Up to date on March 4th, 2022, by Nikolaos Sismanis

Appaloosa Administration was based in 1993 by David Tepper and Jack Walton. The agency used to function as a junk bond funding firm within the Nineteen Nineties however developed by the 2000s to grow to be a extra diversified hedge fund.

It has been probably the most profitable hedge funds by specializing in public fairness and glued revenue markets all over the world, delivering jaw-dropping returns to its institutional traders throughout instances of misery.

As of its final 13F submitting, the fund had ~$3.8 billion in managed securities below administration, a 15.7% decline from its earlier quarter amid decrease capital allocation in its public-equity holdings, probably as a consequence of shedding some purchasers.

Buyers following the corporate’s 13F filings during the last 3 years (from mid-February 2019 by mid-February 2022) would have generated annualized complete returns of 11.97%. For comparability, the S&P 500 ETF (SPY) generated annualized complete returns of 18.17% over the identical time interval.

Observe: 13F submitting efficiency is totally different than fund efficiency. See how we calculate 13F submitting efficiency right here.

Click on the hyperlink beneath to obtain an Excel spreadsheet with metrics that matter of Appaloosa Administration’s present 13F fairness holdings:

Hold studying this text to study extra about Appaloosa Administration.

Desk Of Contents

David Tepper

Little will be mentioned about Appaloosa Administration with out mentioning its legendary supervisor David Tepper. Mr. Tepper has been one in all Wall Road’s highest-paid hedge fund managers of the previous decade, delivering market-beating returns throughout recessionary instances.

His internet price is at the moment round $15.8 billion. His fortune was made by Appaloosa, having the vast majority of his property connected to the fund. Mr. Tepper has created most of his and Appaloosa’s worth by navigating the fund’s allocations throughout instances of misery.

In 2001, for instance, when the market was struggling huge losses amid the dot com bubble, Mr. Tepper generated a 61% return by specializing in distressed bonds. Through the Nice Recession, he embraced the “purchase when there may be blood within the streets” mentality by buying distressed monetary shares.

Whereas everyone else was dumping their shares, Tepper was scooping up shares, together with his well-known play of shopping for Financial institution of America (BAC) shares for $3 every, in addition to AIG’s debt.

His daring bets paid off massively. From 2009 to 2010, the fund’s property below administration grew from $5 billion to $12 billion. Round $4 billion of those positive factors had been added to Mr. Tepper’s internet price, making him the best earner of the recession and forming the vast majority of his wealth.

Final yr, Mr. Tepper introduced his retirement to pursue proudly owning the Carolina Panthers soccer crew, which he purchased in 2018 for a report $2.3 billion. A portion of Appaloosa’s property left the fund, which can clarify its present diminished AUM of $4.8 billion.

Appaloosa Administration’s New Buys & Sells

Throughout its newest 13F submitting, Appaloosa Administration executed the next notable portfolio changes:

Noteworthy New Buys:

- Common Motors Co (GM)

- Dicks Sporting Items, Inc (DKS)

- Hole (The) (GPS)

- Foot Locker Inc. (FL)

Noteworthy New Sells:

- HCA Healthcare Inc (HCA)

- Alibaba Group Holding Ltd ADR (BABA)

- Cvent Holding Corp (CVT)

- Beachbody Firm Inc (The) (BODY)

Appaloosa Administration’s Present Main Investments

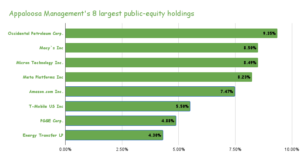

Appaloosa Administration’s long-term technique has centered on concentrated funding positions with multi-bagger potential. This funding philosophy appears to be the case effectively after Mr. Tapper’s departure, because the fund’s practically ~$3.8 billion-worth public fairness portfolio consists of solely 30 shares, with the highest 5 accounting for round 42.0% of its complete holdings.

Supply: 13F Filings, Creator

The fund’s 10 largest investments are the next:

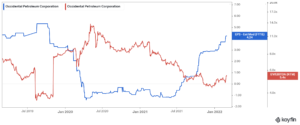

Occidental Petroleum Company (OXY)

On August eighth, 2019, Occidental acquired Anadarko. Occidental pursued this acquisition due to the promising asset base of Anadarko within the Permian, which has enhanced the already sturdy presence of Occidental within the space, and the $3.5 billion annual synergies it expects to attain. Nevertheless, this can be a enormous acquisition, because the $38 billion worth of the deal is sort of equal to the present market cap of Occidental. Occidental secured $10 billion in funding from Berkshire Hathaway (BRK.A) in alternate for most well-liked shares, which obtain an 8% annual dividend.

