Kunakorn Rassadornyindee

Amphenol (NYSE:APH) is one of the world’s largest designers and manufacturers of connectors, interconnects, sensors and cables, amongst others. The company has been and is an enabler of the electronic revolution worldwide and has executed excellently over the last decades.

Over the last decade, the stock returned 17.7% per year, massively outperforming the SPY over the same period (12.4%). Let’s look into the business and find out if we can expect a continuation of the story with Amphenol Corporation.

APH outperformance (Koyfin)

Industry

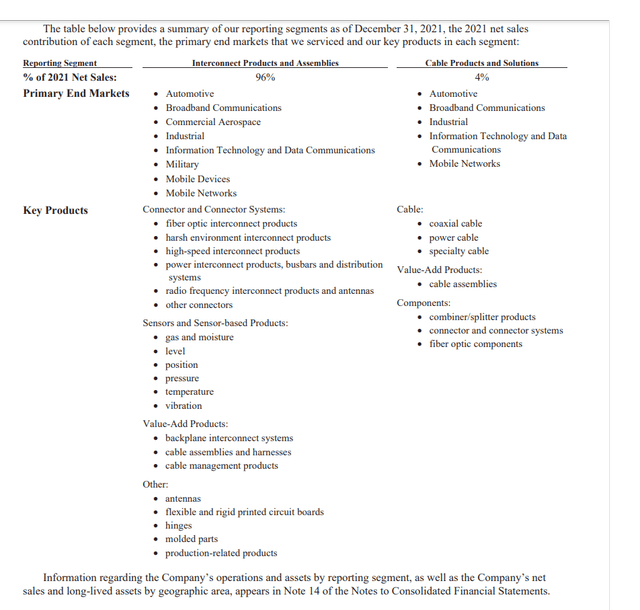

The company designs and manufactures products in a wide variety of segments, with 96% of revenues associated with the Interconnect Products and Assemblies segment and 4% in the Cable Products and Solutions segment. Amphenol is benefiting from several trends in its efforts to drive electrification forward.

- Transition to clean energy: Electrification is a big part of the transition to clean energy. Powering devices with electricity instead of oil and gas has a significant impact. In many industries, regulations are driving higher efficiency solutions(an example is the SEER standard for HVAC devices, which I talk about in this article).

- Connectivity, Mobile & High Speed: The world is becoming increasingly connected and devices are switching to wireless solutions.

- Increasing complexity: Devices are becoming increasingly complex, requiring more parts, connections and cables. An example is an Electric car’s average semiconductor content, which is 2.3x higher than in an internal-combustion car (I addressed it in this article).

- Harsh environments: Electrification also is needed in devices used in harsh environments, requiring especially durable parts.

Amphenol Product segments (Amphenol 10k)

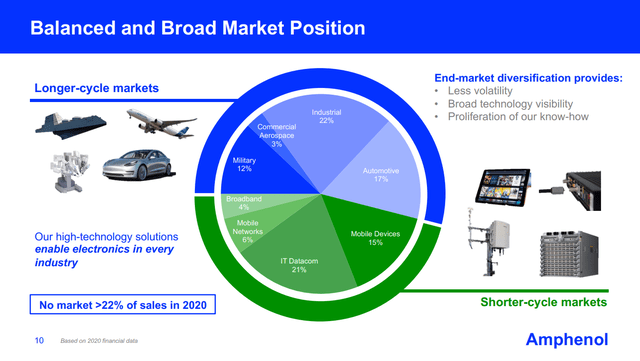

Amphenol has a diversified client base within eight industries; none takes up more than 22% of revenues. This provides stability in the business because one sector having a crisis (i.e., air travel in 2020) does not impact the business too much. It also allows them to acquire new companies in adjacent or existing verticals.

Amphenol revenue by industry (Amphenol investor presentation)

Business culture drives results

To generate a 20% CAGR over 30 years, a company has to have a good culture. Amphenol is no exception. It aims to have a high-performance entrepreneurial culture with ownership and accountability. This is achieved by having General Managers run the individual segments of the company with a clear focus on their business unit’s performance and accountability. Initially, all General Managers used to report to the CEO, which became impractical in 2003 when the company established its first global Operating Groups, led by a Group General Manager, taking care of a handful of General Managers each. This January, the company took its next step in scaling this network of individual business units by grouping the 12 Operating Groups into three Divisions led by a Division President. This way, the company expects to have deeper collaboration between Operating Groups.

“Show me the incentive and I’ll show you the outcome” – Charlie Munger

For a company focused so much on Operating Groups, reviewing the incentives for high-ranking management is even more critical than usual. According to the latest Proxy statement, the executives and directors of the company own 2.1% of shares outstanding. I’d prefer this to be higher, but this often happens with old companies. The company pays its managers through a base salary, Performance-Based Incentive plans, Stock Option Plans, Insurance and Retirement Benefits. We’ll focus on the Performance-Based Incentive plans.

