Bet_Noire/iStock via Getty Images

Introduction

ASML (NASDAQ:ASML) is not a high-profile company outside of the semiconductor space. Yet, for those in the know, Advanced Semiconductor Materials Lithography is the preeminent supplier of machines used to construct semiconductors.

ASML is not a foundry – they do not manufacture chips for end users in the way that TSMC does. Rather, ASML sits at the very foundation of the semiconductor value chain; they build the machines that build semiconductors.

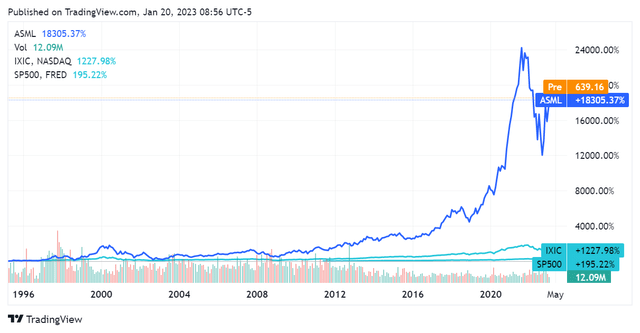

The company was founded in 1984 out of the Netherlands, where it is still headquartered. Growing rapidly since then, it first conducted a dual public listing (Amsterdam & New York) in 1995. The company’s stock has since outperformed both the SP500 as well as the NASDAQ Index (IXIC) by a significant multiple.

SeekingAlpha.com ASML 1.20.22

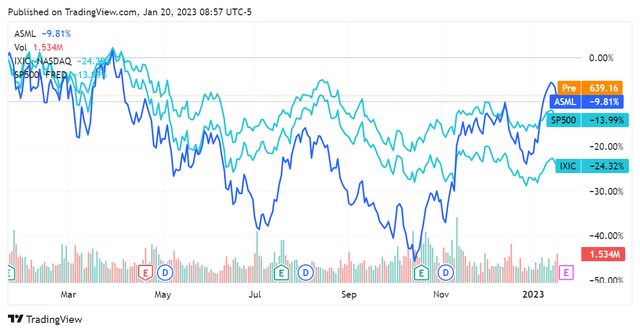

Notably, ASML stock also experienced less downward volatility over the past year, selling off less than either index.

SeekingAlpha.com ASML 1.20.22

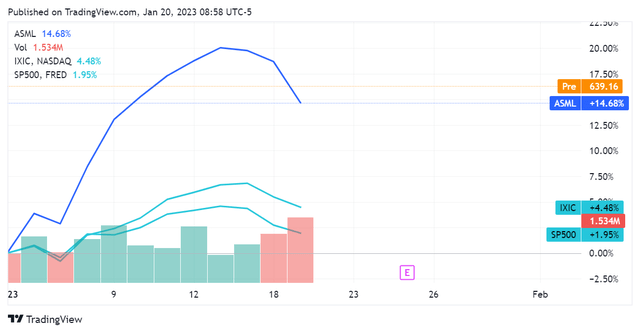

It has continued this run in the new year, with performance continuing to exceed both indices in the first several weeks of 2023.

SeekingAlpha.com ASML 1.20.22

The increasingly high-profile nature of semiconductor manufacturing, along with ongoing strategic investments into the technology worldwide, bode well for ASML. This article will review what makes this company unique from a product perspective as well as its financials.

Product Differentiation

ASML produces lithography machines for building chips. These are machines that make use of focused light to inscribe transistors into silicon at what is now the nanometer level of scale. Different machines allow for semiconductor production at different scales, with more advanced chips requiring more advanced lithography machines.

While ASML sells lithography machines for producing all levels of chip, it is the only company in the world that sells the EUV (extreme ultraviolet lithography) equipment to manufacture chips at the 5 and 3 nanometer size. These chips are the densest in existence, with the most transistors fitting into the least amount of space. They are used in the latest smartphones (iPhone 12 and later has 5nm chips), 5G networking, and artificial intelligence.

Many of the use cases for these technologies are still relatively early stage. Yet, any technology observer can note the increasing relevance – and concomitant investment into – these advanced technologies. ASML’s product differentiation then becomes quite clear-cut: it’s the only game in town. As mentioned, no other company the world over provides machines for building chips 5 nanometer and below.

