People constructed up trillions of {dollars} in financial savings throughout the pandemic. Now, with costs rising at their quickest tempo in many years, they’re tapping that stockpile to maintain on spending.

Client spending rose 0.9 p.c in April, the Commerce Division stated on Friday, as People shook off excessive costs to purchase tickets for flights, sports activities occasions and different experiences they needed to forego earlier within the pandemic. Auto gross sales additionally elevated as automobile consumers snapped up automobiles after months of shortages.

Incomes are rising, too, the results of a strong job market and the quickest wage development in many years. However incomes aren’t maintaining with spending, or with rising costs: After-tax revenue rose 0.3 p.c in April from the prior month and was flat after accounting for inflation.

In consequence, People are fueling their spending by saving much less. Households put aside simply 4.4 p.c of their after-tax revenue final month, the bottom financial savings fee since 2008.

Report ranges of presidency support throughout the pandemic, mixed with diminished spending on many leisure actions, allowed People to construct up a considerable reserve of additional financial savings — $2.5 trillion or extra by some estimates. That cushion might enable shoppers to maintain spending whilst costs rise. A snapshot of People’ monetary well being carried out final fall and launched by the Federal Reserve this week discovered that 78 p.c of respondents felt they have been “doing not less than OK” — the best fee within the survey’s nine-year historical past.

However counting on financial savings is unsustainable in the long term. Economists say many lower-income households have in all probability already exhausted their financial savings, or will within the months forward, particularly as excessive fuel and meals costs proceed to take a toll. Balances of bank cards and comparable forms of debt rose at a 35.3 p.c annual fee in March, the largest one-month enhance since 1998, in keeping with information from the Federal Reserve.

“Should you’re relying on the bank card to fund your spending, that’s by definition not sustainable,” stated Tim Quinlan, a senior economist for Wells Fargo. Client spending has held up higher than most forecasters anticipated, he stated, however is more likely to gradual within the months forward.

Perceive Inflation and How It Impacts You

Shoppers aren’t more likely to get a lot aid from rising costs anytime quickly. Inflation cooled barely in April however remained near a four-decade excessive.

Client costs rose 0.2 p.c final month from March and have been up 6.3 p.c from a 12 months earlier, the Commerce Division report confirmed. That was down from a 6.6 p.c annual enhance in March, which represented the quickest tempo of inflation since 1982.

Economists and buyers intently watch the report’s Private Consumption Expenditures value index, an alternative choice to the better-known Client Value Index, as a result of the Federal Reserve prefers it as a measure of inflation. The central financial institution has been elevating rates of interest and has introduced it is going to start paring its belongings in a bid to chill the financial system and tame inflation.

In an announcement launched by the White Home on Friday, President Biden referred to as the dip in inflation “an indication of progress, whilst we’ve extra work to do.”

The slowdown in inflation in April was largely the results of a drop within the value of gasoline and different vitality. Gasoline costs soared in February and March largely due to Russia’s invasion of Ukraine, then moderated considerably in April. They’ve risen once more in current weeks, nonetheless, which might push measures of inflation again up in Could. Meals costs have additionally been rising shortly in current months, a sample that continued in April.

Stripping out the risky meals and gas classes, client costs have been up 4.9 p.c in April from a 12 months earlier. That core measure, which some economists view as a extra dependable information to the underlying fee of inflation, was up 0.3 p.c from a month earlier, little modified from the speed of enhance in March.

The comparatively tame enhance in core costs within the information launched Friday stood in distinction to the sharp acceleration within the equal measure within the Client Value Index report launched by the Labor Division this month. The divergence was largely the results of variations in the way in which the 2 measures rely airline fares, nonetheless, and economists stated the Fed was unlikely to take a lot consolation from the Commerce Division information.

Inflation F.A.Q.

What’s inflation? Inflation is a lack of buying energy over time, that means your greenback won’t go as far tomorrow because it did right this moment. It’s sometimes expressed because the annual change in costs for on a regular basis items and providers similar to meals, furnishings, attire, transportation and toys.

“My suspicion is they’ll in all probability look by the slowdown,” stated Omair Sharif, the founding father of the analysis agency Inflation Insights. He famous that the core index additionally slowed within the fall, solely to choose up once more on the finish of the 12 months, catching the Fed off guard.

Many forecasters imagine that the headline inflation fee peaked in March and that April marked the start of a gradual cool-down. However the current rebound in fuel costs threatens to complicate that image. And even when inflation continues to ebb, costs are nonetheless rising way more shortly than the Fed’s goal of two p.c over time.