In late February, Occidental reported monetary outcomes for the fourth quarter of fiscal 2021. The common realized costs of oil and gasoline grew 10% and seven%, respectively, over the prior quarter whereas the chemical section posted report earnings due to vast margins amid sturdy pent-up demand. Because of this, Occidental grew its adjusted earnings per share by 70%, from $0.87 to $1.48. Resulting from its excessive debt load, Occidental is likely one of the best beneficiaries in its sector from the 7-year excessive costs of oil and pure gasoline. It diminished its internet debt by $6.7 billion in 2021, to $47.6 billion. As well as, it not too long ago introduced that it’ll retire not less than one other $2.5 billion of debt in 2022.

It’s price noting that the inventory trades comparatively cheaply from a ahead EV/EBITDA perspective. The corporate can be anticipated to attain near-record EPS this yr amid elevated commodity value ranges.

Occidental is Appaloosa’s largest holding. The fund held its place regular over the past quarter.

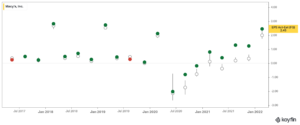

Macy’s, Inc. (M)

Macy’s climbed to the corporate’s high ten holdings after the fund elevated its place within the inventory by 93% final yr.

Macy’s reported its fourth-quarter earnings outcomes on February twenty second. Revenues totaled $8.67 billion throughout the quarter, which beat consensus estimates by $220 million. Macy’s revenues had been up by 27.9% versus the earlier yr’s quarter, which had seen a big pandemic influence.

The income enhance will be defined by the easing coronavirus pandemic within the US. This resulted in a significant margin enchancment in comparison with the earlier yr’s quarter. Macy’s generated earnings-per-share of $2.45 throughout the interval

The corporate has overwhelmed estimates constantly over the previous few quarters as illustrated beneath, which is quite promising with reference to its future prospects contemplating that its funding case nonetheless holds notable dangers.

The inventory accounts for 8.5% of Appalossa’s portfolio.

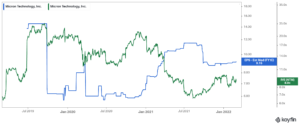

Micron Expertise (MU)

Regardless of Appaloosa trimming its Micron Expertise stake by 51% final yr, the corporate is at the moment the fund’s third-largest holding, accounting for round 8.5% of its public fairness investments. The inventory has skilled a spectacular rally over the previous 5 years, because the demand for its semiconductors has been explosive.

Whereas the inventory is taken into account speculative, its strong profitability during the last a number of years has confirmed bears and short-sellers fallacious. Many had predicted that the corporate’s high & backside traces would endure as a result of pandemic.

Nevertheless, Micron posted a strong FY2021 internet revenue of $5.86 billion. The corporate is predicted to provide EPS of $9.15 subsequent yr. This means a ahead P/E within the single digits which certainly suggests a comparatively honest a number of for a semiconductor firm.

Nonetheless, the business stays wildly cyclical, which may translate to unstable future efficiency for MU’s shareholders.

Appaloosa held its Micron place regular throughout the quarter.

Meta Platforms, Inc. (FB)

Appaloosa decreased its Meta Platforms stake by round 3%, although the inventory remains to be the portfolio’s second-largest holding. Meta shares account for round 8.2% of the fund’s holdings. With sturdy progress, a wholesome stability sheet, and the perfect platform for advertisers to make the most of, Meta stays a horny choose at an inexpensive valuation.

Meta is an incredible money cow, however with an issue. With sturdy financials, a wholesome stability sheet, and the perfect social media platform for advertisers, Meta has been dominating the social media business. The corporate reported an all-time excessive backside line of $19.37 billion in FY2021, amid nice consumer progress, however now decelerating to the one digits.

For these causes, it will not be an entire shock if Meta paid a dividend sooner or later sooner or later.

Then again, the inventory has failed to draw the next a number of, because the steep scrutiny it has confronted over the previous few years have had an influence on the valuation. The inventory is just buying and selling at round 16.3 instances its underlying earnings, regardless of its fast progress.

With its ARPU (common income per consumer) nonetheless very sturdy, Meta’s financials are greater than more likely to proceed increasing quickly. Meta’s funding case in the present day doesn’t solely embrace the potential for a major upside but additionally comes with an awesome margin of security.

If such a valuation enlargement by no means seems, and Meta continues to commerce at a ahead P/E of round 16.3, at an EPS progress fee of 10%-20% within the medium time period (which the present consumer and APRU progress trajectory may simply maintain), traders ought to obtain equally passable returns with a relentless valuation a number of.

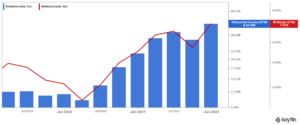

Amazon.com Inc. (AMZN)

Amazon is Appaloosa’s fifth-largest holding, comprising 7.5% of its complete portfolio. The fund held its place regular over the past quarter.

Amazon delivered one other stable quarter not too long ago, with This autumn AWS internet gross sales up 40% YoY to $17.78 billion, topping the $17.23 billion consensus estimate. Revenues grew to $137.4 billion, a 9.4% enhance YoY, contributing to all-time excessive LTM (final twelve months) gross sales of $469.8 billion.

Resulting from scaling its operations, the corporate’s internet revenue margins reached 7.1% throughout the previous twelve months, turning Amazon into an more and more worthwhile firm. The inventory is at the moment buying and selling at a P/E of 60.3 primarily based on this yr’s projected internet revenue, however contemplating its EPS progress, the corporate will probably develop into its valuation.

The inventory has had a spot in Appaloosa’s portfolio since Q1-2019.

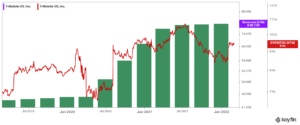

T-Cellular US, Inc. (TMUS)

T-Cellular has had a spot in Appaloosa’s portfolio since 2017. With T-Cellular buying Dash final yr, the corporate ought to have the ability to actively compete with AT&T (T) and Verizon (VZ). On account of the synergies to be unlocked, the corporate ought to bear a progress section over the following few quarters. Revenues rose by 2.2% to $20.79 billion in the newest quarter, with service revenues rising 6% to $15 billion.

Administration raised its merger synergy forecasts following the continuing integration progress. Round 50% of Dash’s buyer site visitors is now carried on the T-Cellular community, whereas roughly 20% of Dash prospects have been moved over.

It already achieved synergies of $3.8 billion for FY2021. Resulting from elevated investor expectations, the inventory’s valuation a number of has expanded, at the moment at a ahead EV/EBITDA a number of of 8.7.

The inventory at the moment occupies round 5.5% of Appaloosa’s portfolio. It’s now the fund’s sixth-largest holding.

PG&E Company (PCG)

PG&E Company engages within the sale and supply of electrical energy and pure gasoline to customers in northern and central California. The corporate owns and runs round 18,000 circuit miles of interconnected transmission traces, 33 electrical transmission substations, and about 108,000 circuit miles of distribution traces amongst different infrastructure property.

The corporate’s shares stay comparatively depressed following PG&E being held accountable for wildfires in recent times that destroyed tons of of hundreds of acres in California. The corporate’s internet debt place has grow to be more and more riskier. That mentioned shares commerce very near their e-book worth. Therefore the inventory could have upside contemplating that profitability has considerably improved. This can be the explanation Appaloosa has allotted capital on this speculative inventory.

PG&E Company is Appaloosa’s seventh-largest holding, accounting for round 4.9% of its holdings.

PG&E Company is Appaloosa’s seventh-largest holding, accounting for round 4.9% of its holdings.

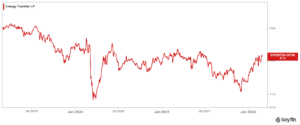

Vitality Switch LP (ET)

Vitality Switch operates one of many largest and most diversified portfolios of vitality property in the USA. Operations embrace pure gasoline transportation and storage together with crude oil, pure gasoline liquids, and refined product transportation and storage totaling 83,000 miles of pipelines. Vitality Switch, a $32.0 billion market capitalization firm, additionally owns the Lake Charles LNG Firm and stakes in Sunoco LP (SUN) and USA Compression Companions (USAC). On December seventh, 2021 Vitality Switch accomplished the acquisition of Allow Midstream Companions (ENBL) in a $7 billion stock-for-stock deal.

In mid-February, Vitality Switch reported monetary outcomes for the fourth quarter of fiscal 2021. The corporate posted all-time excessive NGL transportation and fractionation volumes for the second quarter in a row and likewise benefited from greater commodity costs and the acquisition of Allow. Because of this, distributable money move grew 18% over the prior yr’s quarter, from $1.36 billion to $1.60 billion.

Within the full yr, Vitality Switch diminished its long-term debt by $6.3 billion and thus maintained a good leverage ratio of three.07. It additionally offered steerage for adjusted EBITDA of $11.8-$12.2 billion in 2022 (vs. $13.0 billion in 2021) and raised the distribution by 15%. The lower in annual EBITDA is predicted as a result of abnormally excessive, non-recurring earnings reported within the first quarter of 2021 on account of winter storm Uri. Furthermore, administration acknowledged that it has a purpose of restoring the annual distribution to $1.22 sooner or later sooner or later.

Whereas items of Vitality Switch have considerably recovered recently, the inventory stays fairly valued at a ahead EV/EBITDA of 8.1 contemplating the continuing favorable vitality market surroundings and its total qualities.

Vitality Switch is Appaloosa’s eighth-largest holding, accounting for round 4.3% of its public fairness portfolio.

Remaining Ideas

Appaloosa Administration has had a affluent previous, with a number of achievements below Mr. Tepper’s management. The agency has spoiled its traders with jaw-dropping returns throughout adversarial financial instances. Mr. Tepper’s departure marks a brand new period for the fund.

The agency’s public holdings have underperformed the market over the previous three years, however it nonetheless could also be early to guage. The agency may very well be well-positioned to shine going ahead contemplating administration’s prolonged expertise.

Extra Sources

See the articles beneath for evaluation on different main funding corporations/asset managers:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].