MicroStockHub

Fellow shareholders,

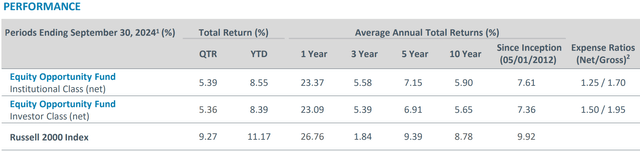

Equities posted a robust quarter on the again of encouraging financial information and the anticipation of a collection of rate of interest cuts by the Federal Reserve. Smaller-cap shares have a tendency to love this mixture and acted accordingly, with the Russell 2000 Index rising +9.3% in the course of the interval – outpacing the S&P 500’s +5.9% whole return. The Fairness Alternative Fund posted a internet return of +5.4% in the course of the three-month interval. With a lot of the 12 months behind us, the Fund continues to carry out solidly, gaining +8.6% on a internet return foundation by means of September.*

The third quarter was marked by stable company fundamentals and enthusiasm over the beginning of a brand new Federal Reserve curiosity rate-cutting cycle, punctuated by an preliminary 50 foundation level discount in mid-September. Smaller-cap shares responded nicely to the primary price minimize, although larger-caps nonetheless have posted roughly double the efficiency on a year-to-date foundation. Nonetheless, we had been happy to see the modest reversion in Q3 efficiency by market capitalization.

Through the quarter, financials and utilities led the Russell 2000 Index, whereas all sectors delivered optimistic returns aside from vitality. Development and worth types each rose, with modest outperformance of worth in the course of the interval. The Fund continues to be balanced on this entrance and, thus, didn’t see a lot influence from type bias.

Efficiency was bolstered by robust contributions from Clear Safe, public security merchandise maker Cadre Holdings (CDRE), and med-tech firm Advantage Medical (MMSI). Clear’s inventory worth rose sharply after the corporate posted yet one more robust quarter. Clear’s optimistic outcomes had been hardly new – however this time, traders took discover. The corporate continues to profit from its robust worth proposition to frequent vacationers, together with enviable execution. We now have owned Cadre since its 2021 preliminary public providing, and the corporate continues to ship on its guarantees. The thesis continues to characteristic predictable underlying development and margin enlargement that may be complemented by strategic acquisitions. Traders appear to love this recipe, and the inventory has labored nicely.

Key detractors to the Fund’s efficiency in Q3 included software program names AvidXchange Holdings (AVDX) and ZoomInfo Applied sciences (ZI). These shares fell in the course of the quarter, when stable Q2 outcomes had been overshadowed by a modestly disappointing again half outlook. Each corporations have been impacted by the macro slowdown that has depressed their main buyer set of small- and mid-sized companies. Whereas near-term inventory worth efficiency would possibly stay subdued, we’ve got added to every place based mostly on the view that higher days lie forward. Clarus Company (CLAR) additionally detracted from efficiency.

There was a lot debate this 12 months over whether or not the economic system is extra more likely to have a tough touchdown (recession) or a tender one. Our working conjecture is that neither of those is almost definitely; as a substitute, we anticipate a “laborious takeoff,” much like an airplane that’s nearing landing solely to rev the engines and take off as soon as once more. A tough takeoff could be marked by still-decent – albeit decelerating – financial development and more and more straightforward monetary situations, fueled by rate of interest cuts.

Furthermore, inflation on this state of affairs would virtually actually stay above the Fed’s long-held 2% goal price. If this speculation proves directionally appropriate, it needs to be an honest backdrop for equities, particularly smaller-cap shares that are likely to carry out higher in periods of enhancing financial development and falling rates of interest. We might anticipate periodic inflation scares to drive heightened market volatility, stoking debate over the tempo of future rate of interest cuts.

Nearer time period, we imagine consideration will shift to the U.S. Elections in early November. With candidates that characteristic vastly completely different agendas, the last word make-up of the White Home and Congress will matter to an array of industries and firms. Moreover, whereas it appears there are all the time geopolitical hotspots, the present struggle within the Center East stays an vital wild card. Uncertainty over these developments may conspire to create market angst into year-end, if not longer.

This creates a sophisticated backdrop for traders. First rate fundamentals and falling rates of interest ought to function a tailwind for equities and smaller-cap shares, particularly. However with equities buying and selling close to all-time highs and above-average valuation ranges, we keep a dedication to managing danger. We do that primarily by using an funding course of that depends closely upon a risk-reward framework for particular person concepts. Moreover, periodically, we make use of portfolio insurance coverage overlays; we’ve got lately bought comparatively low cost safety on a portion of the portfolio’s internet property that may assist cushion a fabric draw back transfer by means of mid-November. We don’t imagine the market will decline materially within the fast time period, per se, however think about it prudent portfolio administration, nonetheless.

Whereas there isn’t any dearth of macro concerns that require thought and evaluation, we imagine that the Fund’s long-term efficiency is extra closely influenced by the person positions in our portfolio. For instance, we lately constructed a big place in NCR Voyix (VYX) following disappointing early 12 months outcomes. The purpose-of-sale chief has undergone huge change, together with new administration, an enhanced enterprise mannequin that focuses on software program and providers, and a latest asset sale that allowed the steadiness sheet to delever from over 4x EBITDA to underneath 2x. We glance to improved development and profitability in 2025 to drive valuation enlargement from at the moment depressed ranges.

We imagine that the Fund is nicely positioned into year-end and, if smaller-cap tailwinds persist, the portfolio ought to enter 2025 with extra wind in its sails than has been our expertise since inception. We want you a contented and wholesome set of upcoming holidays and sit up for offering one other replace early subsequent 12 months.

Respectfully,

Joe Milano

|

*Efficiency information represents previous efficiency and doesn’t assure future outcomes. The funding return and principal worth of the funding will fluctuate in order that shares, when redeemed, could also be value roughly than their unique value. Present efficiency information could also be decrease or greater than the info quoted. For efficiency information as of the latest month‐finish, please go to Baird Asset Administration.

TOP 10 HOLDINGS AS OF JUNE 30, 2024

INVESTMENT TEAM

Data on this doc relating to market or financial traits, or the elements influencing historic or future efficiency, displays the opinions of administration as of the date of this doc. These statements shouldn’t be relied upon for some other objective. Holdings are topic to danger and might change with out discover. The efficiency of any single fund holding is not any indication of the efficiency of different holdings of the Baird Fairness Alternative Fund. References to particular person securities shouldn’t be construed as a suggestion to purchase, maintain, or promote a safety, and it shouldn’t be assumed that the holdings have been or will likely be worthwhile. Positions recognized above don’t signify all of the securities held, bought, or bought in the course of the time interval; previous efficiency doesn’t assure future outcomes. To acquire an entire checklist of positions for the interval, contact Baird Fairness Asset Administration at 800-792-4011. Previous to December 12, 2021, the fund was managed in accordance with a distinct funding technique. The Subadvisor grew to become the Fund’s subadvisor efficient December 12, 2021. The efficiency outcomes proven are from intervals throughout which the Fund was managed by the Advisor previous to the retention of a Subadvisor. As a non-diversified fund, the fund could make investments a bigger proportion of its property in a smaller variety of corporations in comparison with a diversified fund, which will increase danger and volatility as a result of every funding has a larger impact on the general efficiency. The fund focuses on small- and mid-cap shares and subsequently the efficiency of the fund could also be extra risky, much less liquid and extra more likely to be adversely affected by poor financial or market situations than investments in bigger corporations. The fund could make investments as much as 15% of its whole property within the fairness securities of overseas corporations. Overseas investments contain further dangers similar to foreign money price fluctuations, the potential for political and financial instability, and completely different and generally much less strict monetary reporting requirements and regulation. The Russell 2000 is essentially the most extensively quoted measure of the general efficiency of small-cap to mid-cap shares. It represents roughly 10% of the whole Russell 3000 market capitalization. It’s made up of the underside two-thirds in firm measurement of the Russell 3000 index. Indices are unmanaged and should not out there for direct funding. Time intervals larger than one 12 months are annualized. The Fairness Alternative Fund (the “Fund”) has been developed solely by Robert W. Baird & Co. Integrated. The Fund isn’t in any means related to or sponsored, endorsed, bought or promoted by the London Inventory Alternate Group plc and its group undertakings (collectively, the “LSE Group”). FTSE Russell is a buying and selling title of sure of the LSE Group corporations. All rights within the Russell 2000 Index (the “Index”) vest within the related LSE Group firm which owns the Index. Russell® is a trademark of the related LSE Group firm and is utilized by some other LSE Group firm underneath license. The Index is calculated by or on behalf of FTSE Worldwide Restricted or its affiliate, agent or accomplice. The LSE Group doesn’t settle for any legal responsibility in any way to any particular person arising out of (a) using, reliance on or any error within the Index or (b) funding in or operation of the Fund. The LSE Group makes no declare, prediction, guarantee or illustration both as to the outcomes to be obtained from the Fund or the suitability of the Index for the aim to which it’s being put by Robert W. Baird & Co. Integrated. CFA is a trademark owned by the CFA Institute. Baird Funds are supplied by means of Robert W. Baird & Co. Integrated, a registered dealer/vendor, member NYSE and SIPC. Robert W. Baird & Co. Integrated additionally serves as funding advisor for the Fund and receives compensation for these providers as disclosed within the present prospectus. ©2024 Robert W. Baird & Co. Integrated. First use: 10/2024 |

Unique Publish

Editor’s Notice: The abstract bullets for this text had been chosen by Looking for Alpha editors.