FangXiaNuo

Synopsis

Armstrong World Industries (NYSE:AWI) is a number one supplier of ceiling and wall options throughout the Americas, serving each industrial and residential development and renovation markets. It has demonstrated a powerful monitor document of constant income development and maintains strong profitability margins. Strategic acquisitions and natural development from a mixture of giant, medium, and small initiatives, with main contributions from giant airport initiatives like Pittsburgh and Seattle, have pushed this quarter’s efficiency. Amid financial uncertainties, AWI has modestly upgraded its outlook for the second half of the 12 months, pushed by regular demand in healthcare and schooling, sturdy development in transportation, and speedy enlargement within the knowledge middle market, with ~100 initiatives within the pipeline. General, I’m giving a purchase advice for AWI inventory due to its sturdy development prospects and strong monitor document.

Historic Monetary Evaluation

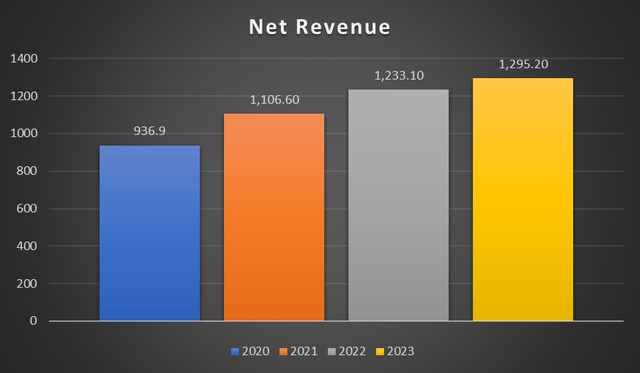

Creator’s Chart

Over time, AWI has demonstrated strong and constant income development. Its upward development in web income is constant, hitting a record-setting $1.29 billion. In FY23, the corporate reported web income of $1.29 billion, indicating a year-over-year development of ~5%, primarily as a result of an improved common unit worth [AUV] of $43 million and a stronger gross sales quantity of $19 million. Acquisitions of BOK Trendy and GC Merchandise primarily drive web gross sales development within the Architectural Specialties section. In FY22, its web gross sales have grown considerably by 11.3% year-over-year. Favorable AUV drives the mineral fiber section’s gross sales, however decrease gross sales quantity from lowered stock ranges within the first half of the 12 months and weaker demand within the latter half offset this development. Progress within the Architectural Specialties section was broad-based, with gross sales growing throughout numerous product classes, contributing considerably to the general section income improve.

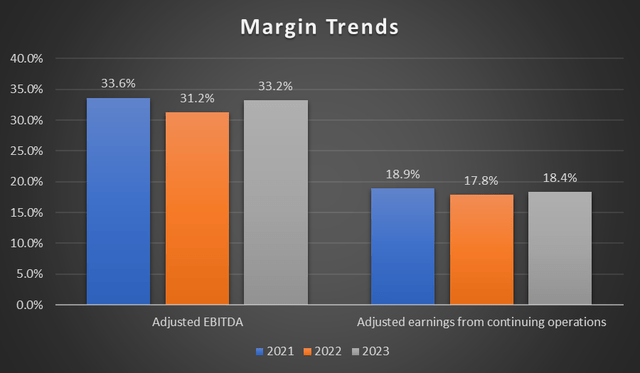

Creator’s Chart

Regardless of a slight dip in adjusted EBITDA and earnings from persevering with operations margins, the corporate’s margins have typically remained strong all through the years. In FY22, adjusted EBITDA margins have contracted barely to 31.2% earlier than recovering in FY23, attaining 33.2%. Adjusted earnings additionally fell in FY22 to 17.8%, and AWI made an effort to regain margin energy in FY23, attaining 18.4% in adjusted earnings margin. The Mineral Fiber section’s adjusted EBITDA margin has expanded by 180 bps, reaching 39.1% on account of favorable AUV and powerful contributions from its WAVE three way partnership. The Architectural Specialties section’s adjusted EBITDA margin has expanded by 230 bps, reaching 18.1% as a result of improved working efficiency in that 12 months.

