akinbostanci/iStock by way of Getty Footage

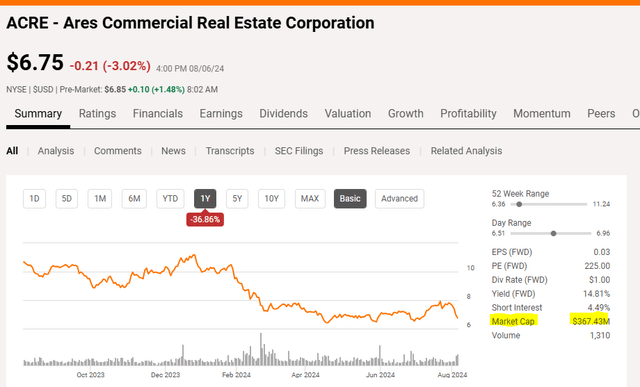

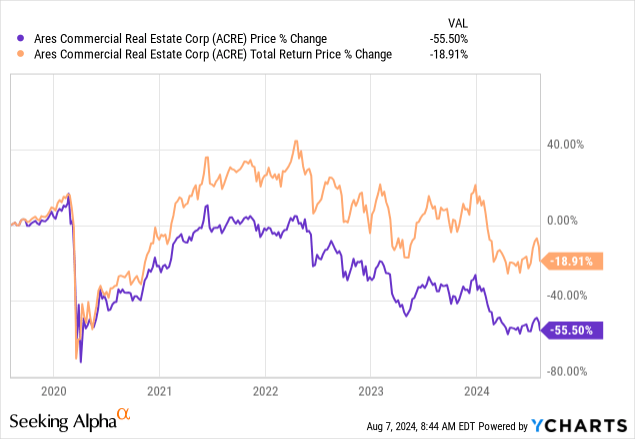

We first wrote about Ares Enterprise Precise Property Firm (NYSE:ACRE) in February 2024. The idea then was that the poor distribution safety would finish in a cut back, sooner reasonably than later. The exact distribution cut back acquired right here inside two weeks, and the stock has responded in kind. Full returns have been unfavorable, even accounting for the distributions.

In search of Alpha

In our subsequent safety, we made the reasonably unusual title {{that a}} second distribution cut back may very well be coming inside a yr. It has been three months since that article and the stock is flat. The present outcomes did current a risk to see whether or not or not each little factor is on schedule or not, and we dived correct in.

