Apple’s celebrating ten years of Apple Pay as we speak, and it’s clear that the Cupertino-based big is fairly happy with its cost choices. I’ll be the primary to confess that Apple Pay continues to be helpful and handy ten years down the highway; more often than not, reasonably than reaching for a bodily card, I merely double-tap the ability button on my iPhone and pay.

A lot extra card companions have arrived within the years for the reason that authentic launch, and extra retailers have been adopting the usual. Whereas new methods to pay, together with rewards, had been teased at WWDC 2024, we’re now seeing these arrive with iOS 18 and much more companions being introduced. All in all, it is freshening the methods you may pay with Apple Pay.

You’ll now be capable of try with Apple Pay and redeem rewards from eligible playing cards – like miles or factors from Uncover bank cards within the US – in addition to entry installment loans from Affirm within the US and Monzo Flex within the UK, and versatile cost choices from Klarna within the US and UK.

Pay with rewards or two new cost choices

Obtainable now with iOS 18 for folk in america on an iPhone or iPad, you’ll now be capable of choose rewards like factors (assume cashback) or miles from eligible Uncover Playing cards to pay for the entire quantity or a portion at checkout. Apple’s built-in this feature immediately on the checkout display – which takes up a portion of the underside of your gadget – and it feels fairly intuitive. It is going to, by default, present you the utmost quantity you may redeem, and by tapping on it, you may alter the quantity.

Even neater, although, and fixing only a sliver of the puzzle that’s airline mile price, it would even provide the conversion of what one mile equals to {dollars}. That’s fairly helpful. This expertise of utilizing card rewards at checkout in Apple Pay is simply beginning with choose Uncover playing cards now, however extra companions will roll out sooner or later. Apple confirmed that choose Synchrony, Fiserv, and FIS playing cards in america and DBS in Singapore will allow you to use rewards.

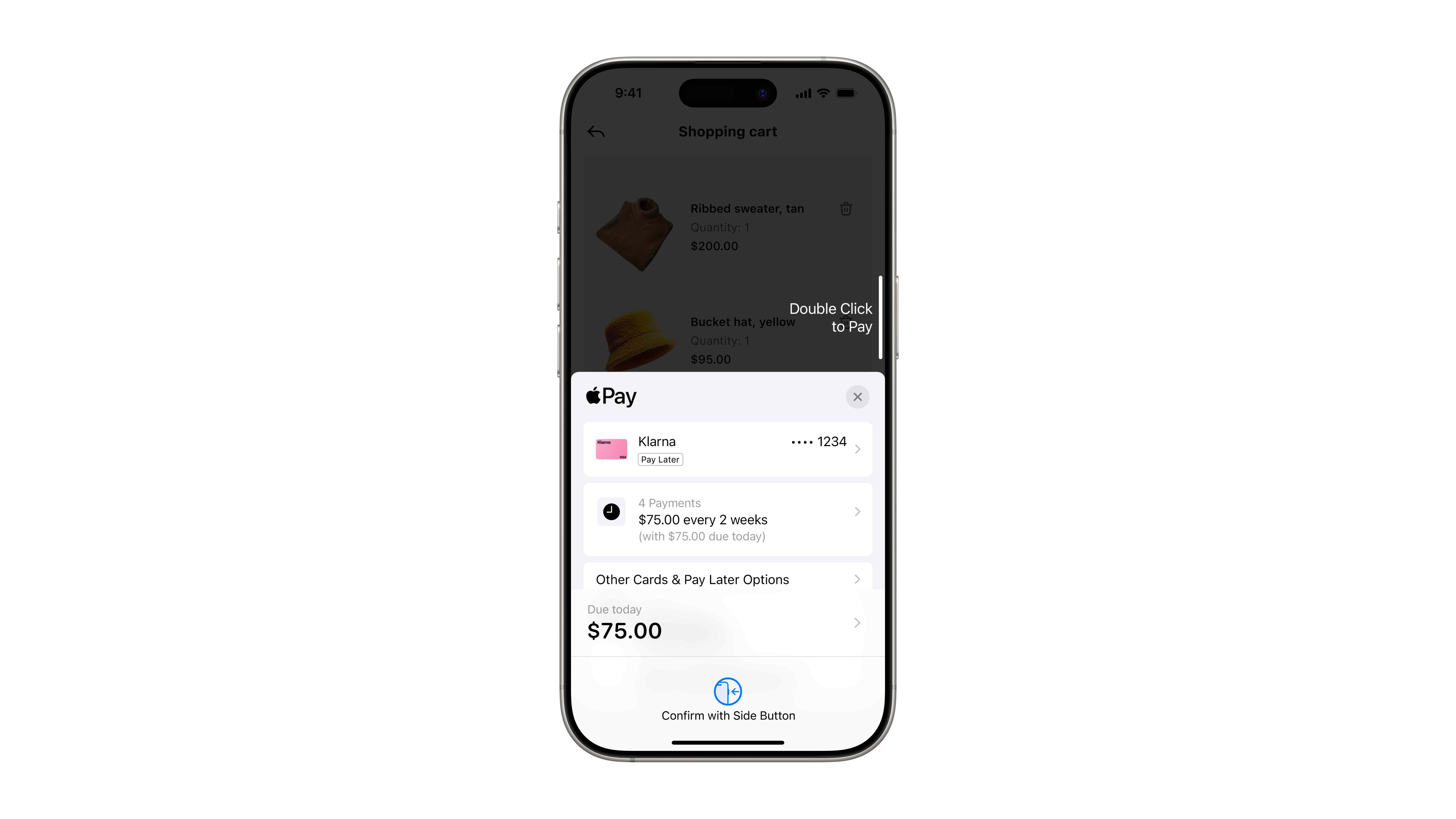

Past rewards, although, Apple is including two new cost choices and the primary of which may be seen because the accomplice successor to Apple’s since closed down Apple Pay Later. First, Klarna’s versatile cost choices at the moment are out there for folk trying out on Apple Pay — with iPhone and iPad, on-line and in app – in america and the UK. Permitting you to pick out the service as a cost choice, get permitted, and choose a plan for splitting the cost. It’s price noting you received’t see the costs hit weekly or bi-weekly (every cost choice differs), and also you’ll want to go to the Klarna app for these.

Second, installment mortgage cost choices are arriving with iOS 18 as effectively. In america, these are finished by Affirm, whereas in the UK, these are finished by Monzo. With these you’ll get permitted for the mortgage, can choose phrases – and see which have curiosity related – after which full the checkout course of. This can be a fairly huge step and a direct substitute for Apple’s personal “Apple Pay Later” installment plans. It is going to even be increasing sooner or later sooner or later to a number of different nations, together with ANZ in Australia and CaixaBank in Spain.

As a complete these new methods to pay, and recent companions, reinvigorate the Apple Pay expertise a bit. It’s additionally key that it doesn’t change the benefit of use that makes Apple Pay a stellar service and performance of Apple’s myriad gadgets. I believe the addition of rewards – for factors and miles – within the Apple Pay checkout course of might be very helpful and can let many make higher use of factors, just like how one can try with factors on Amazon. Nonetheless, they could drain sooner.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25799625/247465_Barbie_Phone_AJohnson_0004.jpg)