Second Quarter Earnings Evaluation

AWI has reported a powerful Q2 efficiency with double-digit web income development and document earnings. Web income is up by 12.2% year-over-year, from $325.4 million to $365.1 million. Working revenue went up by 9.2% from $87.0 million to $95.0 million, whereas adjusted EBITDA grew by 12.5%. Adjusted web earnings per shares rose by ~17%, marking it the 6th consecutive quarter of year-over-year development. Each segments have carried out exceptionally nicely. The mineral fibre section gross sales grew by 7% year-over-year on account of beneficial AUV and stabilizing market demand. Whereas its Architectural specialties section grew by 26% year-over-year, primarily pushed by $20 million contribution from BOK and 3form acquisitions. General working revenue margin has declined barely by 70 foundation factors. The Mineral Fiber section noticed a rise in working revenue margin, enhancing by 40 foundation factors, whereas the Architectural Specialties section skilled a decline, dropping by 90 foundation factors to 12.4%. The administration has raised its full-year 2024 steering because of the strong efficiency this quarter.

Enterprise Overview

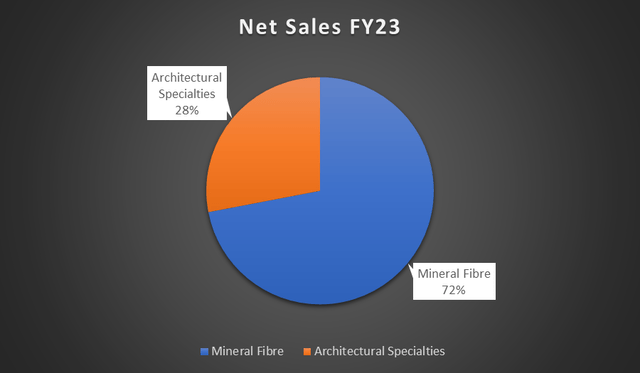

AWI is a market chief in innovation, manufacturing, and design of economic and residential ceiling and wall options within the Americas. They produce their merchandise crafted from all kinds of supplies, equivalent to glass-reinforced-gypsum, wooden, felt, steel, mineral fiber, and fiberglass wool. AWI’s three way partnership with Worthington Enterprises, Worthington Armstrong Enterprise [WAVE], manufactures ceiling suspension system merchandise. We are able to segregate its enterprise into two segments: Mineral Fiber and Architectural Specialties. Mineral Fiber accounts for almost all of the gross sales, manufacturing suspended mineral fiber and tender fiber ceiling methods. They’re principally bought to resale distributors, contractors, wholesale, and retailers. This section additionally accounts for WAVE’s efficiency, which manufactures suspension methods and ceiling part merchandise. The Architectural Specialties segments account for the remaining gross sales. This section manufactures, designs, and sources ceilings, partitions, and facades for industrial makes use of.

Creator’s Chart

Progress Alternatives in Knowledge Facilities

Surrounded by uncertainties from inflationary pressures and rates of interest and their general influence on the financial system, AWI has modestly upgraded its outlook for the remaining half of the 12 months. Because the workplace sectors continued to be challenged, it has proven indicators of stabilization with improved regional exercise. San Francisco is experiencing renewed exercise pushed by AI demand for workplace house. There has additionally been a resurgence of tech initiatives within the Pacific Northwest. The healthcare and schooling sectors are holding regular, offering constant demand. The transportation sector stays sturdy, contributing positively to AWI’s enterprise. Knowledge facilities are recognized as an space of speedy development, providing greater worth alternatives for grid and part gross sales. In the intervening time, AWI is monitoring ~100 knowledge middle initiatives.

As well as, WAVE has not too long ago acquired all of the property of Amherst, Knowledge Centre Assets, LLC [DCR]. This acquisition contains its Cool Protect model, which focuses on designing and manufacturing aisle containment options for knowledge facilities. It’s a trusted and respected model amongst knowledge facilities in the US. DCR Options focuses on maximizing knowledge middle energy utilization and enhancing cooling efficiencies, which helps to scale back working prices and stress on electrical grid infrastructure. These merchandise additionally handle lengthy development lead occasions and shortages of expert labor within the rising knowledge middle trade.