Q2-2024

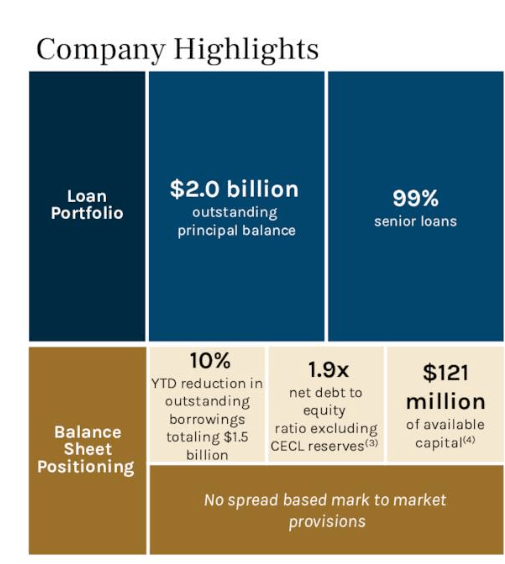

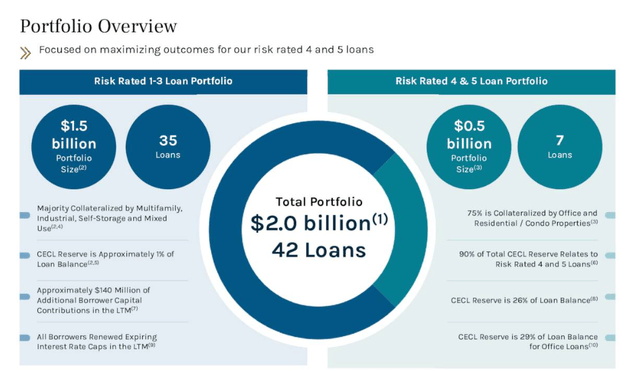

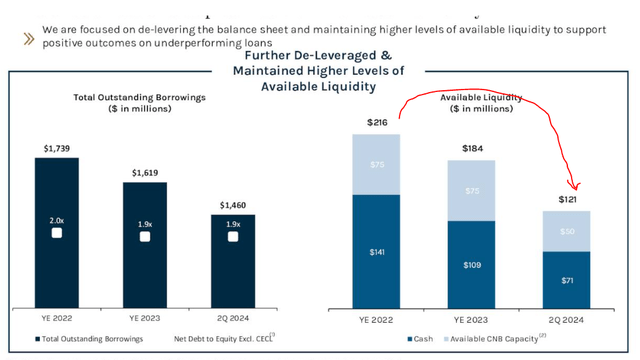

The company’s slide work started off by highlighting the vital factor causes it’s essential to make investments proper right here. That options their debt low cost yr up to now and the reality that that they had been working solely a 1.9X debt to equity leverage ratio.

ACRE Q2-2024 Presentation

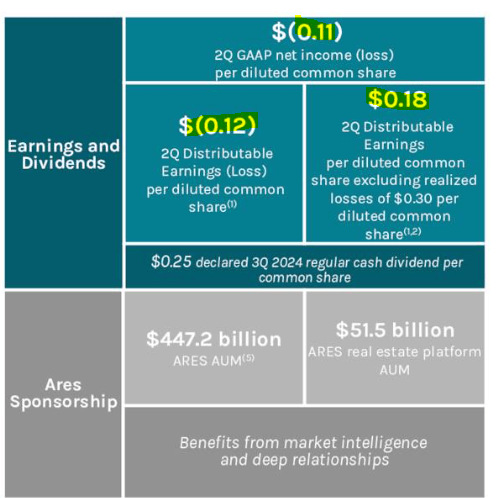

Sadly, the alternative half of that exact same first slide confirmed what an unmitigated disaster the earnings assertion was in Q2-2024. GAAP (positive, pay attention earnings chasers) was unfavorable 11 cents. Their distributable earnings metric was moreover at unfavorable 12 cents. One final metric thrown in there was the distributable earnings excluding losses, which acquired right here to 18 cents.

ACRE Q2-2024 Presentation

In case you had been alarmed by the reality that none of them acquired right here close to the 25 cents of declared distribution, we’d counsel you’re too late. At this stage you must be in panic mode, not merely anxious. So what went fallacious this quarter? Correctly, for starters, one different huge mortgage went on non-accrual and this was inside the multifamily enviornment. Moreover they took a bathe on a stage 5 office mortgage, which was supplied at a large loss.

ACRE Q2-2024 Presentation

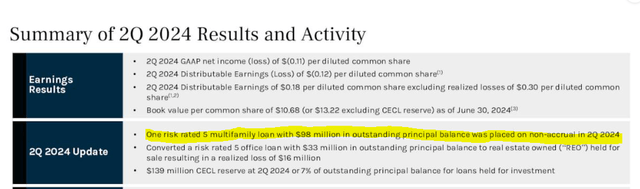

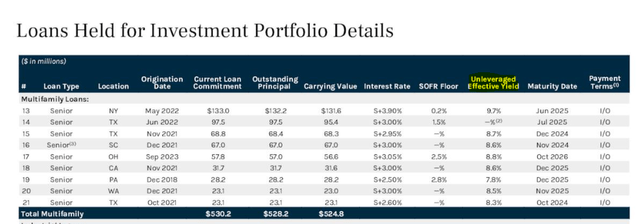

Nonetheless let’s get once more to that multifamily mortgage. In any case, the bullhorn might go that this was just one mortgage. It was already a menace stage 5. So what’s the concern? The concern as on a regular basis is that ACRE has not confirmed the ability to make many good loans. The number of these that protect falling into non-accruals is fairly terribly. Let’s not overlook that $98 million is just not exactly chump change for ACRE. Their entire market capitalization is $367.43 million.

In search of Alpha

Let’s moreover not overlook that they’ve menace 4 and 5 rated loans that exceed their market capitalization, by a lot.

