mysticenergy

Investment Summary

Athabasca Oil Corporation (OTCPK:ATHOF), a Canadian energy company, specializes in the exploration, development, and production of oil sand resources in the abundant Athabasca region of Alberta, Canada. The company’s operations revolve around two key projects: the Thermal Oil Division and the Light Oil Division. The Thermal Oil Division employs advanced techniques like steam-assisted gravity drainage to extract bitumen from the oil sands. Within this division, Athabasca Oil Corporation manages significant projects such as the Hangingstone Project and the Leismer Project, which demonstrate substantial potential for production.

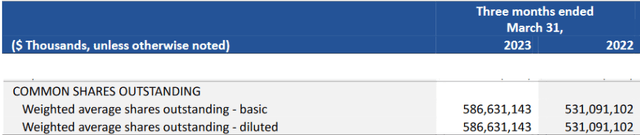

Shares Outstanding (Earnings Report Q1)

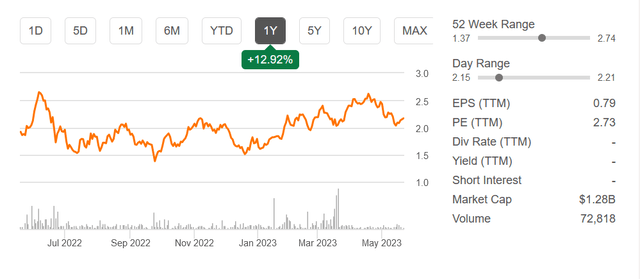

ATHOF is trading at a very low valuation of 2.73 earnings on a TTM basis, but the future seems uncertain in terms of how much value an investor could get from entering at these prices. The company has diluted shares on a YoY basis by around 10%, and the cash flows were negative at the start of the first quarter in 2023. As long as cash flows are negative, the potential investors have to get some value from an investment in it is very small in my view. Appreciation in share price seems unlikely since the bottom line was negative for the quarter, so it’s not trading on fundamentals right now it seems. I think the assets the company owns are the main attraction, but until there are better margins and a stop to the dilution I will rate them a hold.

Potential Growth Drivers

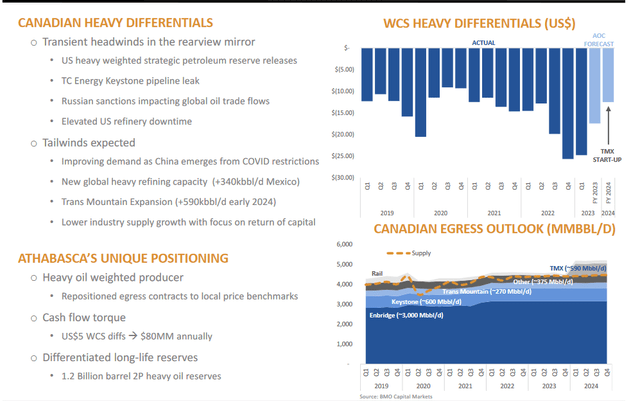

Looking at what the company is projecting to be drivers of growth, it comes down to the US having a reshoring happening right now with companies returning to start-up manufacturing here instead of abroad, despite margins perhaps not being as good. The proximity to the market they are selling to should be of benefit for the long-term, or so at least seems to be the belief.

Company Highlights (Investor Presentation)

With this reshoring, the need for thermal oil is necessary for some parts of the manufacturing process. With new steel factories opening in the US, they provide a market and demand for Athabasca which hopefully should translate into long-term steady revenue growth as these are long-term investments and operations for these companies.

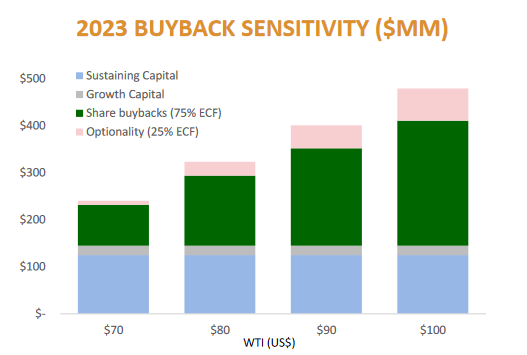

Looking where investors might be able to get some benefit is the capital allocations strategy the company has, where 75% of excess free cash flows will be returned to shareholders. It seems likely however that the cash flows for 2023 will be lower than in 2022. The average prediction and price for oil is $77/b for 2023 and $72/b in 2024, using the predictions Athabasca made that would mean cash flows of just over $200 million. I think there seem to be better options out there if you are looking for a company that is heavy and still sustainable returning a higher percentage of cash flows to shareholders. Murphy Oil (MUR) has an impressive capital structure that should lend itself to providing investors with ample returns over the long term. Right now it feels like ATHOF is in the early stages of this process, and I would be more comfortable investing in a more established company instead.

Risk

Looking at Athabasca one of the major risks I see is the negative FCF the company had in the last quarter. This doesn’t bode well and I fully expect there to be quite some volatility in the coming earnings reports. Pair that with a 10% YoY increase in the shares outstanding which doesn’t seem to be driven by stock-based compensation, as that was just under $5 million in 2022.

Company Allocations (Investor Presentation)

The value that shareholders could get here doesn’t seem as strong as with other companies in the sector. The capital spent and allocated for shareholders is only 75% of the excess FCF, which doesn’t amount to much. The company has a plan set for how much capital could be returned to shareholders. But I feel it is better to spend that capital to gain better stability in the balance sheet and grow that part of the business. For the long-term that seems like the better option as in my opinion, it would reduce the risk of having the dividend cut or a lower buyback budget because of less favorable oil prices.

Valuation & Wrap Up

Right now the company looks like a steal with just under 3x TTM earnings. But looking forward I think the story changes and more uncertainty is present. Dilution of shares has been happening on a yearly basis of around 10%. From a year ago the share price has increased by almost 13%, but taking the dilution into account you really haven’t gained that much. The company seems to be in a growth stage and investing in high-yield projects that could turn out to be incredibly profitable in some years’ time.

Stock Chart (Seeking Alpha)

The dilution of shares and the negative cash flows the company had in the last report makes me uncertain about the outlook though. With the industry, it goes in cycles from incredible profitability to horrible margins and high valuations. I would be more comfortable investing in more established companies in the space which have in my view more sustainable dividend and buyback programs in place. A company mentioned before like MUR comes to mind, but Marathon Oil Corporation (MRO) is also a solid option. For Athabasca however, I will keep a hold rating for them until I see more consistency in the reports and a clearer view about how their projects develop.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.