Tailwinds within the Architectural Specialties Enterprise

Strategic acquisitions like 3form and BOK Trendy have considerably boosted this quarter’s efficiency within the Architectural Specialties section. The section has grown by 26% year-over-year, primarily as a result of acquisition contributions in addition to natural development pushed by giant transportation initiatives. BOK Trendy, which was acquired in 2023, has been performing in step with expectations. The agency’s experience lies in designing and creating architectural steel methods, which positions AWI’s presence within the accretive Architectural Specialties market. As well as, the acquisition of 3form additionally expands AWI’s Architectural Specialties portfolio, bringing in distinctive capabilities with translucent ending, notably for coloration, texture, and light-weight to raise the design of areas.

Along with its strategic acquisitions, AWI has been awarded with a number of transportation initiatives that can present constant tailwind for at the least three to 4 years. These embrace giant transportation initiatives, equivalent to Pittsburgh and Seattle airports. Tampa and Fort Myers airports are more moderen ones. Steady involvement in giant transportation initiatives demonstrates AWI’s means to safe and execute giant, long-term contracts, that are vital development drivers on this enterprise.

Relative Valuation Mannequin

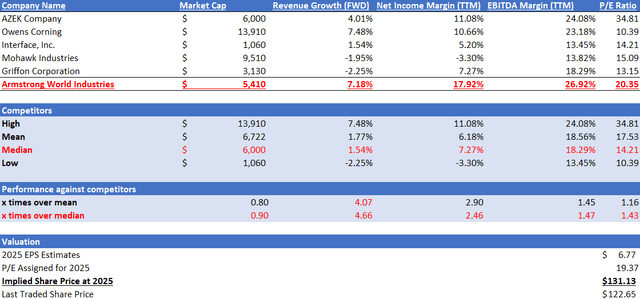

Creator’s Relative Valuation Mannequin

In response to Looking for Alpha, AWI operates within the constructing merchandise trade. In my relative valuation mannequin, I’ll examine AWI in opposition to its friends when it comes to development outlook and profitability margins trailing twelve months [TTM].

Beginning with development outlook, AWI considerably outperformed its friends’ median. AWI has a ahead income development fee of seven.18%, which is 4.66x over the friends’ median of 1.54%. By way of profitability margins TTM, AWI additionally outperformed its friends’ median in each EBITDA margin TTM and web revenue margin TTM. For EBITDA margin TTM, AWI reported 17.92%, in comparison with friends’ median of seven.27%. For web revenue margin TTM, AWI reported 26.92%, greater than friends’ median of 18.29%. General, AWI outperformed friends in each development outlook and profitability margins.

At the moment, AWI’s ahead non-GAAP P/E ratio is 20.35x, whereas friends’ median is 14.21x. Given AWI’s sturdy outperformance, I argue that it’s truthful for AWI to be buying and selling at a premium. AWI’s 5-year common ahead P/E is nineteen.37x. To stay conservative in my valuation method, I might be adjusting my 2025 goal P/E for AWI down in the direction of its 5-year common.

For 2024, the income estimate for AWI is roughly $1.43 billion, whereas EPS is $6.09. For 2025, the income estimate is roughly $1.52 billion, whereas EPS is $6.77. Based mostly on my forward-looking evaluation as mentioned, these estimates are justified as they’re supported by the beneficial outlook of the expansion drivers mentioned in my evaluation. Due to this fact, by making use of my 2025 goal P/E to its 2025 EPS estimate, my 2025 goal share worth is $131.13.

Conclusion & Threat

AWI has been pulling sturdy numbers this quarter, pushed by its strategic acquisitions and natural development from a number of initiatives, which has led to an improve in its full-year steering. Nevertheless, a slowdown in development begins, notably in industrial development, would influence AWI’s development if such demand doesn’t compensate for the decline. Although market circumstances are stabilizing, there are encouraging indicators in transportation, healthcare, and knowledge facilities, that are key areas of alternative and energy. Given its sturdy monitor document of profitability and promising development forecast, I might fee AWI a purchase.