Marko Geber

American Public Education, Inc. (NASDAQ:APEI) provides online and on-campus post-secondary education to more than 108,400 students through three subsidiaries named American Public University System, Rasmussen University, and Hondros College of Nursing. With the main focus on increasing students’ return on their educational investment, the company has taken the initiative called Higher Education Return on Investment for Customers, better known as HEROIC.

The APEI is a purpose-driven company guided by the mission to provide significant value and low-cost higher education to those students who have serves the nation through the military. The total addressable market (“TAM”) for military education is significantly large and has been growing consistently, which will help the business grow in the future.

University programs (annual report)

With its highly qualified staff, the company offers a wide variety of courses to the students and provides graduate and undergraduate level education to the students.

In the last year, management came up with an acquisition of Rasmussen University for about $325 million, funded through cash and debt financing, with the belief that the new acquisition is strongly aligned with its mission. However, the acquisition costs seem considerably high, therefore, return on investment from this asset might lag the core business.

Historical performance

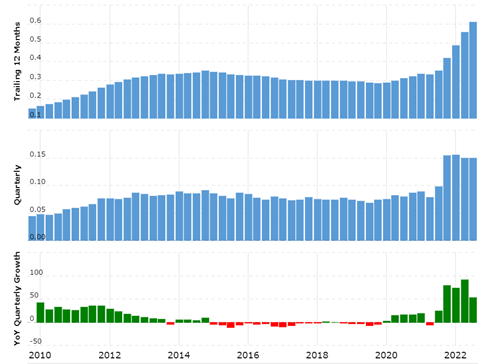

Revenue growth (macrotrends.net)

Until 2019, the company’s revenue growth remained subdued and even declined significantly. However, in the last two years, revenue has seen unusual growth as a result of increased enrollment for the course and strategic acquisition of Rasmussen university.

In the last two years, revenue increased from $268 million in 2019 to about $418 million in 2021.

Over that period, profitability has also fluctuated with revenue. Despite posting significantly higher revenue, the growth in profitability has remained subdued as compared to 2018 levels. However, the gross margins seem substantially improved over the period

Also, over a very long period, the company was focused on share buyback and bought back total outstanding shares from 18 million to 15 million till 2020. However, in the last year, there has been significant share dilution, resulting from a considerable increase in total share outstanding to about 18 million, which resulted in about 20% dilution.

Over that previous period, the business had been debt free. However, due to the recent acquisition, the company’s debt has increased significantly, to about $147 million. The company has maintained significantly high liquid assets, which mitigate the risk of increased debt.

Despite a significant drop in profit, cash flow from operations remains significantly attractive. Also consider, however, that the high cash flow is somewhat attributed to higher depreciation charges.

Strength in the business model

The company has been enjoying strong brand recognition, which has given significant strength to the business model.

Unique business model

APEI focuses mostly on the military community, hence there is a lot of opportunity for the university to increase overall student enrollment. Also, over the period, the company has served a lot of students and produced very good opportunities for them, which has created a very high reputation for its universities.

With the significant efforts put in by the management to grow the business and build its reputation, American Public Education has become the market leader in the military education segment.

These factors provide a significant advantage for the company and provide an edge over its competitors.

Affordable cost

Since its inception, affordable tuition has been the main focus of management. In recent years, educational costs have increased significantly, and students are facing a significant burden of high student loans. In the case of APEI, the company keeps overall costs about 30% less than average costs, which provide the students significant relief. Also operating as a low-cost provider gives American Public Education a significant edge over most of the universities which offer the same courses but at a considerably higher price. Keeping the university’s tuition costs low can attract talented students, further strengthening the university’s brand value.

Risk factors

It should be noted that the significant revenue improvement came from the covid corresponding sharp increase in online learning, which has translated into unusual growth in student enrollment. Still, such growth might not sustain in the future. Although the enrollment for three of its main universities was strong for this quarter, considerable growth in the future seems very much uncertain.

The recent acquisition of Rasmussen University might bring significantly higher operating costs, affecting the company’s overall profitability. As we have seen in the last few quarters, the overall cost of operations and marketing has increased significantly. In the future, if the business is to keep growing, the company will need to spend heavily on marketing, which might further hamper profitability.

Recent developments

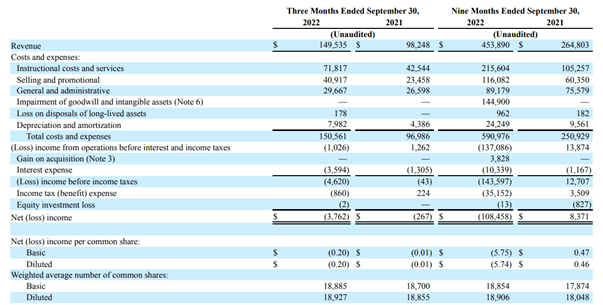

Quarterly results (quarterly reports)

In the last nine months, the company’s revenue has grown significantly, from $264 million last year during the same period to about $453 million to date. Along with the revenue growth, operating costs have hiked significantly due to the higher cost of the acquired university along with the high cost of promotions to market them. As a result, overall profitability has been hampered significantly.

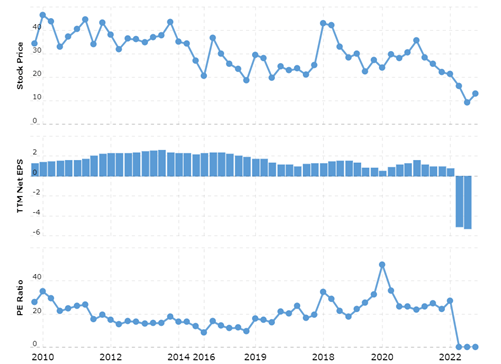

Stock price (macrotrends.net)

Over the years, American Public Education stock typically traded for about 24 times its earnings, but the stock price has dropped more than 68% from its high and has reached a multi-year low price.

The current market capitalization of the company is around $245 million, whereas the company has a history of cash flow generation of nearly $40 million dollar and earnings of about $25 million. This shows that the stock currently is trading at just 10 times its historical earnings.

Also, despite the drop in the stock price, I do not see a margin of safety in American Public Education’s business. Acquisitions of high cash-consuming universities might put significant pressure on the operating margins, resulting in a significant drop in profitability. I assign a hold rating for American Public Education stock.