ElenVD/iStock through Getty Pictures

Introduction

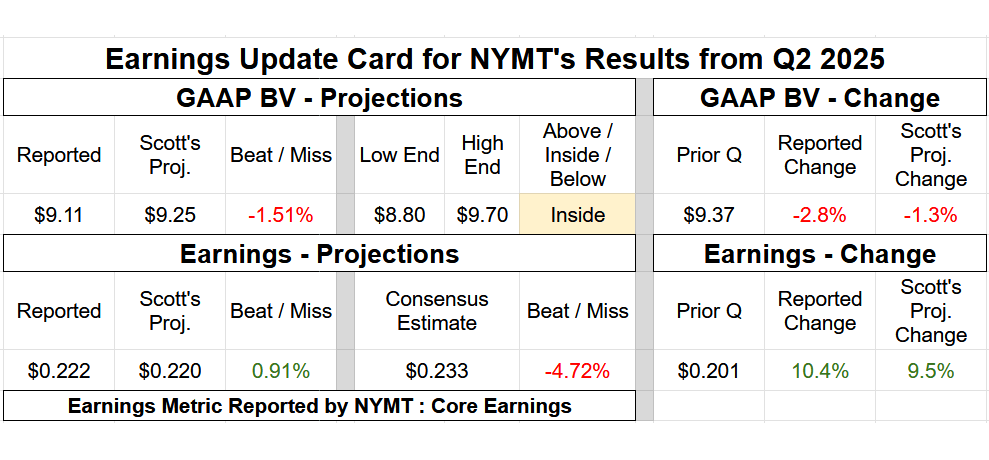

New York Mortgage Belief (NASDAQ:NYMT) had an “as anticipated” quarter with solely a small drop in e-book worth in comparison with my expectations. The corporate stored shopping for mortgage-backed securities however in smaller quantities than final quarter. General, NYMT is slowly enhancing and is at the moment in our maintain vary.

Commentary

- Quarterly BV Fluctuation: Minor Underperformance (1.5% Variance).

- Core Earnings/EAD: Principally an Precise Match (Solely a $0.002 Variance).

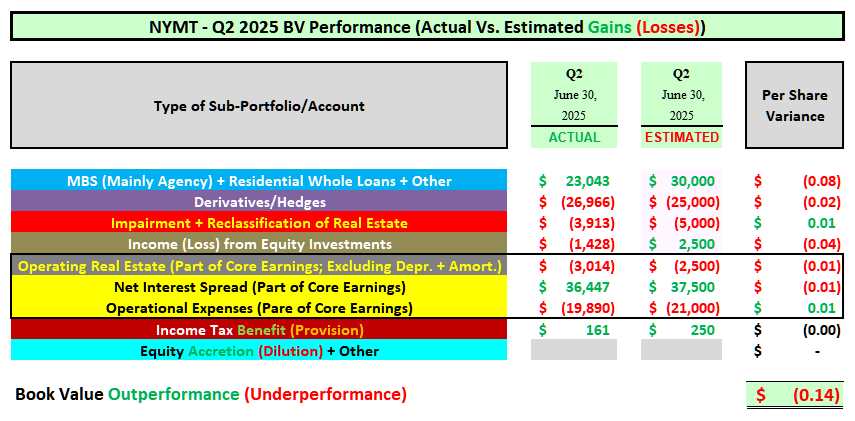

A largely “as anticipated” quarter concerning New York Mortgage Belief’s BV for my part. If something, a minor underperformance. NYMT recorded a minor quarterly BV lower versus my expectations of a really minor – minor lower. Allow us to briefly talk about how NYMT’s sub-portfolios carried out when in comparison with my expectations.

First, NYMT continued to buy fixed-rate company MBS throughout Q2 2025. This was even after buying $4.4 billion of fixed-rate company MBS over the prior 7 quarters. As acknowledged inside final quarter’s earnings convention name, even after fast enlargement, administration remained “bullish” on company MBS and principally acknowledged they might proceed to extend this sub-portfolio over the foreseeable future. Taking that as a cue, whereas I accurately projected NYMT would proceed to buy fixed-rate company MBS throughout Q2 2025, precise quantity was barely smaller-than-anticipated. For instance, NYMT bought $1.5 billion and $504 million of company MBS throughout Q1 2025 and Q2 2025, respectively. Whereas nonetheless a decent enhance throughout Q2 2025, a fairly large pullback versus Q1 2025 buy quantity. Compared, I projected Q2 2025 company MBS purchases of $750 million which was nonetheless a projected (50%) versus Q1 2025 buy quantity. Since fixed-rate company MBS pricing shortly elevated throughout late June 2025, any further purchases would have resulted in bigger valuation features (therefore BV internet features) throughout the quarter (even when assuming further by-product devices would have additionally been added; general unfold/foundation threat declined late within the quarter). As well as, NYMT bought/funded $397 and $280 million of recent residential complete loans throughout Q1 2025 and Q2 2025, respectively. This principally matched my projection of $300 million throughout Q2 2025. So, NYMT’s smaller-than-anticipated company MBS purchases straight led to a minor underperformance inside NYMT’s MBS/funding valuation fluctuations when in comparison with my expectations (see BV desk under; 1st row of accounts).

