Justin Sullivan

Article Thesis

Apple (NASDAQ:AAPL) has been an excellent performer in recent months, and shares hit a new all-time high on Monday, the beginning of its 5-day-long WWDC event. WWDC showcased some solid updates and products so far, but nothing seems game-changing. Overall, AAPL remains a high-quality company that seems to trade at a too-high valuation for an investment at current prices.

What Happened?

Apple’s shares, which are up by a massive 46% year-to-date, hit a new all-time high on Monday, at $185. The company is now valued at $2.9 trillion, just shy of the $3 trillion mark. WWDC, Apple’s annual software-focused event, has started out on Monday and will run through Friday.

What Apple Has Shown At WWDC So Far

Every year, prior to the beginning of Apple’s WWDC event, there are some rumors about what Apple might showcase. This year, rumors included a new version of the MacBook Air, new iterations of Apple’s Macs, and an entirely new hardware product, a mixed reality headset. Of course, Apple also showcases a lot of new software and features at its WWDC events, such as new versions for macOS and watchOS.

Looking at what Apple has announced so far this year, the following are noteworthy:

– Apple announced a new MacBook Air version with a 15-inch screen, larger than the past 13-inch versions. 13-inch versions are still available. While Apple’s Macs are far from the largest business units and while sales in this area have been struggling recently, the new version could attract some customers that want a larger screen but that don’t need the performance advantages of the MacBook Pro versions.

– Apple announced “Game Mode” for its Macs. That’s aimed at improving the performance of games for Mac users, a similar technology is also available for Windows. Gamers generally don’t use Macs, despite the strong performance specs of Macs, as most games aren’t directly available for Macs. Apple also announced a new gaming portability kit that is aimed at making it easier for developers to port their games to Apple’s ecosystem. This could indicate that Apple wants to become a larger force in this growth market – if Apple executes well in that regard, it could open up a new market segment, as Apple currently isn’t doing well in the gaming hardware market.

– Apple announced that its Health app will come to the iPad. That improves the general strength of the ecosystem, as users can track things better across different products. On top of that, this may also indicate that Apple continues to see the health market as a major future growth driver – investing in this area and adding new features in order to become even more attractive to customers could make a lot of sense.

– Apple announced the new Mac Pro with Apple’s new M2 Ultra chip. The Mac Pro will have up to 76 GPU cores and up to 24 CPU cores. With up to 192 GB of RAM, this Mac will be extremely powerful. A 32-core neural engine could also make the new Mac Pro attractive for AI use cases. While a high price will limit the addressable market, Apple could still strengthen its market position in the high-end segment with this product. The new Mac Studio has also been announced and will also offer up to 192 GB of RAM while either using the M2 Max or M2 Ultra chip. Again, the addressable market will not be gigantic for a high-priced product like that, but Apple’s tech looks strong, which could still result in some market share gains. The new versions also prove that Apple is very much focused on its own silicon, becoming more and more independent from (former) suppliers such as Intel (INTC). In that regard, Apple noted several times that the new Mac versions using its own chips are performing way better than the Mac versions using Intel’s chips. This is bad news for Intel, which has been losing data center market share to competitors such as AMD (AMD) and which is also more and more excluded from high-end products such as Apple’s Macs.

– Likely the biggest news, Apple announced its mixed-reality headset. The Apple Vision Pro has been widely anticipated, and while it is too early to say how big this product will eventually become – a high price could make many consumers forego a purchase – the tech looks interesting for sure. As an example, the Vision Pro will allow users to see a screen larger through their headset, e.g., by looking at a Mac screen. It will be controlled via the eyes, hands, and speech, but does not use external hand controllers, unlike Meta’s (META) headset.

Recent Non-WWDC News

While Apple’s WWDC event got a lot of attention, there has been other recent news on top of that. This includes Apple’s large deal with Broadcom (AVGO), which I covered here more in-depth. In short, Apple will buy billions of dollars’ worth of wireless connectivity components from Broadcom. This has been primarily a success for AVGO and is less impactful for Apple overall, but it’s worth noting that this deal will help Apple increase its portion of US-manufactured components. In a scenario where tensions between the US and China escalate, that could be advantageous.

Taiwan Semiconductor Manufacturing Company Limited (TSM), the world’s largest foundry, which produces chips for a wide range of companies, including Apple, AMD, and NVIDIA (NVDA), has announced that it will increase prices meaningfully (by around 5%) next year. While this will hardly break Apple’s large margins, it could still add some incremental margin pressure, all else equal. Alternatively, it could force Apple to increase pricing across its product portfolio (or give Apple a good reason to do so, in case the company planned to increase prices anyways).

Berkshire Hathaway (BRK.A) (BRK.B), headed by Warren Buffett, has been a major shareholder of Apple for a long time. And despite the large allocation, Warren Buffett continues to add to his stake from time to time. During the first quarter, Berkshire bought another $600 million worth of Apple stock, according to Warren Buffett. The oracle of Omaha stated that this happened during a sell-off, thus we can assume that prices were considerably lower than they are today – and that APPL stock thus was a better value. If Warren Buffett bought shares at $130, for example, that does not mean that they are a buy at $180 as well – valuation matters, of course. The Buffett purchase can still be seen as an endorsement – Apple is a quality company – but it does not mean that Apple is a great value at all-time highs, as Buffett bought at significantly lower prices. In fact, Berkshire’s total stake in Apple was bought at a weighted average price of around $40 and Berkshire is sitting on gains of several hundred percent – that was a great investment, of course, but does not mean that shares should be chased or bought at any price.

High-Quality Companies Can Be (Too) Expensive

Almost no one will argue that Apple is a low-quality company or that its products aren’t great. I believe that Apple is very much a high-quality company and that it continues to design and sell quality products. But that alone does not mean that Apple is a buy at every price and at every valuation.

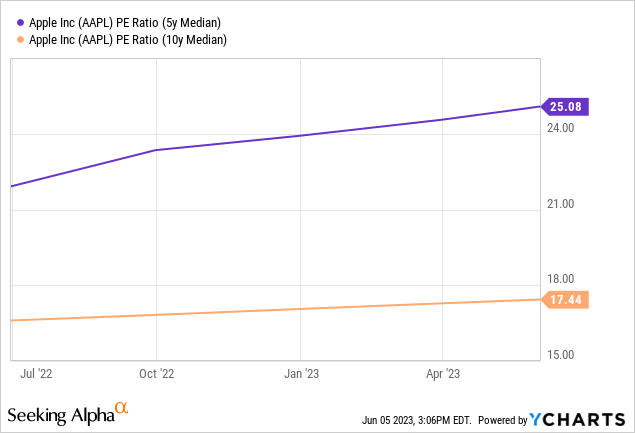

Today, Apple is valued at a little more than 30x net profits. That’s a high valuation for a hardware tech company (and that is what Apple is, as hardware products make up the vast majority of sales and earnings), and it is also a high valuation when we look at AAPL’s historic trading range:

Apple trades at a 20% premium compared to the 5-year median earnings multiple. That was a time of unprecedented fiscal and monetary stimulus, which has ended now, however. It would thus make sense for valuations to be lower than they were over the last five years, on average, I believe (this holds true for Apple and all other companies). Apple trades at a premium of close to 80% relative to the 10-year median earnings multiple.

This could be justified if Apple were to grow much faster in the future, relative to the last five and ten years. But I believe this is unlikely. First, economic conditions have worsened, and we could enter a recession in the coming quarters. This will likely pressure consumer spending and would thus pose a headwind for Apple’s profits. Second, Apple is now a much larger company than ten years ago. The law of large numbers dictates that relative growth will inevitably slow down as a company becomes larger and larger, as maintaining a high relative growth rate forever is impossible.

While Apple is a quality company, the huge premium relative to the historic norm isn’t justified, I believe. A 3% earnings yield isn’t very attractive from a hardware tech company that will show some growth in the long run, but that can’t grow explosively any longer due to its already massive size. In a world where very low-risk fixed-income investments offer yields of 4% to 5%, a 3% earnings yield and a 0.5% dividend yield just aren’t good enough.