Noah Berger

Amazon.com, Inc.’s (NASDAQ:AMZN) AWS segment was always a GARP story for us. Growth At a Ridiculous Price. When we covered this earlier in the year we said that the AWS story was done, at least from an operating income standpoint.

Our outlook here is that AWS will continue its strong revenue growth for some time before even it joins the nominal GDP growth rate of the rest of the company. For 2023, 2024 and 2025, we see AWS revenue growth decelerating to 18%, 14% and 10% respectively. Over the same time frame, operating margins should contract to 14%-17%. That would keep AWS operating income about flat from these levels over the next 3 years. As to what you should value this at, our best number is about 15X after-tax profits. So our fair value for AWS is about $225 billion.

Source: AWS-Gone, How The Last Hope For Amazon Disappeared

That was not taken too kindly by the bulls who liked to assign $3 trillion in market capitalization just for this segment alone. Well turns out that our bearish views were extremely optimistic. We break down Q1-2023 numbers and show how bad the story has gotten for the bulls as far as the AWS story goes.

Q1-2023

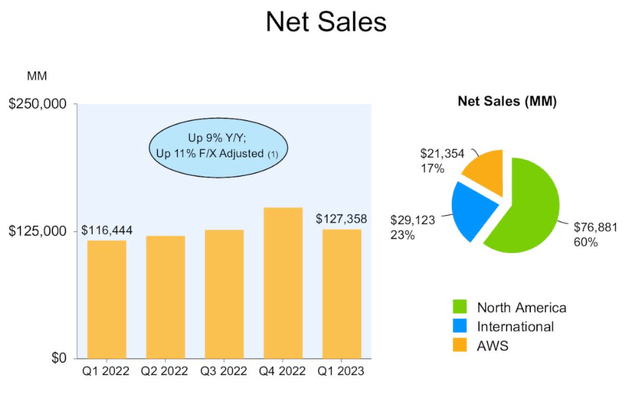

AMZN reported a solid sales number and the 9% year over year beat estimates by a solid $2.85 billion.

AMZN Q1-2023 Presentation

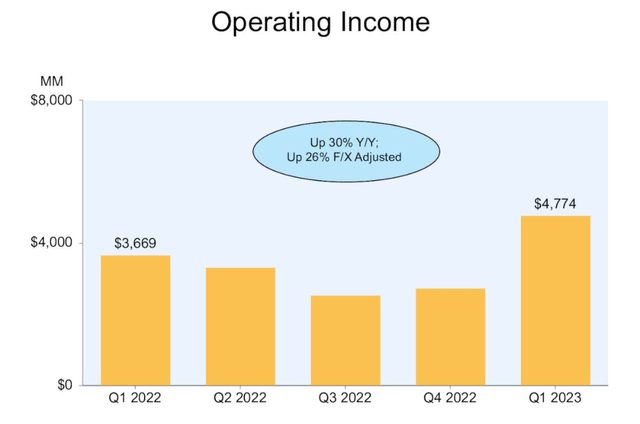

Overall operating income was not too bad either and came in at almost $5.0 billion. This was despite some forex pressure still visible in the quarter.

AMZN Q1-2023 Presentation

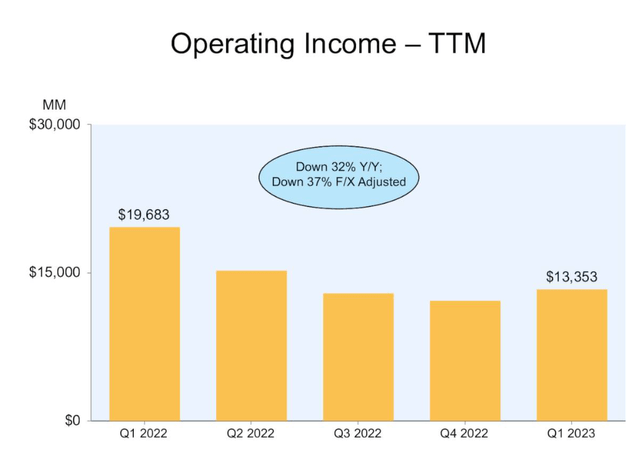

Over the last 12 months, operating income was down significantly as the multiple poor quarters weighed down results.

AMZN Q1-2023 Presentation

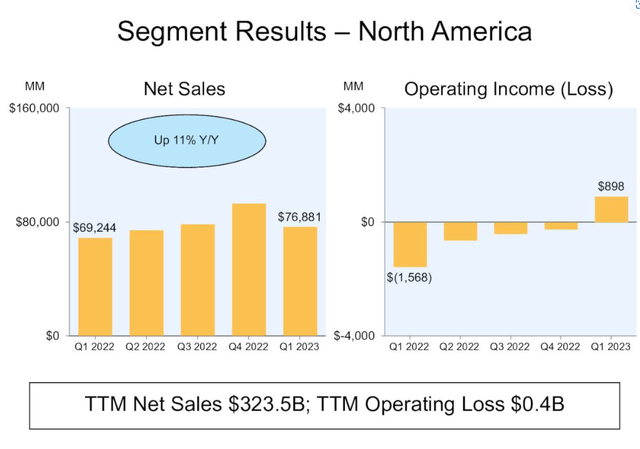

On the retail side, it was all from North America. Sales were up 11%.