The general public, Mr. Quinlan stated, is unlikely to see the slight moderation in inflation as a lot to have a good time.

“To them, the year-over-year development in costs doesn’t matter,” he stated. “It’s, why does a crappy lunch value $12 now?”

Inflation has taken a toll on client sentiment, which fell 10.4 p.c in Could to its lowest stage in additional than a decade, in keeping with a long-running survey from the College of Michigan. Thus far, nonetheless, that pessimism hasn’t translated into diminished spending.

“Not less than within the second quarter, shoppers actually had their purses large open,” stated Kathy Bostjancic, the chief U.S. economist at Oxford Economics. “We expect finally that’s going to have limits. Proper now we’re all feeling pent-up and simply must journey. However come subsequent 12 months, it’s a special story.”

Extra spending has been shifting towards experiences like resort stays, live shows and haircuts in current months as individuals have grown extra snug in crowded areas. Costs for items have been rising quicker than the price of providers, partially due to ongoing provide chain snarls and the battle in Ukraine. Adjusted for inflation, items spending rose 1 p.c over the month, whereas providers spending rose 0.5 p.c.

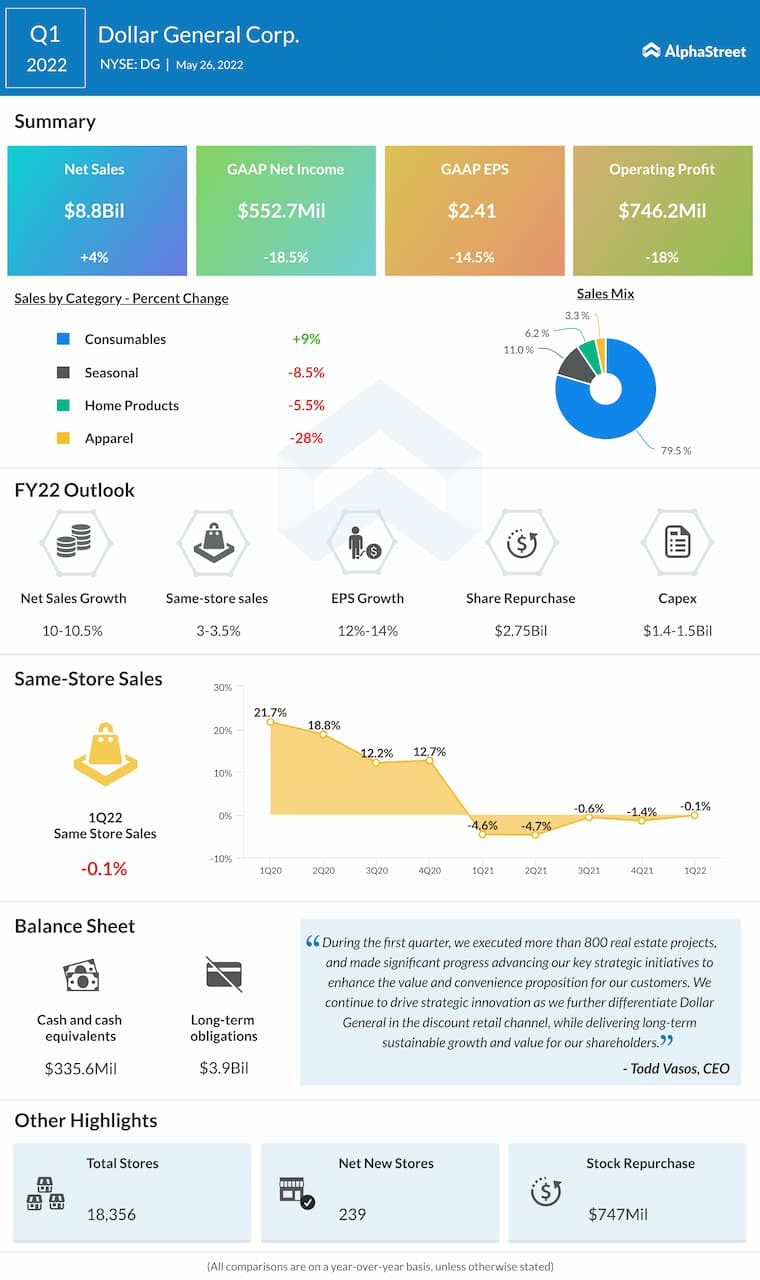

That dynamic has rocked big-box shops like Walmart and Goal, which have discovered themselves unable to move alongside greater prices to buyers. Shares of low cost retailers like Greenback Tree, against this, surged on Thursday as they reported gross sales will increase and raised their earnings forecasts.