Second, NYMT’s hedging/by-product devices largely matched my expectations from a BV perspective throughout Q2 2025. If something, a really minor underperformance. Since NYMT has but to supply the corporate’s 10-Q report (no by-product particulars within the firm’s earnings press launch apart from valuation fluctuations), I can’t reconcile this particular account but. Nevertheless, I’m not too involved by the close to matching of this account’s internet valuation loss (see BV desk under; 2nd row of accounts).

Third, for the twond straight quarter, NYMT recorded fractionally much less extreme impairments/write-downs throughout Q2 2025 when in comparison with my expectations (see BV desk under; 3rd row of accounts). NYMT has continued to document notably higher outcomes inside this account (much less extreme impairments/write-downs) versus late 2023 – elements of 2024.

Fourth, nothing too stunning/alarming inside NYMT’s revenue earned from the corporate’s fairness investments as effectively. If something, a minor underperformance (see BV desk under; 4th row of accounts). That stated, after the turmoil inside this sub-portfolio throughout 2023 – early 2024, the bar was pretty not too long ago set notably decrease. As a refresher, NYMT has continued to try to actively cut back the corporate’s fairness publicity of multi-family properties by means of the corporate’s varied JV agreements and actual property investments. Not like earlier in 2024, this technique lastly picked up throughout Q3 – This autumn 2024 as elements of the industrial actual property market slowly “started to thaw”. Merely put, the hole between patrons and sellers narrowed sufficient, with a bit extra credit score assist from primarily non-bank monetary establishments/market contributors, to start to select up transactional quantity throughout the latter-half of 2024. This generalized pattern continued throughout Q1 2025 however market volatility across the tariff announcement in early April 2025 prompted a discount in exercise throughout Q2 2025. In a nutshell, NYMT’s largely multi-family investments are persevering with to be progressively “off-loaded” however not too long ago the tempo has slowed once more. Nevertheless, not like prior quarters when the “increased high quality” properties had been offered, now NYMT is probably going moving into the much less fascinating properties inside their sub-portfolio. For instance, NYMT recorded a complete internet realized lack of ($41) million throughout Q1 2025. A portion of this loss was attributable to this particular sub-portfolio. That stated, most of this stated loss was already beforehand reserved for in prior quarters (merely an unrealized to realized loss reclassification). Once more, there was minimal realized exercise that occurred throughout Q2 2025.

Fifth, not like the prior a number of quarters, NYMT’s actual property internet working metrics had been fractionally extra unfavourable throughout Q2 2025 when in comparison with Q1 2025. A fractionally worse efficiency (extra extreme internet loss) when in comparison with my expectations however nothing alarming at this level (see BV desk under; 5th row of accounts). Nonetheless appreciable internet enchancment inside this sub-portfolio when in comparison with late 2023 – 2024. Nevertheless, much like the prior quarter, gross sales principally didn’t happen inside this particular sub-portfolio throughout Q2 2025 both. Once more, I imagine market volatility across the tariff announcement in early April 2025 prompted a discount in exercise throughout Q2 2025.

Lastly, NYMT’s revenue tax (provision)/profit account principally matched my expectations (see BV desk under; 8th row of accounts).

Transferring on, for the 1st time in years, NYMT lastly started offering the corporate’s core earnings/EAD metric once more beginning in Q1 2025. As famous final quarter, this was a shock on the time and welcome addition. NYMT’s core earnings/EAD principally matched my expectations throughout Q2 2025 (a minor enhance when in comparison with Q1 2025). Nonetheless, allow us to briefly talk about the primary components that comprise this metric.

First, when reviewing internet curiosity spreads (which excludes unrealized and realized valuation features/losses), NYMT reported a modest enhance in curiosity revenue which was solely partially offset by a minor – modest enhance in curiosity expense. This resulted in a minor enhance in quarterly internet curiosity unfold revenue. With the marginally decrease mixed quantity of fixed-rate company MBS and residential complete mortgage bought/funded throughout Q2 2025 versus my expectations (as famous above), this merely resulted in a barely smaller enhance in NYMT’s internet curiosity unfold revenue (see BV desk under; 6th row of accounts). Second, this was principally absolutely offset by a barely larger-than-anticipated lower in NYMT’s operational bills when excluding any debt issuance prices that are reversed out of core earnings/EAD (see BV desk under; 7th row of accounts).

