marchmeena29

On November 2, 2022, the central bank is generally expected to increase its benchmark interest rate by another 75 basis points. This would be the fourth jumbo-sized rate increase of 75 basis points in 2022.

Unfortunately, this means that pressure on valuation and net interest margin is growing for mortgage real estate investment trusts like Annaly Capital Management, Inc. (NYSE:NLY).

The real estate investment trust released its 3Q 2022 results last week, and those figures revealed yet another sharp QoQ decline in book value. Despite the fact that Annaly was able to pay its dividend with earnings that were available for distribution, the firm is currently experiencing challenges that could result in a bigger discount to book value in the future.

Another Rate Hike Incoming

On Wednesday, the central bank is expected to determine whether to raise interest rates again, and it is anticipated that the Federal Reserve will increase its benchmark interest rate by an additional 75 basis points.

In 2022, the central bank increased its benchmark interest rate three times by 75 basis points each, marking the most significant rate increase in more than 20 years.

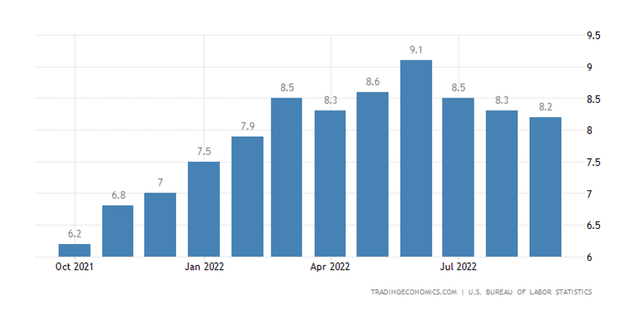

The justification for the sharp uptick in interest rates is the need to tame inflation which, despite cooling off a bit in recent months, still stays near 40-year highs. 8.2% was the rate of inflation in October, and it was probably high during November as well.

Interest Rates (Tradingeconomics.com)

The central bank is attempting to realign the interest rate level in the U.S. economy with inflation rates, so the interest rate increase may not be the last for mortgage trusts like Annaly and they could trade lower as a result.

Annaly’s Book Value Trend: A Trail Of Blood

In the third quarter, interest rate volatility and pressure on the net interest margin caused Annaly’s book value to decrease once more. As a result of the mortgage trust’s 1-for-4 reverse stock split that was performed in September, Annaly’s book values per share for the prior quarters have been revised.

At the conclusion of the September quarter, Annaly’s book value was $19.94 per share, down from $23.59 per share in the preceding quarter, representing a 16% decrease.

In a previous article titled ‘Annaly Capital: Don’t Take The 14% Yield Bait’, I raised the alarm on Annaly’s book value and net interest margin problems. Annaly’s book value decreased 38% over the first three quarters of 2022: 15% in the first quarter, 13% in the second, and 16% in the third.

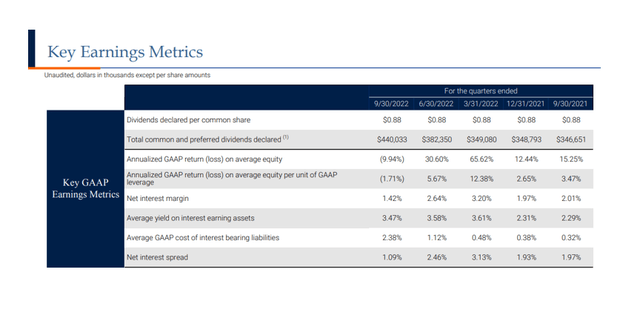

The net interest margin of Annaly has begun to decline as a result of higher interest rates, which are a death sentence for big, leveraged mortgage trusts. Net interest margin for the trust fell by 1.22 percentage points to 1.42% from 2Q-22. The trust’s net interest margin is anticipated to decrease further going forward as interest rates are anticipated to rise even further.

Key Earnings Metrics (Annaly Capital Management Inc)

Discount To Book Value Could Get Substantially Larger

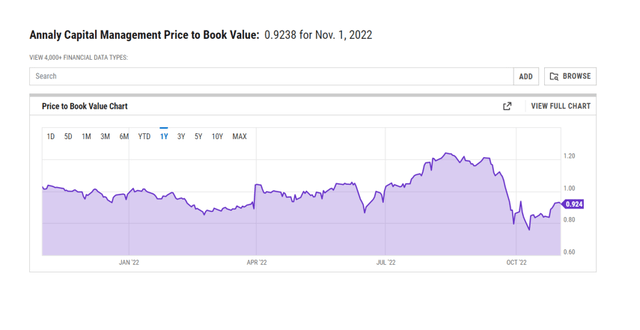

Currently, Annaly’s discount to book value is around 8%, which could not be sufficient to offset the extreme risks associated with increased interest rates.

As investors price in the probability of additional interest rate hikes in 2023, particularly if inflation continues strong, I continue to believe that Annaly might see a significantly lower valuation (a larger discount to book value).

In the near future, Annaly’s book value discount could expand to 20–25%, at which point the stock may be selling in the $15–16 region.

Price To Book (YCharts)

Why Annaly Could See A Higher Valuation

Currently, investors don’t appreciate exposure to the mortgage market because the central bank is about to raise interest rates once more, and as a result, Annaly has lost a sizeable portion of its book value this year.

Naturally, a slower rate of rate increases would be favorable for Annaly and the larger mortgage market. The likelihood of this is mostly influenced by inflation predictions. Although inflation has recently slowed down, it is still a major concern for both consumers and policymakers. In the future, less interest rate hikes are anticipated, which could benefit Annaly and its investor base.

My Conclusion

In the near future, the interest rate environment will continue to be uncertain for Annaly and other mortgage real estate investment trusts.

Despite this, October saw an increase in inflation rates beyond 8%, making this week’s anticipated 75-basis point interest rate hike unlikely to be the last. This means for Annaly that pressure on its mortgage asset portfolio and net interest margin will continue to be high. This could result in an even greater discount to book value for the shares.

Investors may want to avoid Annaly stock until they are certain of the central bank’s interest rate policy due to Annaly’s high yield of 19%, which indicates a very high risk.