ACRE Q2-2024 Presentation

These are various the salient choices you need to think about sooner than you go diving into that “I get a 15% yield” mentality.

Outlook

They didn’t cut back the distribution, no matter all their very personal metrics displaying that that they had been nowhere shut to creating it work. As these losses work their method into the books, ACRE should cut back debt further to cease its leverage from creeping up. The side influence of that’s that its liquidity retains dropping.

ACRE Q2-2024 Presentation

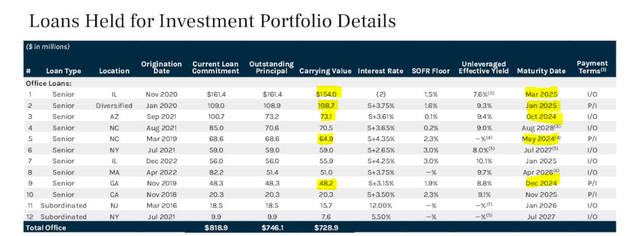

It’ll drop even further if ACRE insists on paying that outlandish uncovered dividend. The office portfolio itself is about 2X the market cap and properly in further of even the tangible equity. A complete lot of those are arising for renewal shortly, and we anticipate further losses proper right here.

ACRE Q2-2024 Presentation

As this quarter confirmed, even multifamily is cracking, and the mortgage that dropped into non-accrual was its second largest in that space. A reminder proper right here that ACRE simply isn’t getting these unleveraged yields because of it’s lending to AAA stage initiatives.

ACRE Q2-2024 Presentation

There could also be extra prone to be significantly further ache. In any case, merchants might attempt to latch on the Fed price cuts. If these happen inside the context of a common or excessive recession, you’re unlikely to get any help from them. Moreover, do phrase that there’s a big lag between cuts and an affect to ACRE. We’d assume 12-18 months or so. Nonetheless let’s merely take a look on the distribution potential proper right here, assuming that we don’t see further hurt.

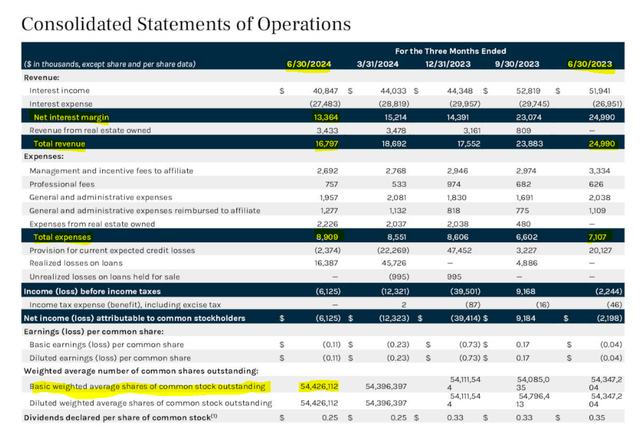

The consolidated statements of operations reveals how web curiosity margin has been collapsing over the past 4 quarters. Now now we have dropped from circa $25 million to $16.8 million. Merely that web curiosity earnings minus the payments will get us close to $8.0 million quarterly run price.

ACRE Q2-2024 Presentation

A couple of of that’s depreciation on precise property owned, nevertheless that may very well be a really cheap worth on these properties that it has been compelled to takeover. $8.0 million divided by 54.4 million shares will get us to under 15 cents a share. That’s your absolute best-case situation for a distribution in 1-2 quarters.

Verdict

ACRE held the highway of the distribution. The rationale likely was that they wished to steer clear of a panic. Nonetheless a sustainable run-rate inside the best-case situation is spherical 15 cents in our opinion. Within the occasion that they want to assemble a buffer to take care of their factors, 10 cents 1 / 4 distribution makes further sense. In any case, that may kill the stock. It likely reprices to a 15% yield on that 40 cents fairly shortly. That’s the place it’ll get to sooner than it attracts inside the new investing champs salivating at a 15% yield and “low price to e-book value”. ACRE now will get the utmost rating on our proprietary Kenny Loggins, dividend hazard, scale.

Author’s Scale

There’s a trigger ACRE has been a nasty select even amongst mortgage REITs over the past 5 years.

We downgrade this to a Sturdy Promote and search for no less than a 40% distribution cut back inside 2 quarters.