The plan consists of two criteria for their responsibility unit, which stands for the Operating Group, Business Unit or the entire company, depending on the manager/executive. The two criteria are pretty simple: Sales growth and EPS/Operating Income growth. If a responsibility unit has a y/y decline in EPS/Operating Income, the multiplier is set to 0%.

| Sales Growth | EPS/Operating Income Growth | Incentive Plan Multiplier | |

|---|---|---|---|

|

Threshold |

0% | 0% | 0% |

| Target | 7% | 11% | 100% |

| Maximum | 17.5% | 27.5% | 200% |

I applaud this incentive structure because it pushes managers in the right direction. The big criticism I have is that there are only short-term targets, with no long-term targets. This could lead managers to push for bad acquisitions for the sake of sales and EPS growth. There is evidence of this if we consider the company’s large goodwill ($6.34 billion in goodwill compared to $11.4 billion of Total Capital and $45.11 billion in Market Cap). Including Return on Capital Employed or Return on Invested Capital as a long-term target would help solve this issue.

Acquire to grow

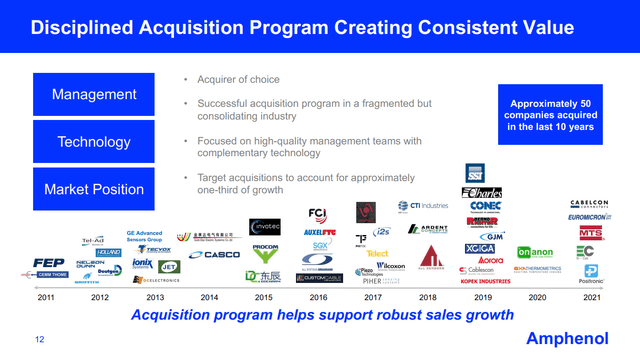

A large part of Amphenol’s growth has been due to disciplined acquisitions. The company acquired over 50 companies in the last ten years, accounting for roughly one-third of the growth. Acquired companies are left alone for the most part to continue operating as they did before, a strategy I prefer to heavy integrations and similar to strategies from serial acquirers like Watsco (WSO), Constellation Software (OTCPK:CNSWF) and Lifco (OTCPK:LFCAF). They do benefit from Amphenol’s network, manufacturing capabilities and knowledge. Overall it is a sound strategy that worked well over the years, but again I am missing a communicated performance metric like ROIC or ROCE.

Amphenol Acquisition Program (Amphenol Investor presentation)

Amphenol is fairly valued

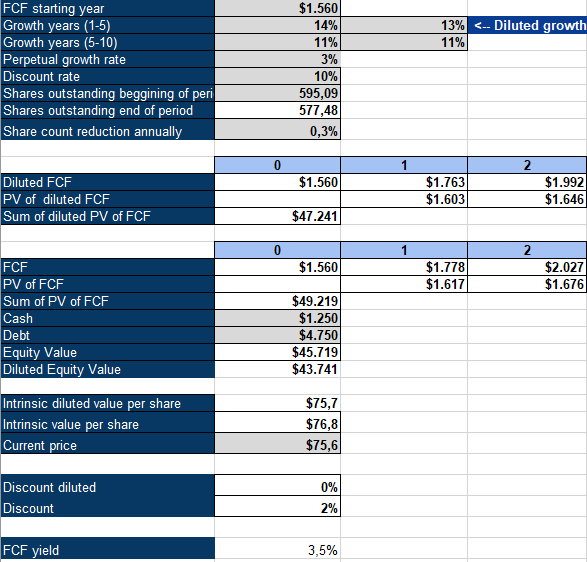

To value Amphenol, I’ll use an inverse DCF analysis using a 10% discount rate and a 3% perpetual growth rate. I assume a very modest annual share counter reduction of 0.3%. While the average annual reduction in the last decade has been 0.7%, the speed of buybacks has slowed over the previous five years.

Using these assumptions, we arrive at an expected FCF growth rate for the next five years of 13% and 11% in the following five years. If we look back at the incentives, we can see that the EPS/Operating income target for managers is 11% growth, slightly below our required growth rate.

Amphenol inverse DCF (Authors Model)

I’m not a buyer

Amphenol is a great company, but I am not a buyer. With the company guiding its managers to achieve an 11% EPS growth, I see the stock as fairly valued or maybe slightly overvalued. The stock also has some risks, like the mentioned lack of qualitative incentive metrics like ROIC or ROCE, giving management the option of bad acquisitions for growth and the high international exposure (67% of sales outside of North America, 45% in Asia). In my opinion, there are better options available to investors.