Financials

ASML has a storied history and decades of success behind it, but of course we must review its financials to see exactly what that adds up to.

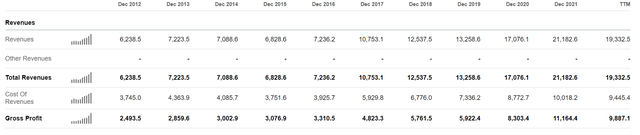

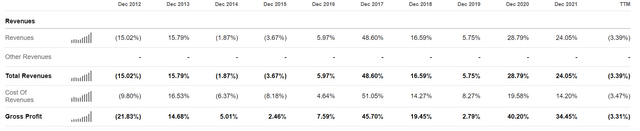

Starting with top-line metrics, we see that ASML has more than tripled its revenues over the last decade. With some occasional bumpiness aside, not much needs to be said here; this is a company turning over billions yearly that is still seeing double-digit growth rates on a regular basis. This performance filters well into gross profit, indicating that the company is able to continue operating at a healthy gross margin – 52.7% for 2021, to be exact.

SeekingAlpha.com ASML 1.20.22 SeekingAlpha.com ASML 1.20.22

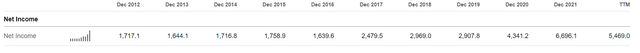

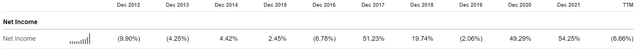

Of course, gross earnings are second to net earnings. Here, ASML has also continued to shine, posting record profits of $6.7B in 2021. Since it has already achieved 81.6% of last year’s earnings in the first 3 quarters of 2022, I would surmise that the results from Q4 2022 will add up to create another record year. These earnings will post in less than a week.

SeekingAlpha.com ASML 1.20.22 SeekingAlpha.com ASML 1.20.22

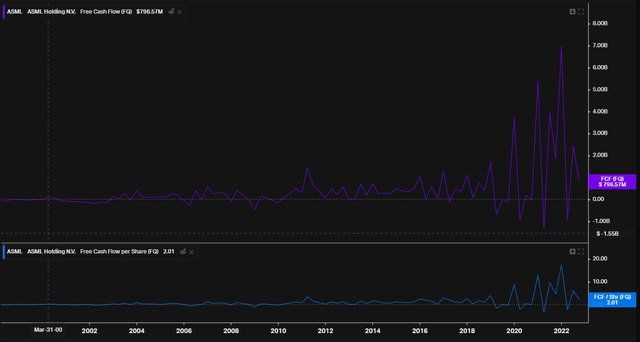

Along with this performance across both the top and bottom lines, ASML has been generating significantly increased levels of free cash flow over the last several years. The chart below illustrates just how much more valuable this business is becoming, with a series of new peaks across both quarterly FCF as well as FCF per share. Given its long production cycle, this cyclicality is natural.

Koyfin.com ASML 1.20.22

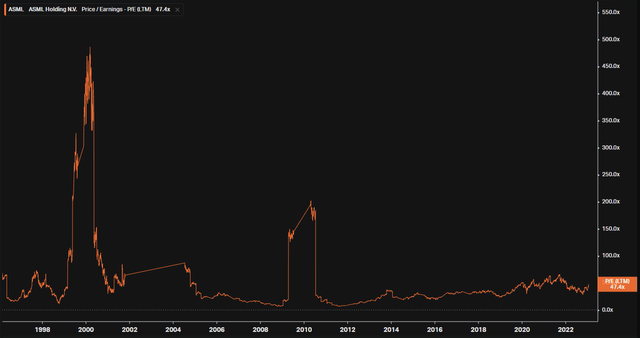

This trendline speaks for itself. Looking over to valuation, we see that ASML is trading at a 47.4 P/E multiple averaged out over the last 12 months. While this may be high in the absolute sense, it does not appear to be so on a relative basis to the company’s forward-looking earnings prospects.

Koyfin.com ASML 1.20.22

Conclusion

ASML is a clear winner. Through its state-of-the-art technology, robust customer base, as well as its long and increasingly successful operating history, I think this company is going to continue to outperform. As technology trends continue to mature, this company’s position in the global value chain will only become that much more important – yielding larger revenues, profits, and cash flows. Since this kind of technology is incredibly expensive and difficult to manufacture, it has a natural moat that will continue insulating it from competition. I am calling it a buy for the long-term.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.