Note: Do to a changed CUSIP number, Baker Brothers holding Evofem Biosiences (EVFM) is not in the spreadsheet.

Keep reading this article to learn more about Baker Brothers Advisors.

Table Of Contents

Baker Brothers’ Philosophy and Strategy

Brothers Julian and Felix Baker have earned their guru status on Wall Street, having delivered an exceptional track record of annualized returns over the years. Julian has a business background from Harvard, while Felix has a Ph.D. in Immunology from Stanford.

Together, they have combined their individual expertise to generate superior returns by focusing solely on the biotech industry. Assets under management grew from $250 million in 2003, to $15.2 billion as of November 15th, 2022.

The fund’s strategy includes utilizing a fundamentally-driven way of investing to come up with its investment decisions, also known as “bottom-up investing”. Unlike top-down investing, which suggests studying the bigger picture of economic factors to make investment decisions, bottom-up investing involves looking at the company-specific fundamentals.

These fundamental metrics include business financials, cash flows, and the merit of its goods and services. This is crucial when investing in the biotech industry, as each company is very unique, requiring niche knowledge to understand its business model.

The fund’s philosophy stands in holding its investments ordinarily for three years, though its higher-conviction investments can be seen held for longer. Additionally, Baker Bros. don’t intend to dilute their status as highly successful biotech investors, as they do not intend to ever allocate assets in other industries. Still, some minor stakes in the industrial sector had been reported in the past.

Finally, the two brothers don’t believe in diversifying the fund’s portfolio. Instead, they emphasize that focusing on specific companies, which they can analyze and understand deeply and place concentrated positions in their securities, can generate superior returns over the long term.

Baker Brothers Investments’ Portfolio & 5 Largest Public-Equity Investments

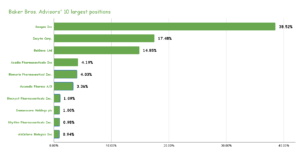

Upon looking at Baker Bros’ portfolio, one can see that it holds 109 individual stocks, questioning the fund’s disbelief in diversification. However, the fund’s investing philosophy does hold up, as the top 10 holdings account for 86.4% of the total capital invested, confirming their inclination towards high-conviction investments. Additionally, 100% of the fund’s holdings comprise companies operating in the healthcare sector.

Source: 13F filing, Author

Seagen Inc. (SGEN)

Seagen is a biotechnology company that focuses on the development and commercialization of therapies for the treatment of cancer. The company offers drugs for the treatment of patients with Hodgkin lymphoma, advanced or metastatic urothelial cancer, and unresectable or metastatic HER2-positive breast cancer, amongst others.

Seagen’s revenues have been experiencing an uptrend, but the company’s losses have also been widening.

Baker Bros owns around 25.5% of the company, the stock occupies around 38.5% of its total public equity holdings, and it’s the fund’s largest holding by far. The position was held stable during the quarter.

Incyte Corporation (INCY):

Incyte Corporation focuses on the discovery, development, and commercialization of various therapeutics. Its flagship products include JAKAFI, which is a drug for the treatment of myelofibrosis and polycythemia, and Iclusig, a kinase inhibitor to treat chronic myeloid leukemia.

Unlike many biotech companies, which are pre-revenue, Incyte has been growing its top and bottom line for years. Revenues have expanded from around $169 million in 2010 to $3.33 billion over the past four quarters. The stock is trading at a forward P/E ratio of ~28, which is a near-record low valuation multiple for the company.

EPS over the medium-term is expected to grow by around 30% since Incyte is an industry leader, having essentially monopolized its areas of treatment. In that regard, the valuation seems compressed. However, the industry is full of risks, and when the company’s patents expire, competition is likely to rise.

The fund owns around 16.3% of the company, with a market cap of $23 billion. The position was boosted by less than 1% in the previous quarter.

BeiGene, Ltd. (BGNE):

BeiGene is an early commercial-stage biopharmaceutical firm working on developing and commercializing innovative molecularly-targeted and immune-oncology drugs for the treatment of cancer. It is the fund’s second-largest holding, occupying 14.9% of its total portfolio.

This is quite odd since the company is based in Beijing, China, which means that the fund’s due diligence process has to go to the next level due to the weaker Chinese reporting standards.

Despite the uncertainty surrounding BeiGene, the company has developed into a fully integrated global biotechnology company with operations in China, the United States, Europe, and Australia. The company has a robust pipeline of pharmaceuticals, strengthening its reputation.

Nonetheless, BeiGene produces miniature revenues against its $18.7 billion market cap, indicating that investors are betting heavily on the company’s long-term prospects. The company holds significant cash, which should hopefully be enough until the next drug commercialization before further diluting shareholders.

Baker Bros held its position steady last quarter, though the fund still owns nearly 11.4% of the company.

ACADIA Pharmaceuticals Inc. (ACAD):

ACADIA Pharmaceuticals focuses on the development and commercialization of small molecule drugs aimed at unmet medical needs in central nervous system disorders. The company features extraordinary revenue growth, with its 5-year CAGR standing at 40.6%. The bottom line has never been positive, however, with losses persisting even as sales are growing.

In March of 2021, Acadia had announced deficiencies identified by the FDA regarding its marketing application for Pimavanserin in hallucinations and delusions associated with dementia-related psychosis. Shares plunged by a massive 45%, and they have yet to recover since then. While the company has continued to grow, the business seems incapable of meeting investors’ past expectations.

This is one of the fund’s highest conviction picks, as Baker Bros still owns nearly 26% of the company’s shares, which have been held since 2010. While the fund has made great gains since, the recent plunge has definitely compressed its unrealized gains, as the position was held stable once again.

BioMarin Pharmaceutical Inc. (BMRN):

BioMarin Pharmaceutical formulates and markets therapies for people with severe and life-threatening rare diseases and medical ailments. While the company’s revenue growth has seemingly stagnated over the past couple of years, it appears that the company’s development pipeline remains rather strong. Most recently, BioMarine got a positive CHMP opinion in Europe for ValRox for the treatment of Hemophilia type A.

BioMarine has had a place in Baker Bros’ portfolio since Q2 2012. The position was left unchanged during the previous quarter. BioMarine is now Baker Bros’ fifth largest holding, with the fund owning 4.14% of the company’s outstanding shares.

Final Thoughts

The Baker brothers have built a truly special hedge fund. Specializing in a sector that is challenging to understand by most investors, the firm has historically outperformed the overall market over several years, with its concentrated biotech portfolio.

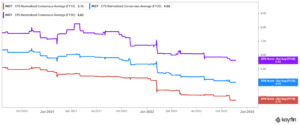

Performance over the past three years has lagged, but it could be a temporary phase for the fund, which, after all, focuses on long-term returns. Investors that are familiar with biotech companies are likely to find some hidden gems amongst their holdings.

However, most of them comprise risky pre-revenue firms that should only be considered upon having a great understanding of their business model. Retail investors should be wary of just “copying” the fund’s portfolio.

Additional Resources

See the articles below for analysis on other major investment firms/asset managers:

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly: