This text/publish incorporates references to services or products from a number of of our advertisers or companions. We could obtain compensation whenever you click on on hyperlinks to these services or products

Returning to work on a Monday after a trip is a fast actuality test. It’d make you dream of when you possibly can take a everlasting work trip, aka retirement. Whereas spending your days {golfing}, touring, and dwelling off the clock is interesting, these days of leisure cannot occur with out cautious saving and strategizing.

No matter your age, retirement is one thing try to be planning for now. On this article, we’ll discover retirement methods for each age group, discuss how a lot you’ll want to save and provide the instruments to measure how your financial savings rank in comparison with your friends.

Nevertheless, do not forget that it is a common overview — not tailor-made monetary recommendation. It’s best to seek the advice of a monetary skilled to find out the perfect particular person answer to set you up for the retirement of your desires.

The Quick Model

- A person’s time left within the workforce will largely dictate their retirement financial savings technique.

- In accordance with Constancy’s information, the common particular person does not have sufficient financial savings after they enter retirement.

- The most typical retirement financial savings autos embody 401(ok)s, Social Safety, and private investments.

- A person’s portfolio allocation will largely decide their success in retirement financial savings, and that allocation ought to shift as the person ages.

How Many Years Are You Away From Retirement?

Many retirement discussions group people based mostly on generations. Whereas that is typical, it’s not essentially the most useful strategy to evaluate people to their friends. A Millennial born in 1981 (age 41) has been within the workforce 15 years longer than the youngest Millennial born in 1996 (age 26). Subsequently, we’ll think about investing methods decade by decade as a substitute.

How A lot Do You Want To Save for Retirement?

Numerous components decide how a lot an individual wants to avoid wasting earlier than retirement, together with the age they need to retire and their bills. A research by Northwestern Mutual signifies that Gen Z and Millennials imagine they’ll retire simply earlier than they attain 60; Gen X believes they’ll retire by age 65. Child Boomers anticipate retirement after age 68.

In accordance with Constancy Investments’ common rule for retirement saving, people ought to try to avoid wasting:

- 1x their wage by age 30

- 3x their wage by age 40

- 6x their wage by age 50

- 8x their wage by age 60

The calculations above assume that people will:

- Save 15% of their earnings

- Make investments greater than 50% of their common financial savings in shares

- Retire at age 67

Learn extra >>> Finest Retirement Planning Instruments & Calculators for 2022

How Does My Financial savings Examine to My Similar-Age Friends?

Constancy additionally presents a useful comparability instrument so you possibly can see the way you’re doing amongst your friends. The calculator makes use of the common retirement account balances for people in numerous age brackets to generate its outcomes. Right here they’re expressed in a desk under:

| Age bracket | Charge of contribution | Common account steadiness |

|---|---|---|

| 20-29 | 7% | $10,500 |

| 30-39 | 8% | $38,400 |

| 40-49 | 8% | $93,400 |

| 50-59 | 10% | $160,000 |

| 60-69 | 11% | $182,100 |

| 70-79 | 12% | $171,400 |

Notice that the common particular person saves lower than 15% of their earnings annually and has a lot much less saved for retirement than the advisable quantity. Which means that most individuals won’t be capable of afford the comfy retirement they dream of when the time comes.

What Ought to My Portfolio and Retirement Financial savings Look Like All through My Profession?

As you age and transfer by the phases of life, the allocation of belongings in your funding portfolio ought to likewise undergo modifications. Broadly talking, your portfolio will possible comprise fewer development shares and extra steady investments as time goes on.

20s

People on this age bracket are the furthest away from retirement, to allow them to theoretically tackle essentially the most danger and spend money on shares with larger development potential with out worrying about market dips. The curiosity from the 401(ok)s and IRA will compound over the many years in the event that they open an account now.

At this age, Capital Group recommends as a lot as 40% of your portfolio in growth-related investments, together with shares in corporations rising sooner than different corporations of their sector. Typically, this contains newer, smaller corporations.

30s

People of their 30s will probably have extra bills like mortgages or rising households, however they nonetheless profit from being 30-40 years away from retirement. Thirty-somethings ought to begin to max out contributions to their employer-sponsored 401(ok)s in the event that they didn’t already try this of their 20s. Moreover, they will nonetheless spend money on riskier shares whereas slowly allocating extra of their portfolio in the direction of bonds.

40s

People of their 40s more likely to attain essentially the most worthwhile factors of their careers. On the identical time, they incur extra bills than ever, comparable to school tuition for his or her children. Folks of their 40s typically spend money on extra steady funds however nonetheless keep some development funds to attenuate the impact of inflation on their financial savings.

50s

As you close to the top of your 40s and enter your early 50s, you may think about halving your development investments and growing your bond allocation by 20%. People close to retirement age ought to lower the volatility of their portfolios by growing the variety of steady investments, like bonds. Nevertheless, this allocation nonetheless capitalizes on some development potentialities.

People of their 50s can begin making the most of advantages the IRS permits, together with the extra $6,500 catch-up contribution to a 401(ok) and the additional $7,000 per 12 months contribution room in an IRA. In the event that they haven’t already, 50-somethings ought to seek the advice of a monetary skilled to assist them reap essentially the most rewards from their remaining working years.

60s

Folks in the previous couple of years of labor earlier than retirement could need to allocate their funds primarily to steady, income-producing financial savings autos. For instance, they might transfer 15% extra into bonds whereas proportionally lowering their development and growth-and-income classes. Sixty-somethings ought to seek the advice of with a monetary skilled in the event that they have not already.

How Ought to I Allocate My Retirement Portfolio?

How buyers allocate their portfolios may be extra essential than how a lot cash they save every month for retirement.

Retirement saving requires two simultaneous methods:

- Diversifying investments for monetary safety; and

- Constructing wealth throughout working years to beat the inflation charge.

American Funds Capital Group developed development fashions to show how totally different age brackets may allocate their portfolios to steadiness these two goals finest. Please observe, nevertheless, that these fashions are merely recommendations, and all people ought to think about consulting with a monetary advisor to allocate their portfolios.

What Are the Most Frequent Retirement Financial savings Autos?

Folks use varied financial savings autos to make sure they’ve a snug retirement. The most well-liked are 401(ok)s and IRAs.

401(ok)

A 401(ok) is a retirement financial savings plan sponsored by an employer. It lets staff save and make investments for retirement on a tax-deferred foundation. Employees can contribute cash to their 401(ok) accounts by payroll deductions. Employers can also make matching or non-elective contributions to staff’ 401(ok) accounts.

The cash in a 401(ok) account might be invested in varied methods, together with shares, bonds, mutual funds, and money. 401(ok) plans typically have options that make them engaging to staff, comparable to employer matching contributions and the flexibility to avoid wasting on a tax-deferred foundation. Nevertheless, staff could also be penalized in the event that they withdraw cash from their accounts earlier than retirement.

There are two forms of 401(ok) accounts—conventional 401(ok)s and Roth 401(ok)s.

With a conventional 401(ok), an worker deposits pre-tax {dollars} into their account, and their contributions usually are not taxed till withdrawal. A standard 401(ok) can deduct worker contributions from taxes yearly.

Nevertheless, with a Roth 401(ok), the worker allocates after-tax earnings into their 401(ok) account. This implies they won’t be taxed after they withdraw this cash in retirement.

The IRS units limits annually on how a lot an worker can contribute to their 401(ok). The 2022 restrict is $20,500, and people over age 50 could make a catch-up contribution (an extra allocation to their retirement account as they close to retirement age) totalling $6,500.

Learn extra >>> 401(ok) vs. Roth 401(ok) Plans: Which One Ought to You Select?

Particular person Retirement Account (IRAs)

Some individuals save by way of an IRA at a monetary establishment. Conventional and Roth IRAs have the identical taxation guidelines as conventional and Roth 401(ok)s. Rollover IRAs are an alternative choice. That is when a 401(ok), 403(b) or one other employer-sponsored plan’s belongings “rolls over” into an account with a monetary establishment.

Learn extra >>> Find out how to Spend money on an IRA

Social Safety

Social Safety is a government-sponsored program that pays people in retirement from a pool of tax {dollars} all working people contribute to, known as the Social Safety Belief Fund. This fund helps retired people, disabled people, deceased staff’ survivors, and staff’ dependents.

People can obtain their full retirement advantages at age 66 to 67, relying on their start 12 months. People can decide to get their Social Safety advantages as quickly as they attain 62, however their month-to-month profit will scale back by as much as 30%.

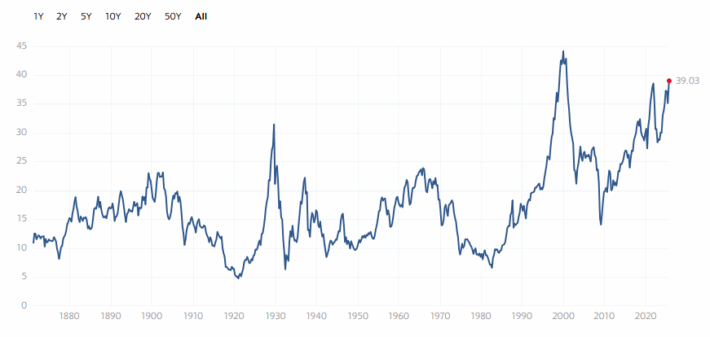

Likewise, people can delay receiving their Social Safety advantages till age 70 and be eligible for barely extra advantages per thirty days. See the under chart for these additional advantages.

The Backside Line

In the end, saving for retirement is a mixture of each self-discipline and technique. The youthful you’re whenever you start placing retirement financial savings apart, the extra you possibly can reap the curiosity advantages and potential development alternatives from fluctuations within the inventory market.

Nevertheless, people close to retirement could need to reallocate their portfolios to extra conservative financial savings autos. That approach, when the time comes, you possibly can commerce clocking into work with teeing off on the course.

Additional studying: