4kodiak/iStock Unreleased via Getty Images

Amazon’s Q3 earnings release

Amazon (NASDAQ:AMZN) will release its Q3 financial results on Thursday, October 27, 2022, after the market closes. For anyone interested, you can catch the call live on Amazon’s investor relations site here. Seeking Alpha will also publish a handy transcript of the call on this page after it is complete.

The company has guided for a 13% to 17% increase in sales to reach $125 billion to $130 billion and $0 to $3.5 billion in operating income. Sales growth hasn’t been an issue recently, as shown below, but operating income has been tough to come by.

Data source: Amazon and Seeking Alpha. Chart by author.

Why is operating income down?

Operating income has taken a significant hit since the pandemic heyday. The initial boost of pandemic spending, economic stimulus, and increased online shopping have given way to unpleasant aftershocks.

First, while the company initially benefited from the stimulus supporting the economy, the rise in wages and tight labor market eventually added billions in costs to the bottom line. This was prevalent in mid to late 2021 and continues.

Next, logistical issues plagued the supply chain for much of 2021, and challenges remain. This adds costs to already tight retail margins. This also contributes to inflation globally and in the U.S. We all know that inflation is adding costs for fuel and, well, just about everything else.

The strong U.S. dollar has put a massive dent in international results. Sales in this segment were down 12% in Q2 year-over-year (YOY) but only 1% when adjusted for foreign currency exchanges. Operating income fell from a $362 gain to a monster $1.8 billion loss last quarter.

Anything else?

Management has done an admirable job of execution in this challenging environment. Through the first half of 2022, the gross margin has only fallen slightly over 1%. In fact, the most significant expense increase isn’t in fulfillment as we might expect. Spending on technology and content has risen the most through the first half of 2022.

This is excellent news. Investing in technology and content, which includes research for new products and servers, equipment, and other expenses for AWS and other businesses, will drive future revenues and profits. Through Q2, Amazon has spent $33 billion in this area, 25% more than in the first half of 2021.

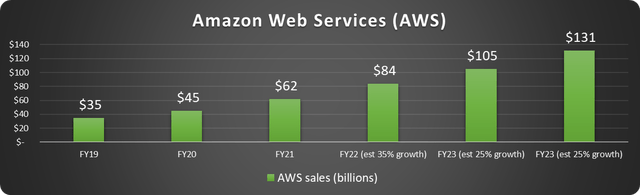

Checking in on AWS

Amazon Web Services (AWS), the largest cloud services provider on Earth, is Amazon’s cash cow and has been the lone consistent profit center lately. The segment produced $19.7 billion in sales last quarter and $5.7 billion in operating income. Amazon reported a $79 billion run rate (annualized sales) for AWS last quarter, and total sales will likely eclipse $80 billion this year with room to spare. Amazon’s cloud business consistently posts operating margins near 30%.

This segment has been so successful that it nearly supports Amazon’s entire $1.17 trillion market cap all on its own. The segment has grown 35% so far in 2022 and, barring something drastic, will easily eclipse $100 billion in revenue in 2023 with plenty of runway left.

AWS has a stranglehold on the cloud infrastructure market of over 33%, topping Microsoft (MSFT) Azure and far outpacing Alphabet’s (GOOG)(GOOGL) unprofitable Google Cloud.

Data source: Amazon. Chart and estimates by author.

Microsoft is a profitable and growing software-as-a-service (SaaS) company, valued at about nine times its sales. It is more diverse and established than AWS but isn’t growing as fast.

I believe AWS could fetch a valuation of 9-10 times next year’s sales, or $900 billion to $1 trillion, as an independent entity on the open market. This means that the rest of the company is relatively inexpensive at the moment.

Other quick hits

Look for AWS sales to hit $21.4 billion if the company maintains the 33% growth it hit in Q2. Anything less would be a bit disappointing.

Advertising growth has slowed a bit but was still robust in Q2 at 18% to reach $8.8 billion. Amazon has generated $34 billion in digital advertising sales over the past 12 months, which is impressive considering where this revenue stream started. Sales in this segment were so insignificant that the company did not even report them separately until recently.

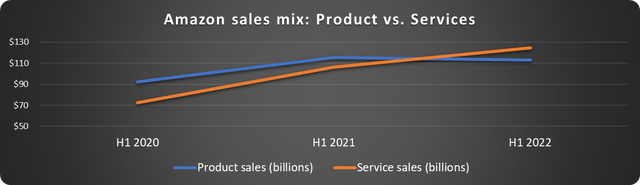

In 2022 total services revenue has outpaced product sales for the first time, as shown below.

Data source: Amazon. Chart by Author.

Why is this important? Service sales are higher margin and recurring, like AWS and memberships. This is fantastic news for shareholders. Hopefully, this trend will continue, and the gap will widen. An Amazon more geared toward services will be more profitable, produce better cash flows, and make shareholders more money.

Is Amazon stock a buy?

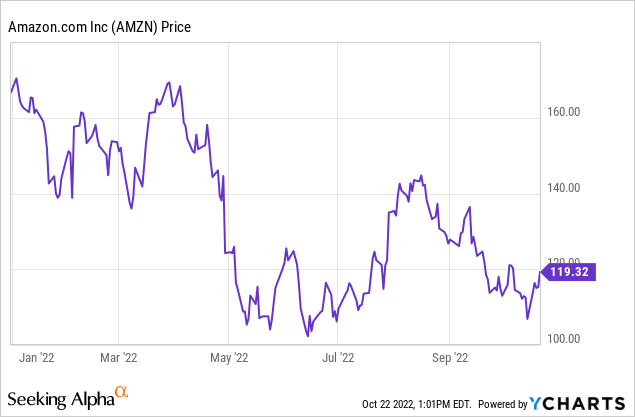

Amazon stock is down 30% year-to-date but made an 11% comeback off its recent low on October 14th, as shown below.

Before the recent rally, I expected a strong positive reaction to earnings. There was just too much negativity priced in. Now we will see if the short-term rally has legs.

Judging from the tone of last quarter’s guidance, I would not be surprised if operating income came in on the lower end of estimates. AWS’s massive success has increased spending on infrastructure, which will increase depreciation expenses and weigh on operating income. Because of this, the market could react negatively before digesting the details of the earnings report.

While the short-term movement is always up for grabs, Amazon is still a solid long-term buy at these prices in my book. The valuation is too compelling. The company continues to turn itself into a service-based business which will boost margins and cash flow, and once the retail headwinds subside, the bottom line should see a massive boost, and the share price will likely follow.