AMZN Q1-2023 Presentation

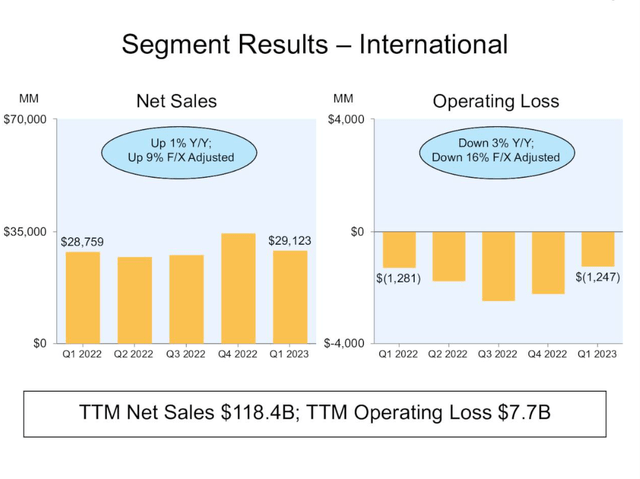

International segment was too heavily weighed down by the strong US Dollar to contribute meaningfully to sales growth. Of course profits have long evaded this area and this quarter was no different.

AMZN Q1-2023 Presentation

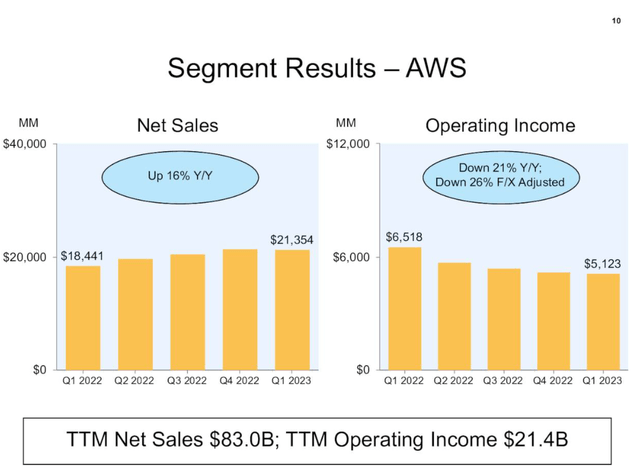

The big disappointment for the bull case though, came from the AWS segment. Sales growth continued to slow down and they were up 16% year over year. As we had noted in our previous work, we expected 18% sales growth for 2023. This is a big deal as the slowdown also showed the first quarter were quarter over quarter numbers declined.

AMZN Q1-2023 Presentation

But the bigger issue was the operating income was down by about 25%. AMZN employs the same “spend at will” attitude in AWS that it does in its retail business. Year over year, AWS operating expenses were up 36%. So when sales come in under long term projected rates, we get this excruciating drop in profits. Operating profit margin for AWS was at 24%. Last year it was at 35%. If you use any long term, stand alone, model to value AWS, you will drop your ending value by about 40%-50% if your operating margins collapse by one-third. That is because the remaining aspects remain relatively static and erode your cash flow by same dollar value.

Verdict

Those numbers were horrifying enough but the stock actually moved up 14% on those really inconsequential “beats”. That held until this came up in the conference call.

Given the ongoing economic uncertainty, customers of all sizes in all industries continue to look for cost savings across their businesses, similar to what you’ve seen us doing at Amazon. As expected, customers continue to evaluate ways to optimize their cloud spending in response to these tough economic conditions in the first quarter. And we are seeing these optimizations continue into the second quarter with April revenue growth rates about 500 basis points lower than what we saw in Q1.

Source: AMZN Q1-2023 Conference Call Transcript

So chalk that one up as something we got completely wrong. We expected 18% growth for the year and that looks like a pipedream with what was reported for Q1-2023 and for April. On a related note, look at what United Parcel Service, Inc. (UPS) had to say about Q1-2023.

Carol Tomé

And maybe just a little more color on volume, and then I’ll go to your question about Teamsters. As we – as Brian detailed, the rate of acceleration in the year-over-year decline caused us pause because we were down around 3% in January, 5% in March – February and 7% in March. As we look at April, April has stabilized relative to how we exited March. So we feel very good that volume has stabilized.

Source: UPS Q1-2023 Conference Call Transcript

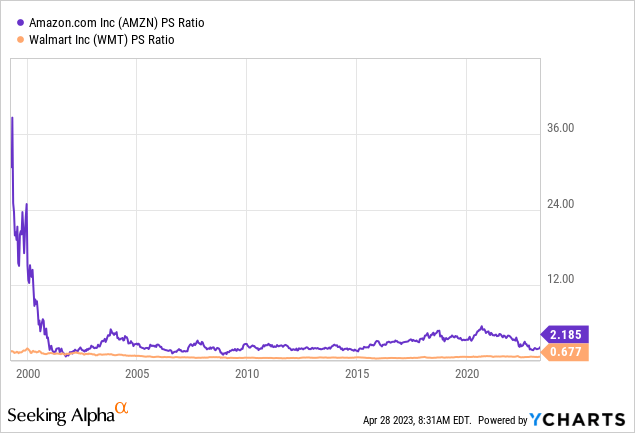

Leaving aside that optimism at the end, those volume numbers look like we already are in a recession. The 1.1% Q1-2023 reported GDP likely gets revised down as we move ahead. The question becomes what do you want to value AMZN at if AWS has its operating income contracting and retail still shows no future potential of profitability? We told you that the last time, and the answer has not changed. AMZN will trade at the same price to sales multiple of Walmart (WMT).

Don’t forget that the two lines did meet after the NASDAQ 2000 bubble and today’s environment looks more like that than any other time in history.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.