Darren415

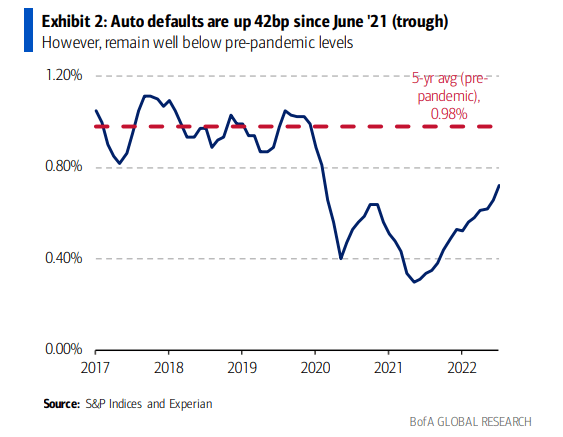

The consumer remains strong. That’s what Bank of America (BAC) and Goldman Sachs (GS) basically relayed to investors earlier this week in their Q3 earnings reports. While there has been a recent uptick in auto loan defaults, general delinquency trends in mortgage, credit card, student, and even auto loans appear benign. One domestic financial services company will provide more clues on the consumer in its Q3 earnings report Wednesday morning.

Consumer Credit Ebbs, Loan Delinquencies Look OK

Goldman Sachs Investment Research

Auto Loan Default Trends Spook Investors

BofA Global Research

According to Bank of America Global Research, Ally Financial Inc. (NYSE:ALLY) is a leading auto lender and a top 25 U.S. financial holding company. Ally’s businesses include one of the largest full-service auto finance operations in the country, a growing online bank, a wealth management and online brokerage platform, and a corporate finance business.

The Michigan-based $9.3 billion market cap Consumer Finance industry company within the Financials sector trades at a low 4.1 trailing 12-month GAAP price-to-earnings ratio and pays a high 4.2% dividend yield, according to The Wall Street Journal.

The company has established relationships in consumer finance from its history as GM Auto Finance. That’s a big advantage compared to some of its newer fintech competitors. Strong retail deposit trends also help the financial services firm as deposit betas remain favorable for such institutions. While there are downside risks around macro recession chances and a recent uptick in auto loan defaults, its low valuation warrants a buy.

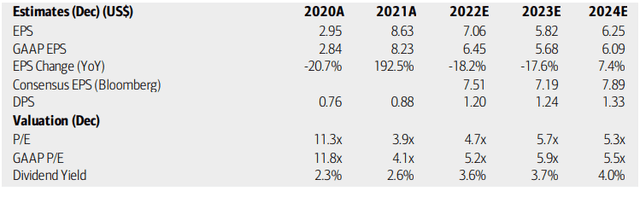

On valuation, analysts at BofA see earnings declining sharply this year and into 2023, but a rebound is seen once the rough economic patch passes by 2024. Even with lower EPS next year, the stock still trades at a low P/E using depressed 2023 per-share profits at just 5.7 (as of July’s stock price). Bloomberg, though, is more sanguine about Ally. Moreover, dividends are expected to increase through 2024. Both Ally’s operating and GAAP P/Es are low despite what should be a valuation premium versus its competitors.

Ally Financial: Earnings, Valuation, Dividend Forecasts

BofA Global Research

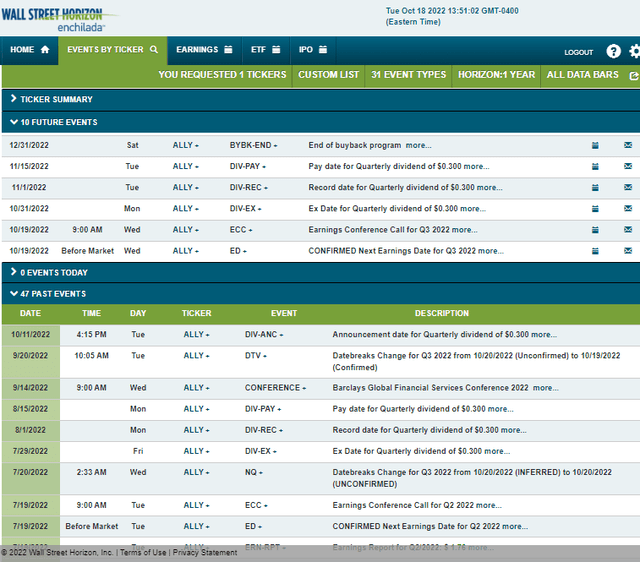

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q2 2022 earnings date of Wednesday, Oct. 19 BMO with an earnings call immediately after results cross the wires. You can listen live here. A dividend ex date is set for Halloween.

Corporate Event Calendar

Wall Street Horizon

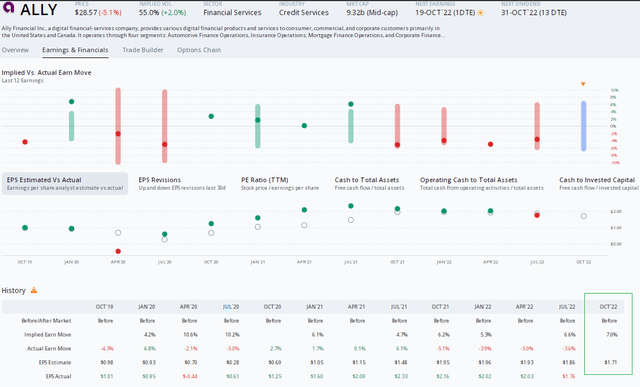

The Options Angle

Digging into Wednesday’s earnings release, data from Option Research & Technology Services (ORATS) show a consensus EPS estimate of $1.71 which would be a 21% drop from the same quarter a year ago. The company has a strong earnings beat rate history, although it did miss in its Q2 report in July. The stock price earnings reaction history is more bearish, with four consecutive quarterly declines post-reporting.

The options market has priced in a 6.7% stock price swing after Wednesday morning’s report. That’s on the high side compared to previous quarters, but with a VIX north of 30, that’s to be expected. Since the July reporting date, there have been a pair of company upgrades and a whopping six downgrades.

ALLY: A Big Stock Price Move Vs History Expected

ORATS

The Technical Take

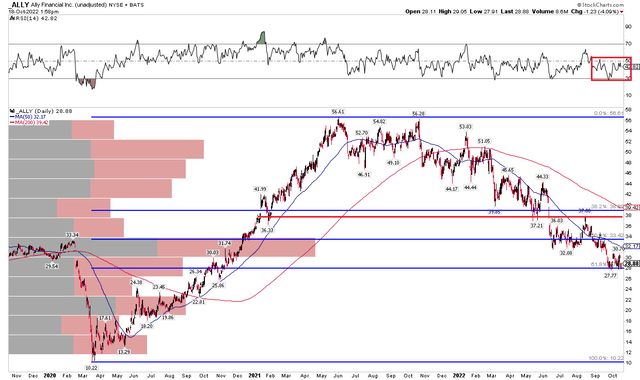

ALLY has retraced 61.8% of its post-Covid rally from March 2020 through June of last year. It has been a nearly year-and-a-half bear market for this Financials sector stock. While there’s a significant overhead supply in the low $30s, the current price is near key support. Being long near $29 with a stop under $27 is a favorable risk/reward setup.

I would like to see the RSI climb above this bearish 20 to 60 range. Also suggesting caution for the bulls is resistance in the $37 to $38 area. While the valuation case is quite strong, the technical picture is mixed.

ALLY: Shares Retreat To Fibonacci Support

StockCharts.com

The Bottom Line

In net, Ally looks good heading into earnings. I think the stock holds this Fibonacci support area while long-term investors should own shares for its low valuation and high dividend. Moreover, some advantages versus its competitors is a bullish fundamental factor.