So, I imagine NYMT reported a median – pretty first rate quarter general. NYMT’s minor quarterly BV lower ought to underperform a majority of the corporate’s hybrid mREIT sub-sector friends. Nevertheless, I’d level out NYMT’s funding portfolio is now 50% company MBS. When in comparison with the company mREIT friends, the severity of NYMT’s quarterly BV lower seems to be pretty first rate. NYMT’s minor quarterly enhance in core earnings/EAD is a continued step in the fitting course (which was already accurately projected on my finish).

I might be happy if/when NYMT continues to unload some actual property/JV fairness multifamily property within the coming quarters. An excellent chunk of those property are producing very low – low levered returns.

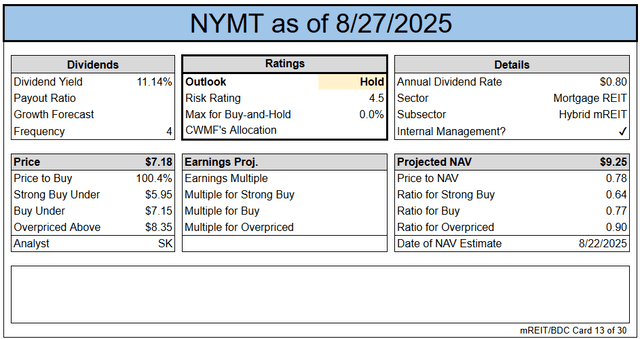

As such, I proceed to imagine a threat/efficiency score of 4.5 for NYMT stays applicable within the present surroundings/over the foreseeable future. That stated, with final quarter’s improve, NYMT has technically moved a bit “nearer” to a threat/efficiency score of 4 (not there but although).

BV Efficiency (Precise Vs. Estimated)

The REIT Discussion board

Change or Preserve

- BV/NAV Adjustment (BV/NAV Used Interchangeably): Our projection for present BV/NAV per share was adjusted: Down ($0.15) (To Account for the Precise 6/30/2025 BV/NAV Vs. Prior Projection). Worth targets have already been adjusted to replicate the change in BV/NAV. The replace is included within the card under and the subscriber spreadsheets.

- Proportion Advice Vary (Relative to CURRENT BV/NAV): No Change.

- Threat/Efficiency Ranking: No Change. Stays at 4.5.

Earnings Outcomes

The REIT Discussion board

Word: BV on the finish of the quarter. Subscriber spreadsheets and targets use present estimates, not trailing values.

Valuation

The REIT Discussion board

Ending Notes/Commentary

As accurately acknowledged in lots of prior evaluation articles, NYMT’s multifamily JV fairness pursuits will proceed to be a “drag” throughout 2024 – 2025 (will alleviate over time although). That is not a brand new occasion. Keep in mind, NYMT has fairness pursuits in these positions when contemplating credit score hierarchy. This has (and can) lead to a extra extreme, everlasting loss in BV/capital when in comparison with first (and even second) lien debt investments if market circumstances stay depressed (or deteriorate additional). Merely put, not state of affairs however, once more, that is already factored in my/our threat/efficiency scores. This has been one thing that has been mentioned for the previous 10 quarters. That stated, by now most of those eventual realized losses are already reserved for. This notion solely solidifies why I/we beforehand had NYMT assigned a threat/efficiency score of 5 (underperforming peer) again in elements of 2023 – 2024. Nevertheless, as this explicit market started to “unfreeze”, together with the latest fast funding shift into company MBS and residential complete loans (much less dangerous), I/we upgraded NYMT to a threat/efficiency score of 4.5 again in September 2024.

Continued progress and enhancing efficiency metrics might ultimately result in one other improve to a threat/efficiency score of 4 (as early as later this 12 months).

Keep in mind, I/we proceed to have NYMT priced at a reduction to the corporate’s better-run sub-sector friends. Although NYMT has not too long ago acquired fixed-rate company MBS, the remaining composition of the corporate’s funding portfolio remains to be riskier than some sub-sector friends. One additionally has to contemplate the GAAP impacts of NYMT’s consolidated VIEs and mortgage-related fairness investments (as mentioned up to now).

I/we proceed to imagine an funding in NYMT’s widespread inventory is a “speculative – very speculative” play. Merely put, not an important “match” on your cautious – semi-cautious investor. It’ll proceed to take time for NYMT to “proper the ship” through persevering with to rotate out of dangerous/underperforming investments (and recording proportionately giant realized losses) into residential complete loans (which nonetheless have credit score threat) and company MBS (which have rate of interest/prepayment threat and wish hedges which at the moment have notably much less engaging phrases). For traders with a excessive – very excessive threat tolerance and long-term time horizon, NYMT may very well be on one’s “radar”.