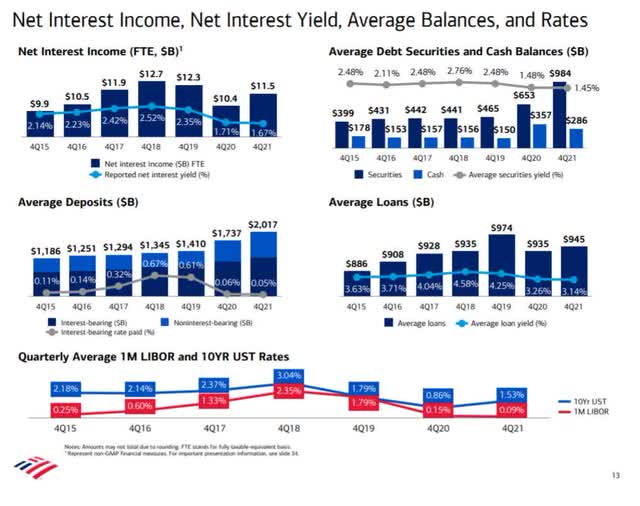

Financial institution of America, in fact, has the choice of passing on larger rates of interest to debtors and making the most of an already increasing mortgage enterprise. The financial institution’s common loans elevated to $945 billion in 4Q-21, they usually could set a brand new excessive in 2022. Nevertheless, I imagine that rising inflation raises the chance of a recession and creates valuation headwinds for Financial institution of America.

Common Loans (Financial institution of America)

My Conclusion

Inflation will likely be a significant headache for the financial system, shoppers, and the central financial institution, which is why Financial institution of America’s inventory might fall even additional. Larger capital prices might eat into the financial institution’s income, and the chance of a recession is growing. All of this implies that purchasing Financial institution of America at such a excessive TBV a number of is a foul thought.

Whereas client spending is just not but contracting and the credit score market restoration has aided Financial institution of America 2021, recession dangers are growing. I imagine that 2022 would be the yr when the market resets inflation expectations and begins pricing in larger borrowing prices for the capital-